LONDON: Sovereign wealth funds are piling into India, buying stakes in everything from airports to renewable energy, attracted by political stability, a growing middle class and reforms making it more enticing for foreigners to invest.

Wealth and state pension funds are expanding their horizons to private markets, to complement an existing focus on stocks and bonds.

“India is popular with sovereign wealth funds,” said Tihir Sarkar, London-based partner at Cleary Gottlieb, which counts several prominent sovereign funds as clients.

“Almost every jurisdiction in the western world is raising the bar for entry for foreign investors but in India it’s the other way round. There’s also the attraction of the demographics and a lot of assets that sovereign funds like, such as infrastructure, where there’s a huge appetite for foreign funding.”

Indian Prime Minister Narendra Modi’s election win last month consolidated his Hindu nationalist party’s power base and is expected to stimulate further foreign investment.

Foreign institutional investor flows into Indian equities are $11 billion year-to-date, surpassing the total annual tally in each of the four previous years and setting 2019 on course for the highest annual inflows since 2012. India’s benchmark BSE index has soared nearly 10 percent year-to-date.

“The rapid rise of an educated middle class offers enormous opportunities for the deployment of long-term capital, the kind that sovereign wealth funds are ideally suited to provide,” said Ravi Menon, chief executive officer of HSBC Asset Management India.

The attention sovereign funds are giving India is like that they have paid to China, now clouded by a trade war with the United States, said a banker specializing in institutional investors. In the public markets, funds were focused on public equity and fixed income, he said. In the private market, momentum is also building.

Private equity deal activity in India surged to $19 billion in 2018, the highest level in at least a decade, according to PitchBook data. Sovereign wealth funds and pension funds participated in about two-thirds of that amount.

Among recent deals, Singapore’s GIC sovereign wealth fund and the Abu Dhabi Investment Authority (ADIA) this month agreed to make a further investment of $495 million in renewable energy firm Greenko Energy Holdings, which has wind, solar and hydro projects.

India is widening its use of solar and wind energy to help reduce its reliance on fossil fuels.

In April, ADIA and India’s National Investment & Infrastructure Fund (NIIF) agreed to buy a 49 percent stake in the airport unit of Indian conglomerate GVK Power & Infrastructure.

Another wealth fund is in talks on an infrastructure investment, while Canadian pension funds are seeking similar deals, said a source familiar with the matter.

Canada Pension Plan Investment Board and GIC earlier this year participated in a $145.8 million buyout of Oakridge International School, an operator of schools in India.

ADIA, the world’s third-biggest sovereign wealth fund, which has been investing in Indian equities and fixed income for years, has broadened its focus to include asset classes such as infrastructure, real estate and private equities, said people familiar with ADIA’s thinking.

Its increased interest in India is driven by the country’s strong growth potential, positive demographics and continued economic development, the people said. More than half of India’s 1.3 billion population is aged under 25.

The push comes as India and the United Arab Emirates seek to strengthen economic and trade ties.

Regulatory reforms are also bolstering sentiment and drawing in wealth funds.

Indian-based fund managers were from this year licensed to manage foreigners’ portfolio holdings in the country, where previously such assets had to be managed outside India.

Prashant Khemka, founder of White Oak Capital Management which advises London-listed Ashoka India Equity Investment Trust, said that change had helped kick-start the onshore fund management industry for foreign-sourced funds.

“This could be looked back on as an inflection point in the growth of the Indian fund management business,” said Khemka, one of four fund managers to gain such an approval so far. Institutional names, including sovereign wealth funds and pension funds, account for around two-thirds of his clients.

Bankruptcy resolution rules introduced in 2016 helped pave the way for ADIA’s $500 million investment earlier this year in a distressed debt fund.

The investment was seen as an effort to launch a secondary market in India’s mountain of distressed debt and help ease the burden on local banks.

But some say more reforms are needed.

A source close to several wealth and pension funds said many would like to see the government further overhaul tax rules, building upon a new goods and services tax that is credited with helping cut red tape, and undertake land and labor reforms.

India becomes investment darling for sovereign wealth and pension funds

India becomes investment darling for sovereign wealth and pension funds

- Wealth and state pension funds are expanding their horizons to private markets

- The attention sovereign funds are giving India is like that they have paid to China

Closing Bell: Saudi benchmark index edges higher to close at 10,974

- MSCI Tadawul 30 Index rose 0.06% to 1,407.47

- Parallel market Nomu lost 0.05% to close at 26,837.30

RIYADH: Saudi Arabia’s main stock index closed slightly higher on Wednesday, as gains in select industrial and infrastructure stocks offset broader market weakness.

The Tadawul All Share Index added 9.7 points, or 0.09 percent, finishing the session at 10,973.98. Total trading turnover was SR6.10 billion ($1.62 billion), with 180 stocks advancing while 66 declined.

The MSCI Tadawul 30 Index also recorded a modest gain, rising 0.06 percent to 1,407.47.

In contrast, the parallel market Nomu dipped slightly, losing 13.49 points, or 0.05 percent, to close at 26,837.30. A total of 35 stocks posted gains on Nomu, while 45 ended in the red.

Sustained Infrastructure Holding Co. led the market with a sharp 9.89 percent increase to SR30.55, followed by Saudi Printing and Packaging Co., which rose 9.83 percent to SR11.84. Saudi Arabia Refineries Co. also saw strong momentum, climbing 5.48 percent to a new yearly high of SR63.50.

Among the session’s notable losers, Specialized Medical Co. dropped 3.36 percent to SR24.16, Zamil Industrial Investment Co. slipped 2.29 percent to SR40.60, and Arabian Contracting Services Co. fell 2.12 percent to SR96.90.

Meanwhile, Saudi Arabian Mining Co., known as Ma’aden, received shareholder approval to raise its capital from SR38.03 billion to SR38.89 billion during its extraordinary general assembly meeting held on June 24. The 2.26 percent increase will lift the number of issued ordinary shares from 3.80 billion to 3.89 billion.

According to a company disclosure on the Saudi Exchange, the capital hike will be carried out through the issuance of 85.98 million new ordinary shares at a par value of SR10. These shares will be allocated as part of an acquisition agreement to purchase full ownership of two subsidiaries: Ma’aden Bauxite and Alumina Co. and Ma’aden Aluminium Co.

Under the transaction, Ma’aden will acquire all 128.01 million shares held by AWA Saudi in the bauxite firm, representing 25.1 percent of its capital, along with 165 million shares held by Alcoa Saudi in the aluminum unit—also a 25.1 percent stake.

Shares of Ma’aden rose 0.2 percent to end the day at SR50.70.

Red Sea International Co. also announced plans to publicly list its subsidiary, Fundamental Installation for Electric Work Co. Ltd., subject to regulatory and shareholder approval. The decision was approved by the board in a resolution passed on June 23 and implemented the following day.

While Red Sea International will not offer any of its own shares in the IPO, the move is considered a significant transaction due to the subsidiary’s strategic role in the group’s operations. The company’s stock rose 0.12 percent to close at SR42.50.

Saudi Arabia’s non-oil exports climb 24.6% in April: GASTAT

- National non-oil exports — excluding re-exports — grew 6.8%

- Machinery, electrical equipment, and parts accounted for 27.7% of total imports

RIYADH: Saudi Arabia’s non-oil exports saw an annual rise of 24.6 percent in April, reaching SR28.36 billion ($7.56 billion) thanks to a sharp increase in re-exports and a strong performance in chemicals and plastics.

According to data released by the General Authority for Statistics, national non-oil exports — excluding re-exports — grew 6.8 percent during the month, while the value of re-exported goods increased 72 percent.

Saudi Arabia’s non-oil exports hit a record SR515 billion ($137 billion) in 2024, up 13 percent from 2023 and over 113 percent since the launch of Vision 2030 in 2016, which aims to diversify the Kingdom’s economy and reduce its dependence on oil by expanding industrial, mining, and service sectors.

The strong non-oil export performance comes as the World Bank projects Gulf economic growth to accelerate to 3.2 percent in 2025 and 4.5 percent in 2026, driven by the rollback of OPEC+ oil production cuts and continued momentum in non-oil sectors.

In its latest release, GASTAT stated: “Among the most important non-oil exports are plastics, rubber, and their products, which constituted 21.7 percent of total non-oil exports, recording a 4.0 percent increase compared to April 2024.” It added that chemical products followed at 21 percent of the total, with a 2.3 percent year-on-year increase.

The release stated that merchandise exports decreased by 10.9 percent in April compared to the same month of the previous year, as a result of a 21.2 percent decrease in oil exports.

“Consequently, the percentage of oil exports out of total exports decreased from 77.5 percent in April 2024 to 68.6 percent in April 2025,” said the report.

This led to a narrowing of the trade surplus by 61.7 percent compared to the same period last year

The ratio of non-oil exports, including re-exports, to imports rose to 37.2 percent in April, up from 35.4 percent a year earlier — largely due to the increases in non-oil exports and imports of 24.6 percent and 18.3 percent, respectively.

On the import side, machinery, electrical equipment, and parts accounted for 27.7 percent of total imports, rising 25.4 percent year on year. Transportation equipment and parts followed at 17.2 percent, with a 64.5 percent surge.

China remained Saudi Arabia’s top export destination, accounting for 12.6 percent of the total in April. Japan ranked second at 10.1 percent, followed by the UAE at 9.8 percent.

Other key destinations included India, South Korea, and the US, as well as Egypt, Malta, Poland, and Bahrain — with exports to these 10 markets comprising 67.5 percent of total exports.

On the import front, China was also the top origin, representing 25 percent of the total, followed by the US at 7.5 percent and the UAE at 6.8 percent.

Imports from India, Germany, and Japan, as well as Italy, Switzerland, the UK, and France, together made up 66.3 percent of the total.

In terms of customs points, the King Abdulaziz Sea Port in Dammam handled 26 percent of total imports in April, followed by Jeddah Islamic Sea Port at 20.4 percent, King Khalid International Airport in Riyadh at 13.9 percent, King Abdulaziz International Airport at 12.6 percent, and King Fahd International Airport in Dammam at 5.7 percent.

These five ports together accounted for 78.6 percent of total merchandise imports.

The strong performance in non-oil exports comes after Fitch Ratings in February affirmed Saudi Arabia’s long-term foreign-currency issuer default rating at ‘A+’ with a stable outlook, citing the Kingdom’s robust fiscal and external balance sheets. The agency also noted that Vision 2030 has played a central role in diversifying one of the Middle East’s strongest economies.

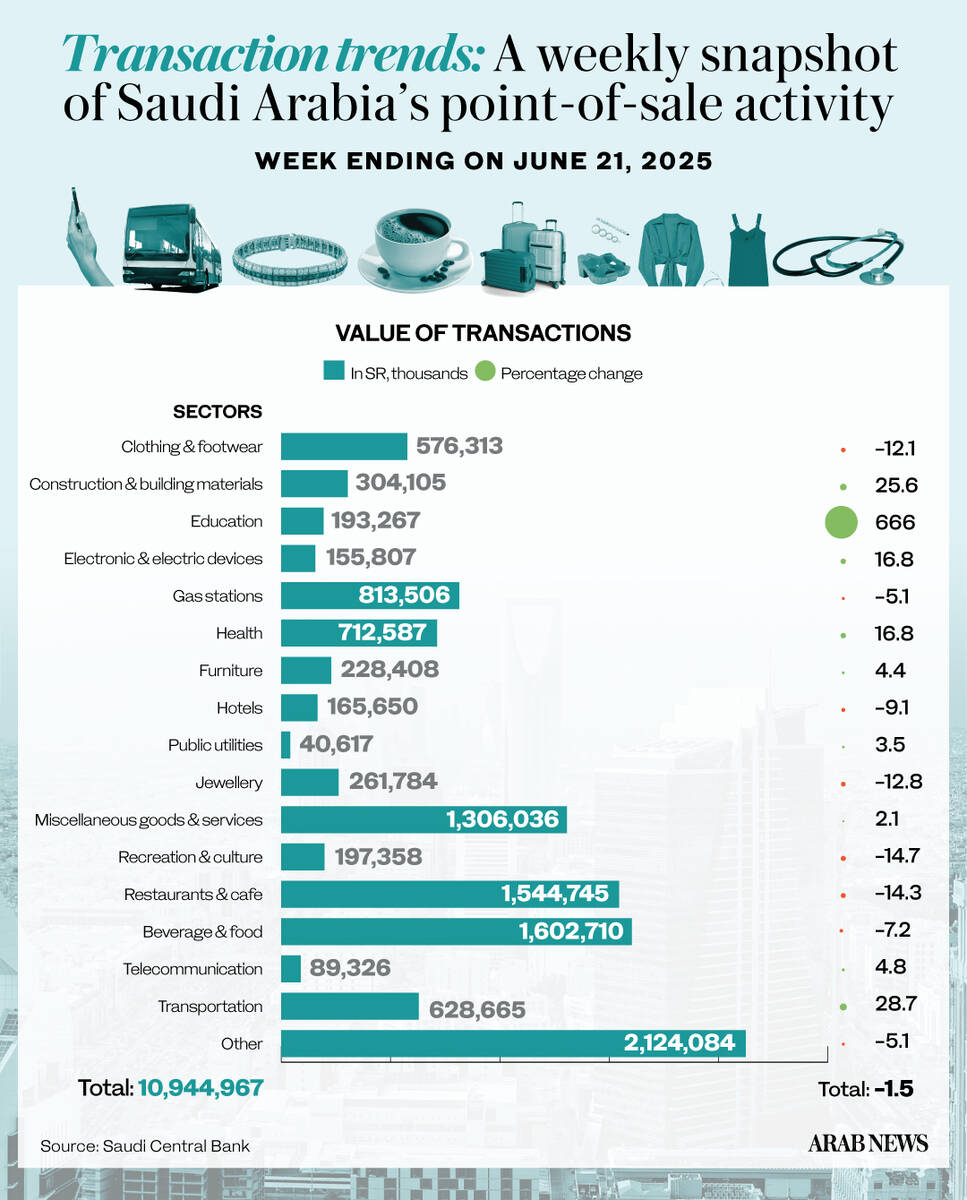

Education sector leads weekly POS surge with 666% value spike despite overall drop

- Spending on transportation increased by 28.7%

- Construction and building materials saw a 25.6% uptick

RIYADH: Saudi Arabia’s point-of-sale spending in the education sector saw a weekly rise of 666 percent to reach SR193.26 million ($51.53 million) by June 21, according to official data.

The latest figures from the Saudi Central Bank, known as SAMA, also showed the number of POS transactions in the sector nearly doubled, climbing by 98.1 percent, indicating a significant rebound in consumer activity in this segment.

This sharp increase in educational spending came despite a 1.5 percent decline in the total value of POS transactions across the Kingdom, which dropped from SR11.1 billion to SR10.9 billion over the same period.

The weekly data further showed that transaction values rose in several other sectors, although none matched the scale of growth seen in the education division.

Spending on transportation increased by 28.7 percent, while construction and building materials saw a 25.6 percent uptick in value.

Telecommunication and health sectors both posted gains of 4.8 percent and 16.8 percent, respectively.

The electronics and electric devices segment recorded a 16.8 percent rise in spending value, and the furniture sector grew by 4.4 percent.

Slight increases were also observed in the public utilities and miscellaneous goods and services sectors, which grew by 3.5 percent and 2.1 percent, respectively.

However, several categories experienced downturns. The largest declines in transaction values were reported in the hotels and recreation and culture sectors, which fell by 9.1 percent and 14.7 percent, respectively.

Regionally, Riyadh remained the top city for POS spending, logging over SR3.91 billion in transactions, a 9.1 percent increase from the previous week. Dammam and Khobar also recorded gains, with spending in Dammam up by 8.4 percent and in Khobar by 5.1 percent.

Cities such as Makkah and Madinah recorded double-digit declines, down by 24.2 percent and 11.7 percent, respectively, in total POS transaction values.

Jeddah maintained a steady performance, with spending remaining flat at SR1.6 billion, while Tabuk saw a slight uptick of 3 percent in value.

Spending in restaurants and cafes dropped by 12.8 percent, while beverage and food transactions declined by 7.2 percent.

Jewelry purchases also contracted by 12.8 percent, and clothing and footwear fell by 7.2 percent. Other sectors, such as gas stations and the category, also saw declines of 5.1 percent.

Overall, the total number of POS transactions across all sectors dipped slightly by 0.6 percent week on week, totaling just over 202.5 million transactions during the reporting period.

Fitch affirms UAE’s ‘AA-’ rating on strong external buffers, fiscal prudence

- Outlook benefits from Abu Dhabi’s sovereign net foreign assets — amounting to 157% of GDP

- Fitch forecasts UAE GDP to grow by 5.2% in 2025

RIYADH: The UAE’s long-term foreign-currency rating has been affirmed at “AA-” with a stable outlook by Fitch, reflecting the country’s consolidated government debt, strong net external asset position, and high gross domestic product per capita.

The US-based rating agency noted that this outlook benefits from Abu Dhabi’s sovereign net foreign assets — amounting to 157 percent of the UAE’s gross domestic product in 2024 — which rank among the highest of all Fitch-rated sovereigns.

The agency noted the ongoing regional geopolitical risks, but it assumes the conflict involving Israel, the US, and Iran will be contained and short-lived.

The report comes as Israel and Iran agreed to a ceasefire brokered by the US, which took effect on June 24, following 12 days of conflict that raised fears of a broader regional escalation.

In its commentary, Fitch Ratings stated: “A regional conflagration would pose a risk to Abu Dhabi’s hydrocarbon infrastructure and to Dubai as a trade, tourism and financial hub,”

It emphasized that “the UAE’s ratings could absorb some short-term disruptions given large fiscal and external buffers.”

Fitch’s assessment follows S&P Global’s recent assignment of “AA/A‑1+” with a stable outlook for its foreign and local currency sovereign credit ratings to the UAE, citing the country’s strong fiscal and external positions.

The agency also noted that the UAE’s sizable asset cushion would help shield it from oil price volatility and regional geopolitical tensions.

Fitch estimated the UAE’s consolidated fiscal surplus stood at 7.1 percent of GDP in 2024, following a level of 8.6 percent in 2023, with surpluses in Abu Dhabi and Dubai and budget deficits in Ras Al Khaimah and Sharjah.

It projected a fiscal breakeven oil price of $45–$50 per barrel in 2025 and 2026, excluding investment income, which Fitch attributed partly to “rising oil production volumes and the significant share of spending by GREs (government-related entities).”

“We forecast the consolidated surplus at 5.3 percent of GDP in 2025 and 5.9 percent in 2026. Narrower deficits in Sharjah and higher oil production levels in Abu Dhabi will mitigate the forecast drop in oil prices from $79.5 per barrel in 2024 to $65/bbl in 2025 and 2026,” Fitch said.

It added: “Dubai will retain a budget surplus.”

With regard to the federal government’s budget, Fitch stated that it remains below 4 percent of GDP and is primarily focused on core services.

The report emphasized that the federal budget must remain balanced by law, leaving limited scope for borrowing or adjustment. From 2026 onward, corporate tax revenue is expected to help offset reduced grants from Abu Dhabi.

Despite moderate direct debt, Fitch views the UAE’s economy as highly leveraged. “We estimate overall contingent liabilities from GREs of the emirates and the FG in 2023 at about 62 percent of UAE 2023 GDP,” the report said, though it acknowledged that many state-owned entities are financially sound.

Fitch forecasts UAE GDP to grow by 5.2 percent in 2025, supported by a 9 percent increase in oil production from Abu Dhabi and strong non-oil growth of over 4 percent, driven by investment and population expansion. However, it warned of risks from “lower oil prices and global growth uncertainties.”

Earlier this month, the UAE Central Bank’s Quarterly Economic Review for December 2024 reported that the country’s GDP reached 1.77 trillion dirhams ($481.4 billion) in 2024, growing 4 percent. Non-oil sectors contributed 75.5 percent of the total — highlighting continued economic diversification.

The central bank maintained its real GDP growth forecast at 4 percent for 2024, with an anticipated acceleration to 4.5 percent in 2025 and 5.5 percent in 2026.

On governance, Fitch said the UAE maintains an ESG Relevance Score of “5[+]” for political stability, rule of law, and institutional quality.

The agency credited the UAE’s “record of domestic political stability, strong institutional capacity, effective rule of law and a low level of corruption,” referencing World Bank Governance Indicators, where the country ranks in the 70th percentile.

Lebanon’s economy to benefit from World Bank’s $250m recovery boost

JEDDAH: Lebanon’s battered infrastructure and strained public services are set for a boost, as the World Bank has approved $250 million to launch a broader $1 billion recovery and reconstruction initiative.

In a statement on Wednesday, the World Bank announced that its board of executive directors had approved the funding a day earlier under the Lebanon Emergency Assistance Project.

The project follows a phased approach to address response, recovery, and reconstruction, focusing on prioritizing and sequencing interventions to achieve maximum economic and social impact in the shortest possible time.

“The Rapid Damage and Needs Assessment of the impact of the conflict in Lebanon between Oct. 8, 2023, and Dec. 20, 2024, estimated total direct damages across 10 sectors at $7.2 billion, and reconstruction and recovery needs at $11 billion,” the bank said in its press release.

It added that around $1.1 billion in damage had been sustained by key infrastructure and facilities vital to public well-being and economic activity. Affected sectors include transportation, energy, water, healthcare, education, and municipal services.

“Considering the scale of needs, the LEAP was designed to support restoration of public infrastructure and buildings, given this is a precondition to economic and social recovery,” the release explained.

According to a separate World Bank report released earlier this month, Lebanon’s cumulative gross domestic product had contracted by nearly 40 percent since 2019. Meanwhile, the Lebanese pound has lost more than 98 percent of its value, driving triple-digit inflation through 2023.

The study highlighted how the collapse of the banking sector and the currency’s crash turned Lebanon into a dollarized, cash-based economy worth $9.8 billion — about 45.7 percent of GDP in 2022.

“The conflict has introduced another shock to Lebanon’s already crisis-ridden economy. While the economic contraction was anticipated to bottom out in 2023, following five years of sustained sharp contraction, the conflict and its spillovers have had negative knock-on effects on economic growth in 2023, continuing into 2024,” the report said.

It further noted that since July 2023, the Lebanese pound has stabilized at 89,500 to the US dollar, which helped bring inflation down to double digits in 2024 for the first time since March 2020, following three consecutive years of triple-digit inflation.

Lebanon’s Prime Minister Nawaf Salam welcomed the news on social media, writing on his X account: “I welcome the World Bank Board’s approval of the $250 million Lebanon Emergency Assistance Project, which represents a key step toward reconstruction by addressing damage to critical infrastructure and essential services in areas affected by the conflict.”

He added that the assistance reinforces national recovery efforts within a government-led implementation framework and paves the way for attracting further much-needed financing.

Jean-Christophe Carret, the World Bank’s Middle East division director, said: “Given Lebanon’s large reconstruction needs, the LEAP is structured as a $1 billion scalable framework with an initial $250 million contribution from the World Bank and the ability to efficiently absorb additional financing — whether grants or loans — under a unified, government-led implementation structure that emphasizes transparency, accountability, and results.”

Carret noted that the framework offers a credible platform for development partners to align their support with Lebanon’s reform agenda and amplify the impact of long-term recovery efforts.

According to the statement, the financing will enable immediate interventions to fast-track recovery and return to normalcy. This includes the safe and efficient handling of rubble to maximize recycling and reuse.

To ensure timely implementation, the government has undertaken key reforms within the project’s implementing body, the Council for Development and Reconstruction, the statement said.

It added that LEAP will be carried out under the strategic guidance of the prime minister’s office, with coordination across relevant ministries through the Council of Ministers. The Ministry of Public Works and Transport will oversee project implementation, while the Ministry of Environment will monitor environmental and social compliance, including rubble management.