LONDON: A former top Barclays executive, on trial in London on fraud charges, would have risked a £50 million ($64 million) “good leaver” package if he had sought a criminal deal with Qatar during the credit crisis, a court heard on Thursday.

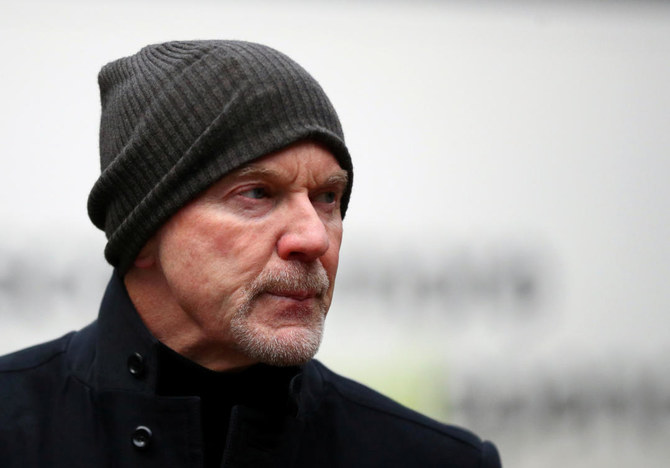

It would have been “lunacy” for Roger Jenkins, one of three men charged with fraud over undisclosed payments to Qatar during emergency fundraisings in 2008, to risk such accrued benefits and a job that had paid him 38 million pounds in 2007 alone, his lawyer told a jury at the Old Bailey criminal court.

The high-profile Serious Fraud Office (SFO) case revolves around how Barclays — one of the few major British banks to survive the credit crisis without direct government aid — raised more than 11 billion pounds ($14 billion) from Qatar and other investors to avert a state bailout as markets roiled.

Prosecutors allege that former top executives lied to the market and other investors by not properly disclosing 322 million pounds paid to Qatar, disguised as “bogus” advisory services agreements (ASAs), in return for around four billion pounds in two fundraisings over 2008.

Jenkins, the former head of the bank’s Middle East business, Tom Kalaris, who ran the wealth division and Richard Boath, a former head of European financial institutions, deny charges of conspiracy to commit fraud by false representation and fraud by false representation.

Lawyers for Jenkins and Kalaris told the jury the case against their clients was misconceived, perverse and illogical and that there was no evidence the ASAs were a sham or fake.

In brief opening speeches before the prosecution continues laying out its case, they alleged the defendants believed the ASAs were genuine agreements to secure lucrative business for Barclays in the Middle East — a region it was keen to exploit.

They said the agreements were side deals during emergency fundraising that June and October that had been approved by internal and external lawyers and cleared by the board.

“The unequivocal, repeated advice was that this was legitimate — providing the ASA was a genuine contract for the provision of benefits to Barclays,” said John Kelsey-Fry, a senior lawyer representing Jenkins.

Jenkins, who will give evidence later, had pursued and won the trust of Sheikh Hamad bin Jassim bin Jabr Al-Thani, the former prime minister of Qatar, and wanted to unseat Credit Suisse as the wealthy, gas-rich Gulf state’s preferred bankers, the jury heard.

Had Jenkins considered a fraudulent deal with Sheikh Hamad, the sheikh might have rung up Barclays bosses and said: “Neither I nor QIA (the sovereign wealth fund) are putting a penny in a bank like yours. I will never do business with you again,” Kelsey-Fry said.

Qatar Holding, part of QIA, invested in Barclays alongside Challenger, Sheikh Hamad’s investment vehicle.

The case against Kalaris, meanwhile, hung on three conversations he had had with Boath on the afternoon of June 11, 2008, that the prosecution had “fundamentally misunderstood,” his lawyer Ian Winter said.

When Kalaris told Boath: “Noone wants to go to jail here” and that lawyers would provide “air cover,” he was trying to ensure that a genuine ASA would be approved by legal experts as a legitimate means of paying Qatar for real value, Winter said.

All three men, aged between 60 and 64, are charged over the June fundraising. Jenkins, alone, also faces charges over the October fundraising.

The trial is scheduled to last around five months.

A sham Qatar deal could have cost ex Barclays exec $64m, court hears

A sham Qatar deal could have cost ex Barclays exec $64m, court hears

- Roger Jenkins stood to get “good leaver” package -lawyer

- Defense lawyers tell jury SFO case is misconceived, perverse

Saudi GO Telecom signs deal to rebuild Syria’s telecom sector

RIYADH: Saudi Arabia’s GO Telecom has signed an agreement with the Syrian government to help modernize the country’s digital infrastructure, marking one of the first major private sector initiatives following the recent easing of Western sanctions.

The agreement was signed by Syrian Minister of Telecommunications Abdul Salam Haykal and GO Telecom CEO Yahya bin Saleh Al-Mansour. The deal aims to revamp Syria’s aging communications network, a critical step in the nation’s long path toward recovery. Riyadh-based GO Telecom is expanding its presence in post-conflict markets through strategic infrastructure investments.

The move follows a significant policy shift by Western powers. Just weeks ago, the US and the EU began lifting long-standing sanctions on Syria — a decision widely seen as a turning point in international engagement with the war-torn country.

On May 13, President Donald Trump announced the sanctions relief during a visit to Riyadh, calling it a “historic opportunity” for Syria’s recovery. The EU quickly followed suit, adopting legal measures to ease economic restrictions while maintaining those tied to security.

“This decision is simply the right thing to do,” said EU High Representative Kaja Kallas, underscoring the bloc’s support for Syria’s reconstruction and political transition. The EU’s move removed 24 entities, including the Central Bank of Syria, from its sanctions list.

“Today the EU reaffirms its commitment as a partner for the transition, one that helps the Syrian people to reunite and rebuild a new, inclusive, peaceful Syria,” Kallas added.

Syrian officials have welcomed the easing of sanctions as a pivotal moment. Speaking to the Associated Press on May 30, Syria’s Minister of Social Affairs and Labor, Hind Kabawat, said the changes would aid anti-corruption efforts and help pave the way for the return of millions of refugees.

Saudi Arabia and Qatar have also pledged joint financial support for Syrian state employees. A high-level Saudi economic delegation has visited Damascus to explore investments across key sectors, including energy, agriculture, and infrastructure.

“The Kingdom will provide, with Qatar, joint financial support to state employees in Syria,” said Saudi Foreign Minister Prince Faisal bin Farhan during a visit to Damascus on May 31. He reaffirmed Riyadh’s commitment to Syria’s reconstruction and emphasized the Kingdom’s involvement in the sanctions relief process.

Prince Faisal added that Saudi Arabia remains one of Syria’s key backers as it works toward economic recovery and long-term stability.

The GO Telecom agreement is seen as a signal of growing regional cooperation, as international and Gulf partners begin to re-engage in efforts to rebuild Syria’s shattered economy and infrastructure after over a decade of conflict.

Saudi Arabia’s Diriyah Co., Kakao Mobility sign deal to boost smart mobility

RIYADH: Diriyah Co., backed by Saudi Arabia’s Public Investment Fund, has signed a memorandum of understanding with South Korea-based Kakao Mobility to enhance smart mobility infrastructure across the historic city of Diriyah.

Announced in a post on X, the agreement is designed to develop integrated transportation solutions to accommodate the 50 million annual visitors projected during the first phase of the Diriyah project.

The partnership will see Kakao Mobility contribute to the implementation of digital transport systems, seamless transit services, and smart parking infrastructure. The initiative aligns with Saudi Arabia’s broader push to diversify its economy and reduce its dependence on oil, as outlined in Vision 2030.

“Mobility to shape the future of urban mobility. This collaboration brings smart, sustainable solutions to life, enhancing the digital movement experience for over 50 million annual visits by 2030,” Diriyah Co. stated in its post on X.

The agreement marks the beginning of a phased rollout, starting with a smart parking pilot. The project also includes plans for a fully integrated prototype for smart parking and the deployment of advanced digital systems to streamline urban movement within Diriyah.

In addition to enhancing visitor mobility, the collaboration supports Saudi Arabia’s National Tourism Strategy, which aims to attract 150 million visitors annually by 2030.

The company emphasized that the digital platform under development will connect key destinations within Diriyah, contributing to sustainable urban mobility and reinforcing the Kingdom’s commitment to innovation and smart city solutions.

Once completed, the Diriyah development is expected to contribute SR18.6 billion ($4.96 billion) to the Kingdom’s gross domestic product and create approximately 178,000 jobs.

In April, Diriyah Co. awarded a contract worth SR5.1 billion for the construction of the Royal Diriyah Opera House — a major cultural project. The contract was granted to El-Seif Engineering Contracting, Midmac Contracting Co. W.L.L., and China State Construction Engineering Corp.

Pakistan hikes petrol price by Rs1 per liter till next fortnight

- Pakistan says increased price of petrol as per recommendations of regulatory authority, relevant ministries

- Prices of petroleum products are reviewed and adjusted on a fortnightly basis to reflect import costs

ISLAMABAD: Pakistan’s government has decided to increase the price of petrol by Rs1 per liter till the next fortnight as per the recommendations of the Oil and Gas Regulatory Authority (OGRA) and relevant ministries, the Finance Division announced recently.

Petrol is primarily used in Pakistan for private transportation, including small vehicles, rickshaws and two-wheelers. Diesel, on the other hand, powers heavy vehicles used for transporting goods across the country.

“The government has decided the following prices of petroleum products for the fortnight starting tomorrow, based on the recommendations of OGRA and the relevant ministries,” the Finance Division said in a statement on Saturday.

After the latest revision in prices, a liter of petrol will cost Rs253.63 while the government has kept the rate of diesel unchanged at Rs254.64 per liter.

Fuel prices in Pakistan are reviewed and adjusted on a fortnightly basis. This mechanism ensures that changes in import costs are reflected in consumer prices, helping to sustain the country’s fuel supply chain.

The Finance Division kept the price of petrol unchanged and slashed the rate of high-speed diesel by Rs2 per liter during its last review on May 16.

The new price of petrol has already taken effect.

Can the green tea wave topple the Middle East’s coffee culture?

- In Dubai, Abu Dhabi, and Riyadh, specialty cafes now offer matcha lattes alongside traditional karak chai

RIYADH: Once reserved for Japan’s sacred tea ceremonies, matcha has become a global sensation, infusing everything from lattes and desserts to skincare routines. Now, it is entering the Middle East, where coffee has long held cultural and culinary dominance.

Matcha’s rise in the MENA region is driven by health-conscious millennials, social media-friendly cafe culture, and a booming fitness scene. With its high antioxidant content, clean caffeine boost, and vibrant green hue, it’s quickly become a favorite among wellness enthusiasts.

But can it compete with the deeply ingrained coffee rituals of the Arab world, where coffee and espresso are daily staples?

The economic landscape: Aligning with Vision 2030

As part of its ambitious Vision 2030 initiative, Saudi Arabia is actively working to diversify its economy and reduce its long-standing reliance on oil revenues. Central to this transformation is the food and beverage sector, which has emerged as a key driver of economic growth.

In 2022, the food and agriculture sector contributed approximately SR100 billion ($26.6 billion) to the Kingdom’s gross domestic product, the highest on record.

The government aims to attract $20 billion in investments into the food industry by 2035, focusing on enhancing food security and broader economic sustainability.

Supporting this momentum is the “Made in Saudi” initiative, launched in 2021 to boost domestic production and services. One of its core goals is to raise the non-oil sector’s contribution to gross domestic product from 16 percent to 50 percent by 2030, making room for innovative products and emerging markets, including health-focused offerings like matcha.

A growing opportunity: the regional matcha market

This strategic shift aligns well with the rising demand for functional foods and beverages across the region. In the Middle East and Africa region, the matcha market is experiencing steady growth, signaling a strong opportunity for Saudi Arabia to enter a promising space.

In 2023, the MEA matcha market generated approximately $86.1 million in revenue, and projections estimate it will grow to $110.7 million by 2030, reflecting a compound annual growth rate of 3.6 percent.

Notably, ceremonial grade matcha, the highest quality used in traditional preparation, is currently the top revenue-generating segment and is expected to see the fastest growth, underscoring the premium positioning of matcha and consumer interest in wellness-driven, culturally rich products.

Matcha vs. coffee: A nutritional and cultural perspective

To better understand matcha’s potential in the Middle East, licensed Lebanese dietitian Reem Harb compared it to coffee in terms of health benefits, energy effects, and cultural fit.

A shade-grown green tea consumed in powdered form, matcha boasts superior levels of phytochemicals like chlorophyll and quercetin, as well as antioxidants such as epigallocatechin gallate, compared to other green teas. However, its caffeine content sits between traditional green tea and coffee.

Unlike coffee, matcha provides a gentler energy boost without a crash. “This is due to the presence of L-theanine, an amino acid that interacts with caffeine to improve cognitive function and energy levels,” Harb said in an interview with Arab News.

Ceremonial matcha is often used for lattes or smoothies due to its perceived health benefits, but this reduces availability for traditional preparations.

Simona Suzuki, president of the Global Japanese Tea Association

The Middle East’s coffee culture is deeply rooted in tradition, from Turkish coffee ceremonies to the social ritual of sharing Arabic coffee. With its earthy and slightly bitter taste, Matcha may initially clash with regional preferences for sweet, aromatic beverages.

However, Harb believed matcha could complement traditional diets if introduced thoughtfully. “Matcha lattes can be a healthier alternative to sugary drinks, especially when prepared without added syrups. Alternating between Arabic coffee and matcha could diversify beverage choices while preserving cultural experiences,” she suggested.

From Kyoto to the MENA: Matcha’s Global Surge

While matcha’s health benefits make it appealing, its journey from Japanese tea fields to Middle Eastern cafes hasn’t been without challenges.

Japan’s matcha industry has seen production nearly triple since 2010, with exports soaring as global demand skyrockets.

This surge in demand, however, has sparked concerns about shortages, prompting renowned Kyoto tea houses like Ippodo and Marukyu Koyamaen to impose purchase limits last year. Social media buzz and the rising demand for functional foods have turned matcha into a must-have trend that Middle Eastern cafes and startups are racing to meet.

Speaking with Arab News, Simona Suzuki, president of the Global Japanese Tea Association, said: “While matcha production in Japan is increasing, it remains relatively limited in scale ... Global demand has surged dramatically, leading to shortages in Japan.”

The rapid growth has strained supply chains, and Suzuki noted it may take time for production to catch up. She also emphasized the importance of using matcha appropriately: “Ceremonial matcha is often used for lattes or smoothies due to its perceived health benefits, but this reduces availability for traditional preparations.”

In Dubai, Abu Dhabi, and Riyadh, specialty cafes now offer matcha lattes alongside traditional karak chai, while local brands experiment with regional twists like matcha-infused dates or cardamom-dusted matcha desserts.

Importing high-grade matcha, however, which relies on specific Japanese tea plant varieties like samidori and yabukita, is costly and logistically complex.

Suzuki encouraged businesses to build direct relationships with producers: “We strongly encourage visiting Japan to connect with tea growers and gain a deeper understanding of cultivation and processing.”

In 2024, THE MATCHA TOKYO, a Japanese organic matcha brand, made its Gulf Cooperation Council debut with a beachside cafe in Dubai. The brand chose Dubai due to the strong presence of Emirati customers at its Tokyo outlets. Beyond Japan and the GCC, THE MATCHA TOKYO has expanded across Asia, with locations in Hong Kong, the Philippines, Bangkok, and Shanghai.

Suzuki remained optimistic about the future of Japanese teas in the region, stating that while matcha is popular, the Global Japanese Tea Association is passionate about introducing the full spectrum of authentic Japanese teas, including sencha, gyokuro, hojicha, and wakocha, to the world.

As Middle Eastern consumers increasingly prioritize wellness while staying rooted in tradition, matcha isn’t replacing coffee, but it’s carving out a lasting niche of its own.

Mining, entertainment sectors eye 100bn in investments by 2030

- Ongoing regulatory reforms are making the Kingdom an attractive destination for foreign investments

RIYADH: Saudi Arabia is steadily progressing in its journey to attract $100 billion in foreign direct investments by the end of this decade, with the Kingdom heavily focusing on securing funds in high-growth sectors, experts have said.

Saudi Arabia’s Vision 2030 economic diversification program aims to transform its economic landscape, including attracting foreign direct investment and increasing FDI’s contribution to the Kingdom’s gross domestic product.

To facilitate and increase FDI, in August Saudi Arabia approved an updated investment law, aimed at boosting transparency and easing the process of investing in the Kingdom.

Speaking to Arab News, Emilio El-Asmar, partner at Oliver Wyman’s Government and Public Institutions practice – India, Middle East and Africa, said that the mining sector is one of the most promising industries that will help the Kingdom achieve its FDI goals by 2030.

He also pointed out that the ongoing regulatory reforms happening in Saudi Arabia are making the Kingdom an attractive destination for foreign investments.

“Saudi Arabia’s National Investment Strategy, central to Vision 2030, aims to transform the Kingdom into a globally competitive, innovation-driven economy,” said El-Asmar.

Saudi Arabia offers geopolitical neutrality, long-term offtake potential, and value-add opportunities.

Emilio El-Asmar, partner at Oliver Wyman’s Government and Public Institutions practice – India, Middle East and Africa

He added: “Mining and metals are among the most promising areas, as the Kingdom has $2.5 trillion worth of untapped resources, including gold, copper, lithium, and rare earth elements, which are vital to energy transition and global industry. Regulatory reforms and integrated industrial zones are opening this frontier market to international investment.”

The comments from the Oliver Wyman official come after Saudi Arabia launched a new incentive package to attract foreign direct investments into the nation’s mining sector.

The Ministry of Investment is collaborating closely with the Ministry of Industry and Mineral Resources through an exploration enablement program aimed at simplifying investments in the mineral exploration industry, the Saudi Press Agency reported in March.

Ryan Alnesayan, partner at Arthur D. Little in the Middle East region, also echoed similar views and said that the mining sector could become a game changer in Saudi Arabia’s economic diversification journey.

“The new mining law and exploration incentives are attracting serious interest, and the Kingdom is positioning itself as a global mining hub with reliable data, infrastructure, and long-term demand,” said Alnesayan.

El-Asmar further said that Saudi Arabia’s Ras Al-Khair and Wa’ad Al Shamal offer integrated infrastructure, rail and port access, and proximity to downstream processing, making them investment-friendly destinations for international entities.

“These ecosystems support refining, smelting, and metal fabrication. A pipeline of investable projects, from exploration to processing, is backed by national institutions including the Public Investment Fund and industrial champions,” said the Oliver Wyman official.

Global players are investing in everything from gaming and digital media to smart cities and AI.

Ryan Alnesayan, partner at Arthur D. Little in the Middle East region

He added: “As global supply chains seek secure mineral sources, Saudi Arabia offers geopolitical neutrality, long-term offtake potential, and value-add opportunities. Its location between Africa, Asia, and Europe gives investors access to regional growth markets.”

In January, speaking at the Future Minerals Forum, Saudi Arabia’s Minister of Industry and Mineral Resources Bandar Alkhorayef said the nation seeks to promote exploration opportunities across 5,000 sq. km of mineralized belts in 2025, aligned with the Kingdom’s broader plans to establish mining as the third pillar of its industrial economy.

In May, a report released by the General Authority for Statistics revealed that net FDI into Saudi Arabia stood at SR22.1 billion ($5.89 billion) in the fourth quarter of 2024, representing a rise of 26 percent compared to the previous three months.

GASTAT also added that this figure was the highest level across the year, surpassing the SR15.5 billion seen in the first three months of 2024, the SR19 billion recorded in the second quarter, and the SR17.5 billion witnessed in the third.

This development comes after Saudi Arabia rose to 13th place in Kearney’s 2025 Foreign Direct Investment Confidence Index, published in April.

This is up one spot from last year and also means the Kingdom retained its position as the third-most attractive emerging market, signaling continued global confidence in its transformation strategy.

Kearney added that the ranking reflects the nation’s bold, reform-driven approach to building an internationally competitive, future-ready economy.

Other crucial sectors

El-Asmar also outlined other crucial areas that could drive FDI into Saudi Arabia in the coming years.

According to the Oliver Wyman official, sectors including pharmaceuticals, biotechnology and petrochemicals are also expected to see foreign funds pour into the Kingdom.

He added: “In petrochemicals, Saudi Arabia is expanding beyond crude oil into speciality chemicals, high-performance plastics, and packaging, backed by integrated feedstock and logistics infrastructure.”

El-Asmar said that Saudi Arabia is ranked second among G20 countries in digital competitiveness, and the Kingdom has strong infrastructure, forward-looking regulations, and digital competitiveness capable of drawing FDI in AI, cloud, cybersecurity, smart city tech, fintech, and health tech.

“Incentives include regulatory sandboxes, IP protections, and access to a growing consumer and enterprise market, making the Kingdom attractive for global tech firms and startups,” said El-Asmar.

Alnesayan also highlighted the role of technology and entertainment sectors in materialising Saudi Arabia’s FDI goals.

“Entertainment and tech reflect Saudi Arabia’s new growth story. Global players are investing in everything from gaming and digital media to smart cities and AI. These sectors are fueling job creation, innovation, and a dynamic consumer market,” said the Arthur D. Little official.

El-Asmar agreed that the entertainment sector is central to Saudi Arabia’s diversification and FDI strategy, reflecting cultural openness and rising domestic demand.

“With a population of 35 million and rising demand for premium experiences, the Kingdom is seeing growth in cinemas, theme parks, live events, and content production. Major international brands are entering the market, supported by co-investment and giga-projects like Qiddiya,” he said.

RHQ program and FDI

Alnesayan believes that Saudi Arabia’s regional headquarters program is emerging as one of the key drivers of FDI in the Kingdom.

“The RHQ Program is not just about relocating offices — it’s about anchoring decision-making in Riyadh. That brings investment, talent, and deeper regional integration. We’ve already seen over 600 companies commit, and the momentum is accelerating,” he said.

Saudi Arabia’s regional headquarters program offers incentives such as a 30-year corporate income tax exemption, withholding tax immunity, and various support services for international businesses.

Some of the noted firms that relocated their headquarters to the Kingdom are Northern Trust, Bechtel and Pepsico from the US, and IHG Hotels and Resorts, PwC, and Deloitte from the UK.

El-Asmar also highlighted the importance of the RHQ program and said that Saudi Arabia’s location — at the crossroads of Europe, Asia, and Africa — makes it an ideal base for regional operations.

Potential challenges

Despite all these positive developments, experts also outlined some of the challenges Saudi Arabia could face in achieving its FDI targets within the stipulated timeline.

“The fundamentals are strong, but challenges remain — global volatility, talent gaps, and the need for ongoing regulatory clarity. But the Kingdom is addressing these head-on through reforms, infrastructure investment, and strategic partnerships that reduce risk and increase investor confidence,” said Alnesayan.

El-Asmar said that foreign investors need predictability, and to address this, Saudi Arabia has launched the Investor Confidence Protection Mechanism and Investor Council, alongside legal reforms including English-language documentation and digital licensing portals.

“High operational costs and complex procedures persist in some sectors. Special Economic Zones, tax incentives, and digital services are helping to reduce these barriers and simplify market entry,” said El-Asmar.

He concluded: “While these challenges are real, Saudi Arabia’s strategic reforms, long-term vision, and favorable location continue to make it one of the world’s most promising emerging FDI destinations.”