What Happened:

Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin testified before Congress, underlining that they would do whatever it takes to keep the economy going amid the crisis brought on by the coronavirus disease (COVID-19).

European equity markets had a lackluster response to Emmanuel Macron and Angela Merkel’s plan to funnel €500 billion in stimulus through the EU budget, which would be awarded to countries as grants rather than loans. The commission could issue AAA-rated bonds. The onus of paying it back would lie on the EU 27.

The package is likely to face pushback from northern countries, which are against the mutualization of debt, and from southern countries, which consider it as being too little too late. It is none the less significant, however, that the plan is backed by the two largest economies, which sit on opposite sides of the debt mutualization debate. This may well be an important step toward some sort of a fiscal union within the EU, which would be important to the longevity of the euro.

The New Zealand dollar saw a boost after Governor of the Reserve Bank of New Zealand Adrian Orr said that he did not want to go into negative rates at this point in time but wanted to preserve the optionality. The litmus test was that negative rates were necessary, effective, efficient and “operationally capable.”

Rolls Royce is cutting 9,000 jobs — nearly 20 percent of its workforce. The majority of the layoffs will hit the aerospace business, which accounted for roughly 60 percent of the company’s sales before the COVID-19 crisis. Rolls Royce CEO Warren East told Bloomberg that the aerospace business could shrink by as much as two thirds in the near term and that current measures were aimed at bringing staffing in line with future demand. He expects air travel to be at 33 percent of 2019 levels by the end of 2021 and thinks that it might take five years until the industry fully recovers.

Target sales were up 10.8 percent for the first quarter, owing mainly to digital sales, in line with a general trend of retail moving online.

Background:

US President Donald Trump considers reopening of the economy to be more important than issuing further stimulus. Both Trump and Senate Majority Leader Mitch McConnell feel that the US needs to grow again, contrasting the proposed $3 trillion additional support package that passed the Democrat-controlled House of Representatives last week.

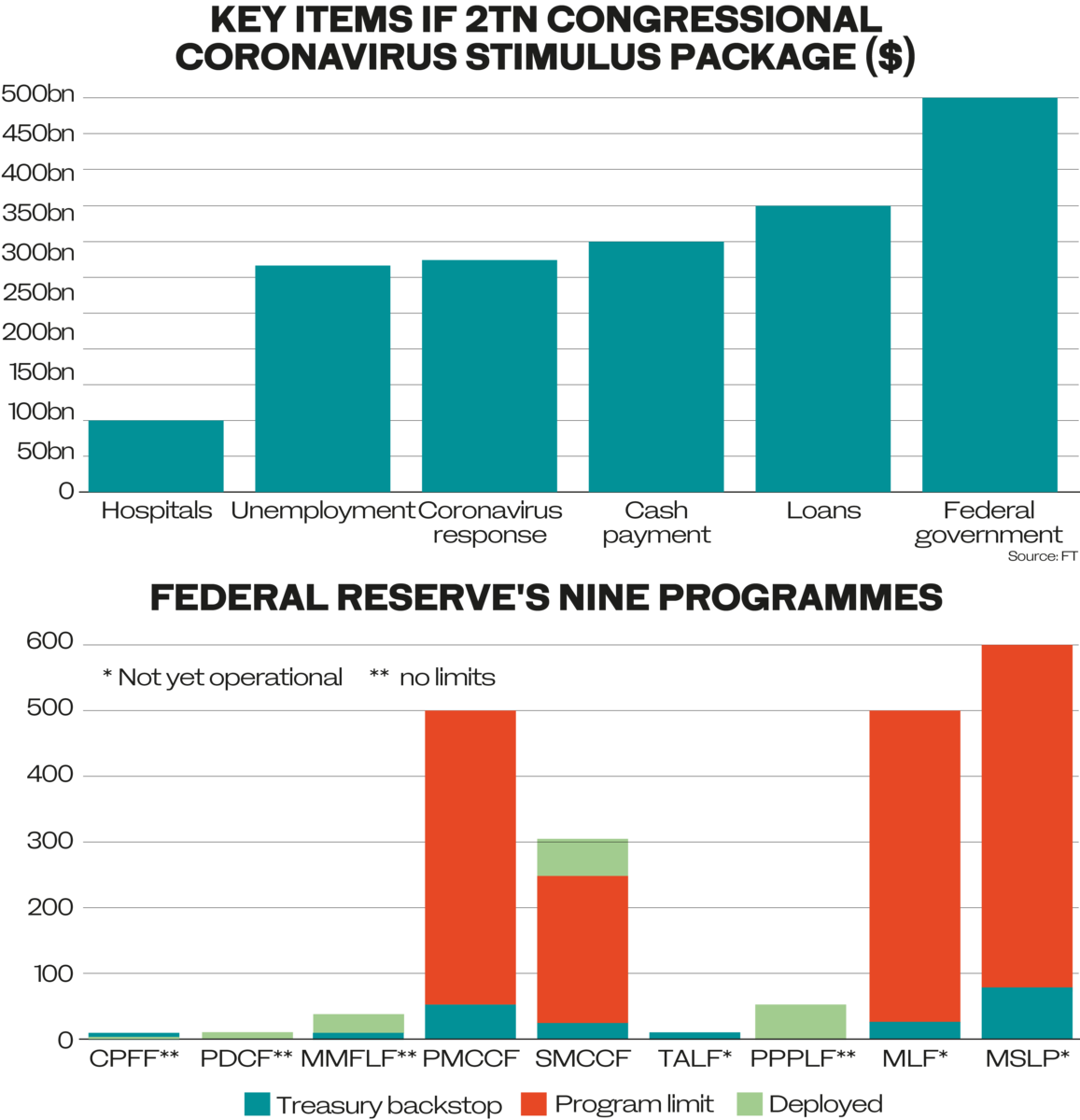

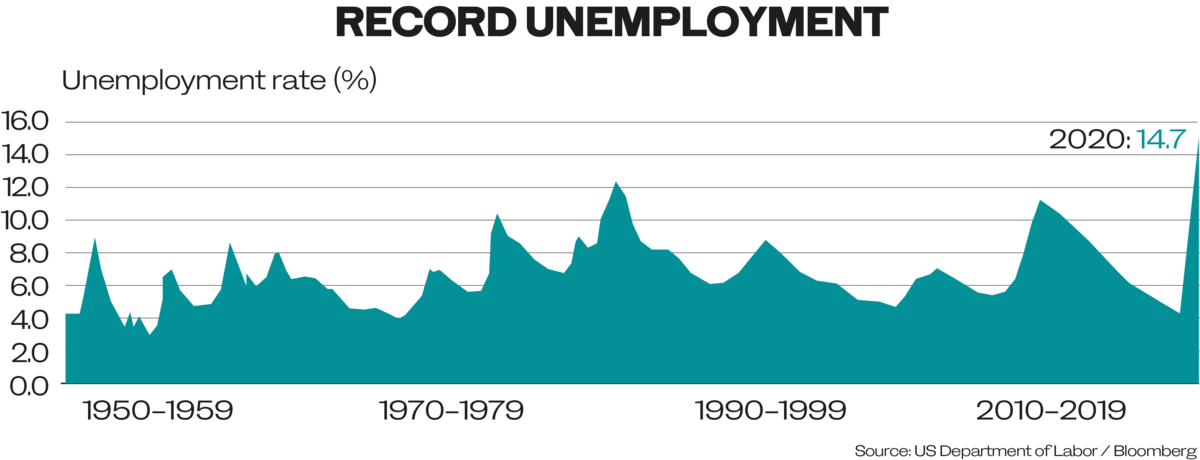

In his testimony, Powell said that he thought additional fiscal stimulus would be necessary down the line but refrained from specifying the timing or shape of the stimulus. At the same time, Powell said he would use all the policy tools at his disposal to combat the recession. He reiterated his opposition to negative interest rates as well as concerns about what current levels of unemployment would do to the economic recovery.

In Powell’s words: “We are committed to using our full range of tools to support the economy in this challenging time even as we recognize that these actions are only a part of a broader public-sector response.”

Steven Mnuchin stated that the Department of Treasury would risk its $75 billion guarantee to back the Federal Reserve’s $600 billion loan facility to Main Street, stating that he was willing to incur losses.

“There’s scenarios within Main Street where we could lose all of our capital, and we’re prepared to do that,” he said.

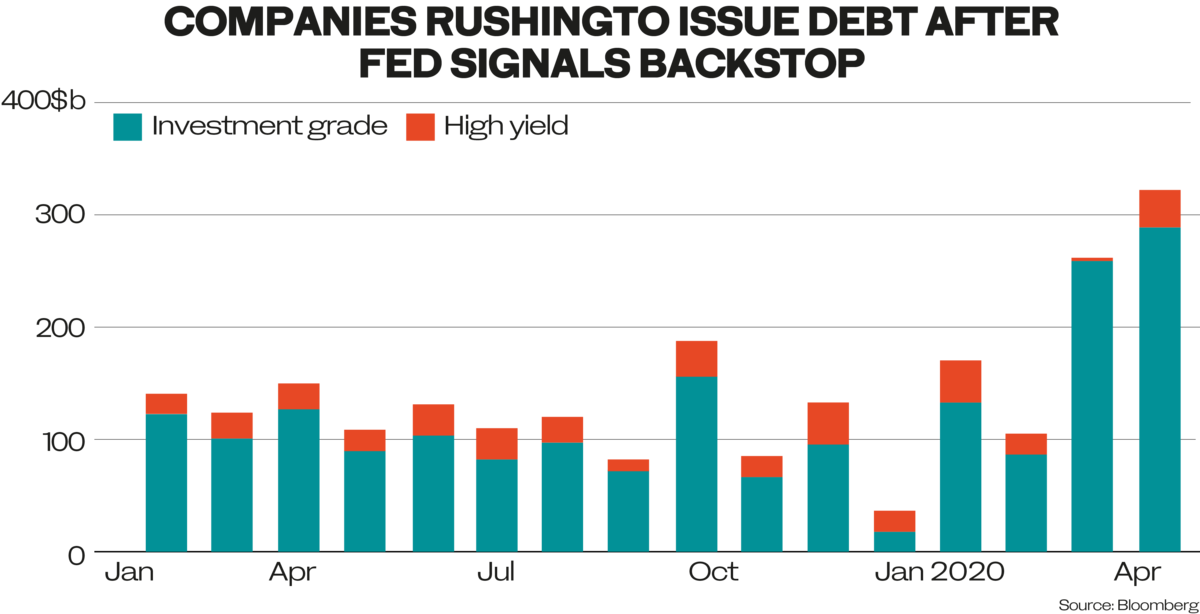

There is the valid question whether a government stimulus plan would support zombie companies in the US and Europe. The Federal Reserve is prepared to support sub-investment grade companies under the caveat that they were investment-grade before the pandemic and could be tagged as “fallen angels.” The European Central Bank may also go down that trajectory in the coming months.

Over 100 companies are on the verge of crossing the threshold between investment-grade and sub-investment grade. So far, big companies that were recently downgraded include Carnival Corp., Marriott International, Delta Airlines and GAP in the US, and Lufthansa, Virgin Atlantic, Bank of Ireland and Peugeot in Europe.

There is an old Wall Street proverb that says one should never bet against the Federal Reserve. The question is whether one must watch out for temporary liquidity impasses turning into insolvency during these unprecedented times.

Where we go from here:

The biggest cyclone in two decades is headed for the Bay of Bengal, hitting both Bangladesh and India at a time when their economies are reeling from the fallout of the COVID-19 pandemic.

Brexit negotiations hit another impasse when UK Chief Negotiator David Frost called the EU’s Brexit proposals low-grade and EU Chief Negotiator Michel Barnier retorted that the UK could not expect to keep the same privileges as before after having left the EU.

Investors will be watching Bank of England Governor Andrew Bailey’s testimony later on Wednesday after the yield of the 2-year guilt turned negative for the first time. Bailey is not known as a friend of negative interest rates.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources