What happened:

US GDP numbers for the first quarter came in at minus 4.8 percent, breaking over a decade of uninterrupted growth. The first quarter only reflects the beginning of the outbreak and the number will deteriorate significantly in the upcoming quarter.

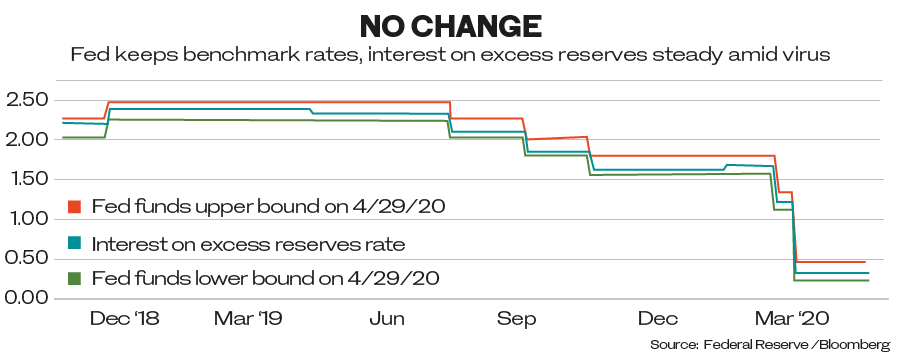

The Federal Reserve’s (Fed) Open Market Committee met and decided to leave interest rates unchanged between 0 and 0.25 bps. The Fed did not announce new measures on top of its current nine programmes. Fed Chairman Jerome Powell made clear that the institution was committed to use its full range of tools.

Spanish and French GDP fell by 5.8 and 3.8 percent respectively.

Earning’s season continued:

In the US it was a tale of two universes: Companies heavily impacted by the pandemic and lockdown on one hand; enterprises in a good position to benefit from new models of work on the other.

Boeing posted a first quarter loss of $641 million down 70 percent compared to Q1 2019. The planemaker burned through around $4 billion of cash during Q1 and will reduce its workforce by 15,000 or 10 percent. GE’s net industrial profit tumbled by 46 percent to $1.1 billion, with the health care division showing gains and aviation a radical decline.

Boeing’s woes reflect the contraction in the wider aviation sector as air travel has drastically dropped since the outbreak of the pandemic. Boeing is also a major part of US exports and its supply chain is global. Its 17,000 contractors will be hit hard by the company’s downturn with ripple effects in the US and beyond — particularly in Japan.

Microsoft revenue increased by $4 billion or 14 percent. Net income stood at $11.6 billion. Owing the success in part to shared cloud storage, which addresses key aspects of a large part of the workforce operating from home. Facebook doubled its net income to $4.9 billion.

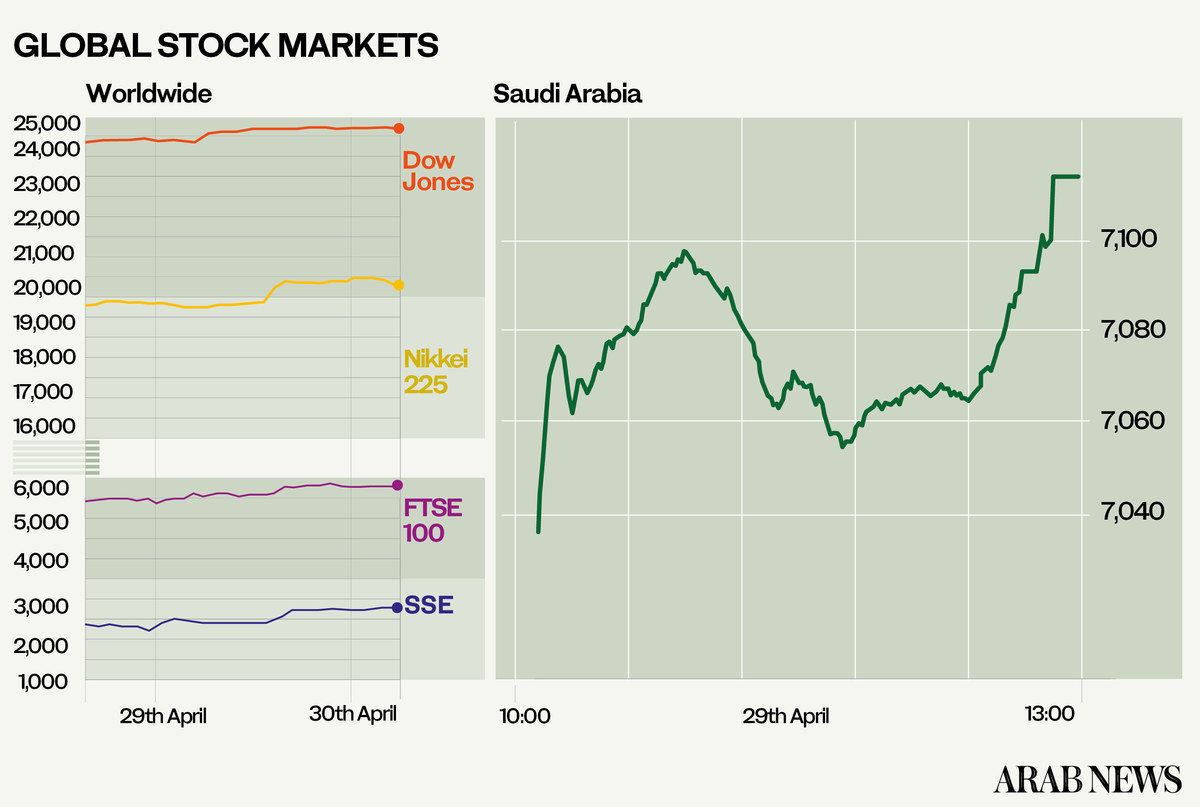

Stock markets seemingly shrugged off the bad news and rallied on tech sector results and early positive results in clinical trials of Gilead’s antiviral coronavirus drug remdesivir.

On the other side of the Atlantic, Shell posted a net loss of $24 million down 100 percent compared to Q1 2019. The picture will turn bleaker in Q2 due to the deterioration in oil prices. The company slashed dividends by 75 percent, which represents the first cut of dividends since the Second World War and is in stark contrast with BP’s decision to leave dividend payments in place.

Société Générale posted a surprise loss of €326 million ($354 million) and Swiss Re’s profits fell to $426 million.

US President Donald Trump announced Operation Warp Speed, a program pulling together private pharmaceutical companies, government agencies and the military. Its aim is to develop a vaccine by January of next year.

Background:

It was widely expected that the Fed would leave interest rates unchanged until the economy has recovered and is on track to achieve maximum employment, while achieving price stability goals.

In a press conference, Powell voiced concerns that the current downturn would leave permanent scars. He stressed that “the ongoing public health crisis will weigh heavily on economic activity, employment and inflation in the near-term, and poses considerable risks to the economic outlook over the medium-term.”

Powell made clear that the Fed’s mission was to ensure the flow of credit and liquidity in the system and that the institution would deploy its full range of tools to this end. He stressed that providing liquidity is about more than just lending, but also creating confidence in the functioning of markets.

He reiterated the limitations to what the Fed could do, emphasizing the need for fiscal stimulus. He urged Congress to use its “great fiscal power,” pointing out that he would have preferred for the US to be in a stronger fiscal position going into the crisis, but that this was not the time for discussion but action.

The Fed’s chairman was particularly concerned about the unemployment rate having surged from a record low of 3.5 percent in February to double digits within the span of two months. This is relevant because consumption contributes 70 percent to US GDP and unemployment of this scale could have a permanent psychological impact on the US workforce and economic confidence.

Powell painted a bleak picture for the world’s largest economy, particularly citing the unpredictability of the pandemic until a vaccine or effective medicine was found.

Where we go from here:

Early afternoon CET, the European Central Bank will announce the outcome of its governing and general councils’ meetings and first time US jobless claims for the week ending April 24 will be released.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources