KARACHI: Police officials in Pakistan say the use of digital currencies, including bitcoin, for international terror financing and crimes like extortion and ransom, is on the rise in the country as authorities move to tighten the reins on illegal methods of money transfer.

Bitcoin is the most common virtual currency and is used as a vehicle for moving money around the world quickly and anonymously via the web without the need for third-party verification.

Militant groups around the world, including Daesh, have increasingly called on supporters to donate using the digital currency.

Pakistan has recently moved to meet 27 targets set for it in 2018 when the South Asian nation was placed on a Financial Action Task Force “grey list” of countries with inadequate controls over terror financing. The task force has urged Pakistan to complete an internationally agreed action plan by February 2021. The next virtual plenary of the task force is scheduled for February 22-25.

“We are seeing this trend [of using bitcoin for crimes] since we tightened the noose around illegal systems of transferring funds,” Raja Umar Khattab, head of the Transnational Terrorists Intelligence Group in Sindh’s counter-terrorism police, told Arab News.

Last month, Khattab arrested Hafiz Muhammad Omar Bin Khalid, a Pakistani engineering student charged with sending bitcoin donations to militants in Syria. Khalid had transferred over Rs1 million by the time he was caught, counterterrorism department (CTD) deputy inspector general Omar Shahid Hamid told reporters last month.

The engineering student had also previously been arrested, and released, in 2018 for extending financial support to an Al Qaeda militant in Afghanistan, officials said.

In December 2019, Khalid came across a Telegram account online that guided him on how to help widows of Daesh militants in Syria.

“Help jihadis and their families by sending money through bitcoins,” said one user on the Telegram group, leading Khalid down a rabbit hole of searches into bitcoin wallets, which in turn led him to an associate named Zia Shaikh Turk, based in Hyderabad, who converted cash into bitcoin and sent it off to ‘jihadi brides’ in Syria, according to officer Hamid.

The Pakistani widow of a militant, who Khalid identified as Umme Bilal, had also asked him to open a mobile wallet account, according to interrogation reports available with Arab News.

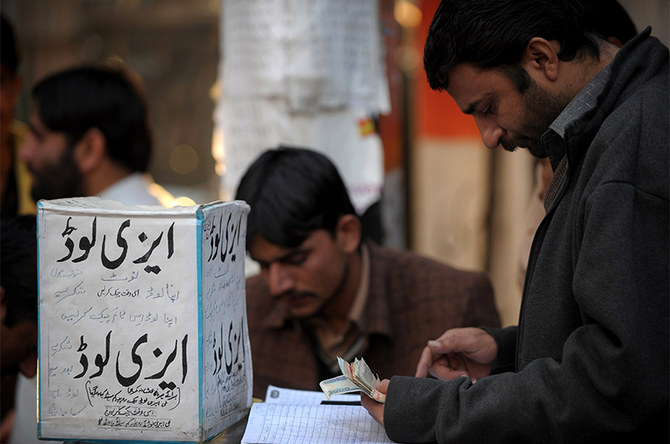

“Umme Bilal asked me to open an EasyPaisa [Pakistani digital payment system] account as some of her acquaintances hadn’t heard of bitcoins, but wanted to contribute,” one intelligence report said, quoting Khalid. “I got Rs450,000 into my account, added another Rs100,000 of my own, converted them into bitcoins and sent them to Syria.”

Policemen stand guard as women queue to collect cash of financial assistance through a mobile wallet in Islamabad on April 9, 2020. (AFP/File)

Last year, a US citizen of Pakistan origin, Zoobia Shahnaz, was sentenced to 13 years’ imprisonment for providing material support to foreign militant organizations, specifically more than $150,000 to Daesh.

Shahnaz, 27, from Long Island, admitted to wiring more than $150,000 to individuals and shell entities that were fronts for Daesh in Pakistan, China and Turkey in 2017. She was engaged in a scheme to scam Chase Bank, TD Bank, American Express and Discover by fraudulently obtaining six credit cards, according to a court filing. She then bought more than $62,703 in bitcoin and other cryptocurrencies, and converted them to cash.

An official at the Federal Investigation Agency (FIA) told Arab News the agency had received tens of complaints in recent months by victims asked to pay ransom and extortion in the form of bitcoin. The official did not go on the record as he was not authorized to discuss the cases with the media.

“Cryptocurrency has been used in international as well as local cases of extortion, kidnapping for ransom, harassment and money laundering as there is no centralized monitoring system,” the official said.

In December, a female student in Karachi was blackmailed by an unknown sender who had uploaded her private photos to a pornographic website and demanded Rs3 million in bitcoins in exchange for removing them. The FIA traced the case to a man in an African country who had hacked the girl’s Snapchat account and eventually taken control of her phone. The alleged blackmailer has since removed the pictures himself.

In another case, a truck contractor in Karachi told Arab News he got a call from an Afghanistan number by a man who knew where he lived and had intricate details of the movements of his family. The man demanded extortion money in bitcoins or else his family would be harmed. The trader declined to be named for fear for his family’s safety but said he had eventually paid the money using digital currency.

This photograph shows a man holding a physical imitation of a Bitcoin at a crypto currency "Bitcoin Change" shop, near the Grand Bazaar, in Istanbul, on December 17, 2020. (AFP/File)

Such cases have led to calls for a complete ban on virtual currencies in Pakistan, while advocates for regulation have also become more active.

Last month, Rehan Masood, a lawyer for the Pakistani central bank, told the Sindh High Court the State Bank had issued a warning about dealing in cryptocurrencies but not banned them.

Pakistan’s central bank issued a circular dated April 6, 2018, advising financial institutions, including banks and payment service providers, “to refrain from processing, using, trading, holding, transferring value, promoting and investing in virtual currencies/tokens.”

The circular said financial institutions “will not facilitate their customers/account holders to transact in VCs/ICO tokens. Any transaction in this regard shall immediately be reported to [the] Financial Monitoring Unit (FMU) as a suspicious transaction.”

TV host Waqar Zaka, an advocate for allowing cryptocurrency in Pakistan, who last January filed a court case against the Federal Investigation Agency for arresting people for possessing bitcoin, described trading in virtual currencies a fundamental right.

“Any ban will deprive Pakistanis of earning the biggest profits,” Zaka told Arab News. “The top countries on FATF have been dealing in cryptocurrency because they know that bitcoins don’t work without the Internet, which has a digital trace.”

Independent blockchain and cryptocurrency expert Hassan Raza agreed, saying a complete ban on blockchain based payment networks should be “out of the question.”

“Terror financing is also done via the banking system but those clearly have not been banned,” he said, adding that the government should regulate, not ban, digital tokens.

“Since every transaction in a public blockchain network like bitcoin is stored in a permanent and immutable distributed, public database, anyone is free to view them and conduct data analysis of any complexity on them,” Raza said. “In fact, several people allegedly involved in illegal activity have been caught in this very manner.”