RIYADH: The second day of the Future Minerals Forum in Riyadh kicked off on Wednesday, with major speakers set to take the stage for high-level talks on the future of the mining industry.

Held at the King Abdulaziz International Conference Center, the three-day event opened on Tuesday with two closed-door ministerial meetings that emphasized on sustainability issues surrounding the sector.

READ: Indian miner Vedanta Resources to explore Saudi Arabia’s Zinc wealth

Representatives from 31 countries met on Tuesday for the talks, where they agreed deeper collaboration on mining across the region was needed to unlock the sector’s full potential.

The meetings discussed the role that metals and minerals could play in the global energy transition, as well as the role each country in the region can play in developing sustainable and responsible mineral value chains.

The event, hosted by the Saudi Ministry of Industry and Mineral Resources, is aimed at highlighting the role of mining in Saudi Vision 2030, after the government identified it as the third pillar of the Kingdom’s economy.

It consists of panel discussions, workshops, and networking opportunities for key industry players, policy makers, and investors.

Follow our coverage (all timings in GMT):

10:55 – ACWA Power signs renewable energy-related MoU with Ma’aden during the Future Minerals Forum in Riyadh.

10:45 – Former US representative Eric Cantor talks about the role of critical minerals in the global energy transition. “We are starting to see the importance of critical minerals in the industry as some projects are now underway, but we still have a lot to do,” he said.

Cantor said the security of Saudi Arabia is “inextricably linked” to the security of the US and vice versa.

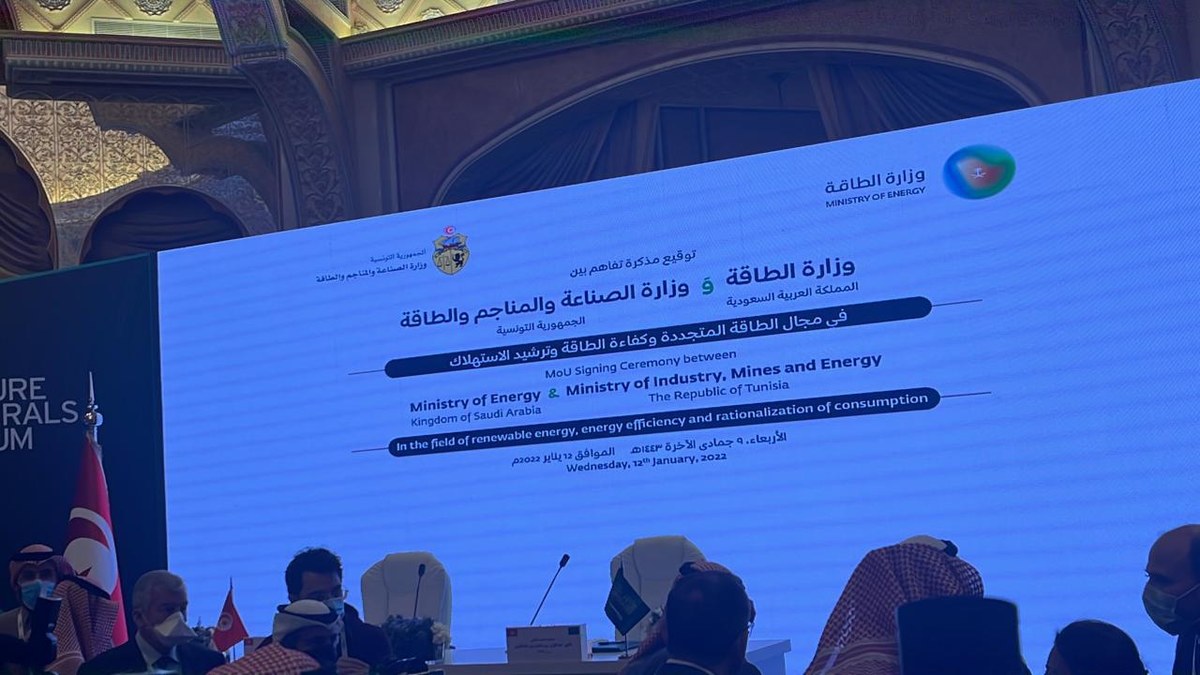

09:15 – The Saudi Ministry of Energy has signed an agreement with its Tunisian counterpart in the field of renewable energy, energy efficiency, and the rationalization of consumption.

“I have the honor to sign the first renewable energy agreement with Saudi Arabia, and we will work to implement the terms of the agreement based on equality and abundance of opportunities,” Tunisian energy minister Neila Nouira Gonji said.

She added they have a “strategic partnership” with Saudi investors and financiers in the field of hydrogen and electric mobility.

08:50 – Keynote discussion tackles how to position the mining industry as a leader on sustainability and partnerships, where Saudi Vice-Minister for Mining Affairs Khalid Al-Mudaifer is participating.

Ma’aden CEO Abdulaziz Al-Harbi talked about the importance of sustainability in the Saudi mining company’s operations. “Ma’aden has focused a lot on the environmental impact of our processes,” he said.

08:20 – Saudi energy minister Prince Abdulaziz bin Salam Al-Saud takes the stage for a fireside chat session. He reiterated the importance of energy security in the global transition to low-carbon economies.

“We must not give up energy security for the sake of energy transformation,” he said.

The minister said the world should be mindful of developing nations, who did not have their own share of growth and development over the years, “they need to be given opportunities.”

Saudi Arabia has a large amount of uranium, Prince Abdulaziz said, and they will work to exploit and develop the resource.

READ MORE: ‘Our uranium is key to achieving energy transformation’: Saudi minister

#LIVE: #Saudi Minister of #Energy Prince Abdulaziz bin Salman says #SaudiArabia has a large quantity of #uranium and will work to exploit, develop, and commercially benefit from it. #FutureMineralsForum #FMF2022 pic.twitter.com/SVXRaPLLJn

— Arab News Business (@ArabNewsBiz) January 12, 2022

07:48 – Egypt’s Minister of Petroleum and Mineral Resources Tareq El-Molla said the country’s legislation has not been attracting mining investments, and as part of its Vision 2030, has started working to make flexible policies around mining.

“Our strategy aims to develop mining cities and one of them will be dedicated to gold,” the Egyptian minister said.

He added they aim to increase the mining sector’s contribution to GDP to 5 percent over the next two decades.

07:35 – Session opens on what governments are doing to maximize mining’s contribution to local economies and communities.

07:27 – Public Investment Fund Governor Yasir Al-Rumayyan addresses the forum. He said the mining industry “is becoming an important contributor to the world's economic, social and environmental goals.”

#LIVE: @MaadenKSA is aiming for #carbon neutrality by 2050, says Yasir Al Rumayyan, Governor of @PIFSaudi. #FMF2022 https://t.co/Lms3pgS03o

— Arab News Business (@ArabNewsBiz) January 12, 2022

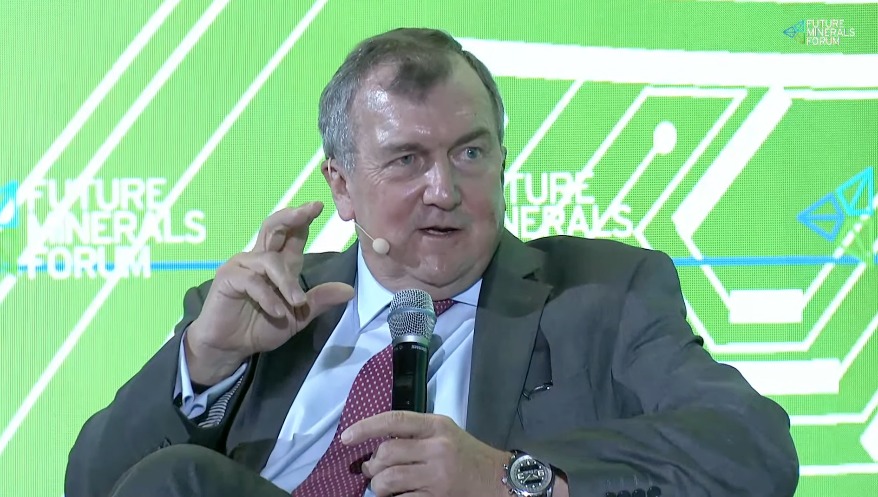

07:22 – Mark Bristow, president and CEO of Barrick, emphasizes the importance of mining in “everyday life.”

Mark Bristow, president and CEO of Barrick

But the world has lagged in terms of investing in the minerals business, “because of the obsession on the environment and anti-mining, we’ve become almost embarrassed to be miners,” he said.

READ MORE: Red Sea mining is needed to quench world’s thirst for metals: Mining company chief

07:00 – Saudi Minister of Industry and Mineral Resources Bandar Alkhorayef opens the second day of the Future Minerals Forum in Riyadh.

He talked about the challenges of meeting the growing global demand for minerals, which the Saudi minister said is being led by a more sophisticated industry, but more importantly by the global energy transition.

Alkhorayef highlighted the role of mining in the Saudi Vision 2030, which sets out an ambitious set of objectives aimed at diversifying the economy away from oil.

“The value of the mineral wealth in Saudi Arabia is estimated about $1.3 trillion,” he said.

H.E. Bandar Al-Khorayef, Minister of Industry & Mineral Resources, #SaudiArabia, spoke about how #mining can benefit society at the #FutureMineralsForum. #FMF2022 pic.twitter.com/BeaCIjTj2M

— مستقبل المعادن | FUTURE MINERALS (@FutureMineral) January 12, 2022