RIYADH: Saudi Arabia is able to issue 50 or even 100-year bonds, but its debt office head said on Wednesday he was not keen to do so at the moment, raising concerns about selling debt of such long maturities.

Speaking at a business conference in the Saudi Arabian capital, Fahad Al-Saif said: “Are we able to issue 50, 100 years, yes. Are we able to issue in different currencies other than dollars, yes. Are we keen to take that step at the moment, I don’t think so.”

“We don’t want to take a step unless it reflects that issuances are mature issuances,” he said.

Among emerging market economies, Argentina last year sold a 100-year bond in US dollars, joining some countries in the euro zone who have taken advantage of a low-yield environment to sell long-dated bonds.

Saudi Arabia can issue 100-year bonds, but ‘not keen’ at the moment: Debt office head

Saudi Arabia can issue 100-year bonds, but ‘not keen’ at the moment: Debt office head

- Saudi Arabia is able to issue 50 or even 100-year bonds

- Speaking at a business conference in the Saudi Arabian capital, Fahad Al-Saif said the move was unlikely

SRC and Hassana launch mortgage-backed securities to boost real estate investment

RIYADH: The region’s first-of-its-kind residential mortgage-backed securities will be available in Saudi Arabia as the Kingdom seeks to enhance liquidity and expand investment opportunities in the real estate finance sector.

A memorandum of understanding, signed between the Saudi Real Estate Refinance Co., a subsidiary of the Public Investment Fund, and Hassana Investment Co., seeks to diversify Saudi Arabia’s financial markets by introducing an innovative asset class.

The issuance of mortgage-backed securities is anticipated to attract a wide base of local and global investors to the secondary mortgage market, creating new opportunities for investment in the sector.

Majeed Al-Abduljabbar, CEO of SRC, said: “Our partnership with Hassana marks a significant milestone in supporting the evolution of the housing finance landscape and fostering the development of Saudi Arabia’s capital markets.”

He added: “Together, we aim to introduce innovative financial solutions that deliver value to both investors and citizens while aligning with Vision 2030’s objectives.”

The deal, signed in the presence of Majid Al-Hogail, minister of municipalities and housing, and Mohammed Al-Jadaan, minister of finance, aligns with the Housing Program and Financial Sector Development Program under Vision 2030.

“This collaboration establishes a new standard for partnerships, enabling the development of scalable financial solutions that contribute to the Kingdom’s economic development goals. It aligns with Hassana’s strategy of diversifying its investment portfolios through long-term partnerships with entities like SRC,” said Saad Al-Fadhli, CEO of Hassana.

Hassana’s participation as a key institutional investor underscores the potential to create sustainable economic investment opportunities.

This comes as the Kingdom’s real estate market continues to show strong demand, with annual growth in residential sales transaction volumes across major metropolitan areas.

Saudi banks’ mortgage lending hit a near three-year high of SR10.06 billion ($2.7 billion) in November, marking a 51.23 percent year-on-year increase and the highest monthly amount in over two years, according to data from the Kingdom’s central bank.

This surge reflects strong activity in the housing market, with houses accounting for 65 percent of the loans, followed by apartments at 31 percent and land purchases at 4 percent.

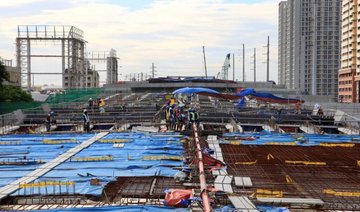

As part of its Vision 2030 agenda, the Kingdom is fast-tracking residential construction, particularly in Riyadh, to accommodate its growing population and attract international talent.

Qatar’s foreign merchandise trade balance surplus slips 5%

RIYADH: Qatar recorded a foreign merchandise trade balance surplus of 57.7 billion Qatari riyals ($15.8 billion) in the third quarter of 2024, down 5 percent year on year, new data revealed.

Merchandise trade balance surplus is the difference between total exports and imports.

According to figures released by the Gulf nation’s Planning and Statistics Authority, the country’s total exports in the third quarter of 2024 — including domestic goods and re-exports — were valued at 87.8 billion riyals. This represents a 2.2 percent decline compared to the same period in 2023.

The value of Qatar’s imports during the same period amounted to 30.1 billion riyals, up 4.1 percent compared to the same quarter in 2023.

The figures fall in with the nation’s trajectory to restore government revenues to pre-2014 oil price shock levels and double its economy by 2031, according to an analysis by Standard Chartered in August.

The data also reflects the steady growth of Qatar’s non-oil economy, contributing to two-thirds of the country’s gross domestic product.

Exports breakdown

The figures further disclosed that the drop in exports is mainly attributed to lower exports of mineral fuels, lubricants, and related materials by 5 billion riyals, or 6.5 percent, and miscellaneous manufactured articles by 100 million riyals, or 22 percent.

Increases were mainly recorded in chemicals and related products by 1.5 billion riyals, or 24.5 percent, machinery and transport equipment by 1.2 billion riyals, or 53.3 percent, and manufactured goods classified chiefly by material by 400 billion riyals, or 17.1 percent.

Exports of crude materials, inedible, except fuels, also witnessed a rise of 100 million, or 24.8 percent.

Imports breakdown

The rise in import values is mainly linked to increases in machinery and transport equipment by 800 million riyals, or 6.7 percent, chemicals and related products by 400 million riyals, or 17.2 percent, and mineral fuels, lubricants and related materials by 320 million riyals, or 58.2 percent.

Imports of food and live animals also jumped by 300 million riyals or 9.8 percent.

Meanwhile, decreases were recorded mainly in miscellaneous manufactured articles by 400 million, or 6.7 percent as well as manufactured goods classified chiefly by material by 300 million, or 7.7 percent.

Principal destinations

The PSA data showed that Asia was the principal destination of exports for the country, representing 75.9 percent, as well as the primary origin of Qatar’s imports, accounting for 39.7 percent.

The Gulf Cooperation Council followed, accounting for 11.6 percent of exports and 11.3 percent of imports, respectively.

The EU came next, with 7.7 percent of exports and 26 percent of imports.

Turkish manufacturing sector nears stabilization in December, PMI shows

- Employment in the manufacturing sector saw a renewed decline, reversing a rise in November

- Input costs increased sharply due to higher raw material prices

ISTANBUL: Turkiye’s manufacturing sector contracted at the slowest rate in eight months in December, a business survey showed on Thursday, in a sign that the sector is nearing stabilization.

The Purchasing Managers’ Index (PMI) rose to 49.1 last month from 48.3 in November, moving nearer to the 50.0 threshold denoting growth, according to the survey by the Istanbul Chamber of Industry and S&P Global.

“December PMI data provided plenty of hope for the sector in 2025. While business conditions continued to moderate, the latest slowdown was only marginal as signs of improvement were seen in a range of variables across the survey,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

The survey highlighted a softer moderation in production, which declined at the slowest pace in nine months, suggesting some improvement in demand. The rate of slowdown in new orders and purchasing eased, although demand remained subdued.

“If this momentum can be built on at the start of 2025, we could see the sector return to growth. The prospects for the sector should be helped by a much more benign inflationary environment than has been the case in recent years,” Harker said.

Despite the positive signs, employment in the manufacturing sector saw a renewed decline, reversing a rise in November, the survey showed.

Input costs increased sharply due to higher raw material prices, but the rate of output price inflation slowed to its weakest in over five years as some firms offered discounts to boost sales.

Oil Updates — crude rises as investors return from holidays, eye China recovery

SINGAPORE: Oil prices nudged higher on Thursday, the first day of trade for 2025, as investors returning from holidays cautiously eyed a recovery in China’s economy and fuel demand following a pledge by President Xi Jinping to promote growth, according to Reuters.

Brent crude futures rose 17 cents, or 0.06 percent, to $74.82 a barrel by 08:47 a.m. Saudi time after settling up 65 cents on Tuesday, the last trading day for 2024. US West Texas Intermediate crude futures gained 19 cents, or 0.26 percent, to $71.91 a barrel after closing 73 cents higher in the previous session.

China’s Xi said on Tuesday in his New Year’s address that the country would implement more proactive policies to promote growth in 2025.

China’s factory activity grew in December, according to the private-sector Caixin/S&P Global survey on Thursday, but at a slower than expected pace amid concerns over the trade outlook and risks from tariffs proposed by US President-elect Donald Trump.

The data echoed an official survey released on Tuesday that showed China’s manufacturing activity barely grew in December, though services and construction recovered. The data suggested policy stimulus is trickling into some sectors as China braces for new trade risks.

Traders are returning to their desks and probably weighing higher geopolitical risks and also the impact of Trump running the US economy red hot versus the impact of tariffs, IG market analyst Tony Sycamore said.

“Tomorrow’s US ISM manufacturing release will be key to crude oil’s next move,” Sycamore added.

Sycamore said WTI’s weekly chart is winding itself into a tighter range, which suggests a big move is coming.

“Rather than trying to predict in which way the break will occur, we would be inclined to wait for the break and then go with it,” he added.

Investors are also awaiting weekly US oil stocks data from the Energy Information Administration that has been delayed until Thursday due to the New Year holiday.

US crude oil and distillate stockpiles are expected to have fallen last week while gasoline inventories likely rose, an extended Reuters poll showed on Tuesday.

US oil demand surged to the highest levels since the pandemic in October at 21.01 million barrels per day, up about 700,000 bpd from September, EIA data showed on Tuesday.

Crude output from the world’s top producer rose to a record 13.46 million bpd in October, up 260,000 bpd from September, the report showed.

In 2025, oil prices are likely to be constrained near $70 a barrel, down for a third year after a 3 percent decline in 2024, as weak Chinese demand and rising global supplies offset efforts by OPEC+ to shore up the market, a Reuters monthly poll showed.

In Europe, Russia halted gas exports via Soviet-era pipelines running through Ukraine on New Year’s Day. The widely expected stoppage will not impact prices for consumers in the EU as some buyers have arranged alternative supply, while Hungary will keep receiving Russian gas via the TurkStream pipeline under the Black Sea.

Saudi Venture Capital invests in VC fund by Global Ventures

- Fund will include supply chain technology, agritech, enterprise software as a service, and emerging technologies

- Partnership underscores growing commitment to innovation and entrepreneurship

RIYADH: Startups in Saudi Arabia’s technology sector are poised to benefit from a new investment announcement by Saudi Venture Capital, which has committed funds to Global Ventures III, according to a press release.

The early-stage venture capital fund managed by Global Ventures exceeds $150 million in size and will primarily target investments in technology and tech-enabled sectors across Saudi Arabia, the Middle East and North Africa, and Sub-Saharan Africa.

The focus areas for the VC fund will include supply chain technology, agritech, enterprise software as a service, and emerging technologies such as artificial intelligence and deep-tech.

Established in 2018, SVC is a subsidiary of the Small and Medium Enterprises Bank, which is part of Saudi Arabia’s National Development Fund.

The investment is in line with SVC’s broader goal of boosting venture capital activity in the Kingdom and supporting the growth of startups and small and medium-sized enterprises in the region.

Nabeel Koshak, the CEO and board member at SVC, highlighted the strategic importance of this investment, saying: “Our investment in the venture capital fund by Global Ventures is part of SVC’s Investment in Funds Program, in alignment with our strategy to catalyze venture investments by fund managers investing in Saudi-based startups, especially during their early stage.”

Noor Sweid, founder and managing partner at Global Ventures, emphasized the significance of the investment in strengthening Saudi Arabia’s startup ecosystem.

“The market opportunity continues to be immense, with emerging technologies across platforms being built by exceptional founders continuing to shine through,” Sweid said.

The partnership underscores the growing commitment to innovation and entrepreneurship in Saudi Arabia’s rapidly evolving tech landscape.