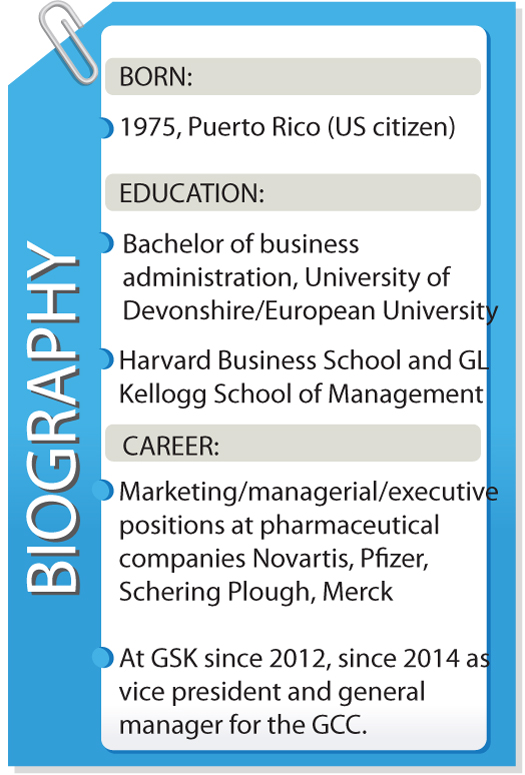

What the critics call “big pharma” has had an image problem in recent years, and Andrew Miles, the executive in charge of the global health care company GlaxoSmithKline’s (GSK) business in the Gulf, thinks he knows how to resolve it.

“Choice of medication should be a clinical choice, rather than being based on some potential conflict of interest,” said Miles when we met at the UAE offices of GSK in Dubai.

For the last four years, GSK has been at the forefront of a transformation of the drugs industry. Barraged by allegations of inappropriate payments to doctors and other health care professionals, especially in the hyper-litigious US, GSK took the decision to halt all payments to health care providers (HCPs), and to cease rewarding its sales force according to the number of prescriptions issued for its products.

The initiative grew out of GSK’s “corporate integrity agreement” in 2012, which settled lawsuits in the US, and involved a multibillion-dollar payment to the authorities, but it has become something more for GSK.

“GSK was the first big pharma company to stop payments to HCPs to promote our products. It was a big decision for us, and nobody else has done it, though maybe other pharma groups will follow. Overall, it has had a net positive impact. Governments love it. They want all pharma companies to stop payments and we are advising them how to do it. It is a policy for the long term, good for patients and good for shareholders,” he said.

That initiative is set to have repercussions in the Middle East, where GSK has been involved for 65 years. Miles revealed that GSK is in advisory discussions with the Saudi health authorities to draw up new legislation to better regulate the medical and pharmaceutical industry in the Kingdom.

“We are in dialogue with the Saudi Food and Drug Administration (SFDA) in an advisory capacity, and I don’t think we’re far off some kind of enactment of major legislation on standards of transparency and engagement with the health care industry,” he said.

Saudi Arabia has been a focus of the company long before the 2000 merger between UK firm Glaxo Wellcome and American SmithKline Beecham that produced the sixth biggest drugs company in the world.

In different guises, GSK has had a manufacturing facility in Jeddah since 1992, currently employing 427 people. Between that facility, a distribution hub in Dubai’s Jebel Ali, and sales offices throughout the region, GSK covers a region of increasing interest.

“The GSK footprint in the region has a big heritage and has been expanding over the years,” he said.

Its regional operation mirrors the three-sector global corporate structure: Consumer products like household drugs Panadol and Sensodyne; pharmaceutical and prescriptions products like its blockbuster respiratory drug Advair; and vaccines, ranging from the full-spectrum of children’s vaccines — over half the pediatric vaccines delivered in the UAE are made by GSK — to anti-HIV and anti-malarial treatments.

“We have an integrated strategy in the Gulf Cooperation Council (GCC) markets. The region does not have a lot of intra-GCC trade, but is very similar in terms of language, culture and business practices,” he said.

“We will be able to supply Kuwait and Oman via the UAE and Saudi Arabia. The UAE has a good position as a re-export hub for the rest of the region and Africa via our facilities at Jebel Ali. In Saudi Arabia, 80 percent of the portfolio is locally manufactured in Jeddah. That operation has been there for a long time, but it is now part of the Vision 2030 strategy to expand localization and local employment,” he added.

A major expansion is also planned in the UAE, with manufacturing facilities in Dubai due to be opened next year, making the full range of GSK products. The standoff between Qatar and the four countries of the Anti-Terror Quartet (ATQ) prompted some urgent changes to distribution channels earlier in the summer.

“Products are now going straight from Europe to Qatar, which used to come direct from the UAE, and we believe supply continuity is going well. We saw an increase in demand when the measures (blocking land, sea and air links with Qatar) were first announced, and some stockpiling of medicines,” he said.

“We are monitoring the situation. We think it could either escalate or de-escalate rapidly, but we don’t see it getting resolved quickly. It could be one or two years on the current status. But really it’s anybody’s guess,” he added.

Even without the distribution changes forced on GSK by the Qatar crisis, other factors are changing the shape of the industry and the traditional marketing methods used by companies.

“The channels of communication with sales reps are all digital now. You might not be able to physically see a sales rep but you can always get experts online,” he said.

And, of course, marketing is being transformed by the decision to stop payments to HCPs. “Before, there were two ways to drive performance. You could pay HCPs to speak on behalf of the science, but this was expensive and problematic. The main concern, however, was the potential conflict of interest involved. So in 2016 we took the decision to stop it completely. Now promotion is purely based on the science. We do still hire HCPs to work for us, to go out and talk about the products, but it is clear they are our employees,” he said.

“The second way was to pay sales representatives by the number of prescriptions issued for a product. We don’t do that anymore either, so again the potential conflict of interest is removed,” Miles added.

Health care is a major pre-occupation in the Gulf and a top priority for policymakers, which has led to a boom in medical-related industries, from the physical provision of hospital and clinic facilities to the expansion of obligatory medical insurance and the growth of pharmaceutical retailers across the region.

But it has not been without its controversies. How does Miles, as a career executive in the “big pharma” sector, see the big issues in health care in the Middle East?

One perennial is the increasing use of antibiotics. Some critics allege that doctors and pharmacists are too ready to prescribe or sell antibiotic treatments for even the most trivial of complaints. The scientific evidence suggests that this is leading to a new generation of “super bugs” that are resistant to traditional penicillin antibiotics, storing up big health problems ahead worldwide.

One of GSK’s biggest products in the region is the ubiquitous antibiotic Augmentin, and Miles concedes that the industry must do more, in conjunction with governments, to curb excessive selling or prescribing.

“There is a risk that the last line of therapy is no longer effective, but there are things that can be done about that. We can invest in new research and development to tackle the superbugs, and we are doing this. But it also revolves around the indiscriminate use of antibiotics. So we need to do more research to monitor the effectiveness and appropriateness of the existing drugs,” he said.

“We must also educate people on the use of antibiotics via prescription. Most illnesses are viral so they are no good anyway. There is a job of education to be done here with the health service providers. We need government support for regulation for the over-the-counter dispensation of antibiotics. The government is taking some steps but more needs to be done,” he added.

The other big issue for the region is in the related field of allergies and respiratory complaints, which have been chronic problems for many in the desert climate.

“We have a big presence in asthma treatment and have a new medicine which presents double the opportunity for asthma control, with a short-acting element to open the respiratory channels and a long-term part to maintain that.

“Maybe because of climate and environment, we’re also looking closely into chronic obstructive pulmonary disease (COPD) at the moment. We’re looking to unveil a ‘blockbuster’ in this area soon. It’s possible now to alleviate the rate of increase in COPD symptoms, and hopefully keep patients out of hospital for longer,” he said.

“COPD and asthma are closely connected, and around 5 percent of asthma patients get acute symptoms. There are around 50,000 people in the GCC with severe asthma who are not currently getting treated. Our new drugs, Relvar and Nucala, tackle this problem and the response has been incredible,” Miles said.

Other blockbusters are also in the pipeline. “Our big new product Shingrix, which will be launched in 2019, is to treat shingles, with an 80 percent prevention rate,” Miles said.

GSK has also been at the forefront of treatment for HIV. “We’ve launched HIV products across the world and the region, to dramatic effect. In the 1980s, it was a death sentence, now it’s under control in all areas, with the possible exception of sub-Saharan Africa. You’re more likely to die of old age even if you have contracted HIV. But we have to emphasize that healthy lifestyles should not be relaxed,” he said.

In Africa and India, GSK has given up its license rights for anti-HIV products to local producers. In many cases, patients and hospitals in those countries could not afford advanced HIV treatments, so GSK in partnership with the Bill & Melinda Gates Foundation waived its right to license fees.

Meningitis is another area where GSK is active. Its incidence always increases during the Hajj season, when pilgrims are in close proximity to each other. “We have developed several vaccines to treat meningitis,” he said.

Other diseases like malaria and polio are also on GSK’s target board, but again there are other factors at play. On malaria, he said: “It’s the biggest killer in the world, but was not well researched because the commercial opportunities are not there. We have a vaccine, which is 50 percent effective, which we are supplying to some countries at cost. But it needs other measures — like water quality control and preventive netting — to make it more effective,” he said.

“Polio too is a problem with a regional resonance. It has largely been eradicated in most of the world, with the exception of some cases in Afghanistan, Pakistan and (now) Syria, as well as a few cases in West Africa. There is still a cultural problem with polio vaccination in some parts of the Middle East and Asia,” Miles said.

Willingness to bend traditional commercial imperatives to the medical needs of communities, in cooperation with governments, is a sign of what some industry analysts have called “new pharma.”

GSK has consciously set out to take a lead in promoting the more progressive, compassionate side of the industry.

At GSK, that change is likely to be accelerated by the arrival of a new British chief executive of the group, Emma Walmsley, who plans to visit the Middle East soon. “The old model couldn’t continue to exist, it had outlived its purpose,” said Miles.

Regional GlaxoSmithKline chief reveals how ‘new pharma’ is changing Gulf health care

Regional GlaxoSmithKline chief reveals how ‘new pharma’ is changing Gulf health care

Closing Bell: Saudi main index rises to close at 11,641

RIYADH: Saudi Arabia’s Tadawul All Share Index gained 50.52 points, or 0.44 percent, closing at 11,641.31 on Thursday.

The total trading turnover of the benchmark index was SR6.02 billion ($1.60 billion), with 134 stocks advancing and 85 retreating.

Similarly, the Kingdom’s parallel market Nomu rose 229.98 points, or 0.76 percent, to close at 30,394.70. Of the listed stocks, 44 advanced while 38 retreated.

The MSCI Tadawul Index increased by 8.37 points, or 0.58 percent, to close at 1,460.35.

The best-performing stock of the day was Tamkeen Human Resource Co., whose share price surged 18.00 percent to SR76.70.

Other top performers included Zamil Industrial Investment Co., whose share price rose 8.70 percent to SR29.35, and Dr. Soliman Abdel Kader Fakeeh Hospital Co., whose stock price increased 5.66 percent to SR63.50.

Saudi Cable Co. recorded the biggest drop, falling 6.93 percent to SR84.60.

Saudi Enaya Cooperative Insurance Co. also saw its share price fall 4.25 percent to SR13.08.

Meanwhile, Saudi Automotive Services Co. saw its stock price drop 4.23 percent to SR68.00.

On the announcements front, Saudi Telecom Co. revealed that it had received foreign investment authorization from the Spanish Council of Ministers, allowing it to increase its voting rights from 4.97 percent to 9.97 percent and gain the right to appoint a board member at Telefonica.

According to a Tadawul statement, the change in stc ownership from 9.9 percent in the previous announcement to 9.97 percent reflects Telefonica’s cancellation of shares in April. stc is currently completing the necessary steps to finalize the increase in its voting rights, which is expected to be completed in the coming period.

stc ended the session at SR39.95, with no change in its share price.

Nofoth Food Products Co. announced the acquisition of a mixed-use commercial and residential land in Riyadh’s Hittin neighborhood for SR22 million, covering 1,580.37 sq. meters. This acquisition is part of the company’s strategic plan to expand operations with new commercial offices and develop its headquarters.

According to a bourse filing, the deal will be financed through the company’s internal resources. The land acquisition will increase the firm’s fixed assets and positively impact financial ratios such as return on assets.

Nofoth Food Products Co. ended the session at SR18.00, down 1.69 percent.

Saudi Arabia’s 2025 education plan boosts Chinese learning, nurtures gifted talent

RIYADH: Around 102,000 students in Saudi Arabia will learn Chinese annually in public schools, while three new institutions for the gifted will open as part of the Kingdom’s 2025 education plans.

According to the Ministry of Finance’s budget report, the education sector has been allocated SR201 billion ($53.50 billion), representing 16 percent of the government’s expenditures for the coming year.

According to Mansoor Ahmed, an independent adviser in various sectors including education: “Saudi Arabia’s higher education sector is the largest individual education market across the Arabian Gulf region with a staggering 2 million students enrolled in 2022.”

He said: “Notably, 95 percent of these students are enrolled in public and semi-public institutions, underlining a significant reliance on the public sector for higher education. This reliance is attributed to the perception of higher quality and job prospects offered by public institutions.”

According to Ahmed, the government’s funding allocation for this sector is expected to shift higher education demand towards fields like AI, robotics, and renewable energy, while focusing more on R&D to address skills gaps and align education with job market needs.

This funding aims to promote comprehensive education, enhance learning within families and communities, and equip individuals with the skills necessary for national development and workforce readiness.

It was announced in September that Saudi Arabia had begun teaching the Chinese language to primary and middle school students to equip learners with valuable skills and promote cultural appreciation.

Pupils are now learning Mandarin, with 175 educators teaching the language as part of an agreement between the Kingdom and China. The program aims to improve job prospects and academic opportunities, particularly for those interested in studying at Chinese universities.

The initiative aligns with Saudi Vision 2030 and China’s growing global influence, further strengthening the trade and cultural ties between the two nations, according to the Ministry of Education.

The program started with pilot schools and will gradually expand to include high school students by 2029. Educators from both nations view the initiative as a “win-win,” promoting cultural exchange and enhancing communication between the two countries.

Key projects for Saudi Arabia’s education sector in 2025, as mentioned in the Kingdom’s budget for the coming fiscal year, include increasing kindergarten enrollment to 40 percent to help achieve the Vision 2030 target of 90 percent while addressing the need for specialized teaching staff.

There are also plans to expand enrollment for students with disabilities and build sports halls for girls in public schools.

According to Ahmed: “In Saudi Arabia, approximately 293,000 children are identified with various disabilities. The National Transformation Program 2020 aims to ensure that 200,000 children with disabilities aged 6-18 would benefit from specialized education programs and support services.”

Ahmed noted that under the Rights of Students with Disabilities and Equal Participation in Education or RSEPI, all children with disabilities in Saudi Arabia are guaranteed free and appropriate education, encompassing individual education plans, early intervention programs, and transition services.

He also highlighted the increasing private sector interest in this area, exemplified by Amanat’s acquisition of a 60 percent stake in the Human Development Co. for SR220.3 million.

The company is a major provider of special education and care services in the Kingdom, operating nine schools, 22 daycare centers, and rehabilitation clinics across six provinces.

The Kingdom aims to raise the percentage of accredited training institutions to 39 percent while establishing three new academic facilities dedicated to nurturing gifted students in areas such as sports and technology, with one school set to open in Riyadh.

Saudi Arabia’s focus on education and the significant investment in this sector reflects its commitment to diversifying its economy and empowering its youth to contribute to the Kingdom’s future growth.

This emphasis on education is driven by the country’s long-term Vision 2030 goals, which seek to transition away from oil dependency and create a knowledge-based economy.

Saudi Arabia has recognized that education plays a central role in shaping the future of its citizens, particularly the younger generation. This has led to a series of reforms aimed at improving the quality of schooling, increasing access to education, and fostering specialized skills.

As the Kingdom seeks to boost industries beyond oil, there is a clear need for a skilled workforce in technology, renewable energy, healthcare, and entertainment sectors.

The Saudi government has also been encouraging international collaboration in the education sector to enhance its global competitiveness. For example, opening branches of prestigious universities, such as Arizona State University, is part of a larger strategy to elevate the country’s standing in the global education rankings.

This is intended to provide students with access to world-class education and attract international talent to the Kingdom.

Main 2024 achievements for education sector

The Ministry of Finance’s budget report shows that the significant investment in the Kingdom’s education sector has played a key role in the sector’s notable achievements.

For instance, three Saudi universities have now ranked among the top 200 globally, with King Saud University advancing into the top 100 in the prestigious Shanghai rankings.

In addition, the percentage of higher education graduates entering the workforce within six months of graduation has increased to 43 percent, a jump from 32 percent in 2023, highlighting the country’s efforts to improve job readiness among graduates.

Saudi Arabia is also enhancing its educational institutions’ credibility, with four training facilities receiving institutional accreditation to support the Human Capability Development Program and raise the overall national education standard.

On the infrastructure front, three Saudi cities—Madinah, Al-Ahsa, and King Abdullah City in Thuwal—have been included in UNESCO’s Network of Learning Cities.

These cities aim to foster a more holistic and inclusive learning environment, offering educational opportunities for all ages and helping to equip citizens with the necessary skills for national development and workforce participation.

Furthermore, Saudi Arabia is expanding its research and development capabilities with the establishment of 40 centers dedicated to innovation, technology, and creativity.

These centers will promote research and entrepreneurship, fueling the growth of new ideas and inventions. In 2024, the Kingdom saw a 10 percent increase in the enrollment of gifted students, with 28,264 scholars now participating in the National Program for Gifted Identification.

Additionally, the country achieved six international awards in areas such as technical activity, innovation, and education.

In terms of physical infrastructure, Saudi Arabia is investing heavily in the construction of new educational facilities. A public-private partnership initiative is developing 30 schools in Madinah to create modern and efficient educational facilities.

In November, PwC Middle East announced the acquisition of Emkan Education, a Saudi consultancy specializing in education and skills development advisory services. The partnership is seen as a significant step toward building a future-ready education system in the Kingdom.

The acquisition adds Emkan’s experienced professionals, including three prominent Saudi female education leaders, to PwC’s Middle East schooling practice.

This integration will strengthen PwC’s regional capabilities and support Saudi Arabia’s goal of fostering innovation, empowering citizens, and driving economic transformation.

S&P Global forecasts 4.7% GDP growth for Saudi Arabia in 2025

RIYADH: S&P Global has projected steady growth for Saudi Arabia’s economy, forecasting a 0.8 percent gross domestic product increase in 2024 and a robust 4.7 percent in 2025.

The agency’s adjustments to its earlier forecasts reflect a recalibration of oil production assumptions, now expected at 9.5 million barrels per day in 2025, down from 9.7 million.

The Kingdom’s non-oil sector continues to exhibit strong potential, supporting Saudi Arabia’s economic diversification efforts.

S&P also anticipated low and stable inflation in the Kingdom, forecasting rates of 1.8 percent in 2024 and 1.7 percent in 2025, highlighting the country’s success in maintaining price stability amid global economic volatility.

The agency reduced its real GDP growth forecasts for emerging markets by 10 basis points for both 2025 and 2026, now projecting growth rates of 4.3 percent and 4.4 percent, respectively.

The Kingdom saw the largest downward revision for 2025, with a reduction of 60 bps, followed by Hungary and Mexico.

“In Saudi Arabia, our revision reflects lower oil production assumptions than previously anticipated,” S&P stated.

The report cited recent OPEC+ announcements and trends in global oil markets as factors behind the adjusted projections for Saudi oil output.

S&P also revised its forecasts for other regions. South Africa’s GDP growth projections were raised to 1 percent in 2024 and 1.6 percent in 2025, driven by strong retail sales and a new pension scheme boosting household consumption. While infrastructure challenges remain, ongoing reforms could enhance long-term growth prospects.

In Southeast Asia, S&P noted heightened uncertainty due to reliance on trade and slowing growth in China.

However, domestic demand remains resilient, supported by sectors like IT, finance, and a recovering tourism industry. Manufacturing, particularly electronics, continues to perform well, and inflation is under control, enabling some central banks to ease monetary policy.

S&P upgraded growth forecasts for Malaysia and Vietnam, citing strong electronics supply chains and resilient domestic demand. Vietnam also benefits from recovering financial and real estate sectors. India’s growth remains robust but is expected to moderate after April 2025 due to slowing consumer momentum and challenges in the rural economy.

The Philippines is projected to see slightly slower growth due to softer consumption, though infrastructure investment will provide medium-term support. Indonesia and Thailand maintain stable outlooks, with emerging sectors like electric vehicles and fiscal stimulus driving development.

S&P also highlighted downside risks to global growth, particularly from uncertainties in US trade policy under President-elect Trump.

While the agency assumed a modest tariff increase between the US and China, it warned that more aggressive measures could significantly disrupt global trade and demand.

Tariffs targeting additional countries could amplify these effects, increasing risk premia and tightening financial conditions for emerging markets, especially those with weaker fundamentals.

Geopolitical risks remain elevated, particularly due to the Russia-Ukraine conflict, which has escalated with ballistic missile launches.

According to S&P, this uncertainty could heighten risk aversion toward emerging market assets and impact commodity prices.

Islamic banking in Kuwait and Oman stable amid favorable conditions: Fitch Ratings

RIYADH: The standalone credit profiles of Islamic banks in Kuwait are expected to remain stable in 2025, supported by favorable operating conditions, according to a recent analysis by Fitch Ratings.

The report highlighted that Islamic banking remains a significant sector in Kuwait, accounting for 49 percent of total banking sector assets by the end of the first half of this year.

This follows a similar forecast from Moody’s in September, which predicted faster growth for Islamic financing compared to conventional banking. Moody’s cited rising demand for Shariah-compliant products and the inherent stability of Islamic banks’ net profit margins as key drivers.

Fitch Ratings noted that capital at Kuwaiti Islamic banks remains adequate, supported by moderate growth and steady profitability in 2024 and 2025.

“As for conventional banks, we view Islamic banks’ profitability to have peaked, and we expect earnings to slightly decline in 2025 following expected rate cuts,” said Fitch Ratings.

The credit rating agency noted that funding at Kuwaiti Islamic banks remains strong, with 80 percent sourced from customer deposits.

The report also highlighted a slight increase in the average impaired financing ratio among Islamic banks in Kuwait, rising to 2 percent by the end of the first half, driven by pressure from higher rates and slower financing growth.

“The average financing impairment charges/average gross financing ratio increased slightly in the first half of 2024 but remains well below the pandemic level. Relatively high real estate exposure and concentration are key risks to the bank’s asset quality. Fitch expects asset quality to be stable in 2024-2025,” added Fitch.

Oman’s Islamic finance sector expanding

In a separate report, Fitch Ratings indicated that Omani Islamic banks are benefiting from favorable economic conditions, improving asset quality, stable profitability, and reasonable liquidity.

The total assets of Omani Islamic banks stood at $21.3 billion by the end of the third quarter of this year, with the Islamic banking sector holding a market share of 18.7 percent of the country’s total banking assets.

Fitch pointed to several factors driving the growth of Islamic finance in Oman, including increasing public demand, deeper distribution channels, the use of sukuk by both the government and corporates, and regulatory initiatives.

“The Central Bank of Oman addressed a structural gap in October 2024 with the introduction of the Bank Deposit Protection Law, which would protect Islamic banks’ deposits,” said Fitch.

“We expect this will aid confidence in Oman’s Islamic banking sector as the previous deposits insurance scheme only covered conventional banks’ deposits,” it added.

The report forecast that Oman’s Islamic finance sector will surpass $40 billion in the medium term, with Fitch estimating its total value at $30.9 billion by the end of September 2024.

According to the analysis, the Omani debt capital market reached $45 billion in outstanding debt by the end of the third quarter. There is no expectation of a significant short-term surge, as the government continues to prepay more of its debt using the budget surplus generated by high oil prices.

Fitch also highlighted Oman’s growing sukuk issuance, which increased by 86 percent year on year to $2 billion in the first nine months of 2024, outpacing conventional bond issuance, which rose 53 percent to $5.6 billion during the same period.

Fitch stated: “The Omani Islamic finance sector remains one of the smallest in the GCC (Gulf Cooperation Council),” and pointed out that it continues to face several challenges.

These challenges include “the lack of Islamic liquidity-management instruments and smaller capital bases compared to the conventional banks,” which, according to Fitch, “could restrict their involvement in major government financing projects.”

However, Fitch emphasized the sector’s long-term growth potential, citing recent regulatory developments and Oman’s predominantly Muslim population as key factors supporting future expansion.

Saudi Aramco maintains propane, butane prices for December

RIYADH: The Saudi Arabian Oil Co., also known as Saudi Aramco, kept its December contract prices unchanged month on month at $635 per tonne, according to an official statement

The company also maintained butane prices for the month at $630 per tonne.

Propane and butane are types of liquefied petroleum gas with different boiling points. LPG is commonly used as a fuel for vehicles, heating, and as a feedstock for various petrochemicals.

Aramco’s OSPs for LPG are used as a benchmark for contracts supplying the product from the Middle East to the Asia-Pacific region.

In winter, the demand for propane rises significantly due to its use in heating homes, which can lead to higher prices if supply struggles to keep up.

Such fluctuations are a normal part of the market and are expected during colder months. The increase in prices reflects the basic economic principle of supply and demand, with higher demand resulting in higher costs.