TOYOTA CITY: Toyota Motor Corp. is doubling down on its investment in hydrogen fuel cell vehicles, designing lower-cost, mass-market passenger cars and SUVs and pushing the technology into buses and trucks to build economies of scale.

As Toyota cranks up improvements for the next generation of its Mirai hydrogen fuel cell vehicle (FCV), expected in the early 2020s, it is hoping it can prove wrong rival automakers and industry experts who have mostly dismissed such plans as commercially unviable.

The maker of the Prius, the world’s first mass-produced “eco-friendly” gasoline-hybrid car in the 1990s, says it can popularize FCVs in part by making them cheaper.

“We’re going to shift from limited production to mass production, reduce the amount of expensive materials like platinum used in FCV components, and make the system more compact and powerful,” Yoshikazu Tanaka, chief engineer of the Mirai, said in an interview with Reuters.

It is planning a phased introduction of other FCV models, including a range of SUVs, pick-up trucks, and commercial trucks beginning around 2025, a source with knowledge of the automaker’s plans said.

The automaker declined to comment on specific future product plans. But it has developed FCV prototypes of small delivery vehicles and large transport trucks based on models already on the road, as Tesla Inc. develops a battery-operated commercial semi-truck from the ground up.

“We’re going to use as many parts from existing passenger cars and other models as possible in fuel cell trucks,” said Ikuo Ota, manager of new business planning for fuel cell projects at Toyota. “Otherwise, we won’t see the benefits of mass production.”

The company is also betting on improved performance. Toyota wants to push the driving range of the next Mirai to 700-750 kilometers from around 500 kilometers, and to hit 1,000 kilometers by 2025, a separate source said.

Driven by the belief that hydrogen will become a key source of clean energy in the next 100 years, Toyota has been developing FCVs since the early 1990s.

Hydrogen is the most abundant element in the universe and stores more energy than a battery of equivalent weight.

The Mirai was the world’s first production FCV when it was launched in 2014. But its high cost, around $60,000 before government incentives, and lack of refueling infrastructure have limited its appeal. Fewer than 6,000 have been sold globally.

LMC Automotive forecasts FCVs to make up only 0.2 percent of global passenger car sales in 2027, compared with 11.7 percent for battery EVs. The International Energy Agency predicts fewer FCVs than battery-powered and plug-in hybrid electric vehicles through 2040.

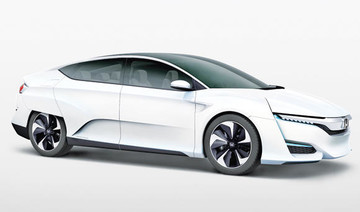

Many automakers, including Nissan Motor Co. and Tesla, see battery-powered cars as a better, zero-emission solution to gasoline engines. Only a handful, including Honda Motor Co. and Hyundai Motor Co, produce FCVs.

But people familiar with Toyota’s plans said the automaker thinks demand will perk up as more countries, including China, warm to fuel cell technology. The company also sees FCVs as a hedge against a scarcity of key EV battery materials such as cobalt.

For now, Mirais are assembled by hand at a plant in Toyota City, where 13 technicians push partially constructed units into assembly bays for detailed inspections. This process yields just 6.5 cars a day, a sliver of Toyota’s average domestic daily production of about 13,400 vehicles.

Strategic Analysis Inc, which has analyzed costs of FCVs including the Mirai, estimates that it costs Toyota about $11,000 to produce each of its fuel cell stacks, by far the vehicles’ most expensive part.

Toyota has been building up production capacity to change that, as it expects global FCV sales climb to 30,000 units annually after 2020 from about 3,000. Strategic Analysis estimates that would allow Toyota to reduce costs to about $8,000 per stack.

It has already begun to use parts developed for the Mirai in other models, such as the fuel cell stack, which is used in Kenworth freight trucks being tested in California, the Sora FC bus it released in Japan in March and the delivery trucks it will test with Seven-Eleven stores in Japan next year.

“It will be difficult for Toyota to lower FCV production costs if it only produces the Mirai,” the first source told Reuters on condition of anonymity as he was not authorized to speak publicly about the issue.

“By using the FCV system in larger models, it is looking to lower costs by mass-producing and using common parts across vehicle classes,” he added.

The Mirai’s high production costs are largely due to expensive materials including platinum, titanium and carbon fiber used in the fuel cell and hydrogen storage systems.

Engineers have been reducing that by improving the platinum catalyst, a key component in the 370 layered cells in the fuel cell stack, which facilitates the reaction between hydrogen and oxygen that produces electricity.

“We’ve been able to decrease the platinum loading by 10 percent to 20 percent and deliver the same performance,” said Eri Ichikawa, a fuel cell engineer at Cataler Corp, a Toyota subsidiary that specializes in catalytic converters.

Strategic Analysis says using that much less of the precious metal would save up to $300 per fuel cell stack, based on an estimate that Toyota now uses about 30 grams of platinum per unit.

“By consistently focusing on these issues, we will be able to progressively lower the cost of FCVs in the future,” Tanaka said.

Toyota cranks up investment in hydrogen fuel cell vehicles

Toyota cranks up investment in hydrogen fuel cell vehicles

- It is hoping it can prove wrong rival automakers and industry experts who have mostly dismissed such plans as commercially unviable

- The Mirai was the world’s first production hydrogen fuel cell vehicle when it was launched in 2014

Saudi Arabia’s Surj Sports Investment partners with Enfield Investment to boost global portfolio

- Surj, established in 2023, is dedicated to fostering growth in the global sports sector and building a robust sporting ecosystem in Saudi Arabia and the wider Middle East

WASHINGTON: Saudi Arabia’s Surj Sports Investment Co. signed a strategic partnership agreement on Monday with US-based Enfield Investment Partners to expand and enhance investments in the global sports sector.

The partnership follows EIP’s recent launch of a $4 billion global fund aimed at investing in sports assets.

The two companies plan to explore opportunities in key areas, including clubs, leagues, media rights, and sports infrastructure, a statement issued on Monday said.

Surj, established in 2023, is dedicated to fostering growth in the global sports sector and building a robust sporting ecosystem in Saudi Arabia and the wider Middle East.

The company’s strategy focuses on direct investments in sports events and activities to enhance fan engagement and regional sports participation.

“We are delighted to partner with EIP, which has demonstrated a bold vision with the launch of its new sports assets fund,” said Surj CEO Danny Townsend.

“This collaboration marks a significant milestone in Surj’s journey to expand its presence in the American market and foster transformative investments in the global sports sector,” he added.

Jake Silverstein, co-founder and chairman of EIP, echoed Townsend’s sentiments.

“The launch of our Global Sports Assets Fund marks the beginning of an exciting chapter. Partnering with Surj Sports Investment enables us to align our shared vision for advancing the future of the sports industry,” he said.

As part of the collaboration, EIP plans to establish a regional headquarters in Riyadh to complement its Washington base, reflecting the partnership’s commitment to fostering growth in Saudi Arabia and beyond.

“The Kingdom’s extraordinary transformation is reshaping the global sports landscape,” Silverstein added. “Through this partnership, we aim to create meaningful and lasting impact, leveraging the resources and expertise of both parties to drive innovation and growth.”

The agreement highlights Saudi Arabia’s growing influence in the global sports arena, which has culminated in the Kingdom’s successful bid to host the 2034 FIFA World Cup.

Saudi Aramco secures $9bn in deals on first day of iktva forum

- 145 agreements signed in one day mark a leap toward strengthening local industries

RIYADH: Saudi Aramco has secured 145 agreements and memorandums of understanding worth an estimated $9 billion on the opening day of the In-Kingdom Total Value Add Forum and Exhibition 2025.

These deals are expected to drive the localization of products and services in Saudi Arabia, enhancing local content in the supply chain and fostering collaboration.

The agreements align with the core objectives of iktva, which aim to enhance supply chain efficiency and add value across Saudi Aramco’s operations.

By increasing local content, the program helps develop a more diverse and competitive energy industry in the Kingdom. It also supports the strategic goal of retaining 70 percent of procurement spending within Saudi Arabia, directly benefiting local businesses.

On its first day, the event highlighted 210 localization opportunities across 12 sectors, with a combined annual market value of $28 billion. These opportunities are seen as key to driving long-term industrial growth and reducing reliance on imports.

During the event, Saudi Aramco President and CEO Amin Nasser reflected on the company’s progress, noting that Aramco achieved a 67 percent local content score for its procurement of goods and services in 2024, up from just 35 percent in 2015.

“Since launching iktva in 2015, we’ve made significant strides. Back then, most of our materials and services were sourced from outside Saudi Arabia,” Nasser said.

Nasser emphasized that the success of iktva depends on its ability to create value for all stakeholders.

“For Aramco, a largely localized supply chain ensures continuity and helps us navigate operational challenges more effectively,” he said. “Since 2015, iktva has contributed over $240 billion to Saudi Arabia’s GDP and led to the creation of 350 local manufacturing facilities with investments totaling more than $9 billion.”

These new facilities cover a range of sectors, including chemicals, non-metallics, information technology, electrical and instrumentation, and drilling. As a result, 47 products are now being manufactured for the first time in Saudi Arabia.

Saudi Energy Minister Prince Abdulaziz bin Salman also addressed the gathering, announcing the Kingdom’s plans to enrich and sell uranium. “We’re committed to monetizing all our mineral resources, including uranium,” the minister said. “By enriching and selling uranium, along with producing yellowcake, we will secure essential raw materials for energy security.”

Prince Abdulaziz discussed the future of the petrochemical sector, emphasizing the importance of producing more advanced chemicals. “The future of petrochemicals is not just about plastics or polymers. We’re aiming for better, more sophisticated chemical products,” he noted.

Looking ahead, the energy minister spoke about potential collaborations with Egypt, indicating that a roadmap for joint ventures would be outlined in February. “We have much to look forward to with Egypt,” he said.

In a separate panel, Prince Abdulaziz highlighted the role of integrated collaboration between sectors in achieving the Kingdom’s Vision 2030.

He explained that major energy expansion projects are key to supporting industrial development by providing diverse energy sources and offering competitive prices for gas feedstock.

This, he added, would help stimulate the growth of manufacturing and facilitate the transition to cleaner energy.

Saudi Investment Minister Khalid Al-Falih also spoke during the ministerial dialogue session, stressing that standardized incentives for the industrial sector are critical to achieving Vision 2030.

These incentives, he said, will help accelerate the creation of new industrial facilities and strengthen local supply chains at all stages of the value chain, making Saudi industries more competitive.

The first day of the forum also saw the launch of ASMO, a joint venture between Saudi Aramco Development Co. and DHL. The new venture aims to transform the procurement and supply chain landscape across the Middle East and North Africa region.

Additionally, the opening ceremonies for the Novel Non-Metallic Solutions facility at King Salman Energy Park and the NMDC Offshore Fabrication Yard at Ras Al-Khair were held.

Novel, a partnership between Aramco and Baker Hughes, is focused on introducing a range of composite products to the market, while the NMDC fabrication yard will provide maritime engineering services and fabricate equipment and materials.

Running from Jan.13-16 in Dammam, the iktva Forum continues to spotlight critical infrastructure projects and collaborative opportunities aimed at advancing the local supply chain ecosystem and supporting the Kingdom’s long-term industrial goals.

Saudi entertainment authority unveils 29 investment opportunities

RIYADH: Saudi Arabia’s General Entertainment Authority has unveiled 29 investment opportunities targeting six key sectors of the industry.

The initiative, in collaboration with the Ministry of Investment, aims to expand the Kingdom’s entertainment landscape while fostering private sector participation and aligning with Vision 2030 objectives.

The targeted sectors include facilities, destinations, water parks, adventure parks, virtual reality parks, and e-gaming centers.

These opportunities are designed to enhance growth in the entertainment sector, drive economic diversification, and promote sustainable development.

According to the GEA, the initiative also seeks to empower the private sector within Saudi Arabia and internationally, while improving the quality of life for citizens and residents.

By focusing on infrastructure development across these entertainment segments, the initiative reflects Saudi Arabia’s strategic commitment to becoming a global entertainment hub. This effort also supports the Quality of Life Program, which is a core pillar of Vision 2030.

These investment initiatives are set to play a significant role in boosting the sector as projections indicate that the sector will generate 450,000 jobs and contribute 4.2 percent to the country’s gross domestic product by 2030.

Vision 2030 aims to transform Saudi Arabia’s entertainment sector by increasing household spending on recreation from 2.9 percent to 6 percent by 2030.

It seeks to generate over SR120 billion ($31.9 billion) in investments, create 100,000 direct and indirect jobs, and enhance the sector’s contribution to the economy.

Saudi Arabia, Oman to strengthen financial ties with new agreement

- Saudi Minister of Finance Mohammed Al-Jadaan and his Omani counterpart, Sultan Al-Habsi, signed deal to enhance cooperation in financial affairs

- Areement underscores commitment of Riyadh and Muscat to collaborate on advancing shared financial sector goals

JEDDAH: Saudi Arabia and Oman are set to strengthen financial ties with a new agreement aimed at enhancing cooperation and facilitating the exchange of information and expertise.

The deal, signed during the board of governors’ retreat of the Islamic Development Bank Group in the city of Madinah, aims to improve financial policies, governance in the public sector, and joint coordination on regional and international issues.

Saudi Minister of Finance Mohammed Al-Jadaan and his Omani counterpart, Sultan Al-Habsi, signed a memorandum of understanding to enhance cooperation in financial affairs between the two countries, according to a statement from the Saudi Finance Ministry.

This comes as Oman’s non-oil exports to Saudi Arabia have more than doubled since 2020, surpassing 1 billion Omani rials ($2.6 billion) by the end of 2023, according to Oman’s National Center for Statistics and Information. Non-oil imports from Saudi Arabia also grew, reaching 1.84 billion rials in the same period.

Al-Jadaan said “this MoU represents a significant step in the ongoing efforts to deepen financial collaboration between the two brotherly nations,”

He added: “it will pave the way for the exchange of financial expertise, the promotion of knowledge-sharing, and the fostering of closer economic ties.”

Al-Habsi underscored the importance of the MoU as “a cornerstone for enhancing bilateral relations.”

He said that “it will facilitate the exchange of financial information and expertise while strengthening coordination between Saudi Arabia and Oman on regional and international financial issues of mutual interest.”

The agreement underscores the commitment of Riyadh and Muscat to collaborate on advancing shared financial sector goals, further strengthening the ties between the two nations, the release added.

In October 2024, the two countries signed a deal to enhance economic and planning cooperation, focusing on medium and long-term strategies, monetary policies, and economic studies.

The five-year agreement was finalized by Saudi Minister of Economy and Planning Faisal Al-Ibrahim and Omani Minister of Economy Said bin Mohammed Al-Saqri.

Earlier in April 2024, another MoU was signed during a meeting between Al-Habsi and Sultan bin Abdulrahman Al-Marshad, the CEO of the Saudi Fund for Development.

The agreement centered on joint development projects, including initiatives in infrastructure, higher education, vocational training, and key industries, including mining, transportation, communications, and energy.

Closing Bell: Saudi main index sheds points to settle at 12,109.94

RIYADH: Saudi Arabia’s Tadawul All Share Index lost on Monday, dropping 17.03 points, or 0.14 percent, to close at 12,109.94.

The total trading turnover of the benchmark index was SR5.77 billion ($1.53 billion), as 114 of the listed stocks advanced, while 119 retreated.

The MSCI Tadawul Index also dropped by 2.34 points, or 0.15 percent, to close at 1,509.67.

The Kingdom’s parallel market Nomu increased, gaining 194.91 points, or 0.63 percent, to close at 31,234.44. This comes as 43 of the listed stocks advanced while 46 retreated.

Buruj Cooperative Insurance Co. was the best-performing stock of the day, with its share price surging by 9.95 percent to SR22.54.

Other top performers included United International Holding Co., which saw its share price rise by 7.97 percent to SR187, and Gulf General Cooperative Insurance Co., which saw a 4.38 percent increase to SR11.44.

Saudi Cable Co. and Saudi Industrial Investment Group also saw a positive change, with their share prices surging by 4.06 percent and 4 percent to SR107.60 and SR17.68, respectively.

Fawaz Abdulaziz Alhokair Co. saw the steepest decline of the day, with its share price easing 5.56 percent to close at SR14.60.

Jamjoom Pharmaceuticals Factory Co. and Middle East Specialized Cables Co. recorded declines, with their shares slipping 4.05 percent and 3.50 percent to SR156.20 and SR42.70, respectively.

National Medical Care Co. also faced a loss in today’s session, with its share price dipping 2.93 percent to SR159.20.

On Nomu, Multi Business Group Co. was the best performer, with its share price rising by 13.64 percent to reach SR18.50.

Alqemam for Computer Systems Co. also delivered a strong performance, with its share price rising by 9.28 percent, to reach SR93, while First Avenue for Real Estate Development Co. saw a 7.27 percent increase to end the session at SR9.44.

Albattal Factory for Chemical Industries Co. also fared well, with a 7.07 percent rise to SR62.10, and Alfakhera for Mens Tailoring Co. increased by 6.62 percent to SR6.60.

Al-Razi Medical Co. shed the most on Nomu, with its share price dropping by 10.58 percent to reach SR60.

Quara Finance Co. experienced a 6.30 percent decline in share prices, closing at SR18.74, while Advance International Co. for Communication and Information Technology dropped 4.98 percent to settle at SR4.20.

Meyar Co. and Intelligent Oud Co. for Trading were also among the top decliners, with Meyar Co. falling 4.70 percent to settle at SR70.9 and Intelligent Oud Co. for Trading declining 4.13 percent to SR51.10.

On the announcement front, Nofoth Food Products Co. has received board approval to transition from the Nomu-parallel market to the main market, according to a bourse filing.

The company noted that the move remains subject to Tadawul’s approval, as well as compliance with all listing rules and requirements.

Estidamah Capital has been appointed as the financial adviser for the proposed transition. Nofoth Food Products stated that any material developments regarding the process will be disclosed in accordance with regulatory requirements.

Nofoth Food Products Co. saw a 0.68 percent drop in its share price on Monday to settle at SR20.46.