RIYADH: US President Donald Trump’s $5 million “gold card” visa is expected to draw wealthy Arab investors seeking economic stability, US market access, and residency prestige, experts say.

With Gulf nations, including Saudi Arabia, successfully running their own golden visa programs, Trump’s initiative positions the US as a competitive destination for high-net-worth individuals from the region, offering them a gateway to business expansion, real estate investment, and financial security.

USCIS handout photo

Salman Al-Ansari, a geopolitical analyst and former investor in the US, told Arab News that the initiative could strengthen economic ties between the US and the Arab world, particularly Saudi Arabia, while driving investments into key industries.

“Saudi investors have always been keen on expanding into the US market, particularly in sectors like technology, real estate, and energy. A more accessible visa process could encourage even greater collaboration and economic integration between both countries,” Al-Ansari said.

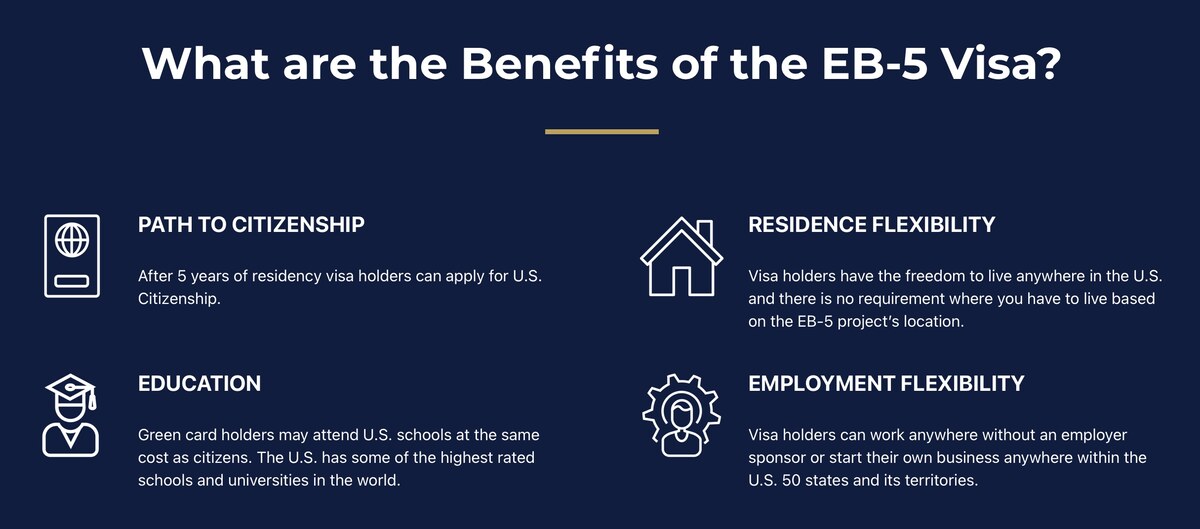

The new initiative will replace the existing EB-5 visa program, which was established in 1990, and is expected to help reduce the national deficit. The EB-5 program grants foreign investors a green card for investing around $1 million in a US business that creates or sustains at least 10 full-time jobs for local workers.

Trump said the initiative will not only bring in revenue but will also lead to job creation as wealthy individuals establish businesses and expand existing ventures on US soil.

“A lot of people are going to want to be in this country, and they’ll be able to work and provide jobs and build companies,” Trump said in the Oval Office announcement. “It’ll be people with money.”

Trump told reporters that investors could come to the US, obtain a green card through the president’s initiative, and contribute financially, with the generated funds helping to reduce the national deficit.

Despite growing global competition, the US remains a uniquely attractive destination for investors. Julien Hawari, founder and CEO of UAE-based content monetization platform Million, explained to Arab News what sets the US apart from similar visa programs worldwide.

Julien Hawari, founder and CEO, CEO of UAE-based content monetization platform Million. (Supplied)

“The speed, depth, and range of opportunities are exceptional. I believe the USA under a Trump administration could become even more attractive, with a significant number of decision-makers coming from the private sector — people like (Elon) Musk, for example,” Hawari said.

Trump described the program as a “green card-plus” and a path to citizenship. He expressed confidence in its appeal, calling it a “treasured” opportunity and noting that sales were expected to begin within about two weeks.

Secretary of Commerce Howard Lutnick, standing alongside Trump during the announcement, said: “Rather than having the EB-5 program, which was full of nonsense and fraud, we are replacing it with a program that is simple, straightforward, and brings in direct financial benefits.”

Deemed to be "full of nonsense and fraud" by the Trump administration, the EB -Visa scheme may soon be replaced.

For some, this marks a strategic shift in US immigration policy. Al-Ansari sees this as an extension of Trump’s “America First” strategy.

“President Trump has been constant in his ‘America First’ approach, and I see his golden visa initiative as a case of quality over quantity,” he said.

“The US has always been a magnet for immigrants, and this policy ensures that those entering contribute meaningfully to the economy. It aligns with the American ethos — rewarding entrepreneurship, talent, and investment.”

The Trump administration’s gold card initiative represents a major shift in US immigration policy, focusing on direct financial investment rather than traditional employment-based or family-sponsored immigration.

Many countries, including Portugal, Canada, and Australia, offer similar programs, but the high price tag of the US gold card positions it as a premier option for the global elite.

US Citizenship and Immigration Services office located in Las Vegas. (USCIS Handout photo)

Hawari noted that the success of golden visa programs in other regions, such as the Gulf Cooperation Council, may provide insight into how the US initiative could play out. “Look at the GCC — they have done a phenomenal job,” he said.

“Over the past decade, the number of companies and ultra-high-net-worth individuals moving to the region has been incredible. This shift has had a massive impact on their economy and overall transformation, from real estate to investments and beyond.”

Hawari explained that the US program “could have a similar effect.” However, he noted that the GCC’s success means the US program will face strong competition as one of several options. “I think people will end up choosing between these two, as they are now the most attractive destinations,” he added.

Al-Ansari noted: “Saudi Arabia, where I’m from, has launched a similar initiative called the Golden Residency. It has successfully attracted thousands of individuals who have contributed to the Saudi economy, and it continues to thrive.”

Salman Al-Ansari, geopolitical analyst. (Supplied)

He added that bureaucratic hurdles had previously made obtaining a business visa challenging and suggested that the new program could simplify the process, potentially attracting more high-value investments into the American market.

However, he expressed his concern about the linkage between the golden visa and the green card. “I’m not sure if investors, including myself, would want permanent residency, as it comes with tax obligations on all global income under the FATCA (Foreign Account Tax Compliance Act) law. It would be more attractive if the golden visa were a standalone option, rather than bundled with a green card,” he said.

If structured correctly, the initiative could lead to a wave of high-net-worth individuals moving their businesses and assets to the US, benefiting key metropolitan areas and industries.

The success of the golden visa programs in other regions, such as the Gulf Cooperation Council, may provide insight into how the US initiative could play out. (Shutterstock)

Al-Ansari said sectors like tourism, manufacturing, and services were likely to benefit. Hawari echoed this sentiment, pointing out that specific sectors stand to gain significantly from an influx of high-net-worth individuals.

“If you look at the GCC, almost every industry benefited. Maybe manufacturing didn’t benefit as much, along with some sectors that require longer-term investment. But overall, most industries saw a positive impact — and I expect the same in the US, with real estate, technology, hospitality, and finance likely leading the way,” he said.

Saudi Arabia introduced its permanent residency scheme, commonly known as the Saudi Green Card, in 2019 as part of its Vision 2030 plan. The program offers permanent residency for SR800,000 ($213,000) or an annually renewable residency for SR100,000. It aims to attract skilled expatriates and investors, boosting economic diversification and increasing the private sector’s contribution to gross domestic product.

Similarly, the UAE launched its Golden Visa in 2019, offering renewable 5 to 10-year residency permits for investors, entrepreneurs, and professionals in fields such as science, technology, and healthcare. The visa allows holders to live, work, and study in the UAE without a national sponsor and grants them the ability to sponsor family members

Night view of Riyadh's skyline. (Getty Images)

Qatar has also taken steps to attract investors by liberalizing its property market and expanding foreign ownership opportunities through its Investment Residence Program. These measures have particularly benefited the real estate sector, which experienced a boost leading up to the 2022 FIFA World Cup.

Across the GCC, these programs are strategically designed to drive foreign investments, strengthen key economic sectors such as real estate, hospitality, and services, and support long-term sustainable development.

Similarly, the newly unveiled US “gold card” program aims to attract high-net-worth individuals by offering a pathway to residency in exchange for investment.

As details emerge in the coming weeks, the initiative is expected to draw attention, particularly its potential to bring substantial foreign capital into the US economy and real estate market while bolstering key industries.