Islamabad: Pakistan’s government said on Sunday, that it would soon be offering tax benefits and incentives to manufacturers and importers of electric vehicles in order to reduce its inflated oil imports’ bill, carbon emissions, boost industrial growth, and create thousands of jobs.

“We have opened up this new futuristic sector for investments by offering massive tax incentives to manufacturers, importers, and buyers,” Malik Amin Aslam, Adviser to Prime Minister Imran Khan on Climate Change, told Arab News in an interview on Sunday.

As part of the initiative, all EV manufacturers will be allowed to import batteries and other motor parts at one percent custom duty, in addition to a “complete exemption from GST [General Sales Tax]” which, at present, stands at 17 percent on each item.

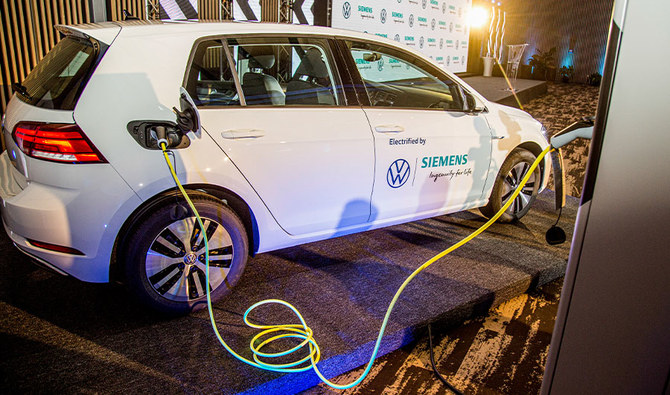

The e-mobility revolution has moved into top gear across the globe with several developed countries such as Norway, Netherlands, and France announcing plans to ban the sale of all vehicles using fossil fuel vehicles in the next ten to 20 years.

Meanwhile, developing countries such as Pakistan have announced plans to switch to e-vehicle use to reduce greenhouse gas emissions.

In Pakistan, transportation accounts for around 43 percent of the airborne emissions, adding to the ever-increasing problem of pollution and resulting in toxic smog in major cities and a sharp increase in the country’s oil import bill which currently stands at around $15 billion – one of the largest import commodities in Pakistan.

The government is hoping that e-vehicles could usher in a new era of a cleaner environment and help save nearly 135,000 people who die from pollution-related causes in Pakistan every year.

“The e-vehicles don’t emit any pollutants and their introduction will limit emissions to a large extent,” Aslam said while referring to the National Electric Vehicles Policy that the federal cabinet approved earlier this month.

Likewise, all EVs manufactured in Pakistan will be sold at less than one percent GST for the next seven years to encourage more sales.

Pakistan-manufactured EVs will also be exempted from a registration fee and annual token tax to facilitate buyers. The imported EVs will also receive the same benefit for the next five years, according to the policy.

“The incentives offered; for both shifting new manufacturing in Pakistan as well as for conversion of existing motorcycles, rickshaws, cars, trucks and buses are the best in the region,” Aslam said, adding that the move is a win-win for Pakistan as it will provide “savings of 70 percent in running cost, cut almost $2 billion in oil imports by 2030 and trigger a new industry delivering thousands of green jobs.”

Talking about the target, he said the government was committed to switch 30 percent of all new vehicles to electric by 2030 and kick off the transition with 100,000 vehicles and 500,000 motorcycles and rickshaws in the next four years.

He added that the government was receiving “a lot of interest” from not only existing manufacturers but new entrants, too.

“Our vision is to make Pakistan a hub for right-hand drive e-vehicles and use that base for not only domestic sales but also export them to earn foreign exchange,” Aslam said.