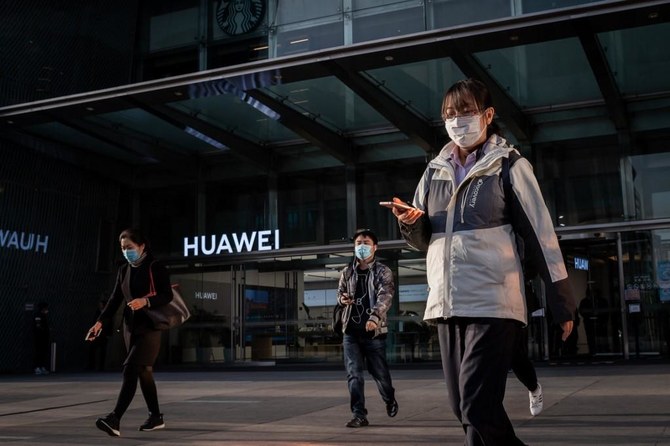

WASHINGTON: The Trump administration said Friday it will restrict the ability of Chinese telecoms giant Huawei, which it considers a national security risk, to develop semiconductors abroad with US technology.

“This announcement cuts off Huawei’s efforts to undermine US export controls,” the Commerce Department said in a statement.

The department said it will “narrowly and strategically target Huawei’s acquisition of semiconductors that are the direct product of certain US software and technology.”

US to restrict Huawei development of semiconductors

https://arab.news/za7a8

US to restrict Huawei development of semiconductors

- ‘This announcement cuts off Huawei’s efforts to undermine US export controls’

Greenland’s leader says his people don’t want to be Americans as Trump covets territory

- “We do not want to be Danish, we do not want to be American. We want to be Greenlandic,” Múte B. Egede tells press conference

- He added, though, that he understands Trump’s interest in the island given its strategic location and he’s open to a dialogue with the US

COPENHAGEN, Denmark: Greenland’s prime minister said Friday that the mineral-rich Arctic territory’s people don’t want to be Americans, but that he understands US President-elect Donald Trump’s interest in the island given its strategic location and he’s open to greater cooperation with Washington.

The comments from the Greenlandic leader, Múte B. Egede, came after Trump said earlier this week that he wouldn’t rule out using force or economic pressure in order to make Greenland — a semiautonomous territory of Denmark — a part of the United States. Trump said that it was a matter of national security for the US

Egede acknowledged that Greenland is part of the North American continent, and “a place that the Americans see as part of their world.” He said he hasn’t spoken to Trump, but that he’s open to discussions about what “unites us.”

“Cooperation is about dialogue. Cooperation means that you will work toward solutions,” he said.

Egede has been calling for independence for Greenland, casting Denmark as a colonial power that hasn’t always treated the Indigenous Inuit population well.

“Greenland is for the Greenlandic people. We do not want to be Danish, we do not want to be American. We want to be Greenlandic,” he said at a news conference alongside Danish Prime Minister Mette Frederiksen in Copenhagen.

Trump’s desire for Greenland has sparked anxiety in Denmark as well as across Europe. The United States is a strong ally of 27-nation European Union and the leading member of the NATO alliance, and many Europeans were shocked by the suggestion that an incoming US leader could even consider using force against an ally.

But Frederiksen said that she sees a positive aspect in the discussion.

“The debate on Greenlandic independence and the latest announcements from the US show us the large interest in Greenland,” she said. “Events which set in motion a lot of thoughts and feelings with many in Greenland and Denmark.”

“The US is our closest ally, and we will do everything to continue a strong cooperation,” she said.

Frederiksen and Egede spoke to journalists after a biannual assembly of Denmark and two territories of its kingdom, Greenland and the Faroe Islands. The meeting had been previously scheduled and wasn’t called in response to Trump’s recent remarks. Trump’s eldest son also made a visit to Greenland on Tuesday, landing in a plane emblazoned with the word TRUMP and handing out Make America Great Again caps to locals.

The Danish public broadcaster, DR, reported Friday that Trump’s team encouraged homeless and socially disadvantaged people in Greenland to appear in a video wearing the MAGA hats after being offered a free meal in a nice restaurant. The report quoted a local resident, Tom Amtof, who recognized some of those in a video broadcast by Trump’s team.

“They are being bribed, and it is deeply distasteful,” he said.

Greenland has a population of 57,000. But it’s a vast territory possessing natural resources that include oil, gas, and rare earth elements, which are expected to become more accessible as ice melts because of climate change. It also has a key strategic location in the Arctic, where Russia, China and others are seeking to expand their footprint.

Greenland, the world’s largest island, lies closer to the North American mainland than to Denmark. While Copenhagen is responsible for its foreign affairs and defense, the US also shares responsibility for Greenland’s defense and operates an air force base there based on a 1951 treaty.

Guinea suspends ‘unauthorized’ political movements

- Government spokesman Ousmane Gaoual Diallo said earlier that the West African nation could hold elections by the end of 2025 after a constitutional referendum “probably in May”

CONAKRY: Guinea’s government has demanded the suspension of all political movements it deemed “without authorization,” as the country’s military leaders hinted at possible elections this year.

In a statement read by a presenter on state television, the minister for territorial administration and decentralization, Ibrahima Kalil Conde, “noted with regret the proliferation of political movements without prior administrative authorization.”

“Consequently, all these political movements are asked to cease their activities immediately and to submit an application for administrative authorization to our ministry for their legal existence,” the statement added.

The junta, which seized power in a 2021 coup, has, in recent days, hinted at the possibility of elections by the end of the year.

Under international pressure, the military leaders had initially pledged to hold a constitutional referendum and hand power to elected civilians by the end of 2024 — but neither has happened.

Junta chief Gen. Mamady Doumbouya said in a New Year’s speech that 2025 will be “a crucial electoral year to complete the return to constitutional order.”

Government spokesman Ousmane Gaoual Diallo said earlier that the West African nation could hold elections by the end of 2025 after a constitutional referendum “probably in May.”

Since taking power, the junta has cracked down on dissent, with many opposition leaders detained, brought before the courts, or forced into exile.

In October, the junta placed the three main political parties under observation and dissolved 53 others in what it termed a major political “cleanup.”

It suspended another 54 for three months.

In Thursday’s statement, Conde said that national and international institutions and partners should “cease all collaboration with the 54 suspended political parties until 31 January 2025.”

S. Africa police rescue 26 Ethiopians from captivity

- According to preliminary information from the rescued men, the group was held in the Sandringham suburb in northern Johannesburg without clothes or documents, Col. Philani Nkwalase said

JOHANNESBURG: South African police said on Friday that they had rescued 26 undocumented Ethiopian nationals who were being held captive in a suburban house in Johannesburg by suspected human traffickers.

Up to 30 other men may have already escaped through a smashed window before police swooped in on the house late on Thursday and could be hiding in the area, the police priority crimes unit said.

According to preliminary information from the rescued men, the group was held in the Sandringham suburb in northern Johannesburg without clothes or documents, Col. Philani Nkwalase said.

Eleven men were taken to hospital with injuries apparently caused when they tried to escape, including deep cuts.

Three other Ethiopian nationals were arrested on suspicion of human trafficking.

Algeria ‘seeking to humiliate France,’ interior minister says

- Algeria won independence from France in 1962 after a ferocious seven-year war that is still the subject of trauma for both sides

NANTES, France: Algeria is trying to humiliate France, France’s Interior Minister Bruno Retailleau said on Friday, after several Algerian influencers were arrested for inciting violence in a growing crisis between Paris and its former colony.

Four Algerian influencers supportive of Algerian authorities have been arrested in recent days over videos that are suspected of calling for violent acts in France.

Meanwhile, Algeria has also been holding on national security charges French-Algerian novelist Boualem Sansal, a major figure in modern francophone literature, who was arrested at Algiers airport in November.

“Algeria is seeking to humiliate France,” Retailleau said on a visit to the western city of Nantes.

“Algeria is currently holding a great writer — Boualem Sansal — who is not only Algerian but also French. Can a great country, a great people, allow itself to keep in detention for the wrong reasons, someone who is old and sick?“

Turning to the influencers, he said it was “out of the question to give a free pass to these individuals who spread hatred and anti-Semitism.”

“I think we have reached an extremely worrying threshold with Algeria,” he said, adding France “cannot tolerate” an “unacceptable situation.”

“While keeping our cool ... we must now consider all the means we have at our disposal regarding Algeria,” he added.

One of those arrested is “Doualemn,” a 59-year-old influencer detained in the southern city of Montpellier after a video posted on TikTok.

He was deported on a plane to Algeria on Thursday afternoon, according to his lawyer, but was sent back to France the same evening as Algeria had banned him from its territory.

On Thursday, Lyon prosecutors said Sofia Benlemmane, a Franco-Algerian woman in her 50s, was also arrested.

Followed by more than 300,000 people, she is accused of spreading hate messages and threats against Internet users and opponents of the Algerian authorities, as well as insulting statements about France.

Arrested in Brest on Jan. 3, Youcef A., 25, known as “Zazou Youssef” on TikTok, will be tried on Feb. 24 on charges of justifying terrorism.

Placed in pretrial detention, he faces seven years in prison if convicted.

And “Imad Tintin,” 31, was taken into police custody on Saturday in Grenoble for a video, since removed, in which he called for “burning alive, killing and raping on French soil.”

He will be tried on March 5 for incitement to acts of terrorism.

Algeria won independence from France in 1962 after a ferocious seven-year war that is still the subject of trauma for both sides.

Riyadh prepares for 2nd annual Saudi Elite Hockey Championship

- 80 players from 8 teams will battle it out at the Prince Faisal bin Fahd Olympic Complex on Jan. 17 and 18

- Najd Falcons were crowned winners of the inaugural event last year, ahead of runners-up Alittihad Club

RIYADH: Final preparations are underway for the second annual Saudi Elite Hockey Championship at the Prince Faisal bin Fahd Olympic Complex in Riyadh next week.

Eight teams, featuring a total of 80 players, will battle it out on Jan. 17 and 18: defending champions Najd Falcons, last year’s runners-up Alittihad Club, Alshabab Club, Jubail Buraq, Naqi, UTSC, Arab Legends and Hamra Legends.

The event has been organized under the supervision of the Saudi Hockey Federation, which said the championship represents a significant step in the development of hockey, in line with the wider sports renaissance in the Kingdom as part of efforts to enhance quality of life and contribute to the goals of the Vision 2030 plan for national development and diversification.