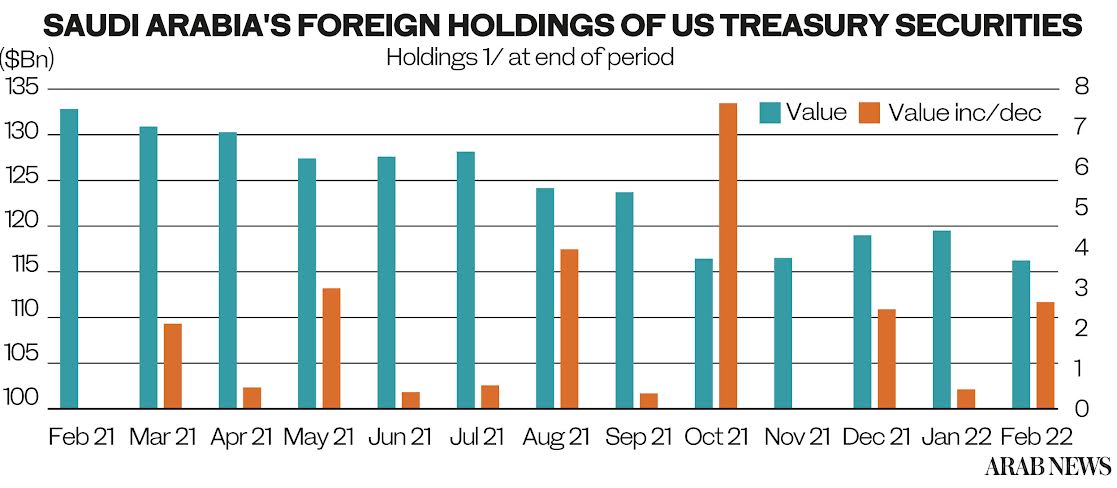

RIYADH: Saudi holdings of US treasuries slipped to $116.7 billion in February, according to data released by the US treasury.

The figure reflects a decrease of around $2.7 billion when compared to January this year.

Among the largest holders of US debt during the month of February, Saudi Arabia has secured 18th place.

The Kingdom’s holdings of US treasuries were distributed among long-term bonds with an accumulated worth of $101.3 billion. This figure accounts for 87 percent of the total holdings.

"Saudi holdings of U.S. treasuries has followed the general trend seen by the SAMA’s total holdings of foreign securities, which declined by 8 percent between February 2020 and February 2022," Albara’a Alwazir, director of economic research at US-Saudi Business Council.

While Saudi holdings of U.S. treasuries declined by 37 percent during the same period, the steepest decline has been its holdings of short-term securities, reflecting a decline of 64 percent compared to long-term holdings, which dropped by 28 percent between February 2020 and February 2022, he added.

Albara’a Alwazir, director of economic research at US-Saudi Business Council

As for the US treasuries distributed among short-term bonds, these amount to $15.5 billion, representing 13 percent of the total holdings.

Saudi Arabia's total holdings in US treasuries peaked at an all-time maximum level of $184.4 billion back in February 2020. Long-term US treasuries holdings also stood at an all-time high of $141.4 billion at the time.

Since then, the value of the Kingdom's holding has fallen by a total of $67.7 billion, including a decrease of $40.1 billion in the value of long-term US treasuries.

The drawdown in U.S. treasury holdings by Saudi Arabia are fueled by the need to service its financing needs associated with the private sector stimulus packages, according to Alwazir.

Furthermore, the Kingdom’s sizeable diversification plans necessitate the injection of capital into a number of Vision Realization Plans, such as the PIF Program and National Transformation Program, he added.

"Looking ahead, I expect a ramp up in Saudi Arabia’s foreign reserves that is perpetuated by the ongoing conflict in Ukraine, which has dramatically elevated oil prices since the end of February. With demand for oil outpacing current supply, the cascading effect on the Kingdom’s finances will elevate capital allocations towards boosting government reserves and accelerating strategic initiatives in line with Vision 2030 goals," Alwazir said.

FASTFACTS

Saudi Arabia’s total holdings in US treasuries peaked at an all-time maximum level of $184.4 billion back in February 2020.

The value of US treasuries owned by the UAE at the end of February 2022 stood at $46.3 billion, $1.5 billion more than in January.

Kuwait’s holding remained virtually unchanged at $50.6 billion.

Looking at some other major oil producers' holdings in US treasuries, Norway has boosted it by a total of $21.8 billion during the first two months of 2020 to $119.4 billion.

The value of US treasuries owned by the UAE at the end of February 2022 stood at $46.3 billion, $1.5 billion more than in January. Kuwait's holding remained virtually unchanged at $50.6 billion.

Japan was the top holder of US Treasury bonds in February with a value of $1.3 trillion, followed by China with a value of $1.54 trillion.

Countries like Saudi Arabia build part of their reserves by buying US holdings as they can be liquidated very fast. The Kingdom and other oil exporters increased their holdings over the past few years when crude prices were on the rise.

Saudi Arabia has been liquidating some treasury holdings in recent years to invest in projects aimed at diversifying its economy away from oil.

The US Treasury only began publishing the details of Saudi Arabia and other oil producers’ Treasury holdings in May 2016. At that time, Saudi Arabia held $116.8 billion, only marginally more than it does today, but up from $102.8 billion in March 2015. China had a portfolio of $1.24 trillion, then the world’s largest holdings, but has since been overtaken by Japan.