KARACHI: The International Monetary Fund’s (IMF) $3 billion bailout deal will provide much-needed fiscal space to Pakistan but not solve the country’s long-term problems, financial experts and economists said on Saturday.

Subject to the IMF’s board approval in July, the stand-by arrangement (SBA) provides breathing space to a Pakistani economy staring at default and in dire need of external financing. The staff-level pact was announced a day before Pakistan’s previous $6.5 billion loan program with the IMF expired.

Cash-strapped Pakistan will get $1.1 billion in funds under the new financing arrangement right after the IMF’s board meeting in mid-July. The new deal provides Pakistan more than the $2.5 billion disbursement it expected to receive under the Extended Fund Facility (EFF) program that concluded incompletely on June 30, 2023.

“The SBA provides some much-needed space to the Pakistani economy and will most certainly dampen near-term uncertainty,” Uzair Younus, director of the Pakistan Initiative at the Washington-based think tank, the Atlantic Council, told Arab News.

“However, the economy remains in a precarious situation and the government has to try and sort out some of the major issues in the energy sector, reduce distortion in the exchange rate market, and adopt a policy framework that doesn’t just burn the external financing the country has unlocked to achieve near-term political objectives.”

Economists say the deal will only offer Pakistan short-term respite.

“It will not solve long-term problems of paying on average around $25 billion per year for the next three years,” Dr. Ikram ul Haq, a Lahore-based senior economist, told Arab News.

The new deal came through after Finance Minister Ishaq Dar revised the federal budget the government passed on June 9, 2023. Dar increased Pakistan’s revenue collection target to Rs9.415 trillion ($33 billion) and put total spending at Rs14.480 trillion ($51 billion), increasing the petroleum levy from Rs50 to Rs60 per liter.

Authorities have taken Rs215 billion ($752 million) additional tax measures, cut Rs85 billion expenditures, hiked allocations under the social safety Benazir Income Support Program (BISP) by Rs16 billion, and withdrew amnesty on foreign exchange inflows, while the central bank jacked up policy rate by 1 percent to record high at 22 percent in an emergency meeting.

Economists said the high cost of the IMF bailout package would be borne by the masses rather than the elite.

“The key to success of SBA and next program will be structural reforms that is Waterloo of our elites,” Haq said, adding that “the real victims will be masses who will pay higher indirect taxes and bear high cost of utilities as has happened under previous program.”

For now, the SBA has had a positive impact on local and international investors’ confidence, with Pakistan’s sovereign dollar bond, maturing in 2024, gaining its value as fears of default subsided.

“Significant upward movement in bond prices demonstrates growing optimism among investors regarding Pakistan’s ability to address its economic challenges and implement necessary reforms under the IMF-supported program,” Tahir Abbas, head of research at Arif Habib Limited told Arab News.

Pakistani analysts and currency dealers expect that the country’s capital markets may rally from next week in response to positive the development, which would unlock further funding from bilateral and multilateral partners.

Malik Bostan, president of the Exchange Companies Association of Pakistan (ECAP) hoped the IMF deal would help Pakistan’s national currency regain its lost value.

“The rupee is expected to recover about Rs5 to Rs10 on the opening day of trading and will further strengthen by Rs10 to Rs20 with the inflow of funds,” Bostan told Arab News. “Those hoarding dollars for gains will not suffer losses if they don’t come out to sell.”

IMF’s $3 billion bailout deal will not solve Pakistan’s long-term problems, say experts

https://arab.news/y4ymw

IMF’s $3 billion bailout deal will not solve Pakistan’s long-term problems, say experts

- Economists say IMF agreement provides much-needed space to Pakistani economy, will dampen near-term uncertainty

- Pakistani rupee to recover by Rs10-20 against the US dollar when the IMF funds are received, says currency dealer

Pakistan’s average inflation to remain between 5.5-7.5% during FY25— central bank

- Pakistan’s real GDP growth rate expected to hover between 2.5-3.5%, says State Bank of Pakistan

- Central bank says “strong momentum” in remittances, exports to continue outpacing increase in imports

ISLAMABAD: Pakistan’s average inflation is expected to remain in the 5.5-7.5% range in the fiscal year ending June 2025, the country’s central bank said in its half-yearly economic report this week, stating that its real GDP growth is expected to hover between 2.5-3.5%.

Pakistan’s economy has improved in recent months, supported by declining inflation, which caused the central bank to reduce its policy rate to 12% after a series of cuts totaling 1,000 basis points since June 2024.

In a report titled “The State of Pakistan’s Economy, Half Year Report FY25” released on Monday, the State Bank of Pakistan (SBP) noted that inflationary pressures have receded notably, with headline inflation reaching a multi-decade low of 0.7% by March 2025.

“In view of steeper-than-anticipated disinflation, combined with an adequately tight monetary policy stance, continued fiscal consolidation and an ease in global commodity prices, the SBP projects average inflation for FY25 to fall in the range of 5.5–7.5 percent,” the SBP said in a press release.

Pakistan’s inflation rate rose to a record high of 38% in May 2023 on account of surging food and fuel costs. This was caused by Islamabad’s move to withdraw energy and fuel subsidies under a deal agreed with the International Monetary Fund in exchange for a financial bailout package.

The report said Pakistan’s current account balance is projected to remain in the range of -0.5 to 0.5 percent of the GDP. The central bank said it expects a “strong momentum” in foreign remittances and exports to continue outpacing the increase in imports.

“This is expected to cushion against lower financial inflows and help strengthen external buffers,” the report said. “The SBP’s projection for real GDP growth remains unchanged in the range of 2.5–3.5 percent.”

The report highlighted downside risks in the form of additional fiscal consolidation and less-than-expected wheat harvests. It pointed out risks to the medium-term outlook, largely stemming from global trade disruptions and related commodity price volatility in light of Washington’s tariffs, changing geo-political situations, adjustments in administered energy prices and spillover of movements in international currencies on the local currency.

Pakistan to hold inaugural Digital Foreign Direct Investment Forum today

- Pakistan’s IT ministry is organizing event with Digital Cooperation Organization, from April 29-30 in Islamabad

- Over 400 delegates, more than 200 IT and telecom companies expected to attend event from over 30 countries

ISLAMABAD: Pakistan will hold a two-day inaugural Digital Foreign Direct Investment (DFDI) Forum 2025 starting today, Tuesday, as it aims to showcase its digital economy potential, attract foreign funding and promote technology exchanges.

The DFDI will be hosted in Pakistan’s capital from April 29-30 and is being organized by the Pakistani IT and Telecommunication ministry in collaboration with the Digital Cooperation Organization (DCO). Over 400 delegates and more than 200 IT and telecom companies will attend the event from over 30 countries.

The forum will aim to bring together global policymakers to discuss frameworks that enhance digital infrastructure, adoption and exports across the 16 DCO member states. It will showcase the readiness of DCO member states, with Pakistan as the host, for digital investment by leveraging their skilled talent, supportive policies, and high-growth sectors such as fintech, AI and cybersecurity.

“We will be welcoming around 100 plus international delegates,” Pakistan’s IT Minister Shaza Fatima Khawaja told reporters at a briefing about the event on Monday. “We will be having over 10 ministers and vice ministers of IT and other allied ministries from different countries.”

The minister said more than 30 investors, both national and international, will participate in the event. She noted that Pakistan’s IT industry has been growing at a “reasonably fast pace,” adding that the country has seen an export growth between 24 percent to 27 percent annually.

“And we’re trying to actually increase the base further up, trying to hit the target of $4 billion hopefully this year,” she said. “Last year it was $3.2 billion.”

As of 2025, Internet penetration in Pakistan was estimated at 58.4 percent, as per the IT ministry, with 142 million Internet users in a population of over 240 million. Mobile penetration is at 79.4 percent, including 72.99 million smartphone users.

Pakistan also has an over $3 billion IT export market, with IT exports reaching $1.86 billion in the first half of fiscal year 2024-25, up 28.04 percent year-on-year. Its exports grew 26 percent in the first half of the current fiscal year, reaching $300 million monthly.

But the forum is being held as digital media in Pakistan has been muffled with measures by telecom authorities to slow down Internet speeds and restrict VPN use while social media platform X has been blocked for over a year. Earlier this year, parliament approved a law to regulate social media content that rights activists and experts widely say is aimed at curbing press freedom and controlling the digital landscape. The government denies this.

Last year, the Pakistan Software Houses Association (P@SHA) said Pakistan’s economy could lose up to $300 million due to Internet disruptions caused by the imposition of a national firewall to monitor and regulate content and social media platforms. The government denies the use of the firewall for censorship.

Khawaja, however, said the government genuinely feels that the freedom Pakistani citizens generally have with regard to Internet usage is “quite high.”

“Actually except for X that you mentioned, there is no platform that is not accessible to anyone,” she said. “There are no, per se, restrictions on the usage.”

Pakistan will assume the DCO’s presidency in 2026, Khawaja said.

Pakistan’s solar revolution leaves its middle class behind

- Affluent Pakistanis buy cheap Chinese solar panels to counter rising electricity tariffs

- Most solar panels aren’t connected to sell excess capacity to grid so benefits aren’t widely shared

KARACHI: Amid the forty-degree heat that paralyzed the coastal city of Karachi in April, Saad Saleem blasted his air-conditioning with near-abandon.

Electricity tariffs have surged, but the affluent entrepreneur has been unbothered since he spent $7,500 installing solar panels on his bungalow’s roof as part of a solar boom in Pakistan.

Saleem bought his modules two years ago, as the International Monetary Fund and economically beleaguered Pakistan were hammering out a preliminary bailout program. Under the deal, Pakistan sharply raised power and gas tariffs to support struggling suppliers in the heavily indebted sector.

Pakistanis now pay more than a quarter more on average for electricity, setting off a scramble to install solar modules.

Solar made up over 14 percent of Pakistan’s power supply last year, up from 4 percent in 2021 and displacing coal as the third-largest energy source, according to UK energy think-tank Ember. That is nearly double the share in China, the world’s top supplier of solar panels and a global leader in green technologies, and one of the highest rates in Asia, according to Reuters’ analysis of Ember data.

But the explosion in solar uptake has left out many in Pakistan’s struggling urban middle class, who have been forced to cut back on electricity in face of soaring bills, according to interviews with more than two dozen people, including energy officials, consumers and power-sector analysts. Most of the nation’s solar panels aren’t connected to sell excess capacity to the grid, so the benefits of cheap and reliable power aren’t widely shared.The flight of affluent Pakistanis with solar access from the national grid has dealt a further blow to those relying on pricey conventional sources of power. Electricity companies that lost their most lucrative clients have been forced to additionally hike prices on their shrinking pool of customers to cover operating costs, according to Arzachel, a Karachi-based energy consultancy.

Some observers also blame financial stress in the energy sector on deals Pakistan made with China for Beijing to finance billions of dollars’ worth of power-generation contracts, many of which involve coal-fired plants. Pakistan is behind on many of the payments and has been in talks with China about extending the time it has to repay the debt.

Countries like South Africa also face widening energy gaps after affluent residents adopted solar power. But analysts are watching Pakistan particularly closely due to the pace at which the nation of 250 million has taken to sun-based energy.

“This could serve as a cautionary tale as to how regulation and policy needs to keep up with technological change and rapidly evolving economics,” said Haneea Isaad, an Islamabad-based energy finance specialist at the Institute for Energy Economics and Financial Analysis.

In an interview with Reuters, Pakistan power minister Awais Leghari acknowledged the energy gap but noted that tariffs have come down significantly since June 2024, when the IMF approved reductions.

He also pointed to heavy uptake of solar by rural Pakistanis, many of whom previously had limited access to the grid. Many non-urban Pakistanis have installed small solar setups to meet their power needs, which are typically far lower than those of their city-dwelling counterparts.

“Pakistan has actually gone through a solar revolution,” he said. “The grid is going to get cleaner by the day, and this is something that we’ve achieved as a nation that we are proud of.”

The IMF did not return requests for comment.

ENERGY DIVIDE

Just a few miles away from Saleem’s upscale neighborhood, Nadia Khan has restructured her life to cut electricity costs.

The air-conditioning in the homemaker’s apartment is rarely used and she’s stopped ironing most of the clothes worn by her family of five, citing the price of power.

Khan’s family is not alone in cutting back: Only 1 percent of paying consumers used over 400 units of power in 2024, per Karachi-based consultancy Renewables First, down from 10 percent before the pandemic.

Like others among Pakistan’s masses of apartment dwellers without space to install solar modules, Khan has been shut out of the revolution.

The roofs of many apartment buildings are designated for water storage and other sanitation purposes, while owners of rental buildings have little incentive to invest in solar connections for their tenants.

“We get some sunlight indoors but I can’t seem to think of a way to go solar,” she said. “Why must people living in apartments suffer?“

Meanwhile, land-owning Pakistanis have benefited from the glut of Chinese-made low-cost solar modules shut out of the West by high tariffs.

China exported 16.6 gigawatts of solar capacity to Pakistan last year, according to Ember, about five times as much as in 2022. The average cost per watt of solar-module capacity exported also fell 54 percent in the same period.

However, most solar setups aren’t configured to send spare power back to the grid, limiting their benefit to the wider public. Renewables expert Syed Faizan Ali Shah, who advises the government on solar adoption, has said that less than 10 percent of solar consumers sell excess power to the grid.

Experts and government officials blame high costs and sanctioning delays. Connecting a solar module to the grid usually takes between three and nine months, said Renewables First energy expert Ahtasam Ahmad, prompting many to not bother.

Converting power generated from a solar panel for transmission to the grid also requires equipment like inverters, which typically cost between $1,400 and $1,800, or roughly half the median household income in Pakistan.

SUNK COSTS

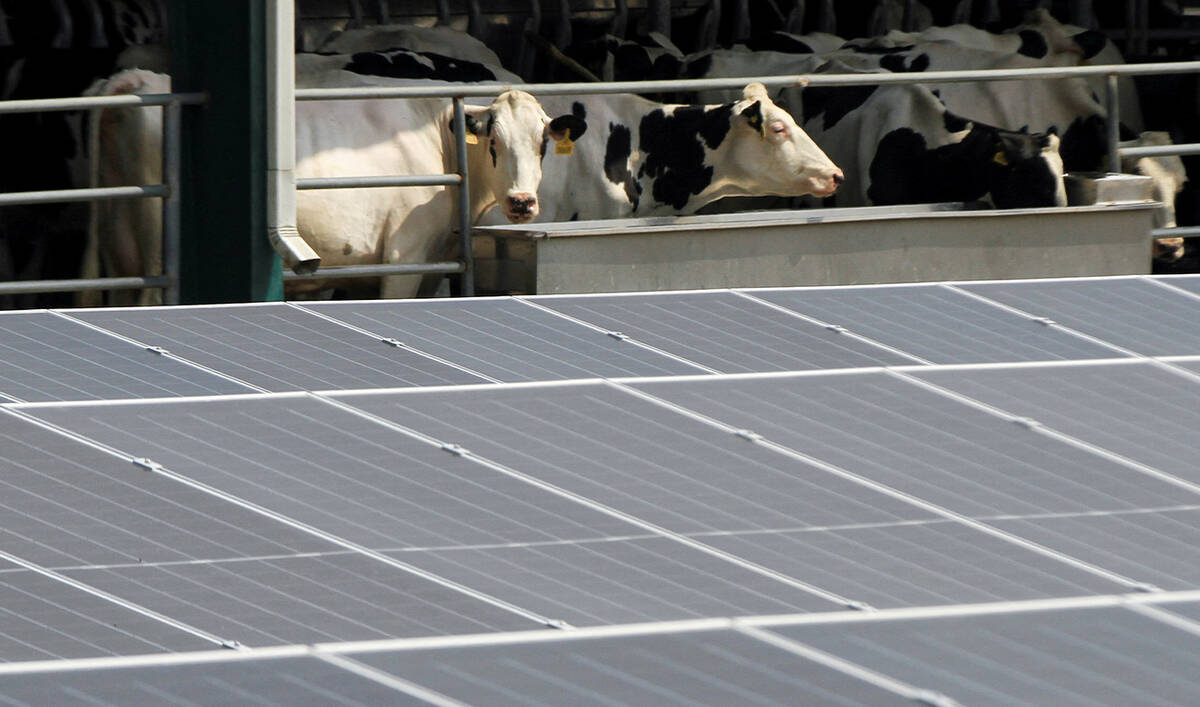

Pakistan conglomerate Interloop has installed hundreds of solar modules next to its cowsheds in Punjab province that help provide the electricity keeping its 9,300 livestock cool and their milk chilled.

The investment in solar has been a lucrative one for Interloop, which typically breaks even on solar installation costs after three to four years. Basic operating costs are about three quarters less than payments to the grid, said Interloop energy manager Faizan Ul Haq.

The money Interloop saves also reflects a gaping hole in the accounts of Pakistan’s power companies.

Even though industrial groups and wealthier Pakistanis now consume less grid power, suppliers’ costs haven’t changed proportionately. Fixed expenses like fuel contracts and upgrades to transmission architecture accounted for about 70 percent of supplier expenditure in the year to June 2024, according to an Arzachel estimate.

To cover costs, suppliers have raised prices on their remaining customers, who have already faced repeated increases as a result of the IMF deal.

Fixed costs of 200 billion rupees were shifted to non-solar consumers in the 2023-2024 fiscal year, meaning they paid 6.3 percent more per kilowatt-hour than they otherwise would have, according to Arzachel data.

Solar panel imports have increased since, meaning grid demand is likely to continue dropping, forcing remaining customers to pay more.

“Pakistan’s experience demonstrates a crucial lesson: when governments fail to adapt quickly enough, people take charge,” said Ahmad of Renewables First.

Pakistan begins Hajj operations as first flight departs from Islamabad with 442 pilgrims

- Over 89,000 Pakistani pilgrims will travel to Makkah and Madinah under government scheme via 342 flights

- Pakistan’s religious affairs minister urges pilgrims to adhere to Saudi Arabia’s laws during Islamic pilgrimage

ISLAMABAD: Pakistan kicked off its Hajj flight operations on Tuesday morning with the first batch of 442 pilgrims departing from Islamabad for Madinah under the Makkah Route Initiative, the country’s national airline said in a statement.

Over 89,000 pilgrims will travel under the government’s scheme during Pakistan’s 33-day-long Hajj flight operations. Pilgrims will travel to Makkah and Madinah via 342 flights in total, with the last one departing from Pakistan on May 31.

“The first Hajj flight for this year, Pakistan International Airlines (PIA) flight PK-713 carrying 442 pilgrims, departed under the Route to Makkah scheme from Islamabad International Airport today (Tuesday) at 4:45 am,” a PIA spokesperson said.

Federal Minister for Religious Affairs Sardar Muhammad Yousaf and Saudi Ambassador to Pakistan Nawaf bin Said Al-Malki bid farewell to the pilgrims at the airport.

The Makkah Route Initiative is designed to streamline immigration processes by enabling pilgrims to complete official travel formalities at their departure airports. Initially tested in Islamabad in 2019, the program was later expanded to Karachi, benefitting tens of thousands of Pakistani travelers. This saves pilgrims several hours upon arrival in the Kingdom, as they can simply enter the country without having to go through immigration again.

Around 50,500 Pakistani pilgrims will travel to Saudi Arabia under the initiative this year. The scheme was launched in 2019 by the Saudi Ministry of Hajj and Umrah and has been implemented in five countries: Pakistan, Malaysia, Indonesia, Morocco and Bangladesh.

A total of 28,400 pilgrims will leave for Saudi Arabia through 100 flights from the Islamabad airport, Pakistan’s religious affairs ministry said. Seven special immigration counters have been set up at the Islamabad airport to facilitate pilgrims under the Makkah Route Initiative.

The remaining 22,500 pilgrims will avail the scheme at the Jinnah International Airport in Karachi.

Yousaf advised Pakistani pilgrims to strictly adhere to Saudi Arabia’s laws and respect the local culture during the annual Islamic pilgrimage.

“As Hajj pilgrims, you are traveling to the sacred land as the guests of Allah and ambassadors of Pakistan, and you are urged to respect the laws and culture of Saudi Arabia,” the minister said in a televised address, as he bid farewell to the pilgrims.

Yousaf said he would “soon” travel to Saudi Arabia to review Hajj arrangements.

“I will take every possible measure to resolve the issues faced by Pakistani pilgrims in Saudi Arabia and will personally be among them to provide facilities,” he added.

Yousaf said the government was striving to extend the Makkah Route Initiative facilities to more Pakistani cities in the future.

“I am thankful to the Custodian of the Two Holy Mosques, King Salman bin Abdulaziz Al Saud, and Crown Prince Mohammed bin Salman bin Abdulaziz, for the excellent arrangements,” he added.

Yousaf said each pilgrim was provided a mobile SIM card that contains an application, which can be used to guide pilgrims with directions in case they lose their way in Mina.

Meanwhile, the second Hajj flight of the day departed from Pakistan’s eastern city of Lahore, carrying 150 pilgrims to Madinah at 8:00 am via AirSial airline’s flight PF-7700.

Six flights are scheduled to depart from Pakistan for the Kingdom on Tuesday: two from Lahore and one each from Islamabad, Karachi, Quetta and Multan.

This year’s annual pilgrimage will take place in June, with nearly 89,000 Pakistanis expected to travel to Saudi Arabia under the government scheme and over 23,620 Pakistanis expected to perform Hajj through private tour operators.

Pakistan eyes major boost in date palm exports with UAE’s assistance

- Pakistan currently exports 125,000 metric tons of dates, valued at nearly $50 million, with dry dates worth $35 million mainly exported to the UAE

- The UAE’s potential investment in establishing processing plants will increase shelf life of dates, maximize production and benefit farmers, envoy says

ISLAMABAD: Pakistan aims to boost its date palm exports beyond the current $50 million per annum with the help of the United Arab Emirates (UAE), Pakistan’s envoy to Abu Dhabi said on Monday.

Ambassador Faisal Niaz Tirmizi was recognized by the UAE for his outstanding contributions to date palm cultivation and production alongside Pakistani scientist Dr. Ghulam Sarwar Markhand, who won the prestigious “Influential Figure” award at the 17th Khalifa International Awards for Date Palm and Agricultural Innovation in Abu Dhabi on April 16. The event, under the patronage of UAE Vice President Sheikh Mansour bin Zayed Al-Nahyan, honored global leaders in agricultural innovation.

During the awards, Pakistan and the UAE signed a memorandum of understanding (MoU) for the second Pakistan International Date Palm Festival 2025 that will take place in the South Asian country later this year and marks a new chapter in agricultural cooperation between the two nations, according to the Pakistani mission in the UAE.

Ambassador Tirmizi told Arab News that Pakistan’s annual date production, which normally ranged between 500,000 and 600,000 metric tons, was expected to reach 800,000 metric tons this year.

“Pakistan currently exports 125,000 metric tons of dates, valued at nearly $50 million, with dry dates worth $35 million exported mainly to the UAE, while other destinations include Germany, the UK [United Kingdom], and Turkiye,” he said.

“Since the UAE market is a global re-export hub, it offers great opportunities for Pakistani agro-based products, including dates, to expand trade through different initiatives and marketing strategies.”

Pakistan produces large quantities of dates in Khairpur district of its southern Sindh province, and in Turbat and Panjgur districts of the southwestern Balochistan province. The export of these dates helps the country earn substantial revenue.

Dr. Markhand, who established a Date Palm Research Institute as a professor at Shah Abdul Latif University in Khairpur in collaboration with Pakistan’s Higher Education Commission, said he was excited to see three decades of his hard work earn global recognition at the Abu Dhabi awards.

“We worked on various aspects of date palm research, with major achievements including the micropropagation and tissue culture of date palms using inflorescence explants, a rarely used method,” he said, describing the details of his work.

The scientist said no one ever succeeded globally in producing female plants through this technique, but he successfully propagated several thousand plants, established a nursery, and distributed those plants among growers.

“These plants are now fruiting well, marking a major breakthrough in date palm tissue culture,” he said.

Dr. Markhand said Pakistan, in collaboration with the UAE, could benefit greatly in further developing the sector and increasing its exports.

At the Abu Dhabi awards, the UAE recognized Ambassador Tirmizi’s key role in facilitating high-level exchanges between government officials, private sector leaders and experts that created new avenues for bilateral cooperation in the field of date palm production.

“These efforts have led to the signing of several important MoUs aimed at boosting bilateral trade, enhancing agricultural exports, and promoting joint ventures in agri-tech, food security, and sustainable farming solutions,” the Pakistani diplomat said.

The Pakistani mission actively worked with Abu Dhabi’s Khalifa Award management to help set up processing plants in key areas and boost Pakistan’s value-added date chain, according to Tirmizi.

“Since dates are used in various ways in domestic, industrial applications and value-added product manufacturing, the UAE’s potential investment in establishing processing plants would increase the shelf life of dates, maximize high-quality date product output, benefit farmers with additional income, and generate local employment opportunities in Pakistan’s agriculture sector,” he shared