What happened:

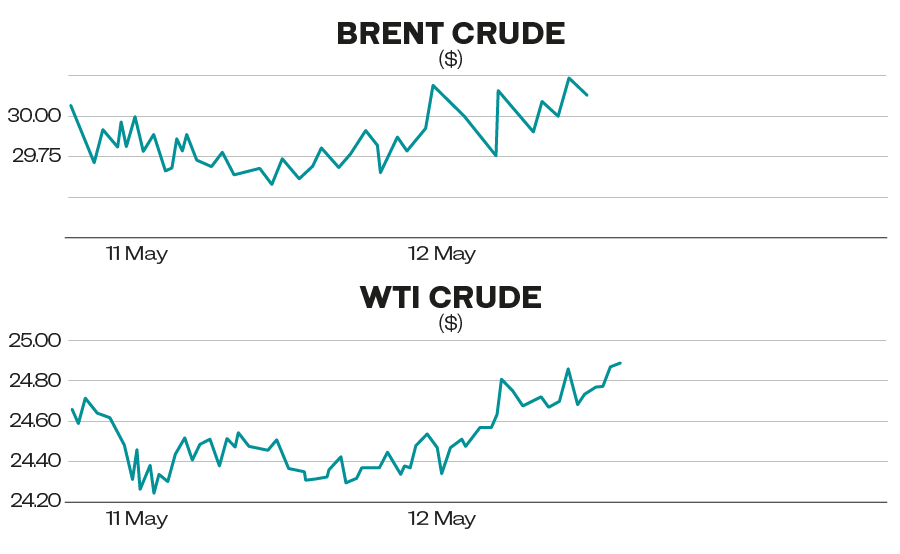

Saudi Arabia announced cutting oil production by a further 1 million barrels as of June 1 bringing production down to 7.49 million barrels per day (bpd), the lowest in 18 years. The UAE and Kuwait followed the Kingdom’s move, cutting production by 100,000 bpd and 80,000 bpd, respectively.

Austrian Chancellor Sebastian Kurz told Bloomberg it would take several years and open borders for the Austrian economy to reach pre-crisis levels.

Austria is an export-driven economy and derives 15 percent of its GDP from tourism. Kurz said the EU would help Italy, Spain, and France with 500 billion euros ($541 billion) via the European Stability Mechanism, but that he was not in favor of coronabonds or mutualizing debt.

Turkey will inject $3 billion into three lenders in an attempt to support the economy. This comes after the government lifted its ban on Citi, BNP, and UBS.

Budget airline Ryanair will resume 40 percent of its flights by July 1, which will of course depend on how borders will open.

Elon Musk reopened his Tesla plant in California despite government orders to the contrary, and US Treasury Secretary Steven Mnuchin said he understood Musk’s desire to reopen.

Earnings season continues:

Motor manufacturing giant Toyota’s net sales for the full year 2020/21 declined by 2 percent to 2.2 trillion yen. Earnings before interest and taxes declined by 2.9 percent to 196 billion yen. Worse is likely to come moving into the second quarter of 2020, because most major economies are in lockdown and only reopening gingerly.

Financial services company Allianz reported revenue growth of 5.7 percent to 42.6 billion euros. Operating profit declined by 22.2 percent to 2.3 billion euros due to claims in its insurance business related to the coronavirus disease (COVID-19). Net income attributable to shareholders decreased 28.9 percent to 1.4 billion euros. At the same time its asset management business saw net outflow of funds worth 46 billion euros.

Saudi Aramco remains the world’s most profitable company. First-quarter sales came in at $51.4 billion, down 19 percent. Net income was $16.7 billion, down 25 percent compared to the same quarter in 2019. The company’s CEO Amin Nasser expects the COVID-19 pandemic’s impact on demand and oil prices to weigh in on earnings going forward.

In March, Aramco announced a 25 percent reduction in capital expenditure, but Nasser said it would continue to review spending in line with the impact of the pandemic.

Aramco is on track to keep its promised $75 billion dividend, paying $18.8 billion in the first quarter.

Background:

By cutting production by 1 million bpd as of June 1, Saudi Arabia took leadership in OPEC+ to do whatever it takes to start on the road toward rebalancing the markets. This was demonstrated by the fact that both the UAE and Kuwait followed suit and will reduce their output, albeit by smaller amounts. These actions should have a positive impact on the next meeting of OPEC+ in early June.

The outlook for oil demand will remain uncertain until there is a clearer understanding of the shape and pace of economic recovery. BP CEO Bernard Looney told the FT that he was uncertain whether oil demand would go back to pre-pandemic levels or if demand had peaked.

As for Aramco earnings, while a 25 percent drop of net income might look big, it has to be viewed against the backdrop of a decline in oil prices by 65 percent during the same quarter.

The decision to maintain the dividend is important. For one, the Kingdom owns more than 98 percent of Aramco shares and so receives the bulk of the dividends. It is also important that the company proves its reliability to the broader stock market in light of the initial public offering which took place less than six months ago.

Oil majors made different choices when it came to dividends, with BP leaving them intact and Shell slashing them by 75 percent, just to mention two.

The company said the acquisition of a 70 percent stake in SABIC was on track for the third quarter. The media is reporting market rumors that aspects of the deal may be revisited.

Where we go from here:

Goldman Sachs issued a note forecasting an 18 percent retrenchment of the S&P 500 over the next three months, driven, among other factors, by a slow recovery in the real economy, a 50 percent reduction in share buy backs, the potential for higher corporate taxes, and the effect of trade tensions between the US and China.

This call is not an uncontested: On the one hand it is true that the rebounding of the S&P 500 is largely driven by government stimulus and seems to defy contraction in the real economy, but on the other there is still a lot of liquidity chasing investment.

In the same vein, DAX valuations have reached a 15-year high.

The US Federal Reserve will today start its exchange-traded fund investment-grade bond purchases.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources