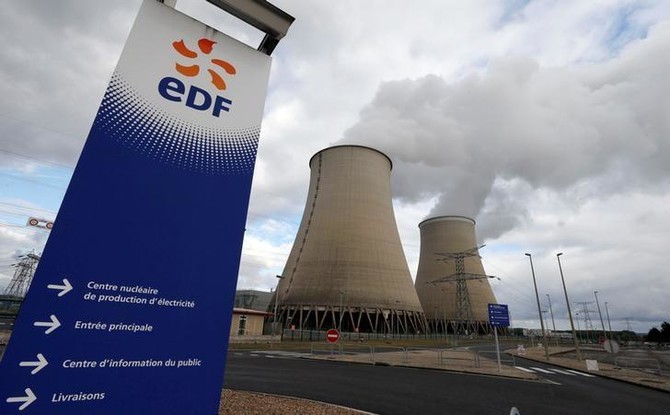

ALKHOBAR: French state-controlled utility EDF intends to take part in a tender to build two nuclear reactors in Saudi Arabia, two sources familiar with the situation told Reuters.

Saudi Arabia, which wants to reduce domestic oil consumption, is considering building 17.6 gigawatts of nuclear-fueled power generation capacity by 2032 and has sent a request for information to international suppliers to build two reactors.

With answers to the request due by the end 2017 or early 2018, a formal tender could be launched by mid-2018, but more likely toward the end of 2018 or early 2019, industry specialists said.

Saudi Arabia’s nuclear plans are some of the largest in an industry struggling with weaker demand following Japan’s Fukushima disaster in 2011.

Russian and South Korean companies have said they plan to bid and sources have told Reuters that Toshiba-owned US firm Westinghouse is in talks with US peers to form a bidding consortium.

EDF has held talks with Saudi Arabia about selling Areva-designed European Pressurized Reactors (EPR) but has not publicly confirmed it will bid.

“EDF wants to participate in the process launched for Saudi Arabia,” a source familiar with the situation said.

EDF wants to assist the King Abdullah City for Atomic and Renewable Energy (KACARE), the government agency tasked with the nuclear program, in drafting its nuclear newbuild program, the source said.

A second source said that EDF would bid in the tender and that EDF officials had visited KACARE last week to discuss the request for information and to give a presentation about the EPR reactor.

EDF declined to comment. KACARE could not be reached for immediate comment.

Last month, a Saudi nuclear official told a conference in Abu Dhabi that for the first two reactors the kingdom is considering reactor models in the 1,000-1,600 megawatt (MW) range.

The EPR, the world’s largest reactor model, has a capacity of 1,600 MW.

EPRs under construction in France, Finland and China are years behind schedule and billions of euros over budget.

EDF hopes that by late 2018-early 2019 at least two should be operational.

Taking part in the Saudi tender would underline that EDF still believes in the capital-intensive nuclear export business despite the strains on its balance sheet.

Industry experts say EDF — which this month dropped a pledge to become cash-flow positive by 2018 — could struggle to raise the equity needed to mount a bid.

For its project to build two EPR reactors in Hinkley Point in Britain, a deal signed last year, EDF put together an £18 billion ($24 billion) debt and equity financing package.

Areva and EDF in 2009 lost to South Korea’s KEPCO in a bid for four nuclear reactors in United Arab Emirates. KEPCO secured a $24.4 billion financing package for that project.

France’s EDF plans to bid in Saudi Arabia nuclear tender

France’s EDF plans to bid in Saudi Arabia nuclear tender

Saudi Arabia sees 45% annual growth in domestic flight bookings: report

RIYADH: Saudi Arabia recorded a 45 percent annual growth in domestic flight bookings in 2024, fueled by the Kingdom’s expanding tourism offerings and increased connectivity through low-cost carriers.

According to Almosafer’s latest travel trend report, domestic room night bookings also saw 39 percent yearly growth. Additionally, combined domestic flight and hotel reservations contributed over 40 percent to the overall travel market, an 11 percent yearly increase.

The growth in domestic travel is largely driven by a broader range of destinations, accommodation options, and experiences that continue to attract leisure visitors to explore their home country. Family and group travel have been key contributors to this upward trend, with bookings in these segments surging by over 70 percent.

Commenting on the trends, Muzzammil Ahussain, CEO of Almosafer, said: “These travel trends align seamlessly with the government’s vision to enhance in-destination value and increase domestic tourism as part of Vision 2030.”

Cities such as Makkah, Riyadh, and Jeddah, as well as Al Khobar and Madinah, remain key attractions.

However, emerging destinations like Abha, Al Jubail, and Jazan, as well as Tabuk and Hail, are gaining momentum due to their distinct offerings, including mountain views, beaches, landscapes, and desert experiences.

“The growth of domestic tourism and the rise of family and group trips, with a focus on unique accommodation experiences and rich in-destination activities, showcase the success of the national agenda of building a thriving leisure tourism sector that contributes significantly to the economy,” Ahussain added.

Almosafer’s report highlights a notable shift in traveler preferences for accommodations. While luxury remains prominent, with 36 percent of room nights booked in five-star properties, budget-friendly stays in three-star or lower hotels now represent 35 percent of total bookings — a segment that has grown 100 percent for families and groups.

Alternative accommodations such as vacation rentals and hotel apartments have also gained traction, with family bookings rising 90 percent and group reservations increasing 60 percent, reflecting growing demand for flexible and affordable lodging options.

Low-cost airlines have also played a crucial role in the domestic travel boom. Increased capacity, expanded connectivity, and additional routes have made budget carriers more accessible to cost-conscious travelers.

While flight bookings grew by 45 percent, the average order value decreased by 7 percent, demonstrating how expanded options are enabling travelers to secure more cost-effective deals.

In-destination activities have become a cornerstone of travel value, with visitors increasingly opting for guided tours, adventure sports, and cultural experiences.

Booking behavior also evolved in 2024, with mobile platforms dominating the market. App bookings grew by 67 percent and accounted for 76 percent of total bookings, while web reservations contributed 17 percent, reflecting 7 percent growth.

Retail bookings, though representing a smaller 7 percent share, remain relevant for complex and higher-value itineraries as travelers seek in-person assistance for personalized planning.

Flexible payment options have further transformed the travel market. Buy now, pay later plans have gained popularity, while Apple Pay accounted for 44 percent of all domestic bookings processed in 2024, reflecting the growing adoption of digital payment methods.

Qatar’s non-oil business growth steady in December; Lebanon’s PMI at 8-month high

- Qatar’s labor market was a key driver of the country’s overall progress in business conditions

- S&P Global added that activity levels across Lebanon’s private sector economy fell in December

RIYADH: The growth of non-oil business activities in Qatar was steady in December, with the country’s purchasing managers’ index remaining stable at 52.9, unchanged from November, an economy tracker showed.

The latest report released by Qatar Financial Center and compiled by S&P Global said that the headline PMI figure for the fourth quarter of 2024 stood at 52.9, up from 52.0 in the previous three months and above the long-run survey average of 52.3 since April 2017.

According to the PMI survey, Qatar’s labor market was a key driver of the country’s overall progress in business conditions in December, with employment and wage increases reaching some of the highest levels on record.

The strong growth in non-energy business activities aligns with the broader economic diversification efforts across Gulf Cooperation Council nations, which continue to reduce reliance on oil revenues.

Earlier this month, S&P Global revealed that Saudi Arabia’s December PMI hit 58.4, driven by a sharp increase in new orders. The Kingdom’s PMI has remained above the neutral 50 mark since September 2020, indicating substantial expansion in the non-oil private sector.

In the UAE and Qatar, the PMI for December stood at 55.4 and 54.1, respectively.

“The headline PMI was unchanged at 52.9 in December, remaining above the long-run trend level of 52.3 and indicating a solid improvement in business conditions in the non-energy sector,” said Yousuf Mohamed Al-Jaida, CEO of QFC Authority.

According to the report, employment and wages have risen more quickly in Qatar’s non-energy business sector than at any other time in survey history, which reflects efforts to raise output, improve services, win new business, and address outstanding workloads.

Even though wage pressures remained strong in December, overall input price inflation eased further from October’s four-year high.

The survey added that Qatari firms continued to hold an optimistic outlook for the next 12 months in December, albeit slightly easing from November.

According to the analysis, Qatar’s Financial Services Future Activity Index rose from 62.1 in November to 68.3 in December, well above the long-run series trend of 63.6.

“The outlook for 2025 is strongly positive, continuing to support a booming labor market. New business growth generated a renewed rise in outstanding work during December, and companies continued to build inventories in expectation of sales growth in the coming months,” added Al-Jaida.

Business confidence in Lebanon rises

In a separate report released by BLOMINVEST Bank, compiled by S&P Global, the PMI of Lebanon hit an eight-month high in December, reaching 48.8, up from 48.1 in November.

The survey revealed that companies recorded their most optimistic assessment of the 12-month outlook in December as the Israel-Hezbollah ceasefire buoyed sentiment.

S&P Global added that activity levels across Lebanon’s private sector economy fell in December, although the pace of decline cooled to the softest seen since March.

“The BLOM Lebanon PMI for December 2024 improved for the second month in a row from the 44-month low in October (45.0) to record 48.8, as slower declines in new orders and new export orders resulted in a softer output contraction,” said Helmi Mrad, research analyst at BLOMINVEST Bank.

He added: “It is interesting to note that the surveyed companies were optimistic regarding the 12-month outlook, with the Future Output Index recording an all-time high of 61.8. This optimism is due to the ceasefire agreement between Hezbollah and Israel.”

According to the survey, the decline in new export business also cooled sharply in December, with the contraction being the slowest in 10 months. This trend also signaled a marked easing of the contraction in international client demand for Lebanese products.

Up to 50% of deep tech startups in Saudi Arabia focus on AI, IoT — report

RIYADH: Up to 50 percent of deep tech startups built in Saudi Arabia are working on artificial intelligence and the Internet of Things, a new report revealed.

Released by the Ministry of Communications and Information Technology, in partnership with King Abdullah University of Science and Technology and in collaboration with Hello Tomorrow consultancy firm, the document indicated that there are over 43 high-growth startups driving innovation in the Kingdom, collectively securing more than $987 million in funding.

This aligns with the National Strategy for Data and AI goals to position Saudi Arabia among the top 10 countries in the open data index and among the top 20 countries in peer-reviewed Data and AI publications by 2030.

It also meets with the strategy’s objective of securing SR30 billion ($7.9 billion) cumulative foreign direct investment and SR45 billion local investment in data and AI in the Kingdom by 2030.

“The deep tech startups that have originated in Saudi Arabia are currently in their early stages of development, but the ecosystem is already attracting mature international companies,” the report said.

On the $987 million secured funding in 2022, the report said this was primarily fueled by a rapidly expanding funding ecosystem, which was ranked in the Middle East and North Africa’s top three for funding and deals.

The report further disclosed that 104 active startup investors registered in the Kingdom in 2023, a 41 percent increase from 2018.

“This expansion is highly dependent on public funds, as the government is committed to nurturing tech startups and scaleups,” the reports said.

It added that the number of researchers in Saudi Arabia has risen by 75 percent since 2015, thereby cementing the nation’s commitment to advancing research and development.

“The country is expanding its research infrastructure to accommodate 140,000 researchers by 2030, marking a sevenfold increase from the current 20,000 researchers in the country,” the report said.

The report tackles the current state and future opportunities of the deep tech ecosystem in the Kingdom as well as key initiatives supporting the goals and objectives of Saudi Vision 2030.

It also seeks to shed light on the prospects and potential in this vital sector which is recognized as a cornerstone for advancing the digital economy and sustainable development as a whole.

GCC, Canada discuss strengthening ties across key sectors

RIYADH: The Gulf Cooperation Council and Canada have reaffirmed their commitment to strengthening international development and investment ties following high-level talks between officials.

On Jan. 6, GCC Secretary General Jasem Al-Budaiwi met with Canadian Minister of International Development Ahmed Hussen to discuss improving bilateral cooperation.

According to a statement from the GCC Secretariat, the talks explored opportunities to deepen alliances between the economic bloc and the North American country, including education and renewable energy.

Within the GCC, countries including Saudi Arabia are actively deepening their relations with Canada, as demonstrated by the restoration of diplomatic ties in May 2023 after a five-year hiatus.

The statement from the GCC Secretariat added that the Jan. 6 discussions also addressed pressing regional and international issues, highlighting the significance of dialogue and strategic partnerships in fostering security and global stability.

“At the conclusion of the meeting, both sides reaffirmed the significance of joint cooperation to enhance sustainable development efforts at both regional and global levels, contributing to greater stability in the region and beyond,” the statement said.

At the end of December, Saudi Arabia’s Minister of Economy and Planning Faisal Al-Ibrahim held talks with Canadian Ambassador Jean-Philippe Linteau at his department’s headquarters in Riyadh, according to the Saudi Press Agency.

Economic cooperation was the focus the meeting as relations between the nations continue to progress.

Bahrain’s non-oil sector fuels 2.1% economic growth

RIYADH: Bahrain’s economy expanded by 2.1 percent year on year in the third quarter of 2024, driven by strong performance in its non-oil sectors, official data showed.

According to data from the Ministry of Finance and National Economy, non-oil sectors grew 3.9 percent during the period, accounting for 86.4 percent of real gross domestic product.

Key contributors included the information and communication sector, which surged 11.9 percent year on year, supported by increased mobile and broadband subscriptions.

Bahrain’s third-quarter growth mirrors positive trends across the Gulf Cooperation Council, with Saudi Arabia’s GDP rising 2.8 percent and Qatar’s advancing 2 percent, driven by ongoing economic diversification.

Despite these gains, Bahrain’s economy faced challenges in the oil sector, where activities contracted by 8.1 percent year on year, contributing to a 0.9 percent decline in nominal GDP.

However, non-oil sectors fared well, with the country’s financial and insurance activities performing strongly, growing by 5.8 percent, while electronic funds transfers increased by 13.7 percent year-on-year.

Manufacturing expanded by 4.2 percent, aided by higher production at the Bapco Refinery, while wholesale and retail trade grew by 2.1 percent, bolstered by a significant rise in e-commerce transactions.

In contrast, the oil sector faced headwinds due to maintenance activities at the Abu Sa’afa field and declining global oil prices. This resulted in a year-on-year contraction of oil activities by 8.1 percent in real terms, while average daily oil production from the Abu Sa’afa field fell by 11.5 percent year on year.

Trade and investment activities also presented mixed results. The current account surplus narrowed by 54.5 percent year on year to 148.6 million Bahraini dinars ($394.2 million), largely due to a 19.2 percent decline in the value of oil exports.

Non-oil exports, however, saw modest growth of 1.1 percent, with base metals and mineral products leading the category. Foreign direct investment stock increased by 3.5 percent year on year, reaching 16.5 billion dinars. The financial and insurance sector remained the dominant contributor, accounting for 67.3 percent of the total foreign direct investments.

Development projects in various sectors continued to advance during the quarter. The Bapco Modernization Program, completed in December, increased refinery capacity by 42 percent, representing the largest capital investment in Bapco’s history.

In the tourism sector, four new five-star hotels and the “Hawar Resort by Mantis” were inaugurated, enhancing Bahrain’s hospitality offerings.

The healthcare sector saw the construction of a new rehabilitation center in Al Jasra, while the Aluminum Downstream Industries Zone was launched as part of Bahrain’s Industrial Strategy.

Monetary and financial indicators reflected positive trends. The broad money supply expanded by 6.1 percent year on year, supported by a 15.6 percent increase in government deposits.

Total loans provided by retail banks grew by 4.9 percent year on year, with personal loans comprising nearly half of the total. The labor market recorded a 1.7 percent increase in the number of Bahrainis employed in the public and private sectors, reaching 153,842.

Recruitment under the Economic Recovery Plan met 98 percent of its annual target for 2024, while over 13,679 Bahrainis received training.

Bahrain’s capital markets also performed well, with the Bahrain All Share Index closing the third quarter at 2,012.77 points, a year-on-year increase of 3.8 percent. The Bahrain Islamic Index recorded even stronger growth, rising by 10.1 percent. Market capitalization increased by 2.4 percent, reaching 7.8 billion dinars.

In global competitiveness rankings, Bahrain retained its position as the freest economy in the Arab world, ranking 34th globally in the Economic Freedom of the World report.

The nation also climbed eight places to rank 30th in the IMD World Digital Competitiveness Ranking, reflecting significant progress in adopting and leveraging digital technologies.