RIYADH: Saudi Arabia’s General Authority for Competition approved 43 applications for mergers and acquisitions in the second quarter of 2022, a 23 percent jump from a year ago, it has announced.

In its recent report, GAC said it received 76 applications for economic concentration in the first quarter of 2022, 11 percent lower than the same period in the previous year, Argaam reported.

Despite the increase in the number of deals in the second quarter, the authority did not receive any merger requests for the same period, according to GAC spokesman Saad Al-Masoud.

GAC is expecting a decline in deals and joint ventures of between 20 and 30 percent, according to Head of the Mergers and Acquisitions, Talal Al-Hogail.

“International mergers dropped in the first half of this year by 25 percent, and according to our internal study (we expect) that requests (in the Kingdom) will drop significantly after the end of 2022,” he said.

Of the 43 no objection certificates issued by the authority, 37 were for acquisitions, with the remaining six for joint projects.

The authority treated 23 applications as “not requiring reporting” during the second quarter of 2022.

Some nine applications are still being considered by GAC in the “under study” category, most of which are in the wholesale and retail trade, and information and communications sectors, according to Al-Hogail.

One application was rejected.

According to the report, economic concentration applications by foreign establishments accounted for 61 percent of total applications filed in the second quarter.

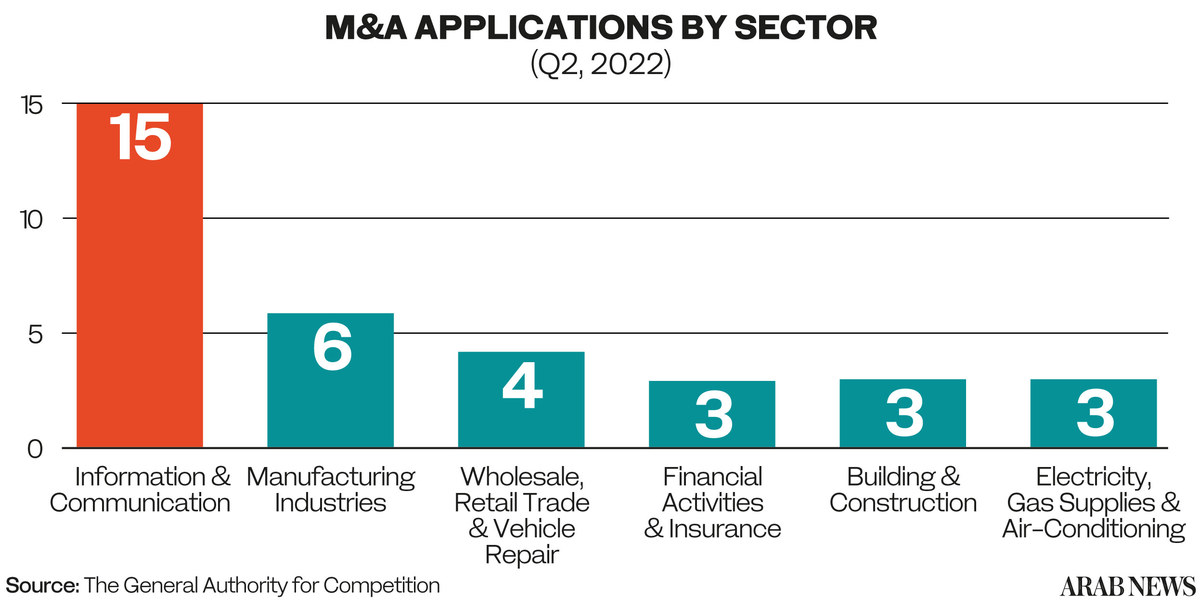

With 15 applications, the information and communication sector topped the list — making up 30 percent of total applications in the second quarter.

Manufacturing industries accounted for 14 percent of the overall applications, followed by wholesale, retail trade and vehicle repair sector.

“The requests for economic concentration of foreign establishments had the largest share, amounting to 61 percent of the total requests received by the authority during the second quarter of 2022,” Al-Hogail said.

The most prominent were the joint venture between Bottega Veneta Netherlands and the Rubaiyat Company for Industry and Trade Holding Ltd., and the establishment of a joint venture between the Saudi Military Industries for Aerospace Systems and Airbus.

Oracle's acquisition, through one of its subsidiaries, of all Cerner shares was also a leading deal.