What happened:

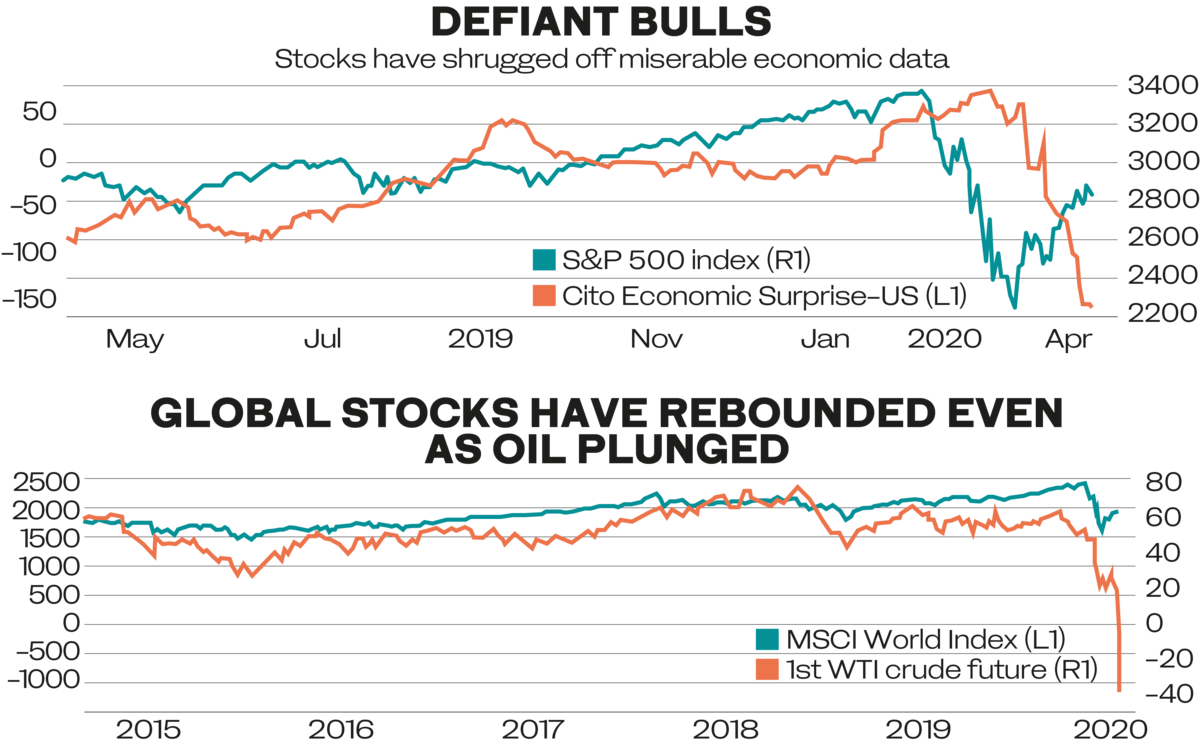

Yesterday virtually all global equity markets fell in reaction to the historic fall of WTI into negative territory. The markets are, however, well above their March lows.

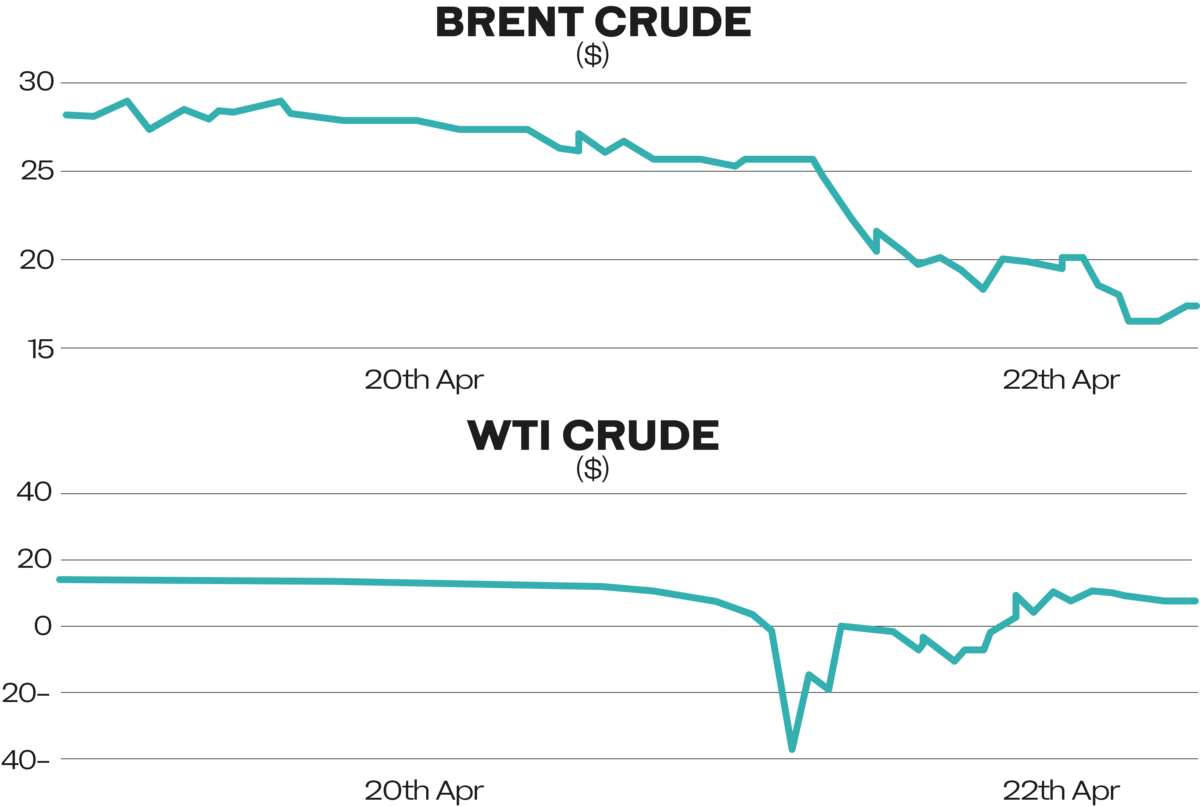

The oil price rout continued into Wednesday. Brent followed WTI in the race to the bottom, reaching levels not seen since 1999. Storage in major hubs like Amsterdam, Rotterdam, Fujairah and Singapore is filling up quickly, and the industry is desperately seeking storage off-shore, underground, or wherever else possible at whatever price. Mid-day Monday CEST, Brent traded at $18.98 per barrel and WTI at $11.42 per barrel — down 1.81 and 1.30 percent respectively

OPEC+ ministers held a conference call to discuss the situation. There were no decisions made about further action — another sign that the drop in demand is beyond any measures that a subgoup of producers can take. This is a demand-driven global problem, requiring global solutions.

The macro picture in the Eurozone looks dismal: The GDPs of Germany, France and Spain are forecasted to shrink by 4 percent, 8.6 percent and 12.4 percent respectively. The ECB will hold a crucial call this evening to discuss government debt in the Eurozone, particularly Italy.

US congress passed another $545bn corona relief package targeting the healthcare sector and small businesses.

Background:

The financial sector is also exposed to the collapse of oil prices as loans turn bad and bets on future prices go badly wrong.

ETFs specializing in oil saw inflows in the billions over the last few months as investors sought to catch the bottom of the market — a dangerous game at the best of times.

The United States Oil Fund (USO) is the world’s largest oil-based ETF with more than $4bn in assets. As WTI dropped below zero, it was forced to change its allocation to longer durations and other kinds of energy derivatives. It had to seek permission from the US SEC to issue further shares.

Equity markets seemed immune to developments in the real economy. The MSCI global traded 20 percent above its low point earlier this year. There is an apparent lack of correlation between what has happened in most major economies as they went into lockdown with steadily declining GDPs.

The recent rally was fuelled by stimulus packages of an unprecedented scale. Still, how companies fare in future depends on the shape and pace of the recovery, which is uncertain

The rally was also fuelled by sliding interest rates, meaning companies paying dividends are king.

The rush into bonds, particularly treasuries, can be explained by investors not looking at government bonds in terms of return on investment but security of investment. We have seen a shift in favor of longer durations like the 30-year treasury, because of their yield.

Where we go from here:

The Bureau International des Exposition agreed to postpone the Dubai EXPO by one year. This is a huge blow to the economy of Dubai, given the importance of travel, leisure, hospitality and conferences to its GDP.

We shall have to look out for credit events in the GCC with oil prices at their current low levels. The weakest economies in the region are Oman and Bahrain.

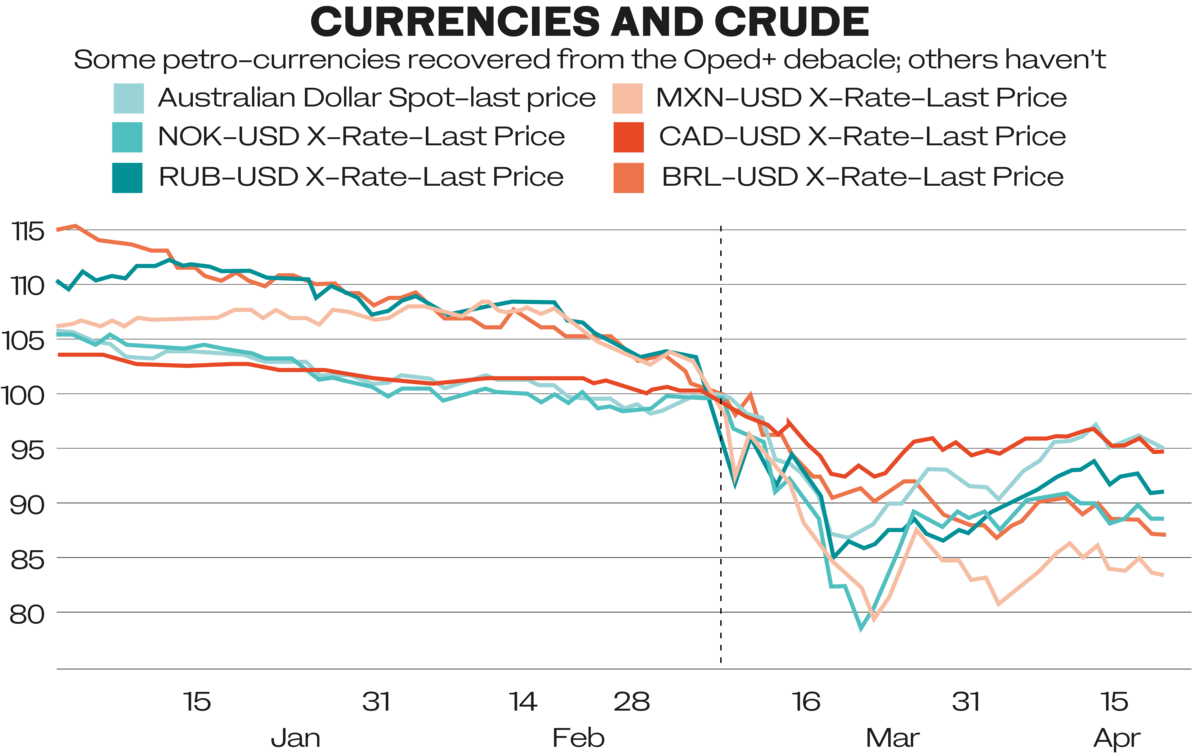

Hopefully currency events can be avoided, as it becomes harder to defend the dollar pegs when reserves decline. Currencies of oil-exporting countries that do not have a dollar peg depreciated in line with how their economies were affected by the falling oil price.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources