LONDON/RIYADH: The second day of the Future Investment Initiative (FII) starts on Thursday in Riyadh, with Saudi Arabia's Crown Prince Mohammed bin Salman holding a conversation with former Italian prime minister Matteo Renzi to begin the day's agenda.

The fourth edition of the forum opened on Wednesday with panels addressing how to rethink the future of the global economy around the theme “The Neo-Renaissance” amid the COVID-19 pandemic.

Speakers discussed how investment can inspire an economic rethink and how it could support the energy sector to power a post-COVID-19 crisis recovery. They also discussed ways to re-imagine a new era of global sports and entertainment.

Follow day two of the event live below (All times GMT):

18:45 - And that brings an end to coverage of this edition of the forum, with its theme of Neo Renaissance and its many discussions, brought to a close by which have been brought to a close by FII Institute's Rakan Tarabzoni. We hope you enjoyed Arab News' coverage. See you in October for the fifth edition!

18:30 - ICYMI: The FII on Wednesday signed a number of major agreements, including a partnership aimed at protecting over 1.2 billion people from counterfeit and illicit trade in Africa.

Addressing a press conference on the second day of the fourth FII forum, Richard Attias, CEO of the institute, announced the three initiatives. READ MORE HERE.

18:20 - Princess Reema, Kingdom's ambassador to the US, is back for the final panel session of the day. This time, she is discussing a panel titled “Redefining leadership for the post-COVID era: How to inspire a 21st century economic renaissance,” along with former Italian prime minister Matteo Renzi.

18:00 - Given the broader economic contraction, what is the pipeline for VC investment and what shifts are necessary to capitalize on the acceleration of digital transformation? The penultimate panel of the final day will discuss how booming technology stocks and rapid digitization across industries have driven a V-shaped recovery for VC.

Moderator: Nadira Tudor, International Broadcaster

•Rajeev Misra, CEO, SoftBank Investment Advisers, UK

• Jack Selby, Managing Director, Thiel Capital, US

• Christine Tsai, CEO and Founder, 500 Startups, US

• Patrick Zhong, Founding Managing Partner, M31 Capital, China

17:40 - ICYMI: In order to achieve viable technological solutions for the future, venture capitalists need to overcome the need for immediate financial return and focus on long-term goals, according to speakers at FII.

Deep technology and solutions for the future that can cope with “feeding nine billion people, climate refugees and habitat provision” are seemingly within reach, but they will take time to accomplish, Interstellar Lab founder and CEO, Barbara Belvisi told delegates. READ MORE HERE.

17:30 - Saudi Arabia's Public Investment Fund launched on Thursday the Cruise Saudi Company, which aims to establish and develop the cruise industry in Saudi Arabia, enhance the Kingdom's efforts to become a tourist destination on the international cruise map, and develop the tourism sector in line with Saudi Vision 2030. READ MORE HERE.

17:15 - With 2020 becoming the year of biotechnology, the next panel ponders how the rapid development of several COVID-19 vaccines has changed, and will continue to change, the global healthcare industry.

Having revolutionized everything from agriculture to energy to medicine, biotech firms traditionally incur high risks, require strict oversight and suffer from slow timelines before delivering a return on financial investments — but 2020 reinvigorated the sector, as the panel discuss.

-----

-----

17:00 - ICYMI: The growing attraction of Riyadh as an economic, financial and investment hub has been underlined by the decision of 24 multinational companies to establish regional headquarters in the Saudi capital. The companies - including such heavyweights as PepsiCo, Schlumberger, Bechtel and Boston Scientific - announced their plans on the second day of the Future Investment Initiative (FII). In a sign of the growing appeal of Riyadh as a consumer hub, Canadian fast food chain Tim Hortons will also set up there.

The news came after Crown Prince Mohammed Bin Salman announced ambitious plans to accelerate the city’s growth to join the ranks of the top 10 city economies in the world and double the size of its population by 2030. READ MORE HERE.

16:45 - Saudi Arabia's ambassador to the US, Princess Reema bint Bandar bin Sultan, is chairing a panel on the future of education and why investment in education technology will help not just students affected by the COVID-19 pandemic today, but also students in developing nations in the future — helping them become “global students.”

16:35 - The GCC is witnessing a serious change, Saudi Minister of Finance, Mohammed Al-Jadaan, said, adding: “We’re in a very healthy competition. We are complementing each other and we are trying at you to build on.”

“Diversification for us is a win-win. I’m helping the economy to grow that will then basically grow the tax base, which means more revenues to the government that would enable it to provide better services to the people and citizens of Saudi Arabia,” Al-Jadaan said. READ MORE HERE.

16:25 - ICYMI: Saudi Aramco, the world’s biggest oil company, could launch a second offering of shares to follow the historic initial public offering of 2019, Crown Prince Mohammed bin Salman told the Future Investment Initiative (FII) gathering.

“This will yield a cash flow transferred to the Pubic Investment Fund (PIF) to be reinvested domestically and internationally for the benefit of Saudi citizens,” the Crown Prince said. READ MORE HERE.

-----

-----

16:10 - ICYMI: Major issues related to health care, climate change, and education could be resolved through the appliance of advanced machine technology, delegates at the Future Investment Initiative (FII) summit were told. READ MORE HERE.

16:00 - Arab News columnist Roxana Mohammadian-Molina heads up the next panel, talking about the revolution in financial technology (or FinTech) and how its development has been fast-tracked by the onset of the COVID-19 pandemic. Read her opinion piece on Saudi Arabia's FinTech development below.

Opinion

This section contains relevant reference points, placed in (Opinion field)

Moderator: Roxana Mohammadian-Molina, Chief Strategy Officer, Blend Network, UK

• Bob Diamond, Founding Partner and CEO, Atlas Merchant Capital, US

• Steve Jacobs, Managing Partner and CEO, BTG Pactual UK,

• Tayo Oviosu, Founder and Group CEO, Paga, Nigeria

• Vijay Shekhar Sharma, Founder and CEO, Paytm, India

-----

-----

15:30: Social distancing and work from home protocols have accelerated digital transformation and will permanently reform workspaces and business models. So, how can investors capitalize on the warp speed of digital transformation and how can CEOs mobilize quickly enough to ensure their companies are not left behind? Our next panel is answering those questions.

Moderator: Edie Lush, Executive Editor, Hub Culture

• Marc Ganzi, President and CEO, Colony Capital, US

• Faraz Khalid, CEO, Noon, UAE

• Jacob Mullins, Managing Director, Shasta Ventures, US

• Lu Zhang, Founder and Managing Partner, Fusion Fund, US

15:15 - We are now listening to a conversation about the need for infrastructure investment, but also investment in the global digital ecosystem, for progress in the 21st century, with executives from Emaar, Hyperloop-One and Bechtel Group.

15:00 - ICYMI: During his discussion with former Italian prime minister Matteo Renzi, Saudi Crown Prince Mohammed bin Salman explained how Public Investment Fund assets will increase over the next decade as the Kingdom moves forward with its development goals. WATCH BELOW:

14:40 - The next panel discusses a roadmap of new global environmental, social and governane (ESG) standards that incorporate the realities and limitations of emerging markets and encourage sustainable developments around the world. Panelists below:

Moderator: Cyba Audi, Senior News Anchor, Asharq News

• Eng. Khalid Abdullah Al-Hussan, CEO, Tadawul, Saudi Arabia (pictured below)

• Loh Boon Chye, CEO, Singapore Exchange, Singapore

• Sherif Foda, Chairman of the Board of Directors and CEO, NESR, Saudi Arabia

• Scott Minerd, Chairman of Investments and Global CIO, Guggenheim Partners, US

14:30 - ICYMI: Saudi Arabia's Crown Prince Mohammed bin Salman talking earlier about the development of Riyadh in a conversation with former Italian PM Matteo Renzi. The crown prince explained how the Saudi capital will be transformed over the next decade, and how it will lead the transformation of the Kingdom as a whole. WATCH CLIPS BELOW:

14:15 - We have a string of short, quick-fire sessions for the next segment of the day. In the first one, Erin Burnett, host of of OutFront, CNN talks to James P. Gorman, Chairman and CEO at Morgan Stanley.

Then we have FII CEO, Richard Attias, back on stage talking to Bruno Le Maire, the French minister of Economy, Finance and Recovery.

14:00 - What are the investment opportunities presented by the new generation of ‘technology for good’ ventures? That's the topic of discussion up next with Barbara Belvisi, Founder/CEO of Interstellar Lab who is in discussion with Anthony Berkley, Head of ACT & Investments.

------

------

13:30 - Following on from the crown prince's comments about the strategy for Riyadh going into 2030, Khalid Al-Falih, Minister of Investment, and Fahd Al-Rasheed, President of the Royal Commission for Riyadh City are talking about what the future of the city holds with FII CEO Richard Attias.

And during the session, 20 companies signed MoUs to boost investment for the city of Riyadh as part of its strategy for the next decade.

13:00 - Crown Prince Mohammed bin Salman has a discussion with former Italian prime minister Matteo Renzi about how the Kingdom is looking to further investment to achieve its Vision 2030 goals. The crown prince also spoke about strategies to turn Riyadh into one of the world's top-10 cities for infrastructure and services.

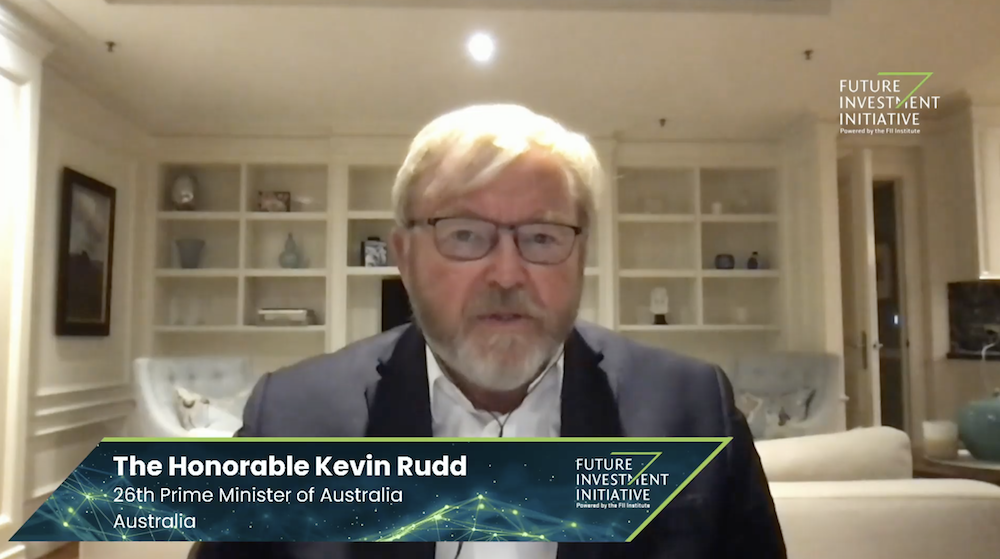

12:45 - We have kicked off with day two, and after a look back at day one’s action, we have former prime minister of Australia Kevin Rudd talking about how world leaders can realize the mandates offered during Saudi Arabia’s G20 presidency.

12:25 - Elsewhere on day one, Usain Bolt made a brief appearance during the discussion on investment in the sport industry, you can find out what he said here.

-----

-----

12:15 - Saudi Arabia will be doing more than many Western countries to tackle climate change by the end of the decade, Prince Abdul Aziz bin Salman (pictured below), the Kingdom’s energy minister, told a panel of energy leaders on day one. READ MORE HERE.

And to back that claim up, Saudi Aramco's Amin Nasser said the firm had been taking advantage of accelerated technology to build its reliability in the market as well as decreasing carbon emissions. READ MORE HERE.

12:00 - It was an intense day of discussions on Wednesday as the FII kicked off virtually, due to the ongoing COVID-19 pandemic. If you want to catch up on what happened on day one, click here.