RIYADH: The imminent initial public offering (IPO) of Saudi Aramco will come at a time of the Kingdom’s choosing, Energy Minister Prince Abdul Aziz bin Salman told delegates at the Future Investment Initiative (FII) in Riyadh.

“The Aramco IPO will come soon, at the right time, the right opportunity and the right decision, but it will be a Saudi decision, and specifically Prince Mohammed’s decision,” he said, referring to Crown Prince Mohammed bin Salman.

Banking sources at the FII believe that the IPO could be launched within days, ahead of a listing on the Saudi Stock Exchange (Tadawul) in early December.

The minister’s comments came at an FII session on the future of energy, at which he also launched a campaign to develop a “circular carbon economy” for sustainable growth in the Kingdom and the world.

He told delegates at the FII that Saudi Arabia, because of its prominent role in the global energy industry, has an important role to play in finding a solution to the issue of sustainable economic growth, which has come to the fore due to the climate change debate.

“Considering our pivotal role, it’s our responsibility to find solutions through innovation and collaboration to create a sustainable framework for growth,” he said.

“A holistic and pragmatic approach is needed to achieve more sustainability in the economic system.”

The circular carbon economy that the world should adopt was based on a new approach to fossil fuel emissions and greenhouse gasses in which the rules of the “4Rs” would apply: Reduce, reuse, recycle and remove.

“Such a closed-loop system, much like what happens in nature, will help restore the balance of the carbon cycle,” the minister said.

“It offers a new way of addressing the challenges of sustainable development that implicitly values all options and encourages all efforts to mitigate carbon accumulation in the atmosphere, while also facilitating global economic growth,” he added.

“Adoption of this holistic model is vital because, as important as renewables are, and as much progress as they’ve made in recent years, most analyzes suggest the world can’t achieve a balance between ‘sources and sinks’ through renewables and reduction alone,” he said.

“Much of the world’s energy is consumed in sectors that are hard to decarbonize, such as heat, industrial processes and transport. So achieving a carbon balance will inevitably include fossil fuels. However, their carbon emissions must be managed.”

Several energy initiatives in the Kingdom are underway as part of the circular carbon economy, the minister said.

The energy efficiency program in buildings and the petrochemicals industry, as well as improving vehicle efficiency and energy pricing reforms, are examples of the Kingdom’s new approach to energy.

There are also plans to advance Saudi carbon capture plans. The Kingdom currently operates the largest carbon capture and utilization plant in the world, turning half a million tons of CO2 annually into products such as fertilizers and methanol.

“We believe that nature-based solutions will play an important role in removing carbon as part of the circular carbon economy,” the minister said.

“Recognizing this, we’re taking actions to achieve these goals, including expanding our mangrove forests and plantations, seagrass meadows and coral reefs in both the Red Sea and Arabian Gulf.”

The Saudi initiative won the support of several of the high-profile panelists at the FII, including US Energy Secretary Rick Perry and Andrew Liveris, an adviser to the Kingdom’s Public Investment Fund.

Perry said his home state of Texas had made big investments in wind power and natural gas as ways to reduce carbon emissions.

Liveris said: “We should see sustainability and the circular economy as a business opportunity.”

Energy minister: Aramco IPO timing will be ‘a Saudi decision’

Energy minister: Aramco IPO timing will be ‘a Saudi decision’

- Banking sources at the FII believe that the IPO could be launched within days, ahead of a listing on the Saudi Stock Exchange (Tadawul) in early December

- The Kingdom currently operates the largest carbon capture and utilization plant in the world

UAE, India, and China among top destinations for KSA’s non-oil goods

- Strengthening the sector is one of the crucial goals outlined in Vision 2030 initiative

RIYADH: The UAE was the leading destination for Saudi Arabia’s non-oil exports in November, with outbound shipments to the Emirates reaching SR7.17 billion ($1.87 billion) in what was a 22.35 percent month-on-month rise.

According to the General Authority for Statistics, the Kingdom exported machinery and mechanical appliances valued at SR3.15 billion to the UAE in November, followed by transport parts and precious metals at SR2.03 billion and SR404.7 million, respectively.

In October, Saudi Arabia’s non-oil shipments to the UAE amounted to SR5.86 billion, while it was SR6.54 billion and SR6.78 billion in September and August, respectively.

Saudi Arabia also exported plastic and rubber products worth SR330 million in November, while outbound shipments of chemical products totaled SR319 million.

Strengthening the non-oil sector is one of the crucial goals outlined in Saudi Arabia’s Vision 2030 agenda, as the Kingdom is steadily diversifying its economy by reducing its dependence on crude revenues.

Affirming the growth of Saudi Arabia’s non-oil private sector, the Kingdom’s Purchasing Managers’ Index reached 58.4 in December, marking a slight decline from a 17-month high of 59 in the previous month, according to the Riyad Bank Saudi Arabia PMI survey compiled by S&P Global.

Any PMI readings above 50 indicate growth of the non-oil private sector, while readings below the number signal contraction.

Underscoring the progress of Saudi Arabia’s non-energy sector, the Kingdom’s PMI has remained above the 50 growth mark continuously since September 2020.

Saudi Arabia’s PMI in December is also the highest among its Middle East neighbors.

The Kingdom’s Arab neighbors UAE posted a PMI of 55.4 in December, with Kuwait registering 54.1, and Qatar on 52.9.

Speaking at the World Economic Forum in Davos earlier this month, Saudi Arabia’s Finance Minister Mohammed Al-Jadaan said that the Kingdom’s commitment to economic diversification under Vision 2030 was driving steady growth, with the growth of non-oil gross domestic product being prioritized over traditional oil revenues. India was another major destination for Saudi Arabia’s non-energy goods in November, with exports amounting to SR2.52 billion, representing a 19.43 percent increase compared to the previous month. GASTAT revealed that Saudi Arabia exported chemical products worth SR1.34 billion, while outbound shipments of plastic and rubber products were valued at SR449.6 million, and base metals amounted to SR324.5 million.

The Kingdom also exported precious stones and metals amounting to SR324.5 million in November to India.

China held the third spot for Saudi Arabia’s non-oil exports, with the Asian giant receiving inbound shipments from the Kingdom valued at SR2.17 billion in November, marking a month-on-month decline of 7.65 percent. Other top destinations for Saudi Arabia’s non-hydrocarbon goods were Singapore, with a value of SR1.23 billion; Turkiye at SR960.4 million, and Bahrain at SR929.7 million.

Egypt received non-energy products amounting to SR868.4 million in November, while exports to the US and Jordan totaled SR772.8 million and SR642.6 million, respectively.

Overall, Saudi Arabia’s non-oil exports witnessed an annual rise of 19.7 percent in November, reaching SR26.92 billion.

Speaking at the World Investment Conference in November, Saudi Arabia’s Minister of Economy and Planning Faisal Al-Ibrahim said that non-oil activities account for 52 percent of the Kingdom’s gross domestic product.

The minister added that the Kingdom’s non-oil economy has been growing at 20 percent since the launch of the Vision 2030. In November, Saudi Arabia exported non-energy goods worth SR16.76 billion via sea, while outbound shipments via land and air totaled SR4.99 billion and SR5.17 billion, respectively.

King Fahad Industrial Sea Port in Jubail was the main exit point for Saudi Arabia’s non-hydrocarbon products with goods valued at SR3.39 billion.

Jeddah Islamic Sea Port and Jubail Sea Port also handled outbound shipments worth SR3.35 billion and SR1.91 billion, respectively.

In terms of exit points via land, Al Bat’ha Port handled goods valued at SR1.85 billion, while products worth SR696.4 million passed through Al Hadithah Port.

Among airports, King Khalid International Airport in Riyadh handled outbound shipments worth SR2.79 billion, while King Abdulaziz International airport processed non-energy goods amounting to SR1.99 billion.

In December, a report released by Mastercard Economics also underscored the robust expansion of Saudi Arabia’s non-oil activities.

The analysis said that the Kingdom’s GDP is expected to witness an expansion of 3.7 percent year on year in 2025, driven by a rise in the Kingdom’s non-oil activities.

The Mastercard report added that economic diversification efforts in the Kingdom will continue in 2025 as the government leverages strong balance sheets to finance investment in infrastructure.

Overall merchandise exports

GASTAT revealed that Saudi Arabia’s overall merchandise exports witnessed a decline of 4.69 percent in November 2024 compared to the same month in 2023, reaching SR90.54 billion.

The authority said this fall in overall exports was due to a 12.3 percent decrease in oil exports.

“Consequently, the percentage of oil exports out of total exports decreased from 76.3 percent in November 2023 to 70.3 percent in November 2024,” said GASTAT.

In November, Saudi Arabia’s overall merchandise exports to China stood at SR13.53 billion, followed by Japan at SR8.93 billion, the UAE at 8.75 billion and India at SR8.74 billion.

The flow of Saudi exports to China signifies strong bilateral relations between both nations, with the Kingdom being the largest trading partner of China in the Middle East since 2001.

The Kingdom and Saudi Arabia are also strategic partners in various other sectors like energy and finance, as well as the Belt and Road Initiative.

South Korea received goods worth SR8.34 billion in November, while the Kingdom’s exports to the US stood at SR3.72 billion, to Singapore at SR3.34 billion, and SR2.85 billion going to Malaysia.

Imports in November

According to GASTAT, Saudi Arabia’s overall imports in November were valued at SR73.65 billion, marking a rise of 13.9 percent compared to the same month in the previous year.

Saudi Arabia imported goods worth SR20.11 billion from China, led by mechanical appliances and electrical equipment valued at SR9.99 billion.

The Kingdom also imported transport equipment and base metal products amounted to SR2.56 billion and SR1.89 billion, respectively.

China was closely followed by the US and UAE with the Kingdom welcoming goods from these nations valued at SR7.52 billion and SR3.90 billion, respectively in November.

The Kingdom also imported goods worth SR3.22 billion from Germany and SR3.14 billion from India.

Japanese imports to Saudi Arabia amounted to SR2.83 billion, while inbound shipments from Italy and Switzerland stood at SR2.58 billion and SR2.40 billion, respectively.

According to GASTAT, imports worth SR44.25 billion entered Saudi Arabia via sea, while inbound shipments valued at SR20.47 billion and SR8.65 billion came via air and land, respectively.

King Abdulaziz Sea Port in Dammam was the primary entry point for goods in September through sea in November, with imports valued at SR18.19 billion, representing 24.7 percent of the total inbound shipments.

The authority added that Jeddah Islamic Sea Port handled incoming shipments valued at SR17.58 billion, followed by Ras Tanura Sea Port at SR3.24 billion.

Through land, Al Bat’ha Port and Riyadh Dry Port processed incoming goods valued at SR3.89 billion and SR2.66 billion, respectively.

Through air, King Khalid International Airport in Riyadh welcomed inbound shipments worth SR10.94 billion in November.

King Abdulaziz International Airport and King Fahad International Airport also handled imports valued at SR5.11 billion and SR4.27 billion, respectively.

Saudi Arabia’s carbon credit market leadership paving way for regional unity

- Kingdom’s investments in renewable energy and advanced carbon capture technologies are growing

RIYADH: A unified regional carbon market is increasingly likely as Saudi Arabia takes the lead in this growing area of sustainability, experts have told Arab News.

Through Vision 2030, the Kingdom’s investments in renewable energy, advanced carbon capture technologies, and a regulated carbon credit market are growing, driving innovation in these areas.

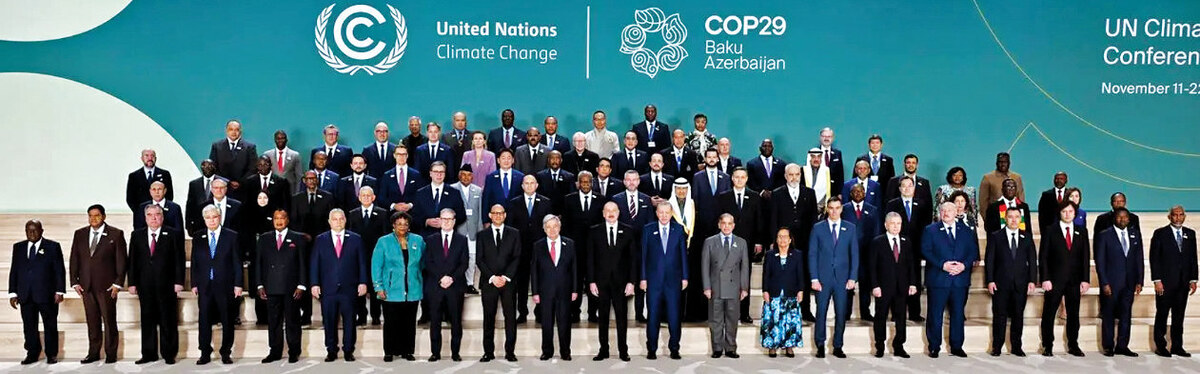

At the UN Climate Change Conference in Baku on Nov. 12, Saudi Arabia launched its first carbon trading exchange — a platform that places the Kingdom at the forefront of the GCC in this field.

Managed by the Regional Voluntary Carbon Market Co. — a joint initiative by the Public Investment Fund and the Saudi Tadawul Group — the exchange underscores Saudi Arabia’s commitment to sustainability and establishes a model of environmental responsibility for neighboring nations.

The inaugural auction on the exchange brought together 22 local and international companies offering 2.5 million high-quality carbon credits, certified by leading standards like Verra, Gold Standard, and Puro.earth.

These credits largely originate from impactful projects across the Global South, including countries such as Bangladesh, Brazil, and Ethiopia.

The market, projected to grow at a compound annual growth rate of 32.2 percent and reach $3.27 billion by 2030, will also drive investment in carbon capture, storage, and emissions reduction.

“Saudi Arabia is following a careful approach in setting up a carbon market and avoiding the mistakes made by the EU and other regions. Investing in voluntary carbon markets is a part of the Kingdom’s efforts to diversify its economy and achieve its goal of net-zero emissions by 2060,” explained Arun Leslie John, chief market analyst at Century Financial.

He added: “By establishing a domestic exchange and regulated marketplace for carbon credits, Saudi Arabia is leading the way for local companies to mitigate reputational risk in an increasingly cleaner energy generating world along with generally boosting liquidity conditions.”

The RVCMC has auctioned high-quality credits supporting projects with measurable environmental impact, most notably through initiatives in Africa, where it sold over 1.4 million tons of carbon credits in its first carbon offset auction in 2022.

Approximately 70 percent of these credits were allocated to climate projects across Africa, benefiting countries like Egypt, Mauritania, and South Africa.

Saudi Arabia’s commitment to stringent standards and regulatory oversight in its carbon credit market is setting a benchmark for other GCC countries. Unlike other regional markets, the Kingdom prioritizes quality and transparency.

“By developing standardized frameworks aligned with global benchmarks, the Kingdom can tackle the issue of lack of standardization, ensuring consistency and reliability across the market,” Louay Saleh, principal at Arthur D. Little, told Arab News.

Saleh added: “Saudi Arabia can ensure real impact and limit greenwashing by leveraging advanced technologies such as drones, satellite imaging, and AI. These tools can provide more accurate baselining and measurement throughout the project lifecycle, enhancing transparency and accountability”.

This dedication to transparency strengthens Saudi Arabia’s carbon market and positions it as an attractive destination for international investors, encouraging other GCC nations to adopt similar standards.

Economic opportunities and new revenue streams

The carbon credit market offers substantial economic potential for Saudi Arabia.

The energy sector, including companies like Aramco, is investing in carbon capture and storage technologies that allow them to generate tradable credits.

Investing in voluntary carbon markets is a part of the Kingdom’s efforts to diversify its economy and achieve its goal of net-zero emissions by 2060.

Arun Leslie John, chief market analyst at Century Financial

This potential extends beyond energy to other sectors, such as petrochemicals, aviation, and construction, which could reduce emissions through clean technologies and sell excess carbon credits.

“Industries such as petrochemicals, aviation, construction, agriculture and tourism in Saudi Arabia are most likely to benefit from or contribute to the carbon credit market,” emphasized Saleh, highlighting the extensive opportunities for both new revenue and emission reductions across these sectors.

In parallel with the growth of its carbon credit market, Saudi Arabia has attracted substantial foreign investment through green finance incentives. Programs like the Saudi Green Initiative and the Middle East Green Initiative, paired with green bond issuance, have provided essential funding for renewable energy and carbon capture projects.

The Kingdom aims to achieve a carbon capture capacity of 44 million tons annually by 2025, enhancing its ability to offset emissions and solidify its position as a high-quality carbon credit provider.

A vision for regional cooperation and the unified GCC carbon market

Saudi Arabia’s leadership in the carbon credit market is poised to significantly influence the GCC, as some regional countries are already reinforcing their market frameworks, suggesting the potential for a unified market.

“The outlook for a unified GCC carbon credit market is promising, with Saudi Arabia, the UAE, and Oman making significant steps forward in their respective carbon market infrastructures,” said Carlo Stella, managing partner and global head of sustainability practice at Arthur D. Little.

“Regional cooperation is very likely to facilitate key aspects such as standardization of methodologies, cross-border trading mechanisms, and the development of a shared carbon registry system,” he added.

By developing standardized frameworks, KSA can tackle the issue of lack of standardization, ensuring consistency across the market.

Louay Saleh, principal at Arthur D. Little

Through Vision 2030, Saudi Arabia’s investments in renewable energy, advanced carbon capture technologies, and a regulated carbon credit market are positioning it as a leader in climate action within the GCC, demonstrating that economic growth and sustainability can go hand in hand.

The Kingdom’s carbon credit initiatives are shaping not only its own future but also setting a model for the GCC to follow toward a more sustainable path.

Poised to play a pivotal role in global sustainability, Saudi Arabia’s carbon credit market — driven by large-scale projects, cutting-edge technology, and a commitment to transparency — is leading the GCC on a transformative journey toward climate-responsible economic development.

Through these initiatives, the Kingdom is not only raising the bar for carbon markets but is also creating a blueprint for the region and beyond in green finance and environmental responsibility.

Saudi ecosystem sees seeds rounds and dedicated funds

- Local firms secure sizable funding rounds and venture capitals announce dedicated funds

RIYADH: Saudi Arabia’s startup ecosystem has seen notable activity across multiple industries with local firms securing sizable funding rounds and venture capitals announcing dedicated funds.

Domestic property technology firm Rize secured a $35 million series A investment funding round led by Raed Ventures, with participation from Nama Ventures, Hala Ventures, JOA Capital, Aqar Platform, and SEEDRA Ventures.

“This investment represents a major turning point in our journey and reflects the investors’ confidence in our vision to develop the leasing sector,” said Ibrahim Balilah, CEO of Rize.

Founded in 2021 by Balilah and Mohammed Al-Fraihi, Rize offers an innovative solution to eliminate bulky, one-time rental payments in Saudi Arabia.

Adopting a rent now, pay later model, Rize offers tenants to pay their rent in flexible monthly installments as opposed to the nation’s standard of one-time payments on a year’s rent.

This converts a single full payment to 12 monthly installments for tenants, while property owners get the full annual rent upfront.

Speaking to Arab News in March, Balilah explained that this model has garnered significant interest with the company getting around SR330 million ($88 million) in requests at the time.

Such an innovative solution requires large capital sums, meaning the company aims to utilize the series A round to accelerate its growth in Riyadh, as well as Jeddah and Dammam.

“We have worked hard to develop our internal technologies to enable the automation process and make the rental experience smoother. This investment round is a significant step to enhance our technologies and accelerate the company’s growth,” said Al-Fraihi, chief technology officer at Rize.

Omar Al-Majdouie, co-founder at Raed Ventures, stated: “We believe in Rize’s ability to bring about a transformative change in the real estate leasing sector, not only by offering innovative services but also by enabling digital transformation in this important field.”

Mohammed Alzubi, founder and managing partner of Nama Ventures said: “Since our investment in Rize’s seed round, we were confident that it had the potential to be a leader in providing rent now, pay later solutions in the Kingdom. We are proud of the remarkable achievements Rize has made so far, and are excited to continue supporting them in this new round.”

Agritech Arable closes $2.55m in seed round

Saudi Arabia’s agriculture technology sector also saw a notable funding round with Arable, closing $2.55 million in a seed investment.

Founded last year by Lawrence Ong and Christina Khalife, Arable aims to boost sustainable farming in the Kingdom’s harsh climate by designing and operating hydroponic farming systems. These systems are ideal for dry landscapes, which occupy most of the Middle East region, as they can produce yields while saving up to 90 percent water.

“Saudi Arabia offers an unparalleled ecosystem for startups like Arable to thrive. Thanks to the support of organizations such as the Ministry of Environment, Water, and Agriculture, the Ministry of Investment, the National Technology Development Program, and the General Authority of SMEs, we’ve been able to scale rapidly and bring innovation directly into the Kingdom,” said Ong, CEO of Arable. The funding round attracted both institutional and private investors, with 90 percent of the capital coming from foreign investors. The funds will be allocated within Saudi Arabia to help advance the country’s agricultural sector, the company stated in a press release.

The company also claimed that 80 percent of the components needed to create its systems can be sourced or manufactured locally.

Saudi Arabia’s Willow closes pre-seed round

Digital transformation is taking shape in all corners of the Kingdom with Willow, a startup that offers laundry booking services through its app, closing a pre-seed investment round for an undisclosed amount.

Founded in 2024 by Mohammed Al-Marri and Wijdan Al-otaibi, the company is leveraging technology to create a digital, seamless laundry experience through pickups and deliveries. Willow will further utilize the funding to cement its digital infrastructure and expand its customer base.

SVC, Jada back US-based VC firm 500 Global’s new fund

US-based venture capital firm 500 Global launched its new Middle East and North Africa-focused fund with backing from Saudi Arabia’s top limited partners.

The fund saw support from Saudi Venture Capital Co., a subsidiary of the Small and Medium Enterprises Bank, which is part of the Kingdom’s National Development Fund, and Jada Funds of Fund, a Public Investment Fund company.

Labeled 500 MENA L.P, it will primarily invest in startups with proven product-market fit — a key milestone in any business journey that demonstrates a specific solution has found and satisfied a strong market demand.

MoneyHash secures $5.2m pre-series A

US-based Egyptian fintech MoneyHash has raised $5.2 million in pre-series A funding. The round was led by Flourish Ventures, with participation from Vision Ventures, Arab Bank’s Xelerate, Emurgo Kepple Ventures, Jason Gardner, and existing investors, including COTU, RZM Investment, and Github founder Tom Preston-Werner.

This follows a $4.5 million seed round in early 2024 co-led by COTU Ventures and Sukna Ventures.

Founded in 2020 by Nader Abdelrazik, Mustafa Eid, and Anisha Sekar, MoneyHash provides a payment orchestration and operating system to address technological challenges faced by enterprise merchants.

The newly raised funds will be used to accelerate its market penetration across the MEA region.

Talent 360 secures six-figure funding

Egypt-based human resources tech startup Talent 360 has closed a six-figure investment round led by Saudi Arabia’s C.STAR.

The funding will support the company’s expansion efforts in Saudi Arabia, which it entered in mid-2024.

Founded in 2017 by Heba Ayad and Mohamed Said, Talent 360 offers talent management, business training, and 360-degree organizational solutions tailored to business needs.

Eyouth and EDT&Partners launch $6m skills program

Egypt-based education tech Eyouth has partnered with Singapore-based education consultancy EDT&Partners to launch a $6 million program aimed at equipping 1 million youth in Africa and the Middle East with digital skills.

The initiative will focus on critical areas like AI, coding, and data analysis, as well as digital marketing, and modern pedagogies.

The program will combine Eyouth’s skills development platform with EDT’s AI-driven educational tools to provide training for youth aged 15 to 35 across the region.

This partnership represents a significant step toward addressing digital skill gaps in emerging markets.

Pluto raises $4.1 million pre-series A

UAE-based fintech Pluto has secured $4.1 million in a pre-series A funding round led by a mix of existing and new investors, including Rhino Ventures, Born Capital, Goanna Capital, Evolution VC, Freesearch VC, and Tiferes VC.

Founded in 2021 by Mohammed Ridwan, Mohammed Aziz, and Nayeem Zen, Pluto helps businesses streamline spending management through virtual and physical cards with customizable spend controls.

The funding will support Pluto’s expansion in Saudi Arabia and the Gulf Cooperation Council region, as well as solidify the growth of its newly launched product, Pluto Connect.

Pluto previously raised $6 million in a seed round in 2022, led by Global Founders Capital.

DataQueue secures undisclosed funding

The Netherlands and Palestine-based AI-training startup DataQueue has raised an undisclosed funding round from Ibtikar Fund and Flat6Labs Jordan Seed Fund.

Founded in 2021 by Bashir Alsaifi, DataQueue specializes in providing annotated and labeled data for AI model training.

The startup aims to position itself as a global AI partner for businesses by leveraging its expertise in data training and annotation.

This marks its second funding round after raising an undisclosed amount from the Ibtikar Fund in August 2023.

Sampo AI raises $750k

Oman-based Software-as-a-Service provider Sampo AI has closed a $750,000 pre-seed funding round co-led by Omantel Innovation Labs and Waad VC, with additional participation from Hexnture and a group of Saudi angel investors.

Founded in July by Saif Al-Essai and Khalifa Manaa, Sampo AI offers an advanced platform that helps e-commerce businesses optimize pricing strategies using data-driven insights, user behavior analysis, and A/B testing.

The funding will drive Sampo AI’s expansion plans in Saudi Arabia and the UAE.

Kingdom’s digital ‘leapfrog’: Intel executive VP highlights 20-year Saudi partnership

- Speaking on the sidelines of the WEF, Christoph Schell emphasized the Kingdom’s commitment to growth and its importance as a key market for Intel

- Says technology plays a crucial role in the Kingdom’s societal development, with a key focus on fostering innovation and bridging the digital divide

DAVOS: Saudi Arabia’s Vision 2030 has enabled the Kingdom to “leapfrog other countries,” creating a robust ecosystem that aligns with Intel’s digital transformation strategy, the company’s executive vice president and chief commercial officer told Arab News.

Speaking on the sidelines of the World Economic Forum in Davos, Christoph Schell emphasized the Kingdom’s commitment to growth and its importance as a key market for Intel, building on a 20-year legacy of collaboration.

“Having lived for eight years in the Middle East, I know that once you define a plan, and you work that plan, that plan will also work out,” Schell said. “So there’s a lot of trust that this vision will become reality.”

Schell, who previously served as HP’s general manager for the Middle East, described the region — and Saudi Arabia specifically — as being at an “exciting historical moment” in terms of technology, innovation and business, positioning the Kingdom as a “crucial market in size and influence.”

Intel has maintained a strong presence in Saudi Arabia for more than two decades, with its innovation and priorities evolving in response to the Kingdom’s changing needs.

“There’s a very long legacy that the Kingdom has of engaging with Intel and for the population of Saudi Arabia to actually use Intel in their daily lives. That’s true on the consumer side, but that’s also true for the large corporations,” Schell said.

“What I see happening for the first time is that the Saudi customers have been, over these 20 years of engagement, buying monolithic products that Intel had to offer. I think this industry is changing as such that we are talking more and more about custom solutions, custom chips, and these are the first (type of) engagements that we have with Saudi customers now, cross-customization.”

He attributed this shift to significant investments in digital infrastructure and the growing tech sophistication of Saudi consumers and businesses.

“I see Saudi not just consuming technology that is off the shelf, but to demand technology that is best in the very specific requirements that you have,” he said.

Highlighting examples, Schell said that Saudi Arabia’s extreme temperatures had led to customized design requests for products operating in harsh conditions, such as on oil platforms and in peak summer heat.

“That requires different design principles across different products. And that’s the opportunity for us,” he said.

In January 2024, Intel announced a partnership with Aramco Digital to establish Saudi Arabia’s first Open RAN (radio access network) development center. Open RAN technology, which allows multiple service providers to deliver services over the same network infrastructure, is expected to accelerate innovation and drive the Kingdom’s digital transformation in line with Vision 2030.

“If you want to scale a data center, if you want to grow a data center, if you want to grow a cloud operation, getting access to power is super important,” he said.

“Obviously the Kingdom has a lot of power, but on the other hand, it is also demanding for that power to be delivered in the most efficient way, and for the computer to be cognizant of power not being there in abundance, but to be managed in a way that is responsible.”

Schell argued that this evolution is a consequence of the cultural and societal shifts in Saudi Arabia, emphasizing the country’s focus on innovation and bridging the digital divide.

“Technologies (are) at the heart of societal development. And I think a lot of the goals that you have as a society is to innovate, is to make sure that there’s no digital divide within the country,” he said.

As part of its vision for the future, Saudi Arabia is prioritizing the development of a robust tech ecosystem by attracting manufacturers, creating jobs and nurturing local talent — a strategy that Schell described as “sustainable.”

“It has a lot to do with education, but I think beyond educating, the ability to design products together, to engineer products together, is something that needs to start, in particular, working together with select universities,” he said.

Schell emphasized the role of AI in shaping the Kingdom’s future, particularly in practical applications such as education and daily life.

“The output that an AI engine delivers is based on the model it uses. And I think what is very important for Saudi Arabia in this context is to have models that have cultural awareness, that have cultural content.”

Drawing on his own experience, Schell highlighted the importance of localization.

“I live in the US right now. I’m German. If I use a US model, a US-centric model, I will get US-centric answers. (While) If I use a Saudi-centric model, I will get Saudi-centric answers.

“This is very important from a culture and from a historic point of view,” he added, stressing the “government’s responsibilities” in fostering an ecosystem that supports culturally relevant AI.

AI no longer an experiment, but a necessity for business, says Publicis Sapient chief

- Nigel Vaz calls for end to ‘wait-and-see’ approach, saying businesses need to ‘act now or risk being left behind’

- Middle East laying the groundwork for ‘truly transformational moment’ in global digital future, says CEO

DAVOS: Technological innovation and its potential to reshape economies is inspiring growing optimism among business leaders despite a global backdrop of geopolitical tension, economic uncertainty, and the urgent challenges of climate change, the CEO of Publicis Sapient told Arab News.

Nigel Vaz, speaking at the annual meeting of the World Economic Forum in Davos, said he sees a moment of both caution and opportunity for businesses worldwide.

“In many ways, businesses thrive on certainty,” Vaz said. “After years of unpredictability, there’s now a sense of optimism about what lies ahead. Investments in technology, particularly in AI, are helping unlock new economic opportunities, from reducing costs to driving transformational growth.”

While acknowledging lingering concerns over inflation and the impact of macroeconomic policies such as tariffs, Vaz believes the focus is shifting toward pro-growth initiatives, including government-led reforms to alleviate pressure on businesses.

“Governments are increasingly exploring tax reforms and other measures to create a more favorable environment for growth,” he said. “And alongside that, investments in AI and digital innovation are starting to deliver real results, moving from proof-of-concept to large-scale implementation.”

With artificial intelligence the hot topic of the day, Vaz said enthusiasm around AI is no longer solely about its potential but also its measurable impact on businesses.

“Last year, AI was something everyone was interested in. This year, they’re seeing the economic benefits of it,” he said.

Vaz pointed to several ways Publicis Sapient is leveraging AI to accelerate transformation, with one significant area in marketing, where AI-driven platforms are enabling businesses to personalize their messages and reach audiences more efficiently.

Publicis Sapient has partnered with its parent company, Publicis Groupe, to invest $300 million in advanced marketing technologies.

“It’s not just about content generation anymore,” Vaz said. “AI is helping with everything from content audits to ensuring the right message gets to the right person at the right time. The ability to connect identity and tailor communication is driving incredible acceleration.”

AI’s influence is also being felt in operational areas traditionally weighed down by inefficiencies.

Publicis Sapient’s work includes modernizing mainframe systems — once seen as expensive and slow — through AI-driven solutions.

“We’ve taken what used to be 10-year migration projects involving millions of lines of code and compressed them into just three years,” Vaz said. “This is digital red-tape removal in action, and it’s allowing businesses to innovate far more quickly than they ever thought possible.”

Vaz also highlighted the Middle East as a critical player in the future of AI and digital transformation. He pointed to countries such as Saudi Arabia and the UAE, where governments are making significant infrastructure investments to foster innovation.

“The Middle East is laying the groundwork for a truly transformational moment,” Vaz said. “If you think of AI as the electricity of the 21st century, the investments being made here are akin to building the power grids of the industrial revolution. It’s about creating an environment where businesses can innovate and thrive.”

He also praised the region’s commitment to developing local talent to drive these initiatives.

“I was speaking with a minister (this week), and he stressed that while they’re putting the infrastructure in place, it’s Saudi talent that’s building and leading these projects. That’s a powerful message about the long-term vision here.”

Looking ahead, Vaz urged business leaders to abandon a “wait-and-see” approach to AI and instead embrace the transformative potential of the technology.

He said that 2025 will be a pivotal year, adding that “the gap between those who adopt AI and those who don’t is going to widen dramatically. Businesses need to act now to ensure they don’t get left behind.”

Vaz added that leaders should move beyond treating AI as a technical tool and instead reimagine their entire business models. “This is not just about technology — it’s about fundamentally rethinking how your business operates and delivers value.”

As Publicis Sapient continues to expand its footprint in key regions such as the Middle East, Vaz is clear about his priorities for the future. “Our focus is on enabling businesses to learn and iterate in real-world applications,” he said. “Whether it’s in travel, financial services, or retail, we’re seeing tremendous benefits from these transformations. The key now is to keep moving forward.”

In a world still grappling with uncertainty, leaders such as Vaz see the promise of AI and digital transformation as a beacon of opportunity. “The future is here — it’s just a matter of who seizes it first,” he said.