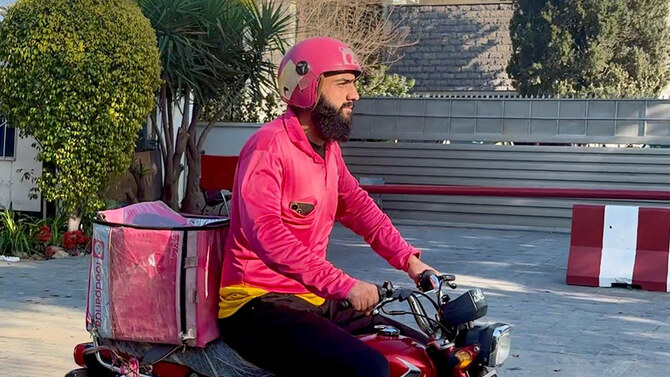

ISLAMABAD: Wearing his signature pink Foodpanda uniform, Hajji Khan stood waiting outside the white gate of a house in the Pakistani capital an hour before sunset would usher in the iftar meal in the holy month of Ramadan earlier this week.

Minutes later, the gate opened, and a customer received his order and paid Khan, who hurriedly hopped back onto his bike and sped off to complete the next delivery for Foodpanda, a prominent online food and grocery delivery platform in Pakistan.

The going gets a bit tough for Khan and other Foodpanda riders during the holy month of Ramadan, when Muslims fast from dawn to dusk and often order food through restaurants or home chefs for the iftar and pre-dawn suhoor meals. Because the timing of the fasting meals are set, there is no room to be late, and riders like Khan, 25, often have to break their fast on the go with water and a fried snack bought from a nearby food stall, or by sitting down for a quick, free meal at a roadside charity ‘dastarkhwan.’

“We do our best to ensure timely deliveries before iftar so that customers can break their fast peacefully,” Khan said this week as Arab News accompanied him on pre-sunset delivery runs.

Haji Khan, a Foodpanda rider, picks up an order from a restaurant in Islamabad, Pakistan, on March 14, 2025. (AN Photo)

“We usually break our fast at free iftar dastarkhwans set up along the roadside. However, if I have many orders, then I break my fast while on the way to a delivery.”

The youngest of five brothers who left his home in the eastern Pakistani city of Sargodha four years ago to find work in Islamabad, Khan says he works in Ramadan from 2pm till the end of the suhoor meal at around 5am, making around Rs50,000 [$178.61] during the holy month, a modest income that barely covers basic expenses.

GoNSave, a data company that serves leading gig platforms, said in a survey this month riders who worked during Ramadan and Eid cited personal financial needs, higher earnings from increased demand and incentives, and more job flexibility. At least 26.66 percent choose only to work during Ramadan.

‘SMALL ACTS OF KINDNESS’

While there are few orders during the morning and afternoon, Ramadan rush hour begins at around 4pm, around two hours before iftar. Then, it is no doubt a challenge to navigate the city’s busy and traffic-snarled roads on an empty stomach, the aroma of food wafting from the delivery box.

“Normally the day passes smoothly while fasting, but it becomes very challenging in the afternoon, when we start delivering food orders and the smell of food intensifies our hunger,” Khan said.

“This is our peak time, and fasting feels particularly difficult but we push ourselves to take as many orders as possible and deliver them before iftar.”

Haji Khan, a Foodpanda rider, prays at a local mosque in Islamabad, Pakistan, on March 14, 2025. (AN Photo)

Khan, who delivers around 25 orders per day, says generous customers sometimes invite him in to break his fast if it is close to iftar time.

These “small acts of kindness,” as Khan described them, made “all the difference” and pushed him to keep performing his duties despite the challenges.

“Sometimes, a kind customer invites me to break my fast with them or they hand me an iftar parcel,” he said, as he stopped at a mosque for Asr, the third of five obligatory prayers in Islam.

“But if there’s nothing, I stop at a roadside dastarkhwan and share a meal with strangers who for a moment feel like family.”