CAIRO: Personalized supplements based on blood test data are set to become available in key Saudi cities as Bioniq brings its patented algorithm to the Kingdom.

Through a partnership with Al Borg Diagnostics, a provider of diagnostic health services in Saudi Arabia, Bioniq has set a strategic expansion plan into the Kingdom.

In an interview with Arab News, Vadim Fedotov, CEO and founder of Bioniq, shared insights into the company’s strategic objectives and expansion plans in Saudi Arabia and the broader Middle East and North Africa region.

“Our immediate goals in Saudi Arabia include establishing a strong presence in key cities, enhancing access to personalized health solutions, fostering strategic partnerships, and consistently delivering exceptional customer experiences,” he said.

The advantage

Looking ahead, Fedotov explained Bioniq’s long-term vision in the Saudi market, focusing on product efficacy and transparency.

“We believe it’s crucial to showcase the benefits of a quantifiable product that demonstrates how it works and its effectiveness,” he noted.

He criticized the prevailing market trends where companies fail to substantiate their claims. “Many companies in the market promise results without concrete evidence, essentially selling a dream. Bioniq, on the other hand, delivers tangible results.”

“We have already established strategic partnerships in the medical and wellness space that we have not announced yet. Moreover, we have already started integrating our solutions in some of the most prominent athletic organizations of Saudi Arabia,” he revealed, indicating an aggressive approach to embedding Bioniq’s solutions into key health and sports ecosystems.

Although specifics were not disclosed, Fedotov hinted at future collaborations that could involve governmental bodies.

The Saudi market is pivotal for Bioniq’s expansion strategy due to its significant growth potential and its position as a key player in the healthcare industry within the Gulf region.

Vadim Fedotov, CEO and founder of Bioniq

“Unfortunately, I cannot disclose details at the moment, but the plans are indeed significant,” he mentioned, suggesting potential engagements that could influence policy or regulatory frameworks within the health sector.

Regarding growth objectives for the next year, Fedotov said: “Strategic partnerships with nationwide medical institutions as well as leading athletic organizations are already in place to build brand awareness and trust.”

Fedotov stated that the company does not plan to offer exclusive products for the Saudi market and that all its products are shipped worldwide, emphasizing a unified product strategy across global markets.

Discussing the partnership with Al Borg, Fedotov further detailed how this alliance would enhance Bioniq’s operational capabilities.

“We plan to leverage our partnership with Al Borg to enhance our presence by expanding accessibility to personalized health solutions,” he explained.

“We aim to collaborate closely with Al Borg to optimize customer experience and provide seamless healthcare solutions to individuals throughout the country,” he added.

Legal standards

Fedotov highlighted Bioniq’s approach to navigating the regulatory environment in Saudi Arabia indicating it is a crucial aspect of their operations.

“We’re working closely with strategic partners in the region who have been established for decades, including nationwide partners who guide us in ensuring compliance with current and new regulations,” he explained.

“We’re fully committed to adhering to these guidelines. As our strategic partners include government entities and medical institutions, we’re confident that our offering is and will be in line with all current and future regulations,” the CEO added.

When asked about the significance of the Saudi market in Bioniq’s global strategy, Fedotov’s response underscored the strategic importance of the region.

“The Saudi market is pivotal for Bioniq’s expansion strategy due to its significant growth potential and its position as a key player in the healthcare industry within the Gulf region,” he stated.

“With its large population and substantial healthcare expenditure, Saudi Arabia presents a ripe opportunity for Bioniq to introduce its personalized health solutions and contribute to advancing healthcare standards in the region,” he explained.

He added: “Additionally, by establishing a strong presence in Saudi Arabia, we can leverage our strategic partnerships and innovative technology to further solidify our position as a leader in personalized nutrition and supplementation across the Middle East market.

Regarding the timing of Bioniq’s entry into the Saudi market, Fedotov shared that the company had already made its debut.

“Our partnership with Borg AI marked our launch in the region in April of this year,” he noted.

This launch introduced Bioniq’s products, including Bioniq GO and Bioniq PRO, to the Saudi marketplace, marking a significant milestone in their regional strategy.

“We are certainly considering establishing an office in the Kingdom,” he said, hinting at a significant operational expansion.

“Currently, we have over 80 employees globally, including headquarters in London, offices in Berlin, Dubai, and New York. Saudi Arabia appears to be a very promising option for one of our future locations. Regarding key members for the region and global expansion, we will be based there, given the strategic importance of Saudi Arabia and the Middle East,” he added.

Business fundamentals

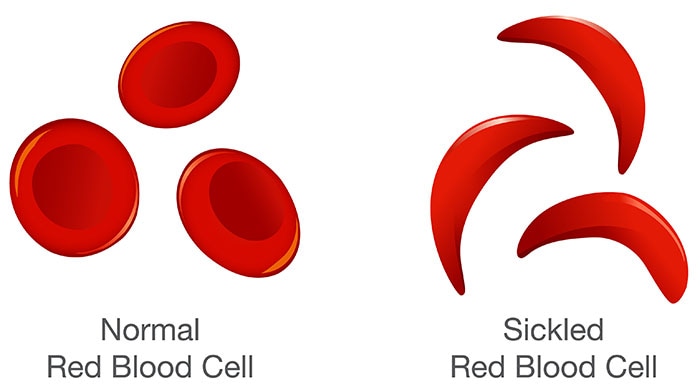

“Our primary mission in the region is to address the challenge of personalized health and wellness in Saudi Arabia’s healthcare industry,” Fedotov stated.

He highlighted that the collaboration with Al Borg is set to boast personalized health across the Kingdom, making Bioniq’s blood test panel available in 28 cities across Saudi Arabia.

“Now, consumers from Riyadh, Jeddah, Alkhobar, or any other cities across the country, can achieve optimal health levels much easier.”

The partnership allows consumers to utilize a 50-parameter blood test offered by Al Borg Diagnostics, after which they can opt for a personalized supplement formula created by Bioniq, based on their specific health data.

“We closely monitor metrics related to customer satisfaction, such as feedback scores and testimonials. We aim to deliver the most personalized supplements, so we are a super consumer-centric company,” he said.

“Of course, as a business, we also focus on revenue growth, customer retention rates, market penetration, and the number of personalized supplement formulas delivered,” the CEO added.

“In the Saudi market specifically, we pay close attention to metrics related to market penetration and customer acquisition. Given the strategic importance of this region for our expansion efforts, we track the number of customers adopting our personalized supplement solutions,” he stated.

The CEO further elaborated on how this approach leverages comprehensive blood tests and tailored supplement formulas to meet individual health needs and optimize overall well-being, marking a significant advancement in personalized health management.

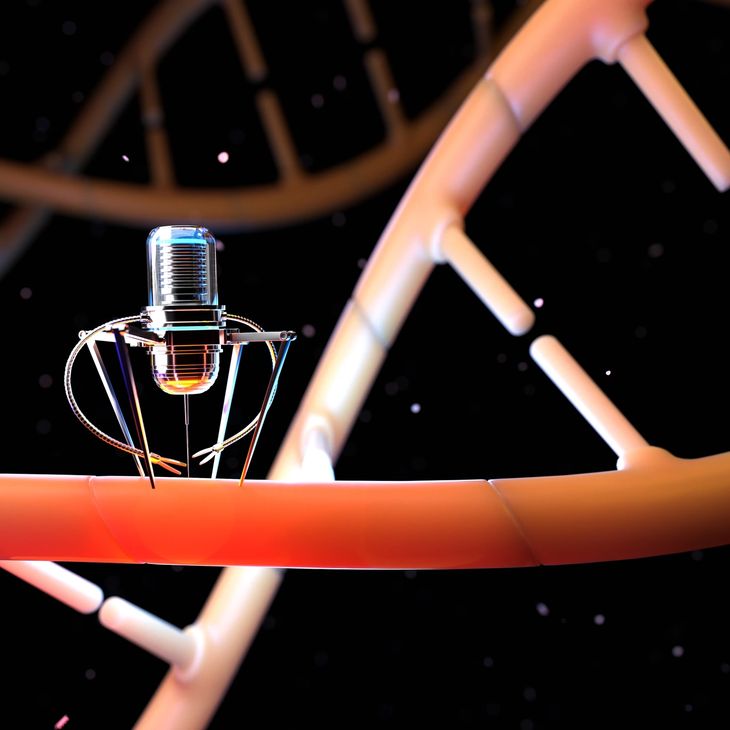

Founded in 2019, Bioniq offers Bioniq PRO and Bioniq GO which are based on algorithms developed from a large and diverse biochemical database.

Bioniq PRO, as Fedotov described, offers personalized supplements derived from extensive biochemical data and combined with health questionnaires and blood tests.

In contrast, Bioniq GO provides a more generalized personalization based on health questionnaires alone. “The cost of Bioniq supplements varies depending on the package the customer chooses,” Fedotov added, with Bioniq GO priced at $75 per month and Bioniq PRO at $199 per month.

On the financial front, Fedotov shared insights into the company’s profitability. “After five and a half years, we have achieved market profitability in all our priority markets,” he revealed.

Bioniq’s inception

“The idea of Bioniq came from my sports background and a subsequent corporate career that left me burnt out at 30,” Fedotov explained.

Despite being medically healthy, he felt unwell, which led him to realize that “wellness goes beyond just the absence of illness.”

Identifying a gap in the market for personalized health solutions, he noted, “In 2018, there were no companies providing personalized solutions for people like myself.” This revelation prompted him to establish Bioniq in London in 2019.

The company has raised $15 million since its inception, and Fedotov revealed:“Given the fact that the Middle East is one of our key regions, there’s a high level of proportionate investment into the Middle East, including Saudi, to develop strategic partnerships, onboard key opinion leaders and share and demonstrate the key advantages of a personalized approach.”

He added: “Additionally, we are leveraging our investment to enhance our technology platform and data analytics capabilities, ensuring that our personalized supplement formulas are backed by the latest scientific research and insights.”

A growing market

“We see significant opportunities for growth and innovation in Saudi Arabia, which is why we are entering this market,” he stated.

Regarding the broader trends in the health tech industry, Fedotov shared his company’s forecasts and strategic plans.

“Our forecasts suggest continued growth and increasing demand for personalized health solutions in our operational markets,” he noted.

Bioniq intends to capitalize on these trends by investing in research and development to enhance its products and services further.

Additionally, the company plans to expand its strategic partnerships with healthcare providers and technology companies and continue innovating in the field of precision health.

Fedotov also emphasized the importance of consumer education in Bioniq’s strategy. “We will continue focusing on educating consumers about the benefits of personalized nutrition and wellness, empowering them to take control of their health journey,” he explained.