LONDON: Saudi Arabia seems to be the key exciting place in the region to be doing business and provides opportunities across e-commerce, logistics, tourism, transport and the on-demand economy, a leading global navigation company has said.

“We view Saudi as an incredibly exciting place to be doing business at the moment,” said Chris Sheldrick, co-founder and CEO of what3words. “I’ve been coming regularly for over five years and just seeing the rapid expansion there across, of course, the megaprojects like ROSHN and others that we’re very happy and excited to be involved in, but (also) all of the things which are pointing toward Vision 2030.”

What3words, which is a proprietary geocoding system designed to divide any location in the world into 3-meter squares, each with a unique combination of three words, has seen rapid growth in the Kingdom in the past couple of years.

The London-based company has signed several agreements with local companies in the past few months, further bolstering its reach in Saudi Arabia, which it sees as the gateway to the region for it to succeed in the Middle East, Sheldrick told Arab News, adding they expect more deals to be signed in the coming months.

The Kingdom’s leading national real estate developer, ROSHN, which is funded by the Public Investment Fund, signed a memorandum of understanding with the location technology solution-provider to adopt what3words addresses in all the communities it will be developing across the country, complementing the Saudi National Addresses.

The partnership targets ROSHN communities, all key social gathering points, retail and entertainment destinations, and public amenities, and residents will be able to receive packages delivered to their doorstep through courier service providers who are already using what3words.

ROSHN’s community operations staff will be able to use what3words addresses to dispatch field staff efficiently and accurately to the exact location where needed, and the deal aims to enhance the quality of life of residents and uplift the services offered within those communities.

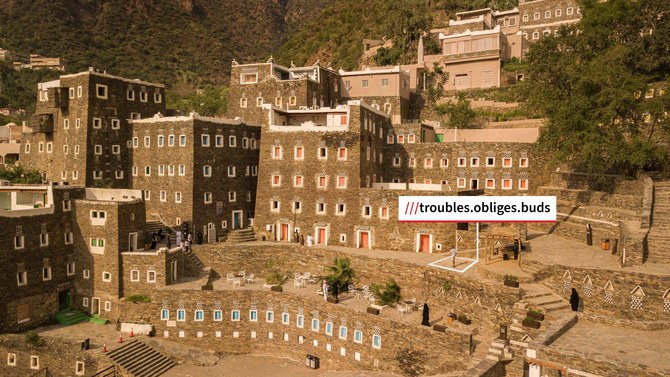

The Kingdom’s leading national real estate developer, ROSHN, signed a MoU with the location technology solution-provider to adopt what3words addresses in all the communities it will be developing across the country. Supplied

“They are using what3words for highlighting all of the key locations in their communities as well as where the houses are themselves, so it’s an enormous-scale project and with new properties being built and entire, if you like, regions and towns taking shape, people will need a ready-to-go address system to use.”

In June, what3words signed a deal with Eirad Trading and Contracting — UPS’s Authorized Service Contractor in the Kingdom, to integrate its technology into their in-flight communications and retailer application programming interface, enabling e-commerce businesses to offer their customers deliveries to any 3-meter-square in the country.

“We’ve had partnerships with other logistics companies like Aramex in the past, so this is a really key brand to be coming on board,” Sheldrick said, adding that Eirad has integrated what3words using a “very slick interface for consumers.”

Redsea, an e-commerce site for Abdul Latif Jameel Electronics, began introducing what3words in September and is a “shining example of what we’d like all the others to do as well,” he said.

“For citizens of Saudi, we’d love to see pretty much every e-commerce checkout page that they encounter, exactly the same as Redsea have done with that field on the checkout page.”

Other e-commerce partnerships they have secured recently include Flow Progressive Logistics, supply chain company Starlinks, shipping gateway company OTO, and Sheta and Saif home appliances and electronics store.

What3words is also focusing on car manufacturers and has now signed nearly 20 car navigation suppliers globally, so “when you go and buy your car, and you use the navigation, you would hope that what3words is embedded within it,” Sheldrick said.

“The Middle East is often one of the territories that is cited, given the address difficulties across the region by the car manufacturers to actually build this technology in, so it’s something that we want to be completely universal (and) that’s a big area of growth for us aside from e-commerce and logistics.”

The company has signed a number of deals with emergency services in the Kingdom, including the Saudi Red Crescent, but is looking to grow a lot more in that area, along with public transport targeting deals to integrate in both Saudi Arabia and the UAE.

Tourism and leisure is another key focus, and the latest travel guide for the Middle East issued by Lonely Planet has three word addresses printed all throughout that Saudi section for people to be able to find exact dive sites or the best hiking or camping spots in the middle of nowhere.

“If you leave the business and e-commerce aspects aside, when it comes to individual or personal use, there are a lot of leisure activities in Saudi Arabia (and) we definitely want people to think of us in that way as a platform that they can use to find absolutely anywhere when they’re enjoying themselves.”

Sheldrick said that he was looking forward to his visit to the Kingdom at the end of the month to attend the 7th Future Investment Initiative conference — a regular fixture in his diary as the event attracts many people from around the world.

“Our core value is that it’s literally an address for everywhere, so it doesn’t matter if it’s a big city, but the rural communities are often one of the places where addressing is the most difficult,” he said.

“What3words (which is available in 50 languages, including Arabic) is becoming increasingly well-known and we aspire to be a household name like we are in the UK, both in Saudi Arabia and the UAE.”