RIYADH: NEOM, the $500 billion (SR1.9 trillion) jewel in the crown of the Kingdom’s Vision 2030 plans, took several strides forward this year with the announcement of two major projects and news that the region could welcome its first visitors in 2024.

The new net-zero megacity on the Kingdom’s northwest Red Sea coast will cover 10,000 square miles, an area 33 times the size of New York, and will be powered entirely by clean energy.

The futuristic car-free region will be run by advanced technologies such as human-machine fusion, artificial and predictive intelligence, and robotics. More than 1 million people will live in the area that will also host sporting, cultural, scientific and tourist attractions.

The region is the flagship giga-project of Saudi Arabia’s Vision 2030 plans, to diversify its economy from oil, ease social customs and boost investment.

Crown Prince Muhammad bin Salman launched the project, which is backed by the Kingdom’s sovereign wealth body the Public Investment Fund, in 2017.

The NEOM company says the megacity will also seek outside investors for the project, which is projected to contribute $48 billion to the Kingdom’s gross domestic product by 2030.

Major earthworks and tunneling through mountains has already begun in the region that houses 1,500 people, NEOM CEO Nadhmi Al-Nasr told Bloomberg TV in October.

Nadhmi Al-Nasr, CEO of NEOM. (Supplied)

He said: “It’s a huge undertaking. Today if you go to NEOM you will see construction all over, you will see earthworks going on all over, you will see regions that are being developed.”

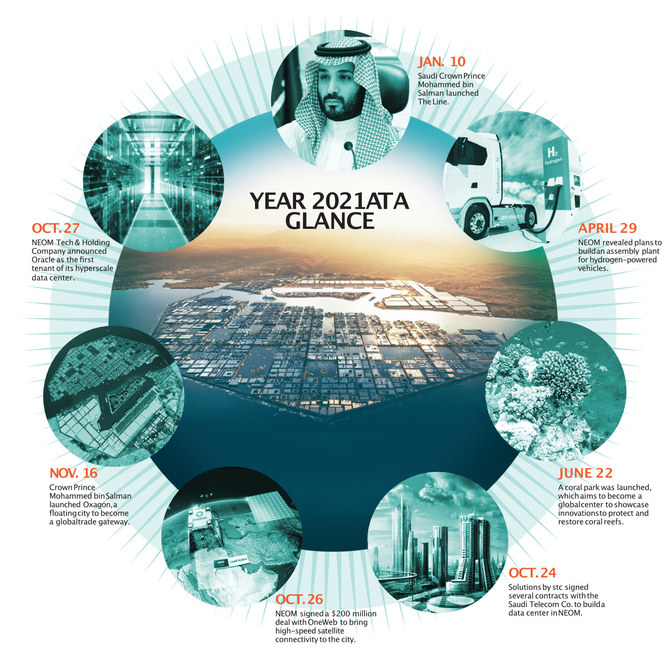

One of the two key projects that were announced this year is THE LINE, a 105-mile long green city, which will have its own schools, clinics, leisure facilities, and open spaces within a five-minute walk.

The project is expected to create 380,000 jobs and to contribute SR180 billion to the Kingdom’s GDP by 2030.

Al-Nasr told Bloomberg TV that the city could welcome its first residents by 2024.

The other key announcement this year was the launch of the OXAGON, an eight-sided city that will be an industrial district and port. NOEM said the area will be “home to the world’s first fully automated port and integrated logistics hub.”

Half of OXAGON will float on the Red Sea, where around 10 percent of the world’s trade sails pass in container ships.

Today if you go to NEOM you will see construction all over, you will see earthworks going on all over, you will see regions that are being developed.

Nadhmi Al-Nasr, CEO of NEOM

NEOM says the industrial city will use the Internet of Things, artificial intelligence and robotics to create “a seamless integrated, intelligent and efficient supply chain.”

It has been a busy year for NEOM. These are its highlights:

April — NEOM awarded the US-based engineering firm Parsons Corporation a management consultancy role in OXAGON.

April — NEOM also said it would develop a plant to build up to 10,000 hydrogen fuel cell-powered commercial vehicles a year. It signed an agreement with US-based Hyzon Motors, which builds zero-emission hydrogen fuel cell-powered commercial vehicles, and Saudi conglomerate Modern Industrial Investment Holding Group as part of this move.

June — NEOM signed a deal with South Korean project and construction management firm HanmiGlobal to manage administrative services on THE LINE, which includes design, structure and execution.

FASTFACT

1 million

The futuristic car-free region will be run by advanced technologies such as human-machine fusion, artificial and predictive intelligence, and robotics. More than 1 million people will live in the area that will also host sporting, cultural, scientific and tourist attractions.

June — NEOM and King Abdullah University of Science and Technology also announced a joint project to establish the world’s largest coral garden at Shusha Island in the Red Sea area by the mega-city. The project, scheduled to be completed in 2025, covers 100 hectares on Shusha Island on the shores of the Red Sea, and bids to establish the region as a global center for protecting and restoring coral reefs.

July — NEOM company received tunnel work pre-qualifications for the China Railway Construction Corp. to operate.

September — NEOM invited bids for the construction of 31 km of tunnels. This project is a part of the infrastructure backbone of THE LINE and the deadline for bids is Dec. 30, according to GlobalData’s MEED.

October — NEOM announced technology firm Oracle as the first tenant of its hyper-scale data centre in the megacity. The data center will be based at the meeting point between terrestrial and sub-sea cable cables, allowing it to provide customers with fast and reliable connectivity.

November — the crown prince announced the launch of OXAGON, a floating, eight-sided city, set to be the largest floating industrial complex in the world.