JEDDAH: Flying into the Saudi capital Riyadh, visitors cannot help but notice the patchwork of green spaces that have popped up across the city. Less than a decade ago, the scene from above would have more closely resembled the fictional Star Wars planet of Tatooine.

Although its territory is largely covered by desert, Saudi Arabia has worked hard in recent years to protect and restore its biodiversity, and has opted for a more sustainable future by turning whole swathes of its landscape into havens of green.

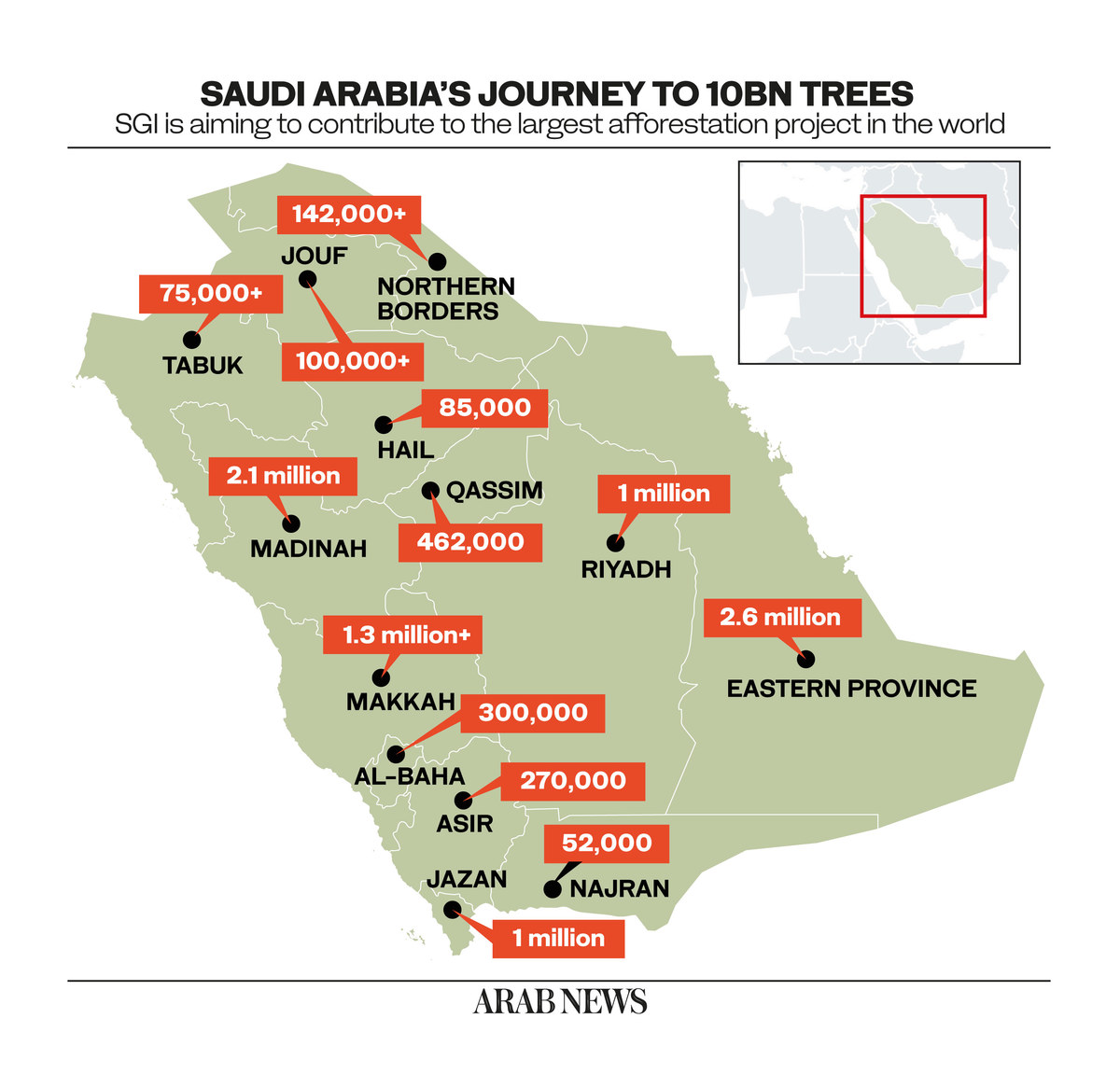

Last year, Crown Prince Mohammed bin Salman launched the twin Saudi Green Initiative and the Middle East Green Initiative, which feature the largest afforestation projects in the world, to capture carbon from the air, improve soil quality, and enhance quality of life.

The second edition of the Saudi Green Initiative Forum is taking place in the Egyptian resort town of Sharm El-Sheikh from Nov. 11 to 12 to coincide with the UN climate summit, COP27.

“As a leading global oil producer, we are fully aware of our responsibility in advancing the fight against the climate crisis, and that just as we played a leading role in stabilizing energy markets during the oil and gas era, we will work to lead the coming green era,” the crown prince said during the initiatives’ launch.

A warming climate is already taking its toll on the Kingdom and the wider Middle East, with less rainfall to water crops and refill groundwater aquifers, creeping desertification and soil degradation, and dust storms growing in scale and frequency.

The two initiatives are designed to help the Kingdom and wider region adapt to and mitigate for the effects of climate variation and to adopt technologies and practices that will reduce greenhouse gas emissions and other environmental pollutants.

Circular farms like these are spread across parts of the Kingdom. (AFP file photo)

By the end of 2021, around 60 community-based projects and private sector collaborations had already been launched under the initiatives to help improve public health, boost quality of life, and promote sustainable lifestyles. At the heart of it all is the city of Riyadh.

The growing metropolis is set to more than double its population in the coming decades thanks to an $800-billion project aimed at transforming it into an economic, social and cultural hub for the region. Such a transformation will of course come with environmental challenges.

In 2019, the Green Riyadh Project, the world’s largest integrated urban reforestation project, announced an intention to plant 7.5 million trees across the capital, to increase green space from 1.7 to 28 square meters per capita, and to increase total green space to 9 percent.

The project aims to reduce ambient temperatures by an average of 8-15 degrees Celsius in afforested locations across the city, to improve air quality by 3-6 percent, and to improve the overall aesthetic of the urban center.

Given Riyadh’s location and high density, it will need time, hard work, and investment to become a sustainable city that fulfills the goals set out in the Kingdom’s Vision 2030 Quality of Life Program, Abdullah Aldakheelallah, an architect and urban researcher, told Arab News.

Community engagement is a key goal of Saudi green efforts. (AN archives)

“Urban areas must not only incorporate green spaces. They must also provide basic amenities, entertainment spaces through eco-friendly practices, afforestation on roads and in neighborhoods, the construction of sidewalks and pedestrian pathways,” said Aldakheelallah.

“Projects in the Kingdom should adapt and adjust themselves to the strategic keys of the Quality of Life Program in their unique way to add to the improvement of urban cities as a whole.

“Green pockets of land will help nourish a city, it can promote outdoor recreational activities, improve the health of citizens and help reduce the urban heat island (UHI) phenomenon, where surfaces absorb heat and retain the heat for longer hours.”

SGI objectives:

Net-zero emissions by 2060.

*Boost use of renewables to 50% by 2030. Contribute to cutting global methane emissions by 30% by 2030.

Plant 10 billion trees and rehabilitate 40 million hectares of land.

Raise protected areas to more than 30% of total land.

Another benefit of the urban afforestation project is that it will curb the effects of “unmanaged surfaces,” such as uninhabited land, roundabouts, and other empty spaces that tend to retain heat longer, said Aldakheelallah.

“Some 20 percent of Riyadh is made up of unmanaged surfaces. By shading such areas, their goal is to decrease the exposure of solar radiation to unmanaged surfaces, and decrease temperatures in the city during daylight. Studies predict that by doing so, you can decrease temperatures by 4-5 degrees during the day,” he added.

Beyond increasing tree cover, Aldakheelallah says the design and retrofitting of buildings can also have a significant impact on local temperatures.

“Roofs play a crucial role in the energy balance of buildings and the surrounding environment,” he said. “The total height-to-floor area ratio and width of the roof are key determining factors for reducing direct radiation exposure.

“Unfortunately, modern ways of building homes have given way to reducing the size and width of roofs, which has had adverse impacts.”

To create and sustain its new green spaces, Riyadh must guarantee plentiful and sustainably sourced freshwater — a limited resource in a country that lacks its own rivers and receives precious little rainfall.

Deep groundwater aquifers and desalination plants are the Kingdom’s primary water resources. In major Saudi cities, desalinated water consumption is extremely high, especially in Riyadh, where its share stood at 63-64 percent in 2020.

Local planting initiatives have been launched around the Kingdom, including in the Eastern Province. (AN archives)

Much of the capital’s drinking water came from desalination plants in Makkah, Jeddah and Taif — a practice which, until more plants are powered by renewable sources of energy, continues to contribute to the Kingdom’s carbon emissions.

Dr. Mark Tester, associate director at the King Abdullah University of Science and Technology Center for Desert Agriculture, says Riyadh needs to better integrate its wastewater management if it wants to irrigate its green spaces sustainably.

“Wastewater is a massive resource, especially in a country which has so little water,” Tester told Arab News. “You need to be able to, for example, separate greywater from blackwater and then use the greywater directly.

“This saves enormous amounts of money and greatly reduces the CO2 emissions from pumping and treating the wastewater. You can use the greywater locally and with minimal treatment and this gives you an opportunity to green the environment.”

Blackwater, also referred to as sewage or brown water, is the wastewater from bathrooms, which can carry disease and bacteria, both of which can be harmful.

Greywater, by contrast, is the wastewater that comes from sinks, washing machines, bathtubs and showers. It contains lower levels of contamination, making it easier to treat and process.

Recycled greywater is commonly used in irrigation and constructed wetlands. In fact, greywater that contains food particles can even nourish plants. Using treated greywater in Riyadh could lead to improved planning, regulations, and building codes, could irrigate tens of millions of trees, and significantly improve health and well-being.

Indeed, at the very heart of the greening strategy is the happiness and well-being of Saudi residents and foreign visitors, allowing them to experience the psychological benefits of the great outdoors in a safe and manageable climate.

“Green spaces should be prioritized where they can be safely and conveniently accessed and enjoyed by everyone, regardless of age, gender, or physical ability, for example, in a neighborhood park as opposed to a street median or traffic roundabout,” Huda Shaka, a sustainable cities adviser, told Arab News.

“Such spaces can improve the physical and mental health of the urban population as well as provide opportunities for improving biodiversity, air quality, and access to food.”