Since the Abu Dhabi Global Market (ADGM) declared itself “open for business” some 20 months ago, Richard Teng has clocked up the air miles in his efforts to promote the Arabian Gulf region’s newest financial center around the world of international finance.

Since the Abu Dhabi Global Market (ADGM) declared itself “open for business” some 20 months ago, Richard Teng has clocked up the air miles in his efforts to promote the Arabian Gulf region’s newest financial center around the world of international finance.

But, it seems, his thoughts have recently turned much nearer home — the potential markets just across the border in Saudi Arabia.

“We’ve had contact with Saudi Arabia recently, and we’re exploring greater cooperation with Saudi Arabia on multiple fronts. Saudi Arabia and Abu Dhabi have many things in common — economic and financial strength and close political alliances. We think we can show the rest of the GCC (Gulf Cooperation Council) how to work more closely together,” he said in a recent interview in Dubai.

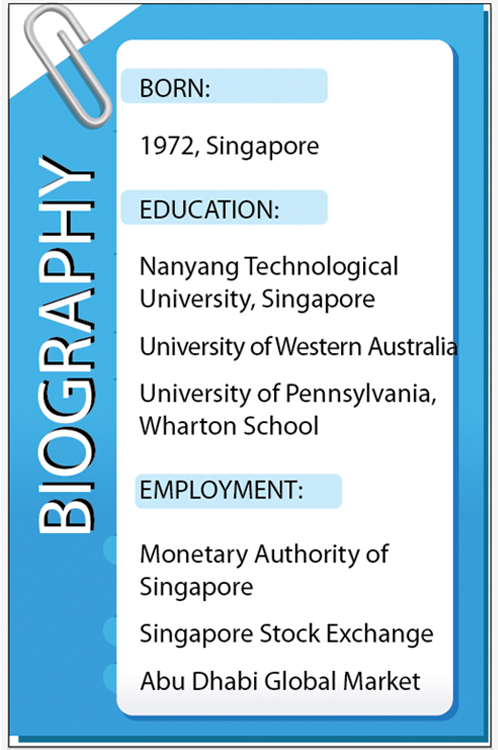

Teng is chief executive of the ADGM regulator, the Financial Services Regulatory Authority (FSRA), but he has also acted as global emissary for the new financial center, capitalizing on the international network of contacts he built up while he was at the center of financial life in his native Singapore, one of the leading global financial centers in the world.

What has attracted the recent interest in the UAE’s biggest neighbor, of course, is the potential boom in financial services there as a result of the economic transformation of the Kingdom envisaged in the Vision 2030 strategy.

The biggest initial public offering (IPO) in history — the estimated $100 billion sale of shares in Saudi Aramco — is only part of a plan that also includes a privatization program worth as much as $200 billion, according to recent official statements from the Kingdom’s Ministry of Economy and Planning.

That is enough to get every global financial institution salivating at the prospect of all the fat fees on offer, and several — most recently Citibank and JP Morgan — have begun to beef up their offices in Riyadh to help pull in that business.

The thinking of the ADGM and other financial centers in the Gulf is that while big banks will be obliged to have an official presence in Riyadh or Jeddah, some banking executives are more likely to prefer to be based in more established financial centers a short flight away.

The Dubai International Financial Centre (DIFC) — the region’s leading financial hub — is also believed to have stepped up its contacts with its S audi counterparts recently. While Teng is reluctant to describe Abu Dhabi and Dubai as competing with each other, he does believe that the UAE capital could be a more attractive base for Saudi Arabia-oriented business.

audi counterparts recently. While Teng is reluctant to describe Abu Dhabi and Dubai as competing with each other, he does believe that the UAE capital could be a more attractive base for Saudi Arabia-oriented business.

“Saudi Arabia is the largest economy in the region and is very important for us. We are working with both the government and private sectors to see how we can support them. They too want to keep financial services in the region, just like us,” he said.

Bringing financial services back to the Gulf is one of the main planks of the ADGM’s business plan. “As a region, the Gulf was exporting too much of its financial services. Wealth and asset management, private banking, IPOs, all these were being taken outside the region, where much of the advisory and transactional work was done,” Teng said.

He declined to mention it, but much of the profit made from these services was also booked outside the region. The Gulf was losing out on its own economic transformation.

Pulling this business back in was one of the main reasons for the launch of the ADGM by a presidential decree in 2013.

Since then, the ADGM had a slow, steady and cautious preparation period, much in keeping with the overall approach of Abu Dhabi policymakers, before the official “open” sign was hung up in October 2015.

Like the more established center in Dubai, it rests on three main operating branches — a registration arm that oversees and administers the center; a common-law courts system; and the FSRA, the independent regulator that Teng runs. Its home is the Al-Maryah Island district of Abu Dhabi, which is part of the portfolio of the government-owned Mubadala Investment Company.

It has the capacity to provide the full spectrum of financial services, from private banking to investment banking and all else in between, but so far has focused on wealth and asset management, funds, financial technology (fintech) and other niche services like special purpose vehicles (SPV), real estate investment trusts and aviation leasing.

Some observers have criticized the pace of growth, but the figures do not bear that out. ADGM has 340 full members, including 26 financial institutions licensed by the Financial Services Regulatory Authority. That compares well with other regional centers at a similar stage of development. “We have witnessed the fastest pace of growth of assets under management in the Middle East and North Africa (MENA),” Teng said.

There are some big names on the financial list — Macquarie Capital, Aberdeen Asset Management, Northern Trust and most recently UniCredit Bank of Italy. The local financial industry has been getting behind the center too, with Abu Dhabi Financial Group (ADFG) and MDC Capital Management, an important investment arm of Mubadala.

Is there any sign of the “big one”: A mega-bank like Goldman Sachs or Morgan Stanley signing up for the ADGM? Teng prefers to keep his counsel on this question: “We have seen the ‘big unicorns’ coming into the region with Amazon’s bid for Souq.com and I think that’s telling us something. After the global financial crisis, lots of Western institutions went in for some quite serious cost-cutting, in this region as well as elsewhere. Now they are looking again at the Gulf and the Middle East. US institutions are looking again seriously at the region as a place to be based and to do business,” he said guardedly.

In the absence so far of the “big one,” Teng has been looking at other areas as well as wealth and asset management. Fintech has been a big focus over the past year, since the ADGM chairman, Ahmed Al-Sayegh, declared his intention to make the center the “capital” of fintech in the Middle East.

A special “regulatory laboratory” regime was set up to encourage fintech entrepreneurs to join the ADGM, with less onerous rules than full financial members and the first five successful applicants — from UAE, India and the West — have been chosen. A second batch is expected to follow soon.

Teng has also signed a partnership with the Singapore authorities to exploit the highly successful “sandbox” model that has helped the city-state become the Asian leader in fintech.

“It provides access to capital with the appropriate level of regulation. There will be more to come on this. We are looking to create a ‘bridge’ with Singapore to create capital and markets for fintech,” he said.

The ADGM was recently ranked the No. 1 hub in the MENA region for fintech by the global accounting and consulting firm Deloitte. Further fintech collaboration with Saudi Arabia is also a possibility.

Other specialisms have accompanied the growth. SPVs — corporate structures designed for particular types of transaction — have been a focus, with a particular appeal for family offices and other private investors. Real estate investment trusts have also seen the attractions of ADGM’s regulatory offering.

One groundbreaking initiative was to develop specialist skills in the aircraft-leasing sector. European financial group Natixis teamed up with Abu Dhabi airline Etihad in a leasing deal recently, and more is expected. “We want to get more of those and further develop our expertise in aviation finance. We have some of the biggest airlines in the world and it makes no sense for that business to be done abroad, in London or Dublin,” Teng said.

The growth looks set to accelerate with the improving economic outlook in the Gulf, a lessening of government “austerity” programs and a stabilization of the oil price.

“The pipeline from now to the end of the year is extremely busy. People are genuinely excited at the prospect of doing business in a ‘best in class’ regulatory regime, where we see our mission as problem solvers for member firms,” Teng said.

Of course, the heart of a financial center — like in London or New York — often revolves around a securities trading market. The ADGM does not have an equity-trading platform yet but is in talks with the Abu Dhabi Securities Exchange, the UAE capital’s onshore market, about ways to develop more liquidity in trading in equities and other financial instruments.

There is already an international market in the Gulf region — Nasdaq Dubai — but it has had only limited success in attracting big international stocks onto its board. Might there be an opportunity there for ADGM to open up an international stock market and — potentially — offer Saudi Aramco another place to list its shares in the region?

Teng would definitely not speculate on this but did say: “There is already a first-class exchange in Abu Dhabi. But we are looking to use ADGM as a platform to explore possibilities we have not had in the past. We should not rule anything out.” Make of that what you will.

Overall, he thinks the changes underway in Saudi Arabia can only be good for the region: “We have Saudi employees in ADGM and they are very thoughtful people, very engaging. We want to help them build a good neighborhood, which will bring value back up. It is a bit like having a house in a good neighborhood — the real estate value goes up. We want the same in financial services. We want to support liquidity in the region, and to work more closely together with them as a regulatory regime,” he said.

‘We want to keep financial services in the region’

‘We want to keep financial services in the region’

Global Markets — stocks and dollar dip as Trump’s spending bill passes, trade deal deadline nears

LONDON: Stocks slipped on Friday as US President Donald Trump got his signature tax cut bill over the line and attention turned to his July 9 deadline for countries to secure trade deals with the world’s biggest economy.

The dollar also fell against major currencies with US markets already shut for the holiday-shortened week, as traders considered the impact of Trump’s sweeping spending bill which is expected to add an estimated $3.4 trillion to the national debt.

The pan-European STOXX 600 index fell 0.8 percent, driven in part by losses on spirits makers such as Pernod Ricard and Remy Cointreau after China said it would impose duties of up to 34.9 percent on brandy from the EU starting July 5.

US S&P 500 futures edged down 0.6 percent, following a 0.8 percent overnight advance for the cash index to a fresh all-time closing peak. Wall Street is closed on Friday for the Independence Day holiday.

Trump said Washington will start sending letters to countries on Friday specifying what tariff rates they will face on exports to the US, a clear shift from earlier pledges to strike scores of individual deals before a July 9 deadline when tariffs could rise sharply.

Investors are “now just waiting for July 9,” said Tony Sycamore, an analyst at IG, with the market’s lack of optimism for trade deals responsible for some of the equity weakness in export-reliant Asia, particularly Japan and South Korea.

At the same time, investors cheered the surprisingly robust jobs report on Thursday, sending all three of the main US equity indexes climbing in a shortened session.

“The US economy is holding together better than most people expected, which suggests to me that markets can easily continue to do better (from here),” Sycamore said.

Following the close, the House narrowly approved Trump’s signature, 869-page bill, which averts the near-term prospect of a US government default but adds trillions to the national debt to fuel spending on border security and the military.

Trade the key focus in Asia

Trump said he expected “a couple” more trade agreements after announcing a deal with Vietnam on Wednesday to add to framework agreements with China and Britain as the only successes so far.

US Treasury Secretary Scott Bessent said earlier this week that a deal with India is close. However, progress on agreements with Japan and South Korea, once touted by the White House as likely to be among the earliest to be announced, appears to have broken down.

The US dollar index had its worst first half since 1973 as Trump’s chaotic roll-out of sweeping tariffs heightened concerns about the US economy and the safety of Treasuries, but had rallied 0.4 percent on Thursday before retracing some of those gains on Friday.

As of 2:00 p.m. Saudi time it was down 0.1 percent at 96.96.

The euro added 0.2 percent to $1.1773, while sterling held steady at $1.3662.

The US Treasury bond market is closed on Friday for the holiday, but 10-year yields rose 4.7 basis points to 4.34 percent, while the two-year yield jumped 9.3 bps to 3.882 percent.

Gold firmed 0.4 percent to $3,336 per ounce, on track for a weekly gain as investors again sought refuge in safe-haven assets due to concerns over the US’s fiscal position and tariffs.

Brent crude futures fell 64 cents to $68.17 a barrel, while US West Texas Intermediate crude likewise dropped 64 cents to $66.35, as Iran reaffirmed its commitment to nuclear non-proliferation.

World food prices tick higher in June, led by meat and vegetable oils

PARIS: Global food commodity prices edged higher in June, supported by higher meat, vegetable oil and dairy prices, the UN Food and Agriculture Organization has said.

The FAO Food Price Index, which tracks monthly changes in a basket of internationally traded food commodities, averaged 128 points in June, up 0.5 percent from May. The index stood 5.8 percent higher than a year ago, but remained 20.1 percent below its record high in March 2022.

The cereal price index fell 1.5 percent to 107.4 points, now 6.8 percent below a year ago, as global maize prices dropped sharply for a second month. Larger harvests and more export competition from Argentina and Brazil weighed on maize, while barley and sorghum also declined.

Wheat prices, however, rose due to weather concerns in Russia, the EU, and the US.

The vegetable oil price index rose 2.3 percent from May to 155.7 points, now 18.2 percent above its June 2024 level, led by higher palm, rapeseed, and soy oil prices.

Palm oil climbed nearly 5 percent from May on strong import demand, while soy oil was supported by expectations of higher demand from the biofuel sector following announcements of supportive policy measures in Brazil and the US.

Sugar prices dropped 5.2 percent from May to 103.7 points, the lowest since April 2021, reflecting improved supply prospects in Brazil, India, and Thailand.

Meat prices rose to a record 126.0 points, now 6.7 percent above June 2024, with all categories rising except poultry. Bovine meat set a new peak, reflecting tighter supplies from Brazil and strong demand from the US. Poultry prices continued to fall due to abundant Brazilian supplies.

The dairy price index edged up 0.5 percent from May to 154.4 points, marking a 20.7 percent annual increase.

In a separate report, the FAO forecast global cereal production in 2025 at a record 2.925 billion tonnes, 0.5 percent above its previous projection and 2.3 percent above the previous year.

The outlook could be affected by expected hot, dry conditions in parts of the Northern Hemisphere, particularly for maize with plantings almost complete.

Saudi Arabia posts 4 years of VC growth despite global slowdown: report

RIYADH: Saudi Arabia achieved four consecutive years of growth in venture capital relative to its economy, a feat unmatched among its peers, according to a new report.

Between 2020 and 2023, the Kingdom was the only large market in the sample to post uninterrupted annual gains in VC intensity, contrasting with the more episodic deal flow seen across Africa and parts of Southeast Asia, MAGNiTT’s recently published Macro Meets VC report stated.

While 2024 saw a slight contraction in funding amid global tightening, Saudi Arabia’s multi-year upward trend signals a sustained commitment to innovation-led diversification.

The Kingdom is steadily consolidating its position as a model for policy-driven venture capital development in emerging markets as it seeks to diversify its economy in line with the Vision 2030 blueprint.

“Saudi Arabia is becoming the model for long-term, policy-driven ecosystem building,” the report notes, highlighting that sovereign limited partners and local funds have been instrumental in buffering the Kingdom from some of the volatility that struck other emerging venture markets.

Saudi Arabia’s policy momentum

The MAGNiTT data revealed that Saudi Arabia recorded a five-year average VC-to-GDP ratio of 0.07 percent.

Although this figure remains modest compared to more mature hubs like Singapore, its consistent upward movement underscores the growing depth of domestic capital formation.

Beyond the headline ratios, the Kingdom’s strategic positioning has also come into sharper focus. Saudi Arabia, along with the UAE, is classified as a “Growth Market”— a designation that reflects not only a sizeable GDP and population but also the rising economic clout of local consumer and enterprise demand.

With a GDP approaching $950 billion and a population exceeding 33 million, Saudi Arabia presents a significant scale advantage.

According to MAGNiTT’s benchmarking, this size creates “natural expansion targets for startups moving beyond initial launch markets,” supporting both regional and international founders seeking to diversify beyond smaller ecosystems.

MENA’s uneven progress

Across the broader Middle East and North Africa region, venture capital activity has continued to evolve unevenly.

The UAE has retained its reputation as a strategic innovation hub and one of the few “MEGA Markets” in the emerging world, boasting a five-year average VC-to-GDP ratio of 0.20 percent.

This proportion — identical to Indonesia’s ratio — signifies robust venture activity relative to the economy’s size.

Yet, while the UAE maintained this level, Saudi Arabia has seen more consistent growth in funding, a dynamic the report attributes to policy-led market development.

In Egypt, VC has gained further traction over the period under review. Egypt achieved a 25 percent rise in total funding compared to the previous five-year average, lifting its VC-GDP ratio by 0.02 percentage points to 0.11 percent.

Although Egypt’s overall economic constraints remain acute — GDP per capita still lags below $10,000 — the relative progress suggests improving investor confidence, particularly in fintech and e-commerce.

However, the report cautions that deal flow in Egypt, much like in Nigeria, remains fragile and prone to episodic swings driven by a handful of large transactions.

The macroeconomic context across MENA has also been influential. Elevated oil price volatility and the impact of the Israel–Iran conflict have created a challenging backdrop for policymakers.

Brent crude surged more than 13 percent in a single day earlier in 2025, underscoring the region’s exposure to external shocks.

Nevertheless, both Saudi Arabia and the UAE managed to maintain monetary policy stability in line with the US Federal Reserve’s cautious stance.

Saudi Arabia kept its benchmark rate at 5.5 percent, supported by inflation trending around 2 percent, while the UAE held steady at 4.4 percent.

These decisions reflected a delicate balance between containing price pressures and supporting economic diversification efforts.

Overall, MENA’s five-year aggregate venture funding reached $12.52 billion. Although this total remains well below the levels seen in more mature regions, it represents a meaningful share of emerging markets capital.

MENA also posted the highest deal count relative to its peers in Southeast Asia and Africa over the period, indicating a broader base of early-stage transactions even as late-stage funding remains more limited.

The report emphasizes that expanding geographic and sectoral reach within MENA will be critical to boosting efficiency metrics.

“VC remains heavily concentrated in a few sectors and cities,” the report observes, warning that without broader inclusion, capital intensity will struggle to match potential.

Southeast Asia’s VC benchmark

Beyond MENA, Southeast Asia’s ecosystem stands out as the most mature among emerging venture markets, driven primarily by Singapore’s exceptional performance.

Over the 2020–2024 period, Singapore achieved a 5-year average VC-to-GDP ratio of 1.3 percent, surpassing not only all emerging markets but also developed economies such as the US, which registered 0.79 percent, and the UK, with 0.73 percent.

Even with a 5.4 percent decline in total funding compared to the prior five years and a 0.19 percentage point drop in VC-GDP ratio, Singapore maintained unmatched capital efficiency.

The report describes the city-state as “a benchmark for capital efficiency in venture ecosystems,” attributing this strength to strong regulatory frameworks, institutional capital participation, and a deep bench of experienced founders and investors.

Indonesia, Southeast Asia’s largest economy, recorded total VC funding volumes nearly twice as large as Singapore’s over five years, but its relative VC-GDP ratio remained lower at 0.2 percent.

This dynamic illustrates one of the report’s core findings: venture capital inflows correlate more strongly with GDP per capita than total GDP.

In Indonesia’s case, while its GDP surpassed $1.2 trillion, GDP per capita hovered around $4,000, constraining purchasing power and, by extension, startup revenue potential.

Thailand, meanwhile, reported funding gains due mainly to a single mega deal rather than systematic improvements in ecosystem depth.

In Africa, Nigeria emerged as an unexpected bright spot in 2024, as a single major transaction lifted its VC-GDP ratio to 0.15 percent — the highest in the region for that year.

However, this outlier result also revealed the episodic nature of capital deployment in developing markets.

Kenya registered a relatively high five-year VC-GDP ratio of 0.3 percent, even as absolute funding volumes remained modest.

The report notes that in low-GDP contexts, this ratio can overstate ecosystem maturity.

South Africa and Egypt showed more modest growth trajectories, weighed down by persistent inflation, structural constraints, and capital scarcity.

In aggregate, African economies continued to lag both Southeast Asia and MENA in total venture funding and deal velocity.

Global challenges ahead

Globally, the five years covered by the report were marked by intensifying volatility.

High interest rates, trade tensions, and geopolitical uncertainty weighed on capital flows.

The US Federal Reserve held its policy rate between 4.25 percent and 4.5 percent through mid-2025, citing “meaningful” inflation risks.

The European Central Bank moved to lower its deposit rate to 2 percent, reflecting cooling inflation but acknowledging sluggish growth.

The World Bank cut its global GDP forecast for 2025 to 2.3 percent, the weakest pace since the 2008 crisis, excluding recessions.

These headwinds contributed to the decline in venture capital across most emerging markets in 2024.

In response, sovereign capital and strategic investors have become increasingly important backstops.

The report highlights that domestic capital formation in MENA has partially offset declining global risk appetite.

However, these funds tend to be slower moving, more sector-concentrated, and less risk-tolerant than international investors.

“Without renewed foreign inflows or regional exit pathways, deal velocity may remain muted into the second half of 2025,” the report warns.

This environment is likely to force startups to extend runway and compel general partners to adopt more selective deployment strategies.

Despite the challenges, the outlook for Saudi Arabia and other growth markets remains constructive over the medium term.

The Kingdom’s policy clarity, deepening institutional capital pools, and Vision 2030 commitments create a foundation for continued expansion.

As the report concludes: “High GDP markets like KSA and Indonesia trail in VC efficiency — suggesting capital underutilization.”

Closing this gap between potential and realized funding will be the defining challenge for emerging ecosystems as they navigate a turbulent global landscape.

Oil Updates — crude falls as Iran affirms commitment to nuclear treaty

LONDON: Oil futures fell slightly on Friday after Iran reaffirmed its commitment to nuclear non-proliferation, while major producers from the OPEC+ group are set to agree to raise their output this weekend.

Brent crude futures were down 49 cents, or 0.71 percent, to $68.31 a barrel by 11:31 a.m. Saudi time, while US West Texas Intermediate crude fell 41 cents, or 0.61 percent, to $66.59.

Trade was thinned by the US Independence Day holiday.

US news website Axios reported on Thursday that the US was planning to meet with Iran next week to restart nuclear talks, while Iran Foreign Minister Abbas Araqchi said Tehran remained committed to the nuclear Non-Proliferation Treaty.

The US imposed fresh sanctions targeting Iran’s oil trade on Thursday.

Trump also said on Thursday that he would meet with representatives of Iran “if necessary.”

“Thursday’s news that the US is preparing to resume nuclear talks with Iran, and Araqchi’s clarification that cooperation with the UN atomic agency has not been halted considerably eases the threat of a fresh outbreak of hostilities,” said Vandana Hari, founder of oil market analysis provider Vanda Insights.

Araqchi made the comments a day after Tehran enacted a law suspending cooperation with the UN nuclear watchdog, the International Atomic Energy Agency.

OPEC+, the world’s largest group of oil producers, is set to announce an increase of 411,000 bpd in production for August as it looks to regain market share, four delegates from the group told Reuters.

Meanwhile, uncertainty over US tariff policies resurfaced as the end of a 90-day pause on higher levy rates approaches.

Washington will start sending letters to countries on Friday specifying what tariff rates they will face on goods sent to the US, a clear shift from earlier pledges to strike scores of individual trade deals.

President Trump told reporters before departing for Iowa on Thursday that the letters would be sent to 10 countries at a time, laying out tariff rates of 20 percent to 30 percent.

Trump’s 90-day pause on higher US tariffs ends on July 9, and several large trading partners have yet to clinch trade deals, including the EU and Japan.

Separately, Barclays said it raised its Brent oil price forecast by $6 to $72 per barrel for 2025 and by $10 to $70 a barrel for 2026 on an improved outlook for demand.

EV maker Lucid’s quarterly deliveries rise but miss estimates

- Lucid delivered 3,309 vehicles in the quarter ended June 30

LONDON: Electric automaker Lucid on Wednesday reported a 38 percent rise in second-quarter deliveries, which, however, missed Wall Street expectations amid economic uncertainty.

Demand for Lucid’s pricier luxury EVs have been softer as consumers, pressured by high interest rates, shift toward cheaper hybrid and gasoline-powered cars.

Lucid delivered 3,309 vehicles in the quarter ended June 30, compared with estimates of 3,611 vehicles, according to seven analysts polled by Visible Alpha. It had delivered 2,394 vehicles in the same period last year.

Saudi Arabia-backed Lucid produced 3,863 vehicles in the quarter, missing estimates of 4,305 units, but above the 2,110 vehicles made a year ago.

The company stuck to its annual production target in May, allaying investor worries about manufacturing at a time when several automakers pulled their forecasts due to an uncertain outlook.

US President Donald Trump’s tariff policy has led to a rise in vehicle prices as manufacturers struggle with high material costs, forcing them to reorganize supply chains and produce domestically.

Lucid’s interim CEO, Marc Winterhoff, had said in May that the company was expecting a rise of 8 percent to 15 percent in overall costs due to new tariffs.

The company’s fortunes rest heavily on the success of its newly launched Gravity SUV and the upcoming mid-size car, which targets a $50,000 price point, as it looks to expand its vehicle line and take a larger share of the market.

Deliveries at EV maker Tesla dropped 13.5 percent in the second quarter, dragged down by CEO Elon Musk’s right-wing political stances and an aging vehicle line-up that has turned off some buyers.