KARACHI: The volume and value of digital transactions in Pakistan continue to grow, with the South Asian country witnessing an expanding digital footprint as it pushes for the digitalization of its payment systems, the central bank said on Monday.

Increasing collaboration between banks and fintech companies has provided efficient, accessible and user-friendly digital payments platform for customers, allowing a greater number of customers to use digital channels to make payments, the State Bank of Pakistan said in its third quarterly review of Payment Systems for Fiscal Year 2022-23, which covers the January-March 2023 period.

Pakistan’s central bank expects migration to electronic means will boost Pakistan’s GDP by 7%, create four million jobs, and result in new deposits of $263 billion and represent a potential market of $36 billion by 2025.

“Adoption and acceptance of digital instruments has been increasing steadily,” the central bank report, released on Monday, said.

During the third quarter of fiscal year 2023, overall e-banking transactions increased by 4.3% in terms of volume and 11.2% in terms of value. Internet and mobile phone banking transactions also grew in volume by 9.9% from 200.7 million to 220.5 million and in value by 19.1% from Rs9,167.6 billion to Rs10,922.3 billion, the State Bank of Pakistan reported.

At the end of March 2023, there were 9.3 million internet banking, 15.3 million mobile phone banking and 48.4 million branchless banking app users. In addition to this, holders of e-wallets reached 1.6 million.

Customers using Raast, Pakistan’s first instant payment system, for online Person-to-Person (P2P) funds transfers increased to 29.2 million users from 25.8 million. P2P value and volume of transactions processed through Raast during the third quarter grew by 92.3% and 55.6% respectively, with 41.2 million transactions amounting to Rs872.8 billion respectively.

With increasing number of digital platforms and online shopping avenues, transactions through Point-of-Sale (PoS) have also witnessed growth, with volume of transactions increasing by 6.8% and value by 10.1%.

However, ATMs transactions remained similar to the previous quarter in terms of volume but increased 6% in value, according to the SBP report.

The average ticket size of transactions through PoS was Rs5,463 per transaction while for ATM based transactions, it was Rs15,429 per transaction, according to the report.

The value of e-commerce transactions processed by banks increased by 7.1% to reach Rs36.6 billion by the end of the third quarter of FY23.

There were 112,302 PoS machines installed across the country by the end of Q3 FY23, increasing from 96,975 PoS machines in the same quarter last year.

The volume of paper-based transactions declined from 95.5 million in Q2 FY23 to 94.3 million in Q3 FY23. However, its value increased by 3% to Rs1,646.6 billion during the quarter.

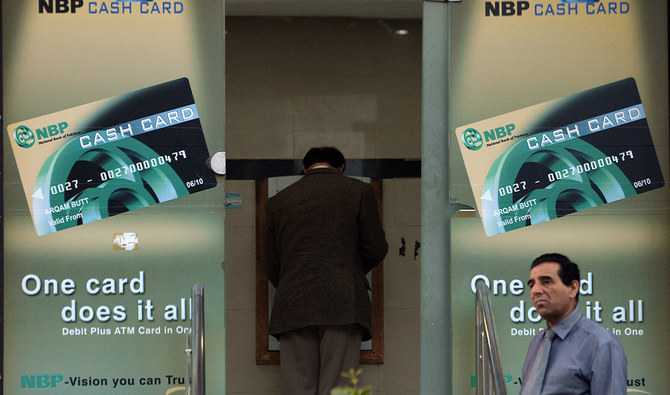

“As of quarter-end Mar-23, total payment cards issued in Pakistan stood at 48.4 million of which, 46.0 million are issued by Banks/ Micro Finance Banks (MFBs) while the remaining 2.4 million are issued by EMIs,” the report said.

Payment cards in Pakistan can be categorized into four categories, debit, credit, pre-paid and social welfare cards. Out of total cards in circulation, there are 37.1 million debit cards capturing 76.7% share of total cards followed by 9.2 million social welfare cards that make up 19.1%, 1.9 million credit cards, which is 4%, and 0.2% prepaid cards.

However, the gap between male and female debt and credit card holders remains large in Pakistan.

“Around 81% of all debit card holders are male, 19.2% female,” the report said.