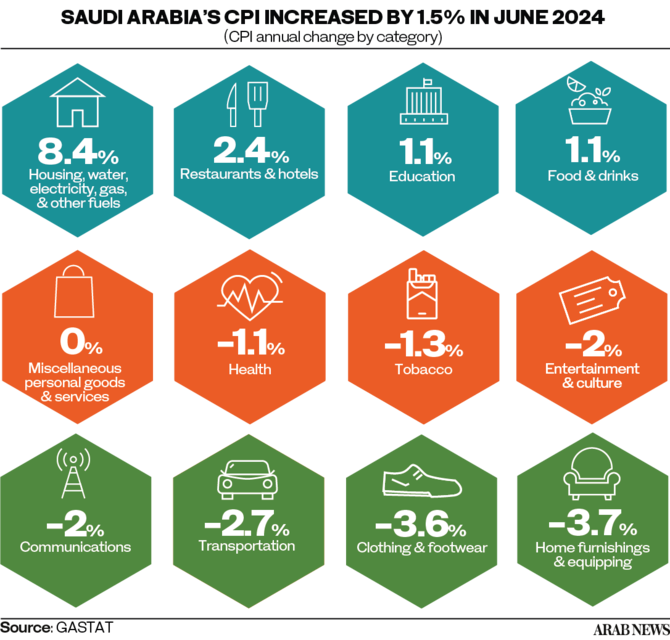

RIYADH: Saudi Arabia’s annual inflation rate reached 1.5 percent in June compared to the same month last year, driven primarily by rising housing costs, according to the latest data.

The report from the General Authority for Statistics highlighted that the 8.4 percent increase in the prices of housing, water, and electricity, as well as gas, and other fuels significantly contributed to the inflation rate.

Actual housing rents saw an increase of 10.1 percent, with villa rentals rising by 7.9 percent. This category’s substantial weight in the overall index had a considerable impact on the inflation rate.

Saudi Arabia’s inflation rate, while influenced by domestic factors such as housing and fuel costs, remains relatively moderate compared to other Gulf Cooperation Council countries, which have faced varying inflationary pressures due to different economic policies and market conditions.

According to the GASTAT report, food and beverage prices also saw an increase of 1.1 percent, influenced by a 6.5 percent rise in vegetable prices. The prices of restaurants and hotels rose by 2.4 percent, driven by a 9.8 percent increase in accommodation services.

The education sector witnessed a 1.1 percent increase, mainly due to a 4.1 percent rise in fees for intermediate and secondary education.

Conversely, the prices of furnishing and home equipment decreased by 3.7 percent, influenced by a 6.0 percent decline in furniture, carpets, and flooring prices.

Clothing and footwear prices dropped by 3.6 percent, with ready-made clothing prices falling by 6.3 percent.

Transportation costs also decreased by 2.7 percent, primarily due to a 4.6 percent reduction in vehicle purchase prices. Communication services saw a slight drop of 0.1 percent.

Monthly inflation

On a monthly basis, the consumer price index recorded a slight increase of 0.1 percent in June compared to the previous month.

This monthly increase was mainly influenced by the rise in housing, water, electricity, gas, and other fuels by 0.5 percent, driven by a 0.7 percent increase in actual housing rents and prices.

The report also noted minor increases in food and beverages with 0.1 percent, restaurants and hotels, and personal goods and services with 0.3 percent each, compared to the previous month.

Meanwhile, the prices of clothing and footwear decreased by 0.2 percent. Furnishings, household equipment, and maintenance saw a decline of 0.5 percent. Recreation and culture prices dropped by 0.3 percent, while communications also fell by 0.3 percent. Health expenses decreased by 0.1 percent, and tobacco prices went down by 0.2 percent.

The prices of education and transportation products remained stable.

Wholesale price index

In another report, GASTAT revealed that the wholesale price index increased by 3.2 percent in June compared to the same month of the previous year.

This increase was mainly driven by a 13.4 percent rise in prices of basic chemicals and an 11.9 percent increase in prices of refined petroleum products.

The category of other transportable goods saw an 8.0 percent increase, significantly impacted by these price rises.

Prices of food products, beverages, tobacco, and textiles rose by 1.3 percent, with leather, leather products, and footwear prices increasing by 6.6 percent, and grain mills, starch, and other food products rising by 4.6 percent.

However, on a monthly basis, the WPI decreased by 0.1 percent in June compared to May, attributed to a 0.3 percent decrease in the prices of ores and minerals, food products, beverages, tobacco, and textiles.

The prices of basic metals decreased by 0.6 percent, while prices of agriculture and fishery products increased by 0.4 percent, driven by a 1.8 percent rise in the prices of live animals and animal products.

Average prices

In a separate bulletin from the GASTAT, notable shifts in the average prices of goods and services across Saudi Arabia for June were revealed.

The data, which tracks price movements on a monthly basis, highlighted both increases and decreases in various categories, reflecting dynamic market conditions.

Several goods and services recorded substantial price increases in June compared to May.

Furnished apartments saw the highest increase at 22.47 percent, followed by hotel accommodation at 20.38 percent, Indian pomegranates at 8 percent, local cucumbers at 7.24 percent, and local fig at 7.23 percent.

The prices of 99mm, 300mm, and 120mm national electric cables increased by 3.39 percent, 3.37 percent, and 3.10 percent, respectively.

Conversely, several items experienced significant price drops during the same period. Local melons saw the highest decrease at 16.39 percent, followed by imported onions at 14.15 percent, local onions at 11.52 percent, Lebanese peach at 9.51 percent, and Pakistani mango at 8.79 percent.

Aluminum slightly decreased by 0.92 percent, 6mm national reinforcing iron by 0.80 percent, coal by 0.10 percent, and 15cm black block by 0.02 percent.

These reports provide a comprehensive overview of the price movements in Saudi Arabia, reflecting the diverse factors influencing inflation and the cost of living in the Kingdom. The data highlighted the complexity of the economic landscape, with significant variations across different sectors and categories.