KIRKUK, Iraq: Iraqi forces clashed with Kurdish fighters Monday near the disputed city of Kirkuk, seizing a key military base and other territory in a major operation sparked by a controversial independence referendum.

The offensive, which follows weeks of soaring tensions between two US allies in the battle against the Daesh group, aims to retake oil fields and military bases that Kurdish forces seized during the fightback against the jihadists.

Iraqi and Kurdish peshmerga forces exchanged artillery fire early Monday south of Kirkuk, the capital of the oil-rich province, after the launch of the operation overnight.

In a major advance, Iraq's Joint Operations Command said central government forces took control of the K1 military base northwest of the city -- the first objective of the offensive -- following the withdrawal of peshmerga fighters.

They also seized bridges, roads and an industrial zone to the southwest of Kirkuk, as well as gas facilities, a power station, a refinery and a police station, it said.

The clashes follow an armed standoff between Kurdish forces and the Iraqi army prompted by the September 25 non-binding referendum that produced a resounding "yes" for independence for the autonomous Kurdish region of northern Iraq.

Baghdad has declared the referendum -- held despite international opposition -- illegal.

Crisis talks on Sunday had made little headway in resolving the standoff, which has raised fears of fresh chaos just as Daesh jihadists are on the verge of losing their last strongholds in the country.

State television announced that government troops had taken "large areas" of the province from Kurdish forces "without fighting".

Military sources on both sides however reported exchange of Katyusha rocket fire to the south of the provincial capital.

Iraqi Prime Minister Haider al-Abadi, who said this week that he was "not going... to make war on our Kurdish citizens", has "given orders to armed forces to take over security in Kirkuk," state television said.

Iraqi troops will "secure bases and government facilities in Kirkuk province" the government said.

Multiple peshmerga fighters were injured in the clashes and hospitalised in Kirkuk, a local security source said.

Abadi said that members of the Hashed al-Shaabi, the paramilitary Popular Mobilisation forces, which are dominated by Iran-backed Shiite militias, would stay away from Kirkuk, where there have been multiple demonstrations against their involvement in the dispute.

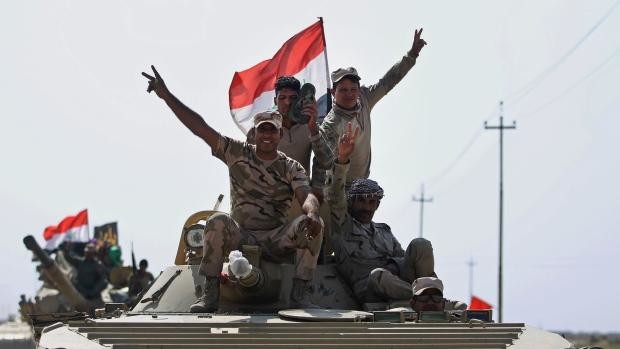

An AFP photographer saw columns of Iraqi troops heading towards Kirkuk from the south.

Two people were killed in artillery exchanges at Tuz Khurmatu, 75 kilometres south of Kirkuk, a doctor at a city hospital said.

On Sunday, Iraq's National Security Council said it viewed as a "declaration of war" the presence of "fighters not belonging to the regular security forces in Kirkuk", including fighters from Turkey's outlawed Kurdistan Workers' Party (PKK).

For their part the Iraqi forces have said that they have no wish to enter Kirkuk but that they wish to retake military positions and infrastructure which were under their control before their troops withdrew in the face of hostility from the jihadists.

On the fringes of the town, they used loudspeakers to call on the peshmerga to give up their positions, local sources said.

Long claimed by the Kurds as part of their historic territory, the province has emerged as the main flashpoint in the dispute.

Polling during the referendum was held not only in the three provinces of the autonomous Kurdish region but also in adjacent Kurdish-held areas, including Kirkuk, that are claimed by both Baghdad and Iraqi Kurdistan.

The Kurds control the city of Kirkuk and three major oil fields in the province that produce some 250,000 barrels per day, accounting for 40 percent of Iraqi Kurdistan's oil exports.

The fields would provide crucial revenue to Baghdad, which has been left cash-strapped from the global fall in oil prices and three years of battle against Daesh. Iraq is also demanding the return of a military base and a nearby airport, according to the Kurds.

Iraqi forces seize territory from Kurds in independence dispute

Iraqi forces seize territory from Kurds in independence dispute

Saudi Arabia to introduce AI education at all grade levels starting this year

- Students will learn to develop innovative technology solutions, beginning in elementary and high schools, and continuing through university studies

RIYADH: Saudi Arabia will integrate artificial intelligence education throughout the country’s public school system beginning in the coming academic year.

The introduction of this nationwide AI curriculum will support the Kingdom’s Human Capability Development Program, part of the Vision 2030 plan for national development and diversification, which is designed to create a comprehensive education system that strengthens core values and boosts the nation’s global competitiveness and AI leadership.

Students will learn how to develop innovative technology solutions, beginning in elementary school and continuing through secondary education, university studies, technical training and lifelong-learning programs, the Saudi Press Agency reported.

The curriculum unveiled by the National Curriculum Center, with the Ministry of Education, Ministry of Communications and Information Technology, and the Saudi Data and Artificial Intelligence Authority, features age-appropriate AI modules in the form of interactive and hands-on teaching. They are designed to connect between grade levels to ensure progressive development of skills and comprehensive student-evaluation systems.

It follows the announcement by the SDAIA in April, during the Human Capability Initiative conference in Riyadh, of an “Introduction to Artificial Intelligence” course for third-year high school students in the general track, in collaboration with the Curriculum Center and the Education Ministry.

This introductory course will serve as the initial phase of the curriculum development and establish the groundwork for the incorporation of AI concepts throughout academic programs, the Saudi Press Agency added.

Kariman Abuljadayel becomes Al-Nassr’s first cross-country skier

- Pioneering athlete signed contract on Wednesday, marking new chapter in her sporting journey and a bold step for winter sports in the Kingdom

JEDDAH: Saudi Olympian Kariman Abuljadayel has made history once again, this time by becoming the first cross-country skier to join Al-Nassr Club, the first Saudi sports club to officially add a winter sport to its roster.

The pioneering athlete signed a contract on Wednesday, marking a new chapter in her sporting journey and a bold step for winter sports in the Kingdom.

“This truly feels like a new chapter for me as well,” Abuljadayel told Arab News.

“I first tried cross-country skiing back in 2019 in St. Moritz, Switzerland, as a form of endurance training during winter — not knowing that a few years down the road it would become my main sport.”

From representing Saudi Arabia as the Kingdom’s first female sprinter at the Rio 2016 Olympics to co-founding the Saudi Rowing Federation, Abuljadayel is no stranger to breaking boundaries. Her move to Al-Nassr continues that legacy.

“I’ve learned what it takes to help build a new sport from the ground up in the Kingdom,” she said.

“This time, it’s cross-country skiing, and I’m excited not only by the sport itself but also by the incredible culture around it. My hope is to inspire more women in Saudi Arabia to get involved, and to ensure that this journey is inclusive — welcoming para-athletes and creating opportunities for everyone to be part of this pioneering movement.”

Abuljadayel famously competed in the 100m at Rio 2016, finishing seventh in her heat. That same year she raced in the 60m at the World Athletics Championships in Portland, USA. Afterward, she pivoted to rowing and was selected to represent the Saudi national team.

Now focused on cross-country skiing, Abuljadayel acknowledged the challenges of training for a winter sport in a desert climate — but sees opportunity rather than limitation.

“Al-Nassr Club is making history as the first in Saudi Arabia to add a winter sport and I’m honored to lead the way. Living in Riyadh, I want to show people that you don’t need year-round snow to pursue this sport,” she said.

“Most professional skiers train on roller skis during the summer, which closely replicate skiing on snow.”

She pointed to Riyadh’s Sport Boulevard project, a major new development featuring car-free paths for sports and outdoor activities, as an ideal venue for roller-ski training.

“You can often find me training there. Every time, people stop to ask what sport I’m doing, which shows just how much curiosity and excitement there is. I truly believe Riyadh has huge potential to become a real training hub for cross-country skiing.”

Abuljadayel now hopes to grow the sport through local events, workshops and community training sessions.

“I want to raise awareness, spark interest and inspire more people to discover this unique sport — and to see that it’s possible right here at home,” she said.

Looking ahead, Abuljadayel has her sights firmly set on the Olympic Games.

“This is such an exciting time to be part of cross-country skiing and winter sports in Saudi Arabia, especially with the Asian Winter Games coming to Trojena, NEOM, in 2029,” she said.

“By representing Saudi Arabia in winter sports, I also get to highlight the incredible diversity of my country’s landscape — deserts, seas, mountains, and yes, even snow. Not many countries can say that, and it’s something I’m truly proud to share through this journey.”

Awami National Party leader killed as militant violence escalates in northwest Pakistan

- Another person with ANP’s Maulana Zeb Khan shot dead by unidentified militants, says CM Office

- ANP spokesperson Ihsan Ullah pays tribute to Khan, says he spoke out against militants frequently

ISLAMABAD: Two people, including a senior leader of the Awami National Party (ANP), were shot dead by unidentified assailants in Pakistan’s northwestern Khyber Pakhtunkhwa (KP) province on Thursday, the chief minister’s office said.

Maulana Zeb Khan, a leader of the Awami National Party (ANP), was shot dead along with another person in KP’s Bajaur tribal district by unknown persons, the chief minister’s office said. English language newspaper Dawn quoted police as saying that the politician was shot dead in Bajaur’s Shindai Mor while campaigning for a peace parade scheduled for July 13 when he was attacked.

ANP spokesperson Ihsan Ullah paid tribute to Khan, saying he frequently spoke out against militants and was a key member of the party, serving as its central secretary of ulema affairs.

“Two people, including Maulana Khan Zeb, were killed in Bajaur in a firing incident by unidentified assailants,” KP Chief Minister’s Office said in a statement, adding that Chief Minister Ali Amin Gandapur condemned the incident.

The KP chief minister directed authorities to prepare a report on the incident and ordered immediate action against those responsible for Khan’s killing.

The incident takes place amid an alarming surge in militant attacks, especially in KP’s tribal districts such as Bajaur, in recent years. Despite past military operations, recent attacks on security forces, clerics and politicians highlight growing instability in the area.

No group has so far claimed responsibility for the incident. However, suspicion is likely to fall on the Tehreek-e-Taliban Pakistan (TTP) outfit that has launched some of the deadliest attacks targeting law enforcers, politicians and civilians since 2007.

Pakistan says Afghanistan-based militant groups launch attacks inside Pakistani territory, a claim Kabul has strongly denied. Islamabad also blames New Delhi for funding and arming these militant groups, which India also denies.

Makkah deputy governor washes Holy Kaaba on behalf of King Salman

- Deputy governor washed interior of Holy Kaaba with Zamzam water mixed with rose water, gently cleansing inner walls with cloth pieces soaked in a sacred blend

MAKKAH: The washing ceremony of the Holy Kaaba was carried out on Thursday by the deputy governor of Makkah, Prince Saud bin Mishal bin Abdulaziz, on behalf of King Salman.

Upon his arrival, the deputy governor washed the interior of the Holy Kaaba with Zamzam water mixed with rose water, gently cleansing the inner walls with cloth pieces soaked in the sacred blend prepared by the General Authority for the Two Holy Mosques. He also performed Tawaf.

During the washing ritual, the prince was accompanied by several officials, accredited Islamic diplomatic corps members to the Kingdom and the hereditary keepers of the Holy Kaaba.

Israeli drone kills one in south Lebanon: ministry

- The Israeli military identified its target as Muhammad Jamal Murad and said he was a Hezbollah artillery commander in the coastal sector

BEIRUT: A man was killed in an Israeli drone strike on southern Lebanon on Thursday, the health ministry said, after Israel announced it was carrying out “special, targeted operations” against Hezbollah.

Despite a November ceasefire between Israel and Hezbollah, Israel has kept up its strikes in Lebanon, hitting suspected Hezbollah targets and occasionally those of its Palestinian ally Hamas.

“One man was killed and two others wounded in an Israeli enemy drone strike that targeted a motorcycle in the village of Mansouri” near the coastal city of Tyre, the ministry said.

The Israeli military identified its target as Muhammad Jamal Murad and said he was a Hezbollah artillery commander in the coastal sector.

It accused him of being behind past rocket launches toward Israel and of attempting to rebuild Hezbollah’s artillery capabilities.

On Tuesday, a drone strike hit a car in a nearby village, killing another man the Israeli military said was involved in developing Hezbollah’s artillery capabilities.

The November 27 ceasefire sought to end more than a year of hostilities with Hezbollah, including two months of all-out war that left the group severely weakened.

Under its terms, Hezbollah was to pull its fighters back north of the Litani river, about 30 kilometers (20 miles) from the Israeli border, leaving the Lebanese army and United Nations peacekeepers as the only armed parties in the region.

Israel was required to fully withdraw its troops from the country but has kept them in five places it deems strategic.

On Thursday, a patrol of the UN Interim Forces in Lebanon was blocked and pelted with stones by “several individuals in civilian clothes” in the southern village of Wadi Jilu, UNIFIL said.

“The (Lebanese army) arrived at the scene and the situation was brought under control,” UNIFIL spokesman Andrea Tenenti said.

In recent weeks, several incidents have seen civilians in Hezbollah strongholds confront UNIFIL patrols. The UN force sits on the ceasefire monitoring committee alongside Lebanon, Israel, France and the United States.

Referencing the attacks, Lebanese President Joseph Aoun told EU ambassadors “these were limited and isolated incidents, which are being addressed and contained,” adding that the “safety of UNIFIL personnel is essential to Lebanon, and that cooperation with the army is close.”