ISLAMABAD: Tag, a one-year-old Pakistani startup that offers banking and financial services, has raised over $12 million in what is now the largest ever seed financing round in Pakistan, the company said on Wednesday.

Pakistan’s startup ecosystem has received a major boost this year, with local firms getting over $228 million in investment just in the first eight months of 2021, compared to $77 million in 2020, according to Ignite, a Pakistani government-owned non-profit company.

Liberty City Ventures, Canaan Partners, Addition, Mantis and Banana Capital and others financed the round that brought Tag’s to-date raise to over $17.5 million. This was the first time many of these investors, including Lee Fixel’s Addition, have invested in a Pakistani startup.

“With this round the value of Tag has reached $100 million,” Talal Ahmed Gondal, co-founder and chief executive officer of Tag, told Arab News without divulging more details.

The round comes as the startup builds one of the crucial railroads for Pakistani users. “We are trying to become both Revolut and Paytm in Pakistan...,” the 29-year-old founder said.

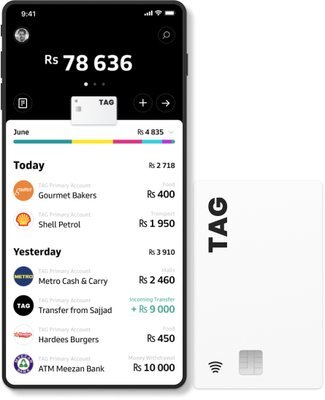

The startup partners with public and private firms to offer their employees banking services, including getting their salaries on the Tag account and Visa-powered virtual and physical cards. It also provides a range of business-to-consumer (B2C) offerings such as the ability to pay others online and top up utility bills that are available to any user in Pakistan who signs up to the platform.

Gondal said signing up on Tag, which included verification of an individual’s identity, just took three minutes.

“We eventually want to offer the complete set of banking and financial services to users in Pakistan,” he said.

The picture shows prototype of the interface of the fintech application, Tag. (Photo courtesy: AP via Business wire)

Before the launch of Tag, Gondal worked as an investor in Europe. He said he had long decided to return to Pakistan and start a firm to serve people back home, but was waiting for the right moment.

A number of young startups have made splashy funding announcements in recent weeks. Quick-commerce startup Airlift unveiled a record $85 million Series B round last month, followed by business-to-business (B2B) venture Bazaar’s record $30 million Series A round.

Gondal said startups were finally having a moment in Pakistan.

“Each country’s startup ecosystem goes through various waves,” he told US-based TechCrunch website on Wednesday. “In India, we saw e-commerce firms like Flipkart flourish in the first wave. Firms like Ola, Zomato and Swiggy and fintech firms like PhonePe and Paytm made inroads in the waves after that.”

The Tag founder said he saw a similar trend in Berlin: “I had the conviction that a similar thing would play out in Pakistan.”

Tag says it is now working to broaden its product offerings and hire talent to win the trust of the market.

“Liberty City Ventures is proud to support a visionary leader like Talal in his efforts to expand financial inclusion for the underserved and underbanked,” Murtaza Akbar, managing partner at Liberty City Ventures, said in a statement. “We expect the world class team he has assembled at TAG to build a regional fintech powerhouse.”

In June, Tag had closed $5.5 million pre-seed round led by Venture Capitals. It is authorized by the State Bank of Pakistan to operate as Electronic Money Institution (EMI) and plans to launch the country’s first digital bank.