DUBAI: The Fourth Industrial Revolution (4IR) will be exciting and full of promise, but carries downsides, Jose Angel Gurria, the secretary-general of the Organization for Economic Cooperation and Development, said on Monday.

In a discussion with CNN’s Becky Anderson at the World Government Summit (WGS) in Dubai, Gurria said: “The danger is not just about knowing the technology that is growing at breakneck speed, but how you empower half of the workforce that will be displaced.

“The Fourth Industrial Revolution will carry with it many promises and challenges in employing technology and how to use it. Half of the workforce is going to be disrupted by technology, due to over- or under-qualification. How can we motivate and upskill those that will be displaced in the process?”

Gurria focused on the need for countries to realize the effects on labor forces and on generations yet to enter the world of work.

He also urged national leaders to “broaden their horizons and make appropriate decisions in order to create a better future.”

Intellectual property in the 4IR

Intellectual property governance policies promote innovation and creativity, according to the World Intellectual Property Organization’s director general, Francis Gurry.

“Effective intellectual property systems ensure that ideas are transformed into products and services that are beneficial to people,” Gurry said. “Through intellectual property, we ensure that good ideas are translated into economic products, balance of interests and competitiveness.”

In 2018 alone, 2.5 million patent applications were filed worldwide, which, Gurry said, explained the need for stricter protection laws.

China and the US lead the world in terms of patent numbers, followed by Japan.

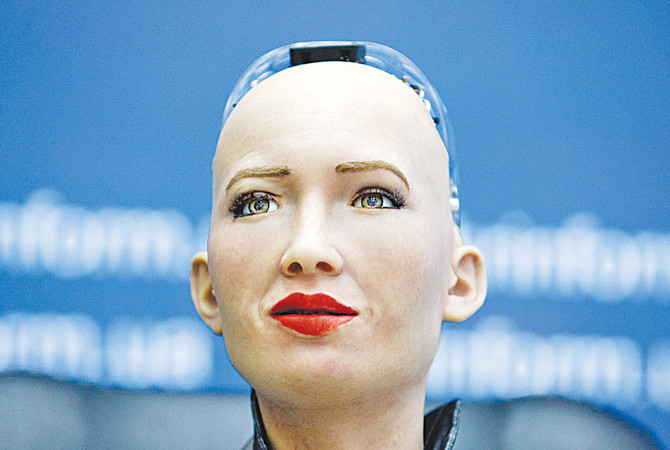

“We have a large number of patents on artificial intelligence, so this sequence must be protected,” Gurry added. “We expect significant changes in the distribution of capacity around the world as a result of the development of artificial intelligence in robots.”

Mobility in the 4IR

Artificial intelligence (AI) and nanotechnologies are among the UAE’s key priorities during the 4IR, according to Mattar Mohamed Al-Tayer, Dubai Road and Transport Authority (RTA) general manager.

“The importance of artificial intelligence in the transportation sector lies in three objectives: supporting the management of major events, forecasting traffic, and monitoring and dealing with accidents,” Al-Tayer said during a session at the WGS on “The Future of Mobility in the Age of 4IR.”

He highlighted the accomplishments the RTA has made over the years, turning Dubai into one of the world’s most efficient cities when it comes to mobility and transportation.

“In Dubai, we organized with international transport companies, such as Uber and others, to provide intelligent services to community members.

“The transport sector in Dubai is moving over a million people, and this figure makes us aware of the importance of establishing a solid infrastructure that enhances transportation,” he said.