RIYADH: Saudi Arabia recorded SR10.5 billion ($2.8 billion) in point-of-sales transactions in the week ending April 5 with only restaurants and cafes witnessing a positive change, according to the latest figures from the Saudi Central Bank, also known as SAMA.

The dip in the overall spending can be attributed to the almost week-long Eid break in the Kingdom. Following Eid Al-Fitr, POS transactions dropped by 47.6 percent, data showed.

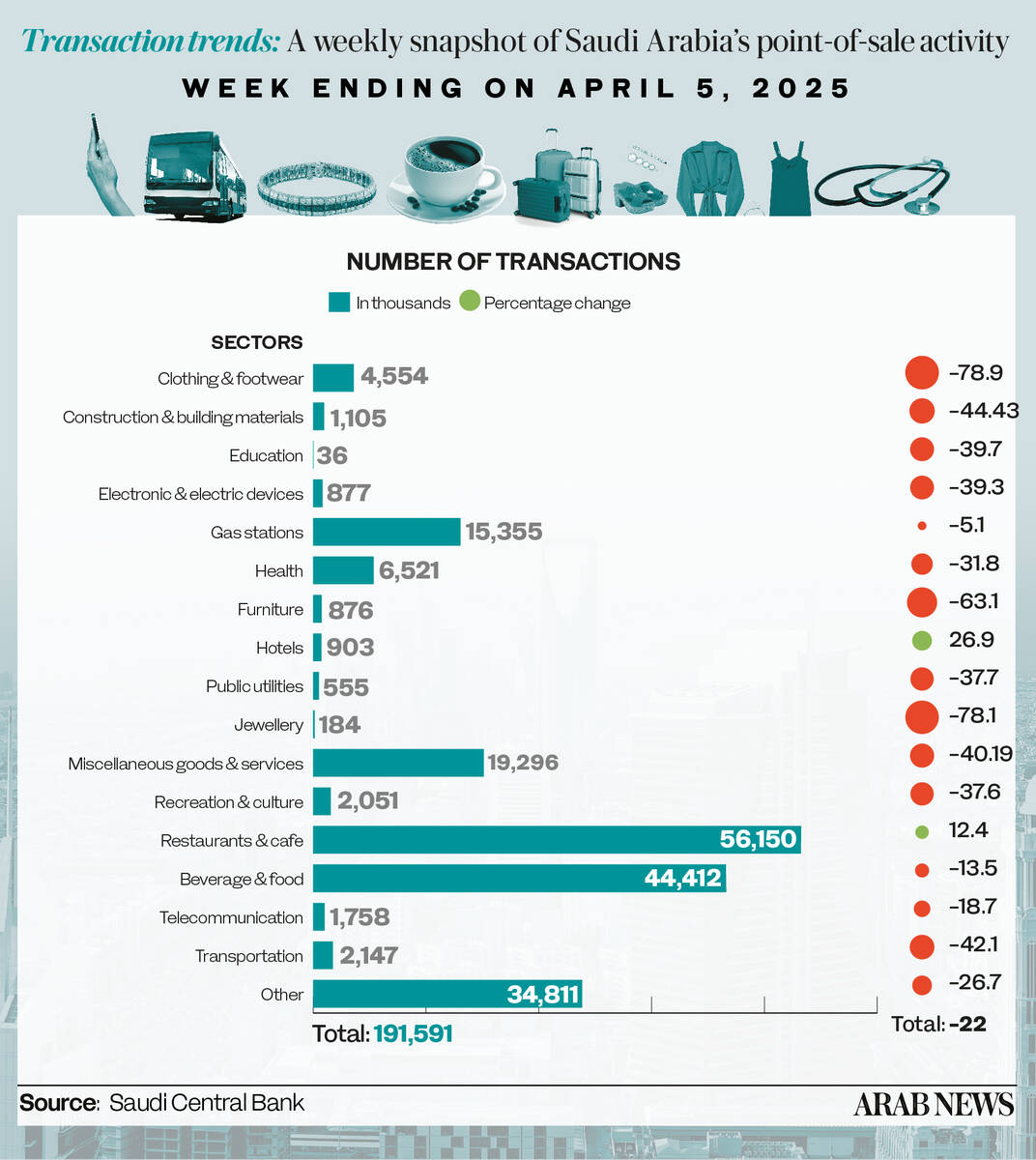

During that seven-day period, spending in restaurants and cafes was the only sector to record a rise, with the value of transactions increasing by 2.6 percent to SR2.23 billion. This sector also saw a 12.4 percent surge in terms of the number of sales, reaching 56.1 million, which claimed the biggest share of the POS.

Spending on clothing and footwear recorded the largest decrease at 82 percent to SR569.9 million. The education sector followed with a 69.8 percent fall to SR10.2 million.

Spending on furniture came in third place, dropping 68.5 percent to SR141 million, while transactions decreased by 63.1 percent to 876,000. Expenditure on transportation followed, falling by 66.8 percent to SR322.8 million.

Spending on miscellaneous goods and services decreased by 58.9 percent, bringing the total value of transactions to SR1.12 billion, claiming the third-largest share of the POS.

The value of transactions in the telecommunication and construction divisions dropped by 47.8 percent to SR86.6 million and 51.6 percent to SR148.8 million, respectively.

Spending on electronics dropped by 47.9 percent to SR10.2 million, while expenditure on public utilities saw a 47.8 percent dip to SR32.5 million. Spending on food and beverages recorded a 36.2 percent decline to SR1.64 billion but still held the second-biggest share of the POS.

Spending in the leading three categories accounted for approximately 47.5 percent or SR5 billion of the week’s total value.

E-commerce in Saudi Arabia accounted for 29 percent of all consumer retail payments in 2024, and this is projected to rise to 46 percent by the end of the decade.

A recent report from market research firm IMARC echoed these findings, emphasizing the growing influence of technology in shaping the e-commerce retail sector.

Geographically, Riyadh dominated POS transactions, representing around 30.3 percent of the total, with expenses in the capital reaching SR3.19 billion — a 49.9 percent decrease from the previous week.

Jeddah followed with a 49.7 percent increase to SR1.4 billion; Madinah came in third at SR516.5 million, down 44.7 percent.

Makkah experienced the most significant decrease in spending, dropping by 57.7 percent to SR515.6 million.

Tabuk followed with a 50.9 percent reduction to SR174.8 million.

Makkah and Tabuk saw the largest falls in terms of number of transactions, dropping by 35.7 percent and 26.1 percent, respectively, to 8.1 million and 3.5 million transactions.