What happened:

Comments by the White House Coronavirus Taskforce’s Dr. Anthony Fauci and veteran investor as well as Duquesne Capital chairman Stanley Druckenmiller sent equity markets down.

Fauci informed the US Senate’s health committee of big risks if states reopened their economies without observing guidance on the coronavirus disease (COVID-19) pandemic. He said that opening up the economy too soon could “trigger an outbreak that you might not be able to control,” resulting in loss of life and economic contraction.

Druckenmiller told The Economic Club of New York that the risk-reward ratio in equities was the worst he had ever seen and called a V-shaped recovery “a fantasy.” He expressed fears that the pandemic would have a long-lasting effect on the economy, leading to bankruptcies.

He regards the massive government stimulus as merely a transfer of money to individuals as well as leading to maintaining zombie companies and has predicted more regulation and higher taxes going forward.

The UK economy entered recession, contracting by 5.8 percent in March. Retail sales were down 20 percent for the same month. The first quarter (Q1) of the year only reflects two weeks of lockdown, which means there is worse to come in Q2. British Chancellor of the Exchequer Rishi Sunak extended the furlough program by four months, costing an extra £34 billion ($41.9 billion).

The Reserve Bank of New Zealand (RBNZ) doubled its quantitative easing program to NZ$60 billion ($36.3 billion), contemplating lowering interest rates further, including into negative territory.

Indian Prime Minister Narendra Modi announced a $265 billion stimulus package, equal to 10 percent of GDP. Benchmark yields fell by 20 basis points to 6.16 percent in the last two sessions.

Earnings season continued in Europe:

Dutch business bank ABN Amro posted a Q1 loss of minus 395 million euros (minus $429 million), the first in seven years. Loan loss provisions and impairment for Q1 were 1.1 billion euros and could go up to 2.5 billion euros for the full year.

German universal bank Commerzbank posted a loss of 277 million euros, which included a markdown worth 479 million euros in assets due to the pandemic. Full-year loan loss provisions went up to 1.4 billion euros, rendering a profit for 2020 challenging.

Revenue at Danish shipping giant A.P. Moller-Maersk A/S increased to $9.57 billion, with earnings before interest, taxes, depreciation, and amortization (EBITDA) at $1.52 billion. The company warned that the COVID-19 pandemic could drive sea freight volumes down by as much a quarter.

CEO Soren Skou said that given its 20 percent market share in the container trade, Maersk would only be contemplating mergers and acquisitions activity landside, for example, in logistics and container ports.

Background:

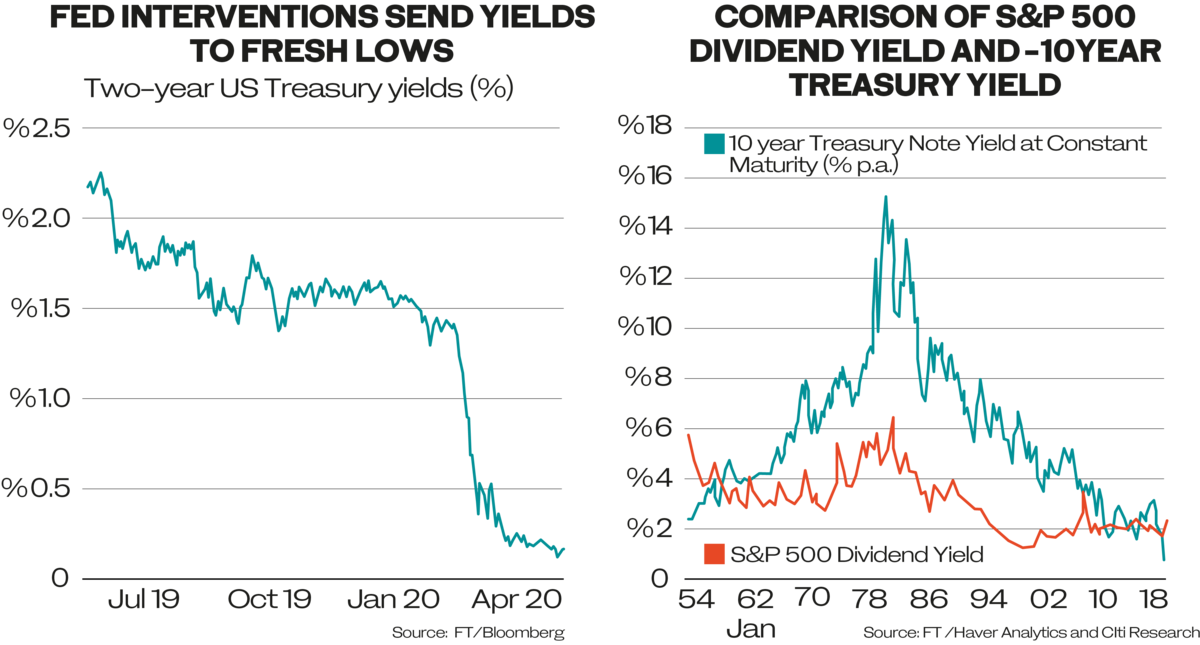

With the RBNZ contemplating negative rates, the conversation moved again to the potential of US rates turning negative by 2021. Speculation was fueled by a tweet from American President Donald Trump calling negative rates a “GIFT.”

The question remains how the US Federal Reserve looks at rates. Trump sees the rate conundrum in parts through the lens of their impact on the dollar, with a cheaper dollar being beneficial to exports. The experience of the Japanese yen and the Swiss franc would suggest that negative rates did not affect their safe haven status in the long run.

While the last two months have seen a significant dollar appreciation, the trend could have reached its end.

The risk-reward picture for negative interest rates looks different from country to country. In the US, the impact on money markets has to be considered, which is of lesser importance in other jurisdictions.

Furthermore, negative interest rates have not had the desired effect of stimulating the economy and reaching target inflation rates in either Japan or the eurozone. Rather, they had a negative impact on the business models of banks, reducing their efficiency as transmission mechanisms.

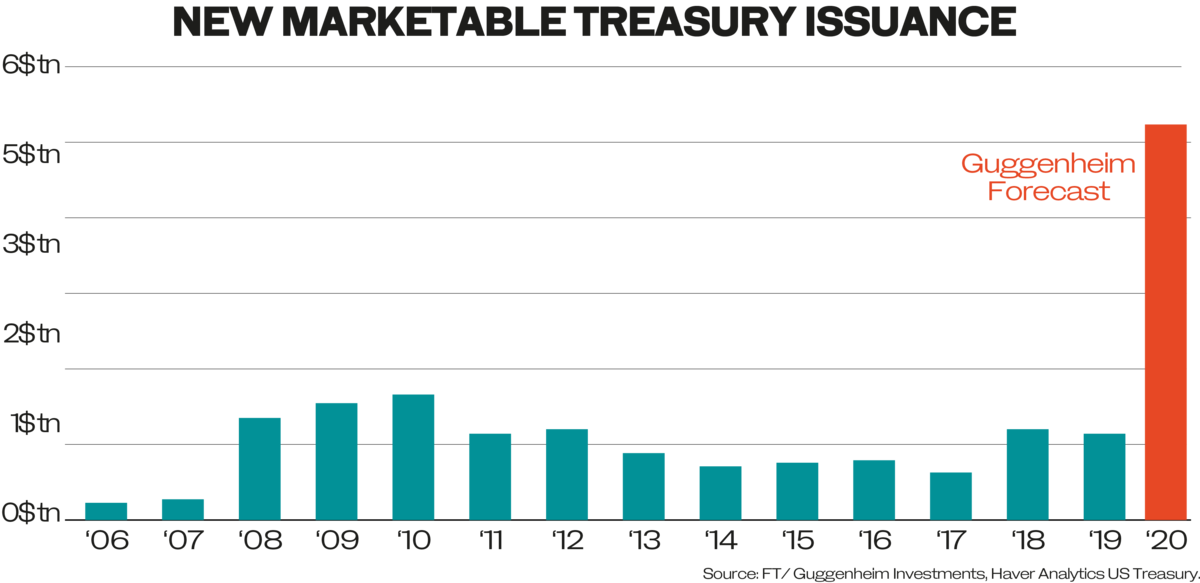

The bond market effortlessly absorbed the arrival of a record-sized $32 billion 10-year treasury note auction on Tuesday. Demand was solid among investors at a record-low yield of 0.7 percent for the new 10-year note.

The global importance of US treasuries beyond that asset class cannot be overstated. Government bond yields in major economies reflect the return expectations by investors without taking risk. This holds particularly true for US treasuries, which are by far the most liquid and issued by the government of the world’s largest economy, hence building a foundation for the relative pricing of all asset classes.

Where we go from here:

The US Congress will be discussing a $3 trillion rescue package, where democrats have earmarked $1 trillion for cities and states, with the some of the remainder going toward “hazard pay” for essential workers and a new round of cash payments to individuals.

Senate Majority Leader Mitch McConnell is more interested in legislation protecting businesses from liability for returning employees if they fall ill or die.

US Federal Reserve Chairman Jerome Powell will speak at the Peterson Institute later on Wednesday. European Commission President Ursula von der Leyen and European Council President Charles Michel will address the European Parliament in the afternoon.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources