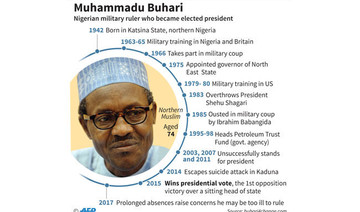

ABUJA: Nigerian President Muhammadu Buhari on Sunday quashed a rumor stemming from his ill health that he had died and been replaced by a lookalike impostor from Sudan, his spokesman said.

“It’s real me, I assure you. I will soon celebrate my 76th birthday and I will still go strong,” Buhari said as he met with the Nigerian diaspora in Poland, where he is attending the UN COP24 climate summit in Katowice.

He was answering a question from the audience about repeated claims — spread via tweets, Facebook posts and YouTube videos — that the leader of Africa’s most populous nation was an imposter called “Jubril.”

“A lot of people hoped that I died during my ill health. Some even reached out to the Vice President to consider them to be his deputy because they assumed I was dead,” Buhari said, according to a statement signed by his spokesman Garba Shehu.

He referred to those who started the rumor as “ignorant” and “irreligious.”

Buhari, who is seeking re-election next year, spent a large part of 2017 in London for treatment for a serious illness, which has never been revealed to the public.

A lack of specific information about the illness, along with Buhari’s gaunt features and a reduction in public appearances have fed speculation about his well-being.

Claims about the president’s identity emerged a month after Buhari returned from another lengthy medical trip to London.

Those pushing the rumor were known critics of the president and his government.

Nigerian president denies rumors surrounding his ill health

Nigerian president denies rumors surrounding his ill health

- Buhari, who is seeking re-election next year, spent a large part of 2017 in London for treatment for a serious illness, which has never been revealed to the public

Saudi Ministry of Health launches nationwide campaign to tackle obesity

- Campaign aims to target 1 million beneficiaries, bringing together several governmental, private, and non-profit entities

- GM of Lilly in Saudi Arabia Mustafa Abdul Rahman: The company supports the ‘A Nation Without Obesity’ campaign

RIYADH: The Saudi Ministry of Health launched on Thursday its “A Nation Without Obesity” campaign in Riyadh, an initiative aimed at raising awareness and combating obesity across the Kingdom.

In its initial phase, the campaign aims to target 1 million beneficiaries, bringing together several governmental, private, and non-profit entities.

“A Nation Without Obesity” was launched in response to multiple calls from Shura Council members and aligns with the Kingdom’s health transformation efforts, which have recorded notable progress toward the targets set out in Saudi Arabia’s Vision 2030.

Mustafa Abdul Rahman, general manager of Lilly in Saudi Arabia, emphasized that obesity is not a personal choice or a lifestyle issue, but a chronic disease that demands long-term management grounded in science, innovation, treatment, and prevention.

He highlighted the urgent need to shift societal perceptions and eliminate the stigma surrounding obesity, which often discourages individuals from seeking the help and treatment they need.

“The company supports the ‘A Nation Without Obesity’ campaign, which aims to raise awareness, remove psychological and social barriers, and empower individuals to access the support and treatment they need,” Abdul Rahman added.

Real transformation, he noted, starts with formal policies that back sustainable solutions and with strong partnerships between the public and private sectors.

Obesity impacts not only physical health, but also leads to a decline in mental well-being and social stability, often intensifying social isolation and reducing overall quality of life. Eliminating the stigma surrounding individuals living with obesity is therefore essential, Abdul Rahman explained.

The economic toll of obesity is equally pressing, with escalating healthcare costs linked to associated diseases and a notable decline in productivity driven by its complications — factors that cannot be ignored. For this reason, Lilly places economic impact at the core of its comprehensive strategy to combat obesity, Abdul Rahman said.

Mohammed Alghasham, CEO of Qalb Health Association, praised the campaign’s remarkable spirit of collaboration, emphasizing the strategic partnership with the Quality of Life Program and the engagement of Kayl Association for Combating Obesity as key contributors to a unified awareness effort.

“The association is committed to driving forward innovative social, awareness, and pharmaceutical initiatives while continuing to conduct studies and research aimed at enhancing existing solutions to the complex challenge of obesity, and supporting healthcare providers with insights that strengthen decision-making,” Alghasham said.

White House wants deep cut in US funding for war crimes investigations, sources say

- The programs also include work in Iraq, Nepal, Sri Lanka and the Gambia

- The expectation that Rubio would argue for many of the programs to be continued is slim

WASHINGTON/THE HAGUE: The White House on Wednesday recommended terminating US funding for nearly two dozen programs that conduct war crimes and accountability work globally, including in Myanmar, Syria and on alleged Russian atrocities in Ukraine, according to two US sources familiar with the matter and internal government documents reviewed by Reuters.

The recommendation from the Office of Management and Budget, which has not been previously reported, is not the final decision to end the programs since it gives the State Department the option to appeal.

But it sets up a potential back-and-forth between the OMB and US Secretary of State Marco Rubio and his aides, who will reply to OMB with their suggestions on which programs deserve to continue. The programs also include work in Iraq, Nepal, Sri Lanka and the Gambia.

The State Department and OMB did not immediately respond to a request for comment.

The expectation that Rubio would argue for many of the programs to be continued is slim, according to two US officials. However, the top US diplomat could make a case to keep crucial programs, such as aiding potential war crimes prosecutions in Ukraine, according to one source familiar with the matter.

Several of the programs earmarked for termination operate war crimes accountability projects in Ukraine, three sources familiar with the matter said, including Global Rights Compliance, which is helping to collect evidence of war crimes and crimes against humanity across Ukraine, such as sexual violence and torture.

Another is the Legal Action Network, a legal aid group which supports local efforts to bring cases against Russian suspects of war crimes in Ukraine, the sources said.

Requests seeking comment from the groups were not immediately answered.

State Department bureaus that would like to preserve any war crimes and accountability programs should send their justifications by close of business day on July 11, said an internal State Department email seen by Reuters.

CHANGING PRIORITIES

The administration of President Donald Trump has frozen and then cut back billions of dollars of foreign aid since taking office on January 20 to ensure American-taxpayer money funds programs that are aligned with his “America First” policies.

The unprecedented cutbacks have effectively shut down its premier aid arm US Agency for International Development, jeopardized the delivery of life-saving food and medical aid and thrown global humanitarian relief operations into chaos.

The OMB recommendation is yet another sign that the administration is increasingly de-prioritizing advocacy for human rights and rule of law globally, an objective that previous US administrations have pursued.

While US foreign aid freezes had already started hampering an international effort to hold Russia responsible for alleged war crimes in Ukraine, Wednesday’s recommendations raise the risk of US completely abandoning those efforts.

Among the programs that are recommended for termination is a $18 million State Department grant for Ukraine’s Prosecutor General’s Office that is implemented by Georgetown University’s International Criminal Justice Initiative, two sources said.

While the programs do not directly impact Ukraine’s frontline efforts to fend off Russia’s invasion, supporters say they represent the best chance of extensively documenting reported battlefield atrocities in Europe’s biggest conflict since World War Two, now grinding toward a fourth year.

Ukraine has opened more than 140,000 war crime cases since Moscow’s February 2022 invasion, which has killed tens of thousands, ravaged vast swathes of the country and left behind mental and physical scars from occupation. Russia consistently denies war crimes have been committed by its forces in the conflict.

PATH TO APPEAL

Other programs include one that does accountability work on Myanmar army’s atrocities against Rohingya minorities as well as on the persecution of Christians and other minorities by Syria’s ousted former president Bashar Assad, two sources said.

While the OMB recommendations could face State Department push-back, the criteria to appeal are set very strictly.

In an internal State Department email, the administration cautioned that any effort to preserve programs that were recommended to be terminated should be thoroughly argued and directly aligned with Washington’s priorities.

“Bureaus must clearly and succinctly identify direct alignment to administration priorities,” the email, reviewed by Reuters said.

US says giving $30 million to back controversial Gaza relief effort

- The Gaza Humanitarian Foundation is backed by armed US contractors with the Israeli troops on the perimeter

- Nearly 550 Palestinians have been killed near the fountantion’s aid centers while seeking scarce supplies

WASHINGTON: The United States said Thursday it has approved its first direct funding for a controversial Israeli-supported relief effort in the Gaza Strip and urged other countries to follow suit.

"We have approved funding for $30 million to the Gaza Humanitarian Foundation. And we call on other countries to also support the GHF, the Gaza Humanitarian Foundation, and its critical work," State Department spokesman Tommy Pigott told reporters.

Israel starting in March blocked deliveries of food and other crucial supplies into Gaza for more than two months, leading to warnings of famine in the territory widely flattened by Israeli bombing since the massive October 7, 2023 attack on Israel by Hamas.

The Gaza Humanitarian Foundation, backed by armed US contractors with the Israeli troops on the perimeter, began operations at the end of May that have been marred by chaotic scenes, deaths and neutrality concerns.

The Gaza health ministry says that since late May, nearly 550 people have been killed near aid centers while seeking scarce supplies.

The GHF has denied that deadly incidents have occurred in the immediate vicinity of its aid points.

Major aid groups and the United Nations have refused to work with the officially private group, saying it violates basic humanitarian principles by coordinating delivery with troops.

Asked about the criticism of the operation, Pigott said that the 46 million meals the group says it has so far distributed are "absolutely incredible" and "should be applauded."

"From day one, we said we are open to creative solutions that securely provide aid to those in Gaza and protects Israel," Pigott said.

The financial support to the GHF is part of President Donald Trump and Secretary of State Marco Rubio's "pursuit of peace in the region," he said.

Members of UK Jewish group to appeal punishments for Gaza war criticisms

- Board of Deputies of British Jews suspended 5 members for 2 years and reprimanded 31 over a letter they signed criticizing Israel’s conduct during the conflict

- In a new statement, the disciplined members renewed their concerns about the ‘destruction being wrought on Gazan civilians’

LONDON: Dozens of representatives of the main organization representing Jews in the UK are appealing against disciplinary action taken against them after they criticized Israel’s war on Gaza.

The Board of Deputies of British Jews this week sanctioned 36 of its representatives after they signed a letter in April in which they said they could “no longer remain silent” over the loss of life in Gaza. The board suspended five of the deputies for two years and reprimanded the remaining 31 for breaching its code of conduct.

The reprimanded members said on Thursday they would appeal against the decision, and continued to voice concerns about the conflict, The Guardian newspaper reported.

In a group statement, they said they “remain deeply concerned about the remaining hostages, the appalling humanitarian crisis and ongoing war in Gaza and the further deteriorating situation in the West Bank.”

They added that they stand in solidarity with the majority of Israelis who want an immediate end to the war in Gaza, and there was “no justification for the continuing misery and destruction being wrought on Gazan civilians.”

When it announced the punishments on Tuesday, the Board of Deputies said the letter was “neither authorized by the board nor did the signatories share it with the organization before sending to the Financial Times.” It had received various complaints about the letter and the media coverage that followed, it added.

The five signatories suspended for two years were removed from any elected positions they held. They were handed more severe punishments than the others because they had “contributed to the misleading press release,” the board said, and made public statements relating to the letter.

The remaining 31 deputies who signed the letter but did not promote it received a “notice of criticism” and were warned they would face suspension if they were involved in any similar incidents.

One of the five suspended members, Harriett Goldenberg, was vice chair of the board’s international division.

She told The Guardian: “So many Jews in the UK agreed with our sadly groundbreaking letter. We were inundated with thanks from those who said we represented them, and that we were their voice. It is tragic that voice is still needed.”

The Board of Deputies is the largest representative body for Jews in the UK, with 300 deputies who are elected by synagogues and communal organizations.

Pakistan will continue to play ‘constructive role’ for Middle East peace, PM Sharif tells US

- Prime Minister Shehbaz Sharif speaks to United States Secretary of State Marco Rubio, says Sharif’s office

- Both agreed to continue working closely to strengthen Pakistan-US ties, particularly through enhanced trade, says PMO

ISLAMABAD: Prime Minister Shehbaz Sharif spoke to United States Secretary of State Marco Rubio on Thursday, telling him Islamabad will continue to play a “constructive role” to bring peace in the Middle East, the Pakistani premier’s office said amid regional tensions following the Iran-Israel military conflict.

The 12-day war between Iran and Israel began on June 13 after Israel carried out airstrikes on Iranian nuclear facilities, killing several senior military commanders and scientists, while officials in Tehran were engaged in nuclear negotiations with the US. The conflict worsened when before the ceasefire announced by Trump, US forces struck three Iranian nuclear sites last week. The American president claimed the strikes set back Iran’s nuclear program by years.

Pakistan had remained engaged in talks with regional partners Saudi Arabia, Iran, China, Qatar and other states to de-escalate tensions in the Middle East. Sharif said on Thursday Tehran had thanked Pakistan’s political and military leadership for playing a constructive role during the war.

“While exchanging views on the current situation in the Middle East, the Prime Minister stated that Pakistan would continue to play a constructive role for bringing peace to the Middle East,” Sharif’s office said in a statement.

“While appreciating these efforts, Secretary Rubio said the US would like to work with Pakistan for promoting peace and stability to the region.”

Pakistan and India also engaged in a days-long conflict last month before US President Donald Trump announced on May 10 that both countries had agreed to a ceasefire. India and Pakistan had pounded each other with missiles, fighter jets, artillery fire and drone strikes during the four days of conflict that killed over 70 on both sides.

Pakistan has repeatedly thanked Trump for his mediation during the crisis and decided to formally nominate him for the 2026 Nobel Peace Prize. The American president has claimed he convinced both sides to back down by threatening not to do a trade deal with them.

During their conversation, Sharif thanked Rubio for the “key role” Washington played in the Pakistan-India ceasefire, the Prime Minister’s Office (PMO) said.

“The Prime Minister and Secretary Rubio agreed to continue working closely to strengthen Pakistan-US relations particularly through enhanced trade,” the statement said.

While the May 10 ceasefire continues to persist between the nuclear-armed nations, tensions simmer as New Delhi refuses to budge from its earlier stance of suspending a decades-old water-sharing treaty with Pakistan.

Pakistan has said any attempts to stop or divert its flow of water by India will be regarded as an “act of war” and will be responded to with full force.