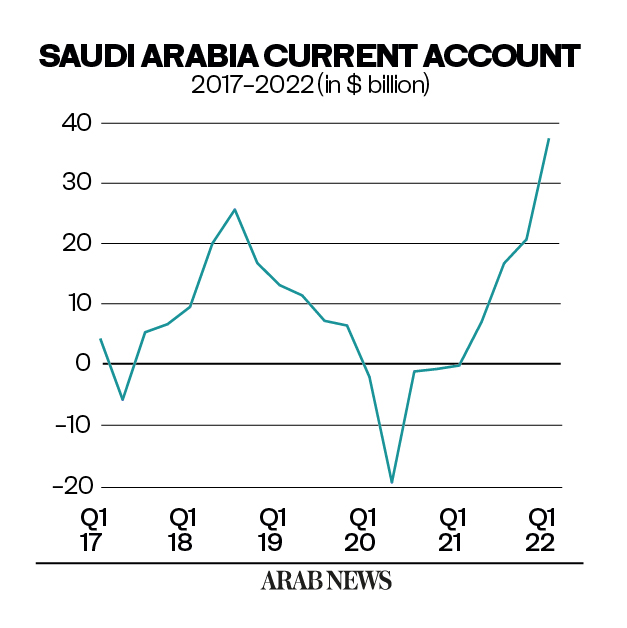

CAIRO & MOSCOW: Oil exports have skyrocketed Saudi Arabia’s current account balance to $37.4 billion in the first quarter of 2022, according to preliminary data on the Kingdom’s balance of payments published by Saudi Central Bank.

The figure for the first quarter compares with a deficit of $169 million and a surplus of $20.7 billion recorded in the first and fourth quarters of 2021, respectively.

The growth rate in the current account surplus compared to the fourth quarter of 2021 translates to an almost 81 percent increase.

The surge in the current account balance is attributed to a $37.1 billion increase in oil exports which hit $76.6 billion in the first quarter of 2022 compared to $39.4 billion in the same quarter a year ago.

The inflows from non-oil exports also increased noticeably by almost $5 billion to $20.7 billion from $15.7 billion in the first quarter of 2021.

The outflows in the general merchandise account increased by only $4.8 billion as goods imports rose relatively modestly to $38 billion in the first quarter of 2022. This includes a positive effect from the re-exports, which reduced the imports account number by $3.1 billion.

As a result, the general merchandise account posted a year-on-year increase of $37.3 billion, hitting $59.4 billion compared to $22.1 billion in the first quarter of 2021.

The Kingdom’s current account turned positive in the second quarter of 2021 after it recorded a deficit in the five preceding quarters from the first quarter of 2020 through the first quarter of 2021.

It’s worth mentioning that the Kingdom’s current account turned positive in 2021 at $44.3 billion, following the $22.8 billion deficit in 2020.

Similarly, the service sector account showed an 18.3 percent decrease in deficit from $14.7 billion to $12 billion, easing decreases in the current account balance.

The improvement resulted mainly from a $2.4 billion reduction deficit in the “other business services” account, which posted a shortfall of $1.64 billion in the first quarter of 2022 compared to $4 billion in the first quarter of 2021.

Moving on to the personal transfers account, worker remittances, the outflow recorded an annual increase of 14.9 percent from $9.3 billion in the first quarter of 2021 to $10.7 billion in the first quarter of 2022.

Separately, looking at other parts of the balance of payments – beyond the current account – the net foreign direct investment showed an inflow of $1.97 billion in the first quarter of 2022, a 1.7 percent increase quarter-on-quarter. This compares with an 11.9 percent increase in its transition from the third quarter to the fourth quarter of 2021.

The net foreign portfolio investment showed an inflow of $7.54 billion in the first quarter of 2022 compared to the $1.4 billion outflows in the fourth quarter of 2021 and an influx of $7.8 billion in the first quarter of 2021.