DUBAI: Three years after the COVID-19 pandemic forced Saudi Arabia to impose strict travel restrictions, this year’s Hajj has given a palpable boost to the regional economy, with an estimated 1.6 million Muslims from around the world converging on Islam’s holiest sites.

The annual pilgrimage began on Sunday with the ritual of Tawaf Al-Qudum, when pilgrims dressed in white robes walk in a circle around the Kaaba, the stone structure at the center of Masjid Al-Haram, or the Grand Mosque, the most important mosque and holiest site in Islam.

With pandemic restrictions imposed in 2020 fully lifted, a very large number of people were able to participate in Hajj this year, creating increased business opportunities for travel agencies, airlines and the hospitality industry in the Kingdom and the wider Gulf region.

With the coronavirus emergency over, the annual pilgrimage is essentially back to normal. (SPA)

The number of pilgrims is significantly higher this year compared with the period during the pandemic. Only 10,000 people were permitted to participate in 2020, and about 59,000 in 2021, because of social-distancing rules.

Last year capacity was greatly increased but still capped at 1 million pilgrims. During that time authorities also imposed an age cap of 65 to protect older people, who were considered more vulnerable to the most severe symptoms associated with COVID-19.

Now, thanks to the success of the vaccines developed to combat the coronavirus and the lifting of travel bans and other restrictions, the annual pilgrimage is essentially back to normal and the Hajj economy is enjoying something of a post-pandemic rebound.

Through the combined efforts of the Kingdom’s flag carrier, Saudia, and budget airline flyadeal, more than 600,000 pilgrims were transported from domestic terminals to Hajj sites, Saudia Group said.

Saudia, the Kingdom’s flag carrier, and budget airline flyadeal combined transported more than 600,000 pilgrims from local airports to the holy sites this Hajj season. (SPA /File Photo)

The firm, which also operates Saudia Private Aviation in addition to Saudia and flyadeal, said it provided more than 1.2 million seats on its fleet of 164 aircraft, transporting pilgrims to and from more than 100 regular and 14 seasonal destinations, including Jeddah, Riyadh, Dammam, Madinah, Taif and Yanbu.

Just before Eid Al-Adha, the UAE’s flag carrier, Emirates, also added extra flights to cater to an increase in travelers. Ten flights to and from Jeddah, all operated using Boeing 777 aircraft, were added to accommodate Hajj pilgrims until July 7.

These extra Hajj flights were in addition to Emirates’ existing scheduled services to Saudi Arabia and were available to all travelers holding a valid Hajj visa. All passengers over the age of 12 were required to be vaccinated against COVID-19.

Emirates said there had been an increase in bookings for Hajj travel from Pakistan, India, Bangladesh, Indonesia, Thailand, Senegal, Ivory Coast, Mauritius and South Africa. The airline also added 34 flights to popular vacation destinations during the six-day Eid Al-Adha holiday.

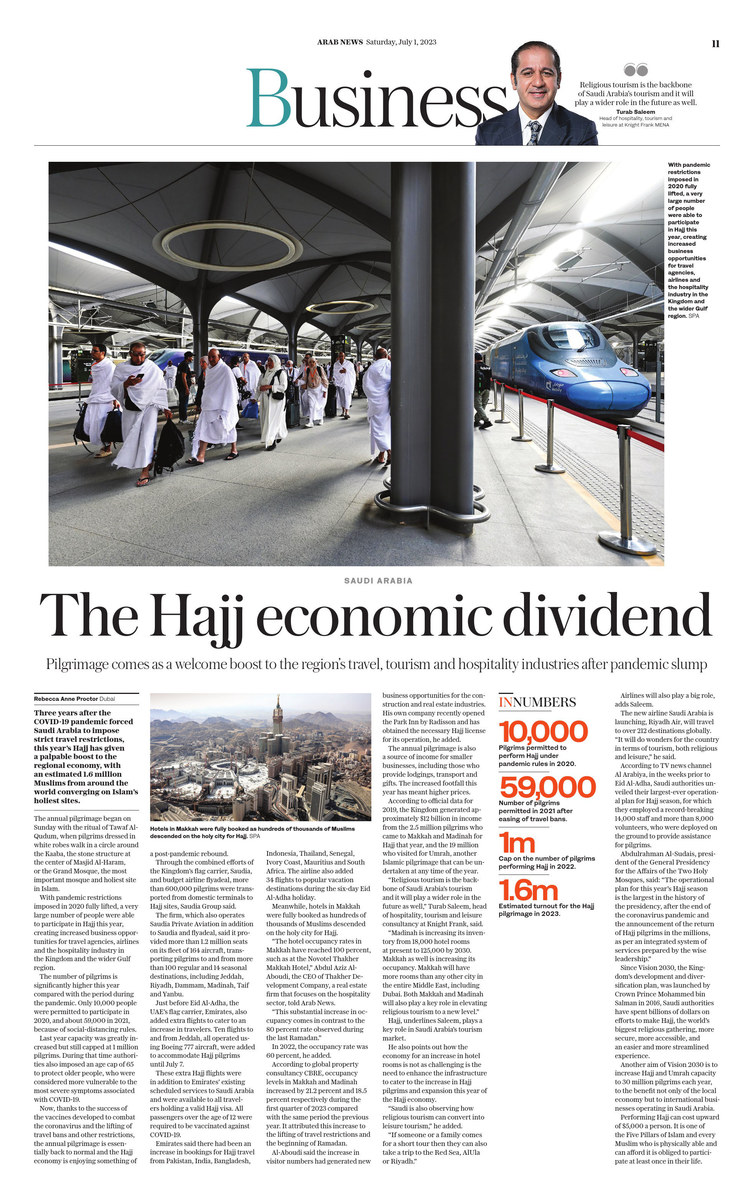

Meanwhile, hotels in Makkah were fully booked as hundreds of thousands of Muslims descended on the holy city for Hajj.

“The hotel occupancy rates in Makkah have reached 100 percent, such as at the Novotel Thakher Makkah Hotel,” Abdul Aziz Al-Aboudi, the CEO of Thakher Development Company, a real estate firm that focuses on the hospitality sector, told Arab News.

“This substantial increase in occupancy comes in contrast to the 80 percent rate observed during the last Ramadan.”

Hotels in Makkah were fully booked as hundreds of thousands of Muslims from the 2.5 million pilgrims who descended on the holy city for Hajj. (SPA)

In 2022, the occupancy rate was 60 percent, he added.

According to global property consultancy CBRE, occupancy levels in Makkah and Madinah increased by 21.2 percent and 18.5 percent respectively during the first quarter of 2023 compared with the same period the previous year. It attributed this increase to the lifting of travel restrictions and the beginning of Ramadan.

Al-Aboudi said the increase in visitor numbers had generated new business opportunities for the construction and real estate industries. His own company recently opened the Park Inn by Radisson and has obtained the necessary Hajj license for its operation, he added.

The annual pilgrimage is also a source of income for smaller businesses, including those who provide lodgings, transport and gifts. The increased footfall this year has meant higher prices.

IN NUMBERS

10,000 Pilgrims permitted to perform Hajj under pandemic rules in 2020.

59,000 Number of pilgrims permitted in 2021 after easing of travel bans.

1 million Cap on the number of pilgrims performing Hajj in 2022.

1.6 million Estimated turnout for the Hajj pilgrimage in 2023.

According to official data for 2019, the Kingdom generated approximately $12 billion in income from the 2.5 million pilgrims who came to Makkah and Madinah for Hajj that year, and the 19 million who visited for Umrah, another Islamic pilgrimage that can be undertaken at any time of the year.

“Religious tourism is the backbone of Saudi Arabia’s tourism and it will play a wider role in the future as well,” Turab Saleem, head of hospitality, tourism and leisure consultancy at Knight Frank, told Arab News.

“Madinah is increasing its inventory from 18,000 hotel rooms at present to 125,000 by 2030. Makkah as well is increasing its occupancy. Makkah will have more rooms than any other city in the entire Middle East, including Dubai. Both Makkah and Madinah will also play a key role in elevating religious tourism to a new level.”

Madinah's shopping centers and hotels are once again seeing a surge in customers since the lifting of pandemic restrictions. (SPA)

Hajj, underlines Saleem, plays a key role in Saudi Arabia’s tourism market.

He also points out how the economy for an increase in hotel rooms is not as challenging is the need to enhance the infrastructure to cater to the increase in Hajj pilgrims and expansion this year of the Hajj economy.

“Saudi is also observing how religious tourism can convert into leisure tourism,” he added.

“If someone or a family comes for a short tour then they can also take a trip to the Red Sea, AlUla or Riyadh.”

Airlines will also play a big role, adds Saleem. The new airline Saudi Arabia is launching, Riyadh Air will travel to over 212 destinations globally.

“It will do wonders for the country in terms of tourism, both religious and leisure,” he said.

Places as far as Jizan are expected to benefit from an influx of visitors as the Kingdom's religious tourism program goes in full swing. (SPA)

According to TV news channel Al Arabiya, in the weeks prior to Eid Al-Adha, Saudi authorities unveiled their largest-ever operational plan for Hajj season, for which they employed a record-breaking 14,000 staff and more than 8,000 volunteers, who were deployed on the ground to provide assistance for pilgrims.

Abdulrahman Al-Sudais, president of the General Presidency for the Affairs of the Two Holy Mosques, said: “The operational plan for this year’s Hajj season is the largest in the history of the presidency, after the end of the coronavirus pandemic and the announcement of the return of Hajj pilgrims in the millions, as per an integrated system of services prepared by the wise leadership.”

Since Vision 2030, the Kingdom’s development and diversification plan, was launched by Crown Prince Mohammed bin Salman in 2016, Saudi authorities have spent billions of dollars on efforts to make Hajj, the world’s biggest religious gathering, more secure, more accessible, and an easier and more streamlined experience.

Another aim of Vision 2030 is to increase Hajj and Umrah capacity to 30 million pilgrims each year, to the benefit not only of the local economy but to international businesses operating in Saudi Arabia.

Performing Hajj can cost upward of $5,000 a person. It is one of the Five Pillars of Islam and every Muslim who is physically able and can afford it is obliged to participate at least once in their life.