JEDDAH: In Saudi Arabia, policies and regulations, access to finance, and acquiring talent are among the biggest challenges facing entrepreneurs when starting up a business.

Raising funds is a difficulty that has been faced by entrepreneurs and small-to-medium enterprises (SMEs) globally. But it is even a greater challenge for Saudi-based entrepreneurs. Startups and SMEs here face immense difficulties securing finance from conventional sources such as bank financing, as well as bearing the burden of debt repayment during the initial stages of their development.

It is one of the main reasons why startups can fail during the consolidation stage. Only 3.2 percent of the Saudi established businesses last for more than three years, according to this year’s Global Entrepreneurship Monitor (GEM) report for Saudi Arabia.

This is evident from the fact that loans to Saudi SMEs, on average, account for less than 2 percent of total bank lending. While startups have even fewer sources of financing with most being dependent on personal resources, family, and friends.

New technology in finance has created the fintech (financial technology) industry: Online businesses and solutions that provide services in a faster, cost-effective and more streamlined manner. Innovative alternative finance, such as peer-to-peer lending (P2P) or crowdfunding, aims to help plug the SME and startup financing gap.

In July 2018, the Capital Market Authority (CMA) announced the approval of the first two trial financial technology licenses to two fintech companies, Scopeer, and Manafa Capital. This qualified the two companies to provide crowdfunding services in the Kingdom as the first results of the Financial Technology Laboratory initiative (FTIL) launched by the CMA at the beginning of 2018.

Abdulrahman Altheeb, CEO of Scopeer, told Arab News: “We worked with the CMA since March 2017 on developing the crowdfunding framework before obtaining the announced license.

“Through benefiting from other newly developed regulations and practices around the world, such as the Financial Conduct Authority in the United Kingdom, the CMA launched its FITL to introduce a set of regulations for the P2P sector that fits the Saudi market needs and behavior. It is aimed that the FITL will function for two years for research and investigatory work which will end with comprehensive market regulations.”

Scopeer is an equity-based crowdfunding platform that connects entrepreneurs, startups, and SMEs in Saudi Arabia with potential local and international investors.

Scopeer is an equity-based crowdfunding platform that connects entrepreneurs, startups, and SMEs in Saudi Arabia with potential local and international investors.

“We consider ourselves a startup, and we understand the issue faced by both startups and SMEs in raising fund, and obtaining financing,” Altheeb said.

“The main goal of Scopeer is to fill the financing gap in Saudi Arabia and provide alternative financing options for startups and SMEs by introducing crowdfunding to the market.”

Crowdfunding is one of the fintech solutions, the practice of funding a project or a venture by raising money through the collective effort of a large number of people who each contribute a small amount.

It helps entrepreneurs, startups, and SMEs by showcasing their businesses and projects via an online platform.

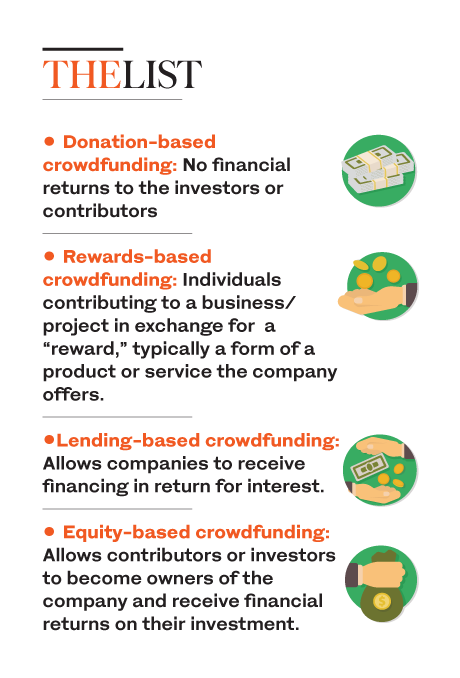

Altheeb explained: “There are a variety of crowdfunding types that include donation-based crowdfunding, rewards-based crowdfunding, lending-based crowdfunding, and equity-based crowdfunding.”

Currently, he said, “CMA is only issuing licenses for equity-based crowdfunding, which is what we do.”

As its name suggests, equity-based crowdfunding allows contributors or investors to become owners of the company by trading capital for equity shares. As equity owners, contributors receive a financial return on their investment and ultimately receive a share of the profits in the form of a dividend or distribution.

In addition to crowdfunding activities, Scopeer will offer a comprehensive entrepreneurial network that facilitates entrepreneurs’ communication with each other and with investors.

The CEO said: “We will also offer a network of business services providers to help companies in meeting our basic requirements in order to be listed for a crowdfunding campaign. Basically, that will include reputable professionals and consultation companies who will be providing their services for free.”

He also added “requirements would include the companies’ financial position, legal frame, and scalability. And all companies will be evaluated and reviewed by our team before being listed in order to ensure their scalability and sustainability for investors.”

FASTFACTS

CROWDFUNDING

•Crowdfunding: The practice of funding a project or a venture by raising money through the collective effort of large number of people who each contribute a relatively small amount. •Scopeer: an equity-based crowdfunding platform that connects entrepreneurs, startups and SMEs in Saudi Arabia with potential local and international investors. •Crowdfunding is an internet-enabled way to raise money — typically from about $1,000 to $1 million – in the form of either donations or investments from multiple individuals. This new form of capital formation emerged in the wake of the 2008 financial crisis.

Although it has been known as one of the most promising sources of funding in Europe and the US, crowdfunding is relatively new to Saudi Arabia and the developing world.

A recent report issued by the World Bank suggests that “Crowdfunding currently is predominantly a developed world phenomenon, but the potential exists for developing countries to capitalize on this new form of funding. We estimate that there are up to 344 million households in the developing world able and willing to make small crowdfund investments in community businesses.”

In its announcement earlier in July, the CMA said: “The Financial Technology Laboratory License is one of the CMA’s strategic initiatives resulting from the CMA’s ‘Financial Leadership 2020’ program which works under the umbrella of the Financial Sector Development Program, one of the Kingdom’s 2030 Vision execution programs.”