KARACHI: Amid sluggish domestic demand, major stakeholders in Pakistan’s engineering sector are optimistic about new business opportunities in the Middle East following the signing of a Free Trade Agreement (FTA) with the Gulf Cooperation Council (GCC).

Pakistan inked a preliminary agreement with the GCC last month to bolster trade relations with the regional bloc, which has not formalized such an agreement with any country since 2009. The FTA will now go through the GCC’s internal administrative and approval processes before taking effect.

Insiders in the Pakistani engineering sector have called the signing of the preliminary agreement a positive development that will enable industrial players to explore new opportunities and solidify their Middle Eastern presence.

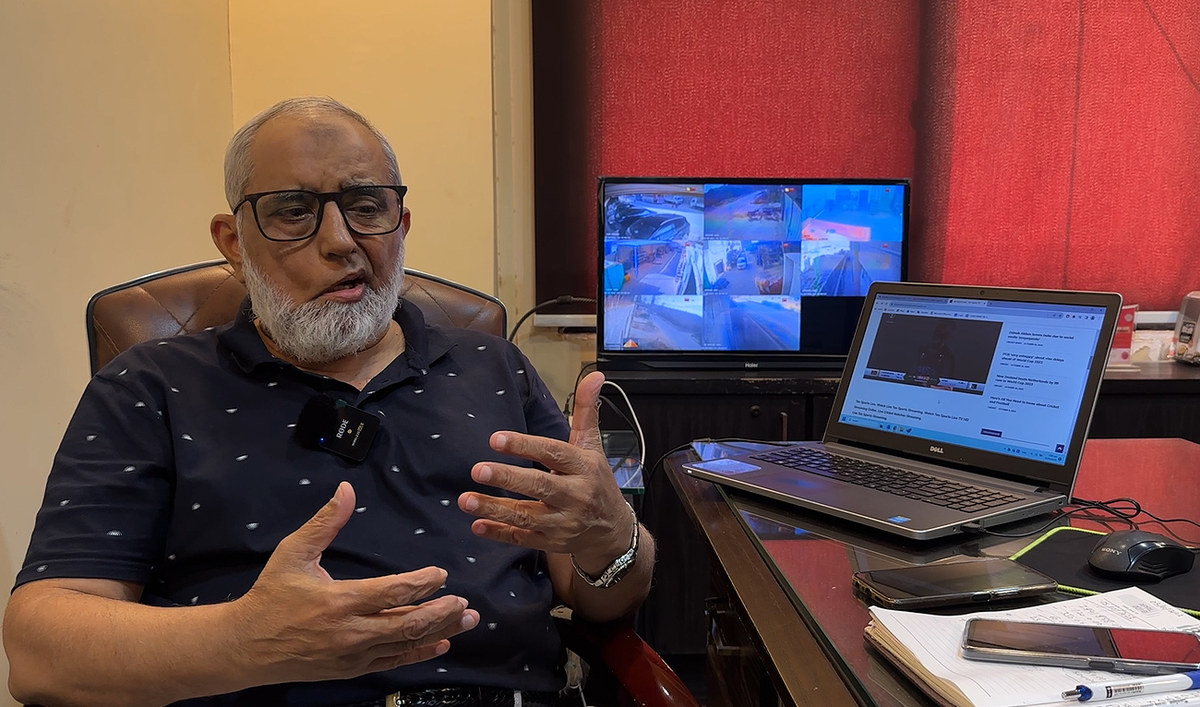

“This is really good news for us that the GCC countries and Pakistan have signed the [preliminary] FTA now,” Syed Muhammad Masood, CEO of Aftab Engineering Services (AES), owned by the United Arab Emirates-based Central Ventilation Systems (CVS), told Arab News in an interview this week.

In this picture, taken on October 10, 2023, Syed Muhammad Masood, CEO of Aftab Engineering Services, an auto parts manufacturing factory, speaks during an interview with Arab News in Karachi. (AN Photo)

Masood argued that Pakistan’s automotive industry would be able to better tap into the Middle Eastern market under the new FTA.

“You name any automotive brand and you will find it in the GCC,” he added. “We can explore the opportunities for the automotive parts, we can explore the opportunities for the HVAC [Heating, ventilation, and air conditioning] industry, we can explore the opportunities for the air conditioning industry. There are so many opportunities available.”

The AES official expressed confidence that the FTA would remove bilateral trade barriers between Pakistan and the GCC.

In this picture, taken on October 10, 2023, a worker operates a machine manufacturing auto parts at the Aftab Engineering Services factory in Karachi. (AN Photo)

Last month, his company exported six hydraulic sharing and punching machines for the HVAC industry for the first time after experiencing a downturn in domestic automotive demand.

“Considering the downfall in the automotive sector, we luckily managed to get orders for the customized hydraulic and punching machines from the UAE and we have successfully completed those machines and exported them,” Masood said, pointing out that his organization was expecting more orders from the Gulf region after the FTA was implemented.

Pakistan’s automobile industry contributes 2.8 percent to its GDP and Rs30 billion to the national exchequer in terms of annual taxes and duties, according to the country’s board of investment (BoI).

However, sectoral demand has shrunk due to various reasons, including rising dollar-rupee disparity and high costs of doing business leading to increasing automobile prices in Pakistan.

In this picture, taken on October 10, 2023, workers operate machine manufacturing auto parts at the Aftab Engineering Services factory in Karachi. (AN Photo)

“We have witnessed the downfall of the auto industry in Pakistan during the last two to three years and that is what prompted us to explore new avenues in the UAE market due to the presence of our owners [in that country],” Masood said, adding that his company’s production facility was only operating at up to 30 percent capacity.

Representatives from other Pakistani auto parts manufacturing firms also reported a 55 percent decline in annual sales amid rapid inflation and sluggish market conditions that have reduced production to less than 30 percent.

“We manufacture 459 dies and 155 parts for the auto industry and for that we have invested billions of rupees from 2019 to 2023, but due to the current industry issues our production has shrunk to less than 30 percent from 140 percent,” Mohsin Siddiqui, General Manager Plant at Agriauto, said in a statement issued last week.

In this picture, taken on October 10, 2023, a worker operates a machine manufacturing auto parts at the Aftab Engineering Services factory in Karachi. (AN Photo)

Pakistan’s exports of engineering goods, including auto parts, have declined by over 13 percent to $38.3 million during the current fiscal year between July and August.

However, the export of electric and specialized machinery for particular industries has seen a growth of 52 and 6 percent, respectively, according to the Pakistan Bureau of Statistics (PBS).