What happened:

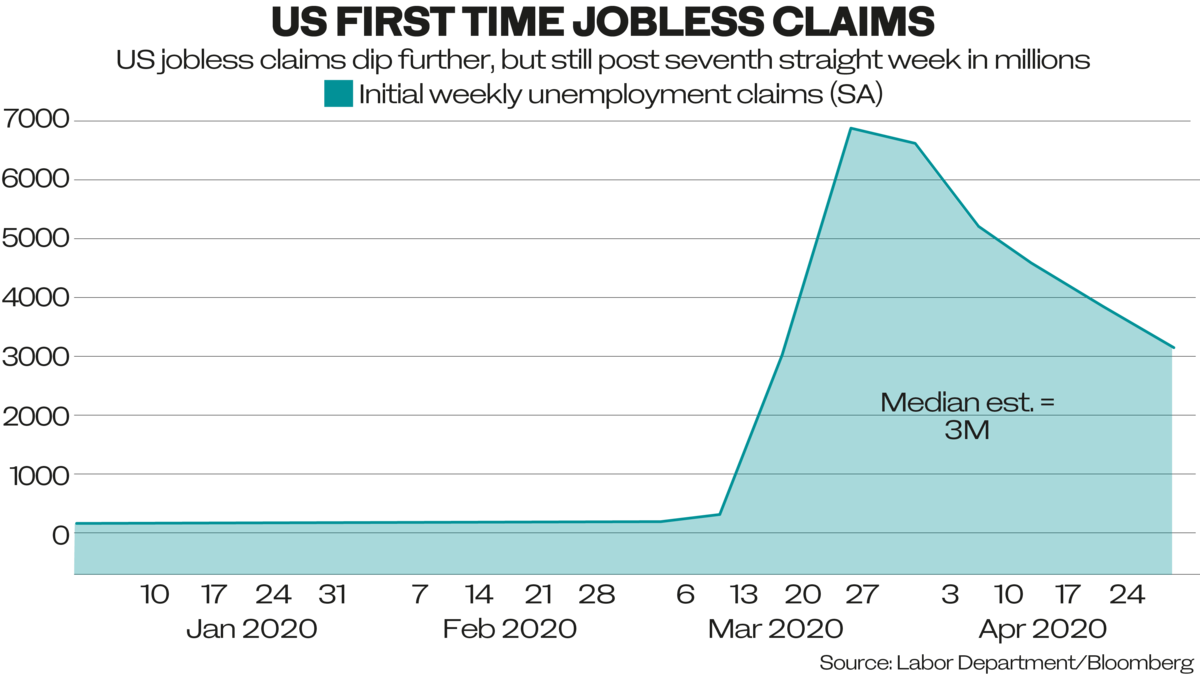

First-time jobless claims in the US for the week ending May 8 came in at 3 million, pushing the total up to 36.5 million. The trajectory of increases is falling, but 3 million is a huge number.

Unemployment filters through to consumption, which constitutes 70 percent of GDP. A further reflection of the dire situation in America is that 12 retailers and restaurant chains have filed for bankruptcy or outright liquidation this year.

Oil markets are starting to rebalance with OPEC+ on track to deliver the 9.7 million barrels per day (bpd) of production cuts this month, supported by a further cut of 1.18 million bpd from Saudi Arabia, the UAE and Kuwait.

The International Energy Agency (IEA) boosted its second-quarter global demand outlook by 3.2 million bpd, to 79.3 million. It also reduced its full-year outlook on demand contraction by 700,000 bpd to minus 8.6 million or minus 9 percent. Faster-than-expected supply adjustments and better-than-expected demand forecasts contribute to sentiment. Brent traded at $31.74 per barrel and West Texas Intermediate (WTI), the American benchmark, at $28.10 per barrel midday in Europe. These prices are still more than 50 percent lower compared to January.

Former US Federal Reserve chair, Ben Bernanke, believes that the economy will not truly recover until the coronavirus disease (COVID-19) is defeated. He also said that the current monetary and fiscal packages, which deploy more than $6 billion to households and individuals, will avoid the downturn being as severe as the Great Depression.

Germany’s GDP contracted by 2.2 percent during the first quarter. France had come in at minus 5.8 percent, Spain at minus 5.2 percent, and Italy at minus 4.7 percent.

Paul Hudson, CEO of multinational pharmaceutical company Sanofi, sparked a wider debate on who should have control over the distribution of vaccines and medicines.

He said that the US should get priority over any new COVID-19 vaccine, because research had been funded by the US. French President Emmanuel Macron objected, claiming that he would not allow Sanofi, which is a French firm, to embark on such a course.

Background:

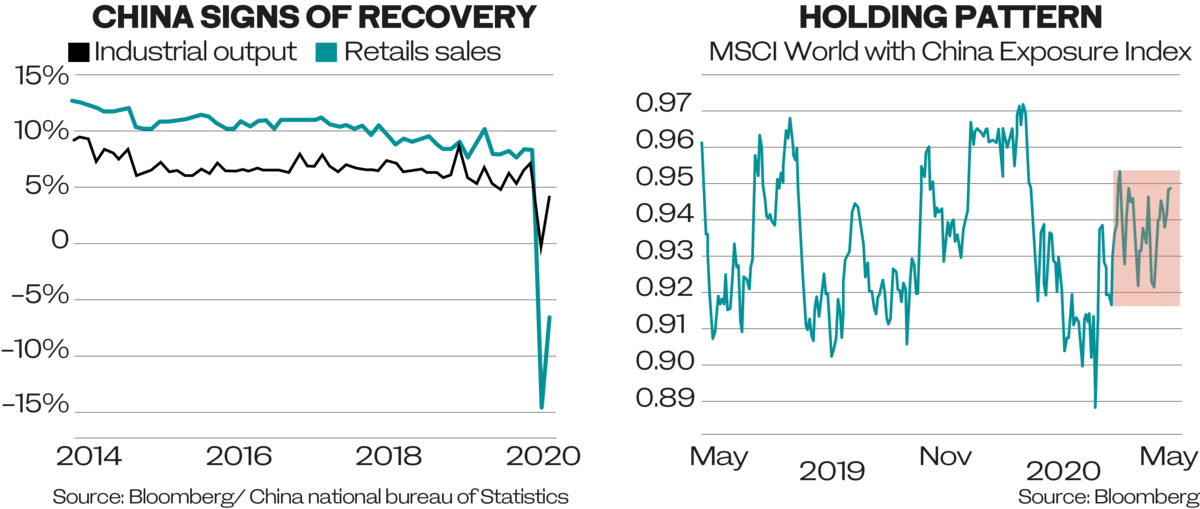

China was the first country hit by the pandemic and also the first to emerge from lockdown.

Manufacturing output for April rose by 3.9 percent, while retail sales contracted by 7.5 percent and fixed-asset investment decreased by 10.3 percent. The urban jobless rate was reported at 6 percent.

These numbers indicate that, even if people are going back to work, they feel hesitant to spend: While the employed worry about low job security, they will tighten their purse strings. The unemployed will not spend at all.

Similar consumer behaviors can be expected in the US and Europe – particularly as furloughed workers fear descending into unemployment.

More cautious people will also want to minimize the potential risk of exposure to the virus by venturing out of the house as little as possible. These fears will only be assuaged once COVID-19 is contained.

The fixed-asset investment number indicates a pessimistic outlook on growth and a desire by most companies to preserve cash, a trend that can be observed in Europe and the US.

This goes a long way to explaining why the stocks with China exposure have traded sideways on the MSCI for the last couple of months, despite the country being the first to reopen its economy.

New infections in northeastern China and South Korea have resulted in renewed lockdowns, highlighting how difficult it is to control the virus and that similar incidents could happen elsewhere as economies reopen. Renewed lockdowns would lead to a W-shaped recovery – one of the worst-case scenarios.

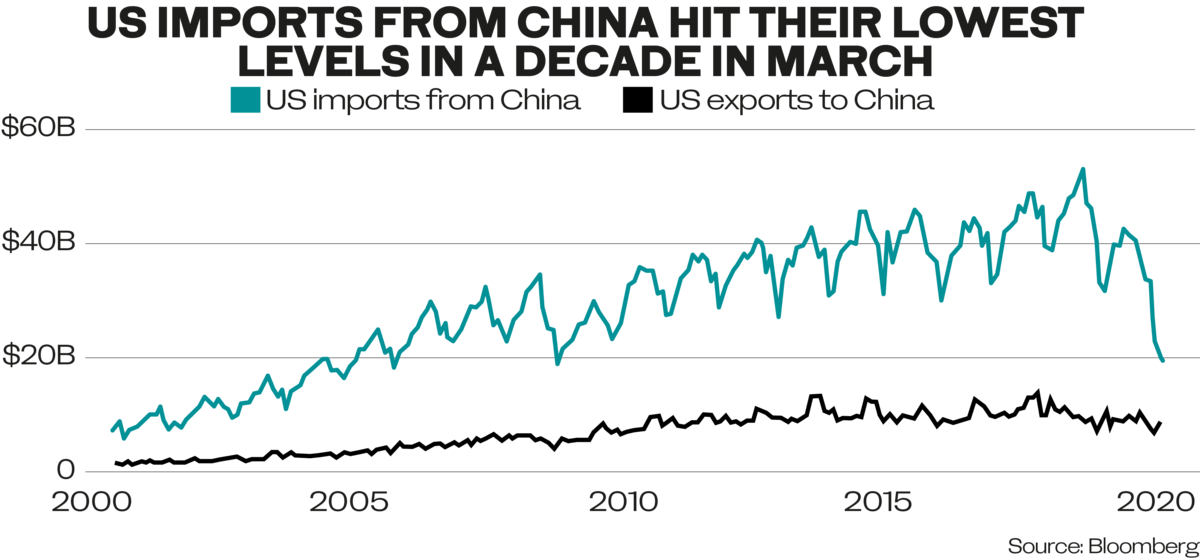

At the same time US-China relations hit a new low with US President Donald Trump publicly refusing to speak to Chinese President Xi Jinping and threatening to cut off ties with China, a move he claimed could save America $500 billion a year.

The rhetoric from Democratic presidential candidate Joe Biden also grew harsh. Some observers consider US-China relations to have reached the lowest point since the 1970s. Two-thirds of Americans have a negative view of China.

Former US diplomat and director of the Aspen Security Forum, Anja Manuel, told Bloomberg she was in favor of localizing supply chains in key sectors such as defense or healthcare, but that painting with too broad a brush was counterproductive. The focus should shift from emphasis on restrictions to research and development cooperation with allies in key sectors.

The above does not bode well for a speedy conclusion of phase one in the US-China trade agreement.

Where we go from here:

China’s National People’s Congress will meet next week and announcements on further stimulus measures are expected.

The latest round of Brexit negotiations end on Friday with no resolution of key issues in sight. The danger of a no-deal Brexit inches ever closer, as the deadline of reaching an agreement by June is enshrined in UK law.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources