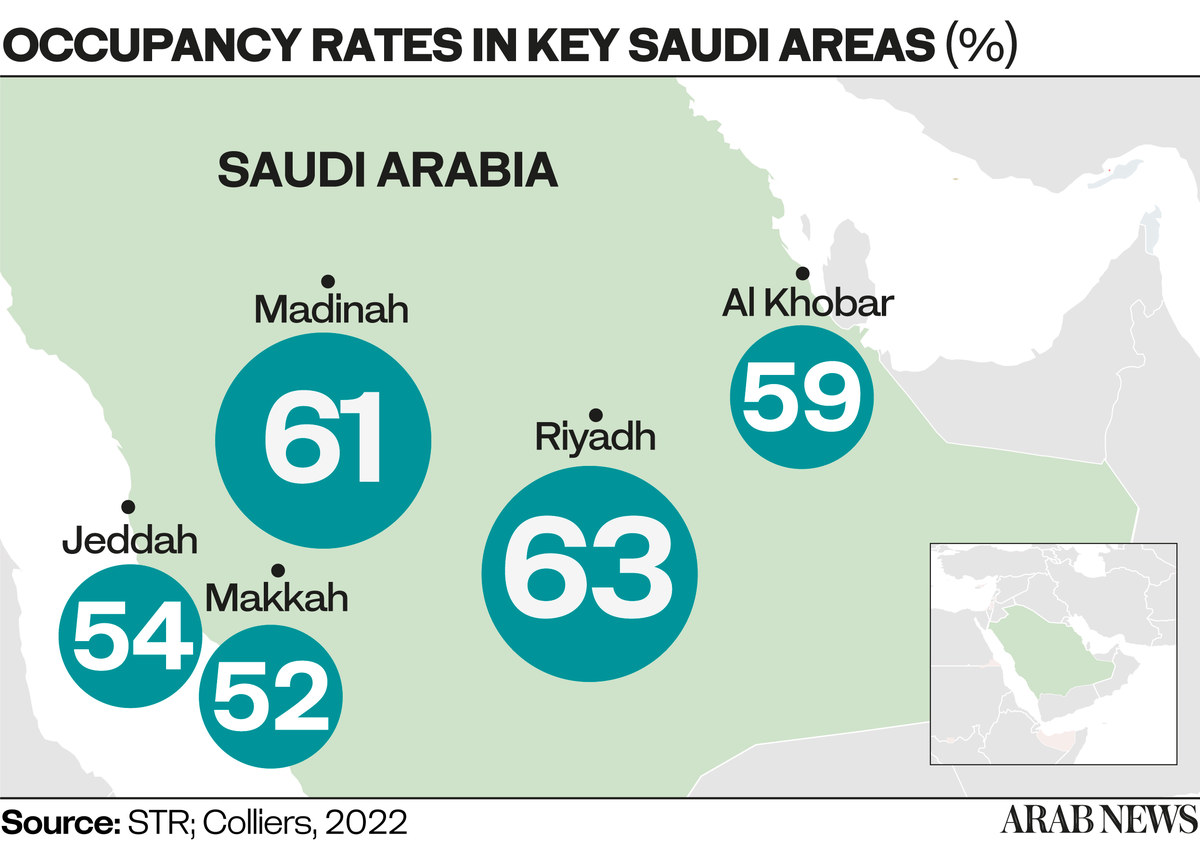

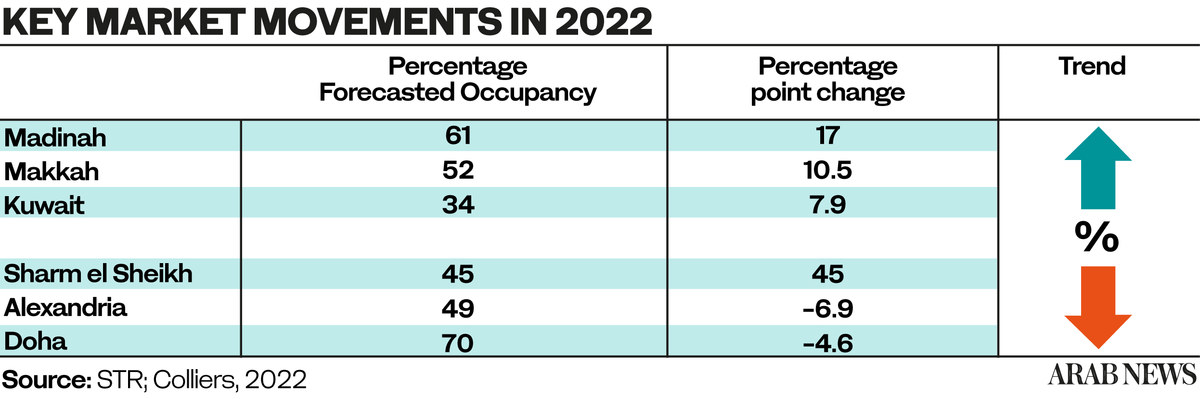

Makkah and Madinah’s 2022 hotel occupancy rate forecast has increased by 10.5 and 17 percentage points respectively after two years of COVID-19 restrictions in the hospitality sector were lifted, according to Colliers’ July 2022 report.

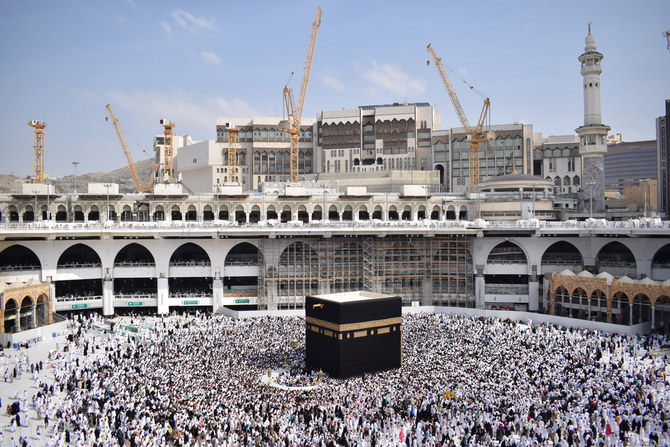

The real estate and investment management firm believe that, after the long-awaited return to Hajj, Makkah’s hotel occupancy rates are now expecting a 106 percent surge compared to last year, reaching 52 percent occupancy.

Likewise, Madinah is looking at an 80 percent increase, achieving 61 percent occupancy.

In contrast, Sharm El-Sheikh, Alexandria, and Doha experienced a 9.2, 6.9, and 4.6 percentage point reduction respectively from their previous occupancy rates forecasts.

Moreover, Saudi Arabia’s booming oil market has increased corporate demand in the Alkhobar and Dammam regions, as occupancy levels are predicted to reach 59 percent.

In the UAE, hotel occupancy rates rose significantly between Oct. 1, 2021 and March 31, 2022 in tandem with the Expo 2020 event which took place in Dubai.

Although Qatar has experienced a decline in its hospitality market in the first half of 2022, this is set to change with the 2022 FIFA World Cup, where Doha’s hotel occupancy is anticipated to reach 70 percent by the end of the year —a 3 percent decline compared to 2021.

The World Cup is expected to have a positive impact on the UAE’s hospitality markets, as spectators decide to take a pit stop at Dubai or Abu Dhabi, forecasted Colliers.

Unlike Sharm El-Sheikh and Alexandria, occupancy rates in Cairo and Hurghada are predicted to come in at 69 and 59 percent respectively this year, a 19 and 11 percent increase respectively year-on-year.

Furthermore, other countries in the region such as Jordan and Oman are also expecting to see higher hotel occupancy rates in the second half of 2022.