DUBAI: Yemen’s Minister of Planning and International Cooperation, Waid Batheeb, discussed on Wednesday a recovery plan for the interim capital Aden with the World Bank and the reopening of the organization’s office in the city.

Batheeb spoke with the Dean of the Board of Executive Directors of the World Bank, Mirza Hassan, about ways to ease economic suffering for the people in Yemen, state news agency SABA reported.

During the virtual meeting, the two officials agreed on coordinating to define intervention priorities to be included in the International Development Association package (IDA20).

Efforts to enable national institutions carrying out current and future projects provided by the World Bank and other international organizations were also discussed.

Batheeb stressed the importance of carrying out an updated economic study on Aden and for coordination between the government and the World Bank in carrying out studies and analysis to avoid mistakes and conflicting information.

Meanwhile, Hassan confirmed the World Bank’s continued support of developmental projects in Yemen, including government and private sectors.

Yemen minister in talks with World Bank on Aden recovery plan

https://arab.news/v427y

Yemen minister in talks with World Bank on Aden recovery plan

- Aden recovery plan under discussion

- World Bank pledges support for development projects

Saudi Arabia, US to deepen mining ties after high-level talks with Secretary of Energy Chris Wright in Riyadh

JEDDAH: Saudi Arabia and the US are poised to strengthen mining ties following high-level talks in Riyadh, where both sides discussed boosting investment, economic cooperation, and critical mineral supply chains.

Minister of Industry and Mineral Resources Bandar bin Ibrahim Alkhorayef met with US Secretary of Energy Chris Wright on April 13, as part of the White House official’s ongoing visit to the Kingdom, according to the Saudi Press Agency.

The meeting, which was also attended by Deputy Minister of Industry and Mineral Resources for Mining Affairs Khalid bin Saleh Al-Mudaifer, focused on strengthening the strategic partnership between Saudi Arabia and the US in the mining and minerals sector.

In a post on his X account, Alkhorayef said: “I met with US Secretary of Energy Chris Wright at the Ministry’s headquarters in Riyadh, where we focused on enhancing strategic cooperation in the mining sector. We also discussed future partnership prospects and reviewed the long-standing industrial relations between our two countries.”

Discussions explored ways to expand bilateral cooperation in mining, with an emphasis on the sector’s critical role in the global energy transition, advanced technologies, and clean energy-driven economies.

The talks also highlighted the importance of minerals in electric vehicle production and their components, identified key investment opportunities, and examined mechanisms to unlock their potential. Both sides reaffirmed their commitment to strengthening economic collaboration and deepening long-standing ties.

Alkhorayef extended an invitation to Wright to attend the 2026 Future Minerals Forum, scheduled to be held in Riyadh.

The Kingdom aims to position mining as a foundational pillar of its industrial economy, with its mineral wealth estimated at SR9.4 trillion ($2.4 trillion), according to official figures.

Attracting international investment in the mining sector is central to Saudi Arabia’s ambition to reach $100 billion in annual foreign direct investment by the end of the decade.

In March, the Kingdom announced a new incentive package to boost FDI in the mining industry, underscoring its broader strategy to diversify the economy and tap into its untapped mineral reserves.

The initiative reflects close coordination between the ministries of investment and industry through an exploration enablement program aimed at streamlining market entry for exploration firms.

The program also seeks to enhance geological surveying and foster a competitive investment environment for both local and international mining companies.

Pakistan remittances cross record $4 billion in March, Saudi Arabia remains top contributor

- Government expects economy to expand three percent this year against earlier projections of 2.5-3.5 percent

- The country broke its own record in February 2025 when overseas Pakistanis sent $3.1 billion back home

KARACHI: Pakistan’s central bank governor on Monday said the current account would show a “substantial” surplus this year through June mainly on the back of a record inflow of remittances which crossed the $4 billion mark in March, with Saudi Arabia once again topping the list of biggest contributors.

Pakistan received a record-high $4.1 billion in remittances in March 2025, which bodes well for the government’s efforts to revive an economy that it expects will expand three percent this year, State Bank of Pakistan (SBP) governor Jameel Ahmad said at an event at Pakistan Stock Exchange in Karachi.

The central bank had earlier projected economic growth to range from 2.5 percent to 3.5 percent.

“With this level of remittances, we are hoping that for the current fiscal year our current account will stay in surplus,” the governor said. “There will be a substantial surplus and this surplus is the best performance, I will say, on the external account during the last two decades.”

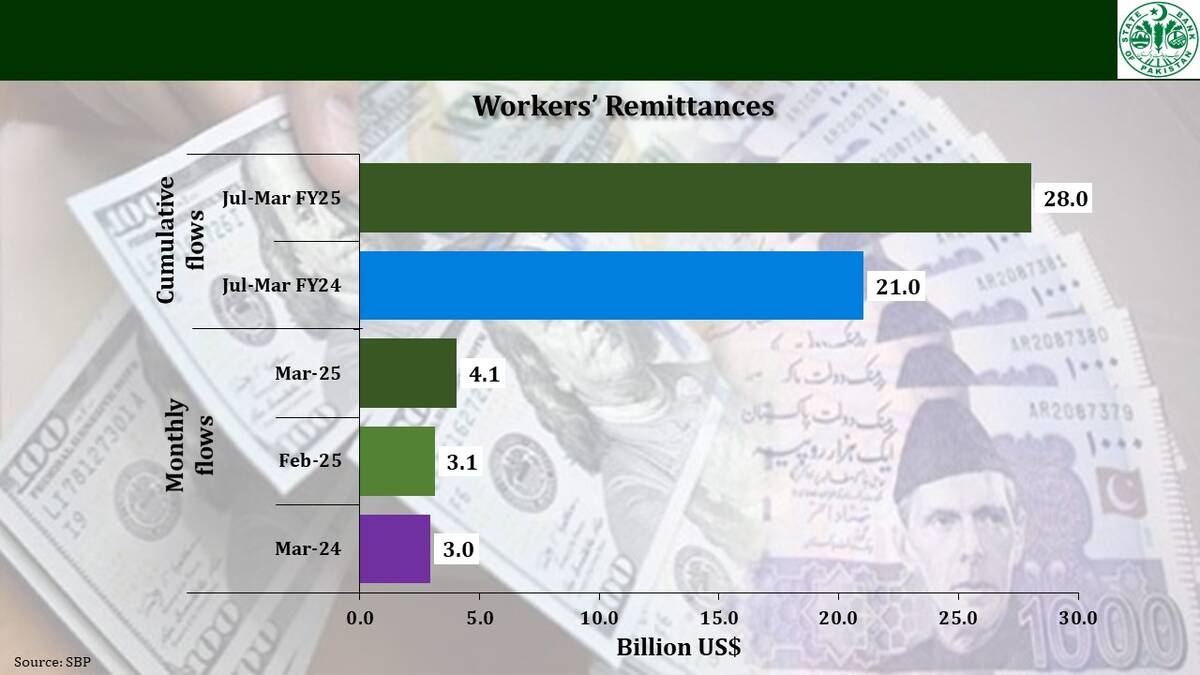

The country broke its own record in February when overseas Pakistanis remitted $3.1 billion.

Pakistan has faced a serious shortage of dollars and had to restrict imports in 2023 to avoid an imminent default on its foreign debts, which was avoided with the help of a last-gasp $3 billion financial bailout from the International Monetary Fund (IMF).

Prime Minister’s Shehbaz Sharif’s government is now waiting for the IMF’s executive board to approve the next $1 billion tranche of a new program, approved in September last year, to boost foreign exchange reserves that currently stand at $10.6 billion.

The current trend in the worker remittances inflows, Ahmad said, had made the central bank revise its earlier projection of $36 billion to $38 billion for this financial year. On the basis of such healthy inflows, the country’s foreign exchange reserves were expected to surge beyond $14 billion this year.

Ahmad said the country had paid most of its external debt for FY25 and was expected to receive as much as $5 billion from external sources by the end of June.

“I am quite confident that we will be receiving $4 to $5 billion before the end of June this year,” he said, without mentioning the exact source of these funds.

Pakistan’s total debt liabilities this year amounted to $26 billion of which $16 billion was supposed to be rolled over or refinanced, the governor said. Of this, he said, $3.7 billion debt was refinanced while close to $12.4 billion has been rolled over by friendly countries including China, Saudi Arabia and the UAE.

Out of the remaining $10 billion debt, Pakistan has already repaid $8 billion and was required to repay only $2 billion in the remaining months of this year.

“We have been servicing all those debt obligations on time,” said the SBP governor, adding that some inflows were delayed, but these would also come before June 30.

Jameel said Pakistan’s current account was stable and showed a $700 million surplus this year through February. Last year, the country’s current account showed $1.7 billion, close to half percent of GDP.

“Good thing is that we have been able to achieve this surplus despite substantial increase in imports,” he said, rejecting the claims that the government was still restricting imports.

Pakistan was also spending around $5.7 billion every month on oil and non-oil imports.

Due to the current account surplus and other policy and regulatory measures like exchange companies’ reforms, the Pakistani rupee had stabilized.

“The gap between the interbank market and the open market is very narrow,” Ahmad said.

While the economy was expected to grow three percent this year compared with 2.5 percent last year, agriculture was a major drag on economic expansion this year and rose less than one percent during the first six months through December.

Otherwise, he said, the economy was “doing well.”

“You can see the economic activity has already picked up. This is reflected in our high frequency data. Look at cement sales, look at auto sales, look at the high value textile exports,” Ahmad said.

While inflation was one of his biggest concerns previously, the central bank governor said the pace of price hikes had slowed to 0.7 percent last month, the lowest level in six decades.

Consumer prices in Pakistan have been backbreaking in recent years and rose 38 percent in May 2023. Pakistan’s central bank had to halve its interest rate to 12 percent since June last year to tame inflation in the country of more than 240 million people.

“From the current month onward, the inflation will be rising and ultimately stabilize within the target range of 5 to 7 percent [in the full year],” the central bank chief added.

Meanwhile, March 2025 data on remittances showed remittances reached $ 4.1 billion last month, a record high. In terms of growth, remittances increased by 37.3 percent and 29.8 percent on y/y and m/m basis, respectively.

Cumulatively, with an inflow of $ 28.0 billion, workers’ remittances increased by 33.2 percent during Jul-Mar FY25 compared to $ 21.0 billion received during Jul-Mar FY24.

“Remittances inflows during March 2025 were mainly sourced from Saudi Arabia ($987.3 million), United Arab Emirates ($842.1 million), United Kingdom ($683.9 million) and United States of America ($419.5 million),” the data showed.

Omani banks’ credit metrics remain stable amid robust economic growth: Fitch

RIYADH: Business conditions for Omani banks are expected to remain stable in 2025, supported by sustained high oil prices and robust economic growth, a new report revealed.

Data released by Fitch Ratings indicates that the country’s growing economic diversification has strengthened its financial outlook and created new growth opportunities for banks.

Real gross domestic product is expected to accelerate, driven by expansion in both the hydrocarbon and non-oil sectors.

The report from the US credit rating agency comes after it revised Oman’s long-term foreign currency issuer default ratings to positive from stable in December, and affirmed the IDR at BB+, driven by the availability of fiscal tools to combat future shocks.

It also aligns with the positive outlooks for all Omani banks, which reflects the upgrade in the sovereign rating and expectations that better operating conditions may strengthen the fundamental profiles of some banks.

The latest Fitch analysis said: “We expect asset quality to gradually recover further in 2025, helped by write-offs and the favorable economic conditions. This should support sector capitalization. Stage 2 loans should continue to reduce, and we do not expect any material migration to Stage 3, despite the remaining pressures in the real estate, construction and hospitality sectors.”

It added: “We expect lower interest rates will have a limited impact on banks’ net interest margins and that loan impairment charges will remain moderate, along with reasonable cost discipline.”

The report also highlighted that most banks maintain solid capital reserves, primarily strengthened by healthy internal capital generation, while funding and liquidity environments remain steady.

“We expect oil prices to continue to support growth in customer deposits, which accounted for 90 percent of total sector non-equity funding,” it said.

Earlier in April, Fitch Ratings shed light on how strong economic growth and relatively high oil prices, despite a recent minor decline, are expected to sustain favorable business conditions for Omani banks in 2025.

At the time, the credit rating agency said that Oman’s dedication to economic diversification has enhanced its growth outlook and opened up new opportunities for the banking sector.

Oman achieved a 6.2 percent budget surplus and a 2.4 percent current account gain in 2024, driven by prudent fiscal policies, high oil prices, and nonhydrocarbon export growth.

In its January 2024 Article IV consultation, the International Monetary Fund credited these figures to effective economic management.

At the time, the IMF noted that despite higher social spending under a new protection law, the nonhydrocarbon primary deficit as a share of nonhydrocarbon gross domestic product remained stable, highlighting the government’s commitment to financial discipline.

Government debt as a percentage of GDP also declined further, reaching 35 percent in 2024, marking continued improvement in Oman’s economic fundamentals, the IMF added at the time.

Saudi Arabia opens charter airline license bidding to expand aviation sector

JEDDAH: Saudi Arabia has launched a public tender for a national charter air carrier license, inviting private operators to offer non-scheduled services as part of its push to expand the aviation sector.

The General Authority of Civil Aviation said interested investors must request the tender documents via email. The bidding window opened April 13 and runs through May 21, with offers to be submitted both physically in sealed envelopes and electronically in encrypted form. Bids will be opened on May 22 in Riyadh.

The move supports the Kingdom’s National Aviation Strategy, which targets facilitating 330 million passengers annually and connecting to over 250 international destinations by 2030.

In an official release, GACA said that the initiative is designed “to enhance the quality of services provided to travelers, raise the level of competitiveness.”

The development follows a February policy shift that lifted cabotage restrictions, allowing foreign charter operators to apply for domestic routes under Saudi regulations beginning May 1.

Cabotage restrictions are regulations that prohibit foreign-flagged ships or airlines from transporting goods or passengers within a country’s borders, typically allowing only domestic carriers to operate such routes to protect national industries.

The reform is expected to stimulate competition and attract foreign investment in general aviation.

The development marks a key milestone in Saudi Arabia’s ongoing efforts to diversify its aviation sector and enhance private sector participation in the growing charter services market.

According to official data, the Kingdom’s business jet sector recorded a 24 percent increase in flight volumes in 2024, with domestic flights rising 26 percent to 9,206 and international flights up 15 percent to 14,406 — reflecting the sector’s expanding contribution to the national economy.

Announcing the policy changes in February, Imtiyaz Manzary, general manager for general aviation at GACA, highlighted the significance of the move, noting that the authority is opening new opportunities for the global aviation industry by lifting restrictions on domestic charter flight operations in the Kingdom.

“This regulatory decision supports GACA’s roadmap to establish Saudi Arabia as a general aviation hub, alongside an unprecedented infrastructure program to develop new private airports and terminals across the Kingdom,” he said, as reported at the time by the Saudi Press Agency.

The removal of these restrictions forms a key part of the authority’s strategy to boost competition, attract foreign investment, and offer greater operational flexibility within the general aviation sector.

As part of its broader General Aviation Roadmap — unveiled at the Future Aviation Forum in May — GACA aims to transform the sector into a $2 billion industry by 2030, generating 35,000 jobs. The plan includes the development of six dedicated business aviation airports, nine specialized terminals, and expanded maintenance, repair, and overhaul capabilities for business jets.

GACA said inquiries on the license tender will be accepted via email until May 8. It also warned that discrepancies between hard and electronic copies will result in disqualification and that late submissions will not be accepted.

Saudi Venture Capital CEO highlights Kingdom’s investments to boost innovation

RIYADH: A Saudi government backed venture capital firm has invested in over 50 funds in various sectors and stages, according to its CEO, underscoring the Kingdom’s strong commitment to fostering innovation.

On the second day of the Human Capabilities Initiative in Riyadh, Saudi Venture Capital’s Nabeel Koshak emphasized the growing prominence of national startups.

During a panel discussion titled “Powering Venture Capital Investments to Turbo Boost Innovation in HCD,” Koshhak, said: “Since inception, we invested in more than 56 funds, we are across multiple sectors, multiple stages.”

He added: “It’s good to shed the light on the amazing entrepreneurs and startups being launched here in Saudi Arabia and now going global. And also the companies that are starting globally, originally, and also expanding in Saudi Arabia.”

The CEO specifically commended Classera, a Saudi-born education tech company now operating in over 40 countries, calling it a “learning super-platform” with 50 million global users.

Also appearing on the panel, Dong-Su Kim, CEO of LG Technology Ventures in the US, shared insights into corporate venture strategies, saying: “We invest in promising startups and then we help them get connected with the right people. In many cases, we advise our portfolio companies on how to work with a big company.”

Kim also highlighted entrepreneurship as a critical tool for personal growth, adding: “I think, for a young person to increase your capability, there’s no better tool than starting your own companies.”

Jonathan Ortmans, president of the Global Entrepreneurship Network, pointed to the evolving mindset of young entrepreneurs. “What we’re seeing now is startups coming from a younger generation who care about more than the return on investment,” he said.

Ortmans also noted the massive reach of entrepreneurial initiatives, mentioning that his organization’s Entrepreneurship World Cup attracted over 100,000 startups globally.

Discussing the impact of artificial intelligence, Ortmans cautioned that while generative AI relies on past data, entrepreneurship thrives in uncertainty. “One of the things I’m learning is that, clearly, there are some areas where AI will not be useful in the immediate future. One of those is in terms of entrepreneurs— they’ll have to learn to operate in unpredictable, uncertain environments,” he said.

He expressed optimism about the future of venture capital, stating: “I think the venture community should be extremely excited because you’re going to see some super innovative new ideas coming from a new generation of thinkers.”

Ortmans also underscored the vital role of entrepreneurs in job creation, declaring: “Entrepreneurs create almost all the net new jobs around the world.”

The panel highlighted the dynamic interplay between venture capital, innovation, and human capability development, with the Kingdom emerging as a key player in the global startup ecosystem.