KARACHI: Pakistan’s stock market hit an all-time high on Wednesday on the back of a staff-level agreement reached last week with the International Monetary Fund (IMF) on the first review of a $3 billion bailout, which will unlock $700 million in funding for the cash-strapped country.

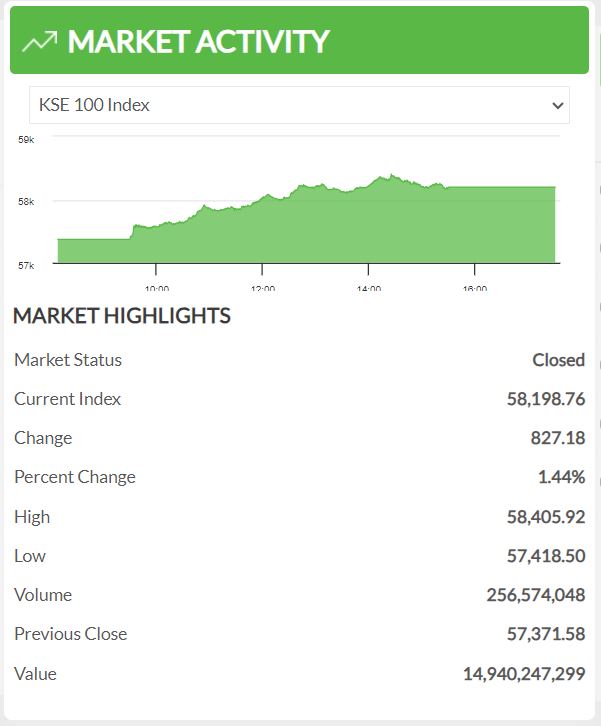

Pakistan’s benchmark share index, the KSE 100 index, gained 827 points to close at 58,198, another all-time high in one of the fastest recoveries witnessed at the Pakistan Stock Exchange (PSX).

The benchmark index has gained over 13,000 points or 29 percent since September this year, according to PSX data.

Pakistani financial experts attribute the historic growth to the completion of the first review of the IMF program and an expected cut in inflation and interest rates, as well as the expectation of political stability in the coming months as general elections are scheduled to be held in February.

“Investors at PSX think that the inflation and interest rates have peaked out, which would push the monetary easing cycle into motion as early as January 2024,” Tahir Abbas, head of research at Arif Habib Limited, told Arab News.

Abbas said the profitability of listed companies at PSX was continuously increasing but market valuation had not increased comparatively.

“The PE [price to earning] ratio which was 11.5 times and now is 4.3 times, which shows that the market is still attractive for investors,” he added.

“The completion of the first review of the IMF program and expected inflows of $700 million from the fund is also playing a contributing role in the upsurge of the stock market,” Samiullah Tariq, director research at Pakistan Kuwait Investment Company, told Arab News.

This graph shows Pakistan’s benchmark share index, the KSE 100 index, after closing of the session on November 22, 2023. (PSX)

“Generally, all the signals are positive,” he said, adding that the announcement of general elections in February was a “feel good factor” playing a positive role in the growth of the bourse on the expectation of a peaceful political transition.

Financial experts said they believed the stock market would continue to rally.

“Overall, there is more stability, and optimism compared to the situation a year ago,” Ali Farid Khwaja, chairman at Karachi-based KASB Securities, told Arab News, pointing to five contributing factors.

“Firstly, valuations were very cheap, especially compared to other assets such as real estate. Secondly, high inflation means that there is a lot more currency in circulation. Thirdly, there is a marked improvement in business sentiment since May last year,” the analyst said.

The fourth factor, Khwaja said, was that the caretaker government of Prime Minister Anwaar-ul-Haq Kakar had initiated credible reforms, which were giving confidence to investors.

“Lastly, there is expectation of foreign direct investment from Saudi Arabia and China for the privatization of state assets,” he added.

The national currency of Pakistan also posted slight gains on Wednesday against the United States dollar.

The rupee ended 0.23percent higher at Rs285.13 against the greenback in the interbank market.