DUBAI: Amaeya Media, a UAE-based podcast network, has released its 2020 report “Podcasts in MENA: State of the Industry.” This is the second annual report published by the company exploring the state of podcasting in the region, and covers consumer habits, brand spending, standardization and the impact of factors such as the pandemic.

The 2020 survey has taken a broader view — in 2019, 90 percent of the respondents were from the UAE, while in 2020, this number was down to 71 percent, after which came respondents from Saudi Arabia and Egypt.

Chirag Desai, CEO of Amaeya Media said there were three key themes that stood out in 2020:

Listenership and interests

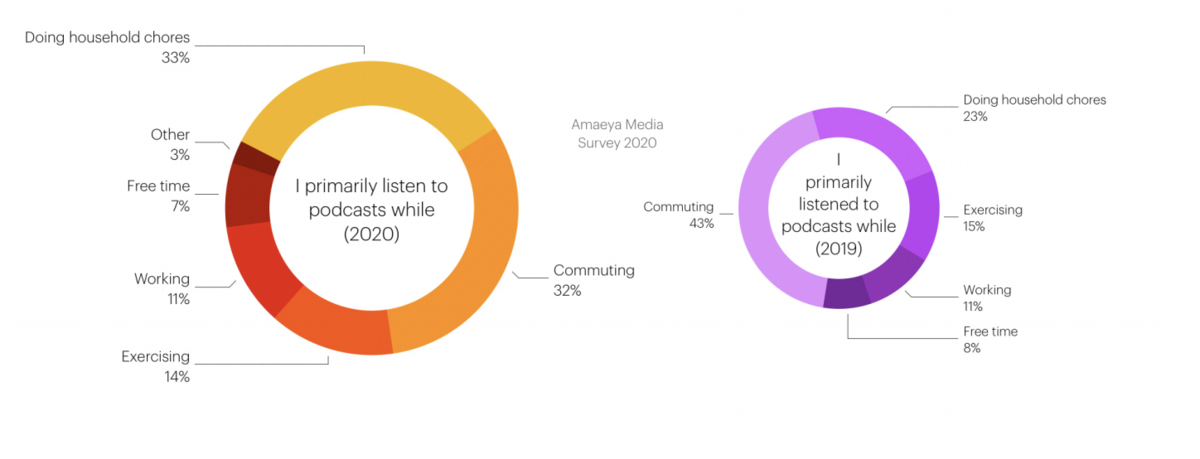

Podcast listenership dropped in the first few months of the pandemic but recovered later in the year. “Podcasts are typically consumed in passive way. The majority of people do it while they’re multitasking and invariably it’s commuting, working out or working,” said Desai. As these activities came to a halt due to the lockdowns, listenership dropped. But, as people adapted to a different lifestyle, listenership picked up again with more people listening to podcasts while doing household chores. The survey shows that 56 percent listened to more podcasts since March 2020.

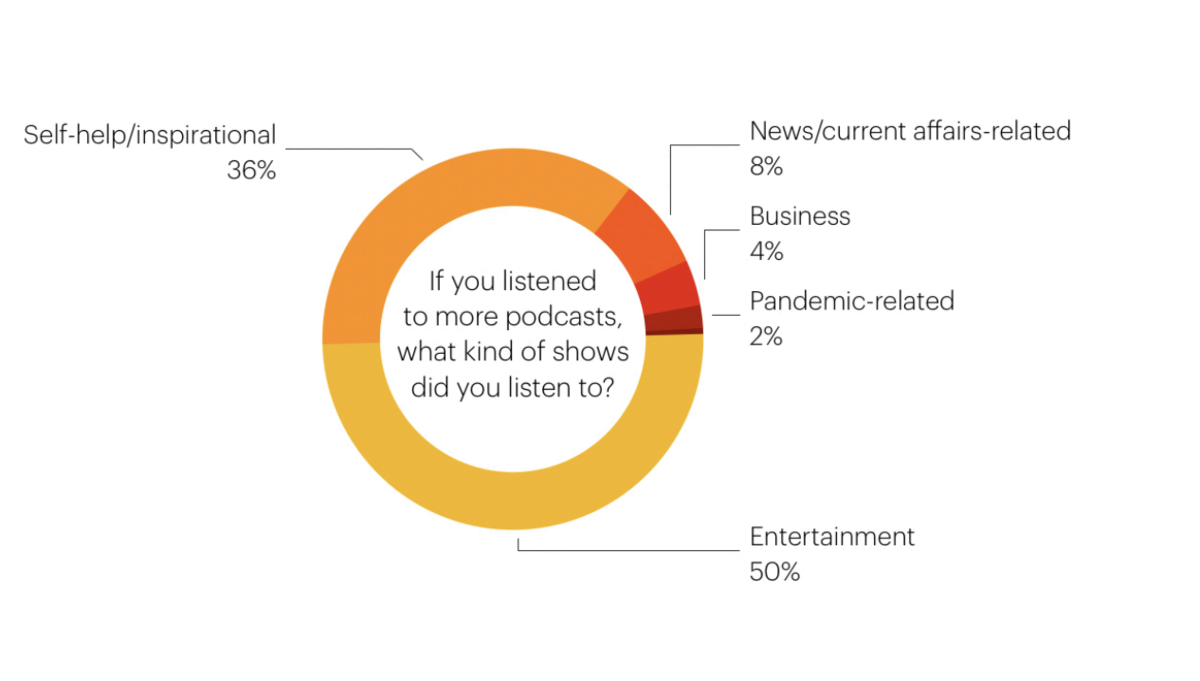

The majority of listeners preferred to listen to entertainment-related content (50 percent) followed by self-help and inspirational content (36 percent), with only 8 percent interested in news and current affairs, 4 percent in business content and a mere 2 percent in pandemic-related content.

Standardization

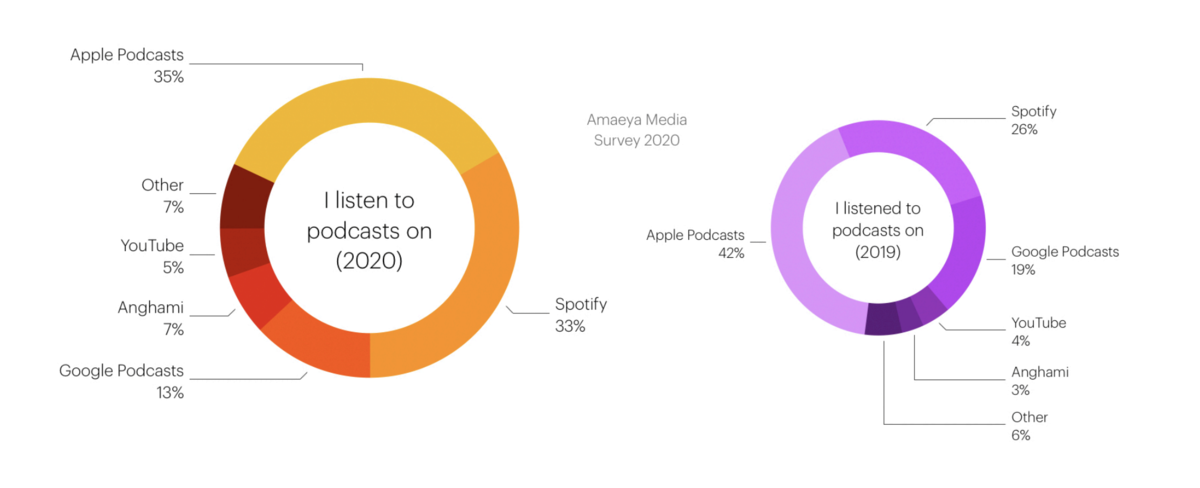

The second emerging theme is that of standardization. Historically, podcasting has been a decentralized industry with multiple platforms hosting podcasts. Desai said that in 2020 silos were created as platforms sought to create their own exclusive content. At the end of 2020, Amazon bought podcast publisher Wondery, which is known for producing hit shows such as “Dirty John” and “Business Wars”. Spotify stands out here with purchases of companies including Gimlet and Parcast and exclusive deals with Michelle Obama, Joe Rogan, Kim Kardashian, and Prince Harry and Meghan Markle.

Unsurprisingly, more listeners have been turning to Spotify, which saw a 7 percent increase in listenership in the region in 2020. The phenomenon is similar to what’s happening with streaming services, which are also creating original content. However, it does make measurement and standardization tricky. “If Spotify (or any one) platform owns 99 percent of the market and we, the industry, set a standard about something, Spotify doesn’t need to adhere to it and there is nothing we can do because ultimately all the listeners are there,” explained Desai.

Advertising and brand spending

Desai, whose company produces podcasts for brands such as The Lighthouse, Volkswagen and Alserkal Avenue, explained that the general trend, especially in this region, is that brands prefer to create their own podcast than insert an ad in an existing podcast.

As the market matures over the next few years, Desai believes that brands will shift towards advertising in the podcasting space.

The Interactive Advertising Bureau’s mid-2020 study reported a 15 percent drop in advertising growth compared to pre COVID-19 projections, but advertising revenue is projected to bounce back and hit the $2 billion target that was expected for 2020.

During 2020, Lebanon-based podcast platform Podeo produced five shows for the organization responsible for the 2022 FIFA World Cup’s operations and delivery, showing an appetite towards mainstream organization and government support for the medium in the region.

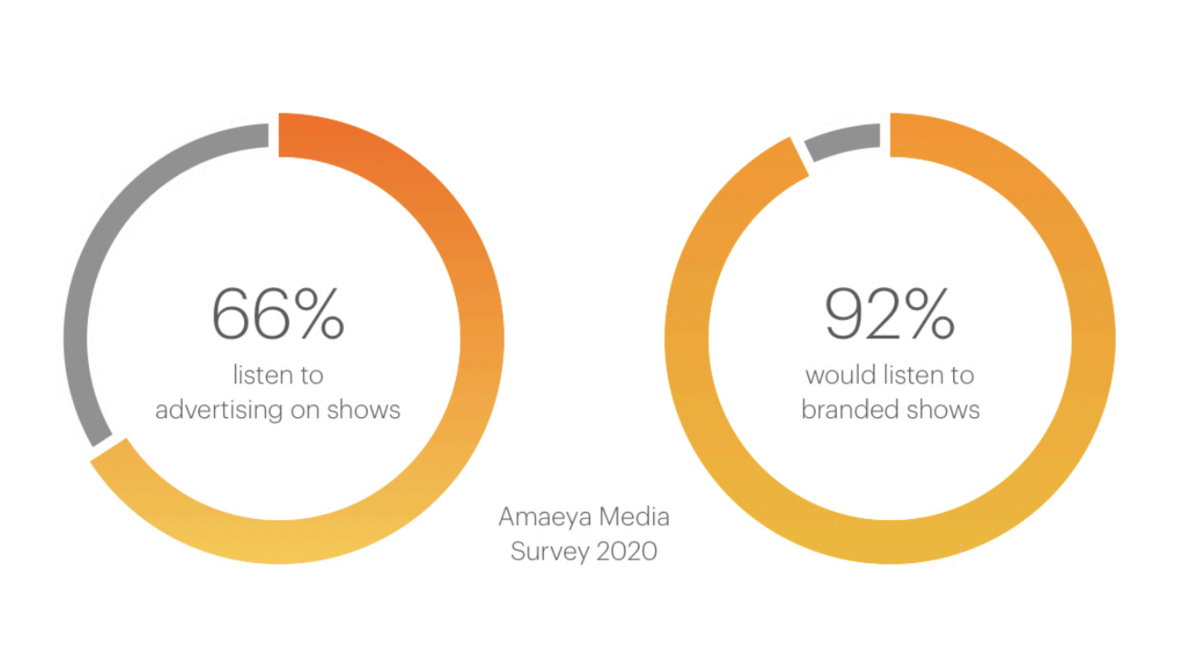

Local listeners listen to ads on podcasts, with 66 percent saying they don’t skip ads; some even said they use podcast ads to discover brands, with only 9 percent finding them truly annoying. This is also true for branded shows — only 8 percent said they wouldn’t want to listen to branded shows.

“There is an opportunity for podcasts because they are cost-effective in terms of advertising,” said Desai. Moreover, they have greater brand value as they sit on a platform for as long as the creator wants and many people tend to go back and listen to old podcasts. “There’s a genuine return value, and there are a lot of studies that show that brands get a lot of positive brand awareness,” he added.

Chirag Desai, the chief executive of Amaeya Media. (Supplied)

The past year has been interesting for the podcasting industry. On the one hand, advertising revenue dropped and platforms started creating exclusive content. On the other, the number of podcasts went up significantly – more than doubling from 800,000 podcasts in 2019 to 1.7 million at the end of 2020 in the Apple Podcasts directory – and audio as a medium started gaining more traction as evidenced by the popularity of the audio-based invite-only social app Clubhouse and beta launch of Twitter Spaces.

The recovery of economies and brands during the year, coupled with the measures being taken by the podcasting industry to standardize it, could just make 2021 the year that podcasts go mainstream.