What happened:

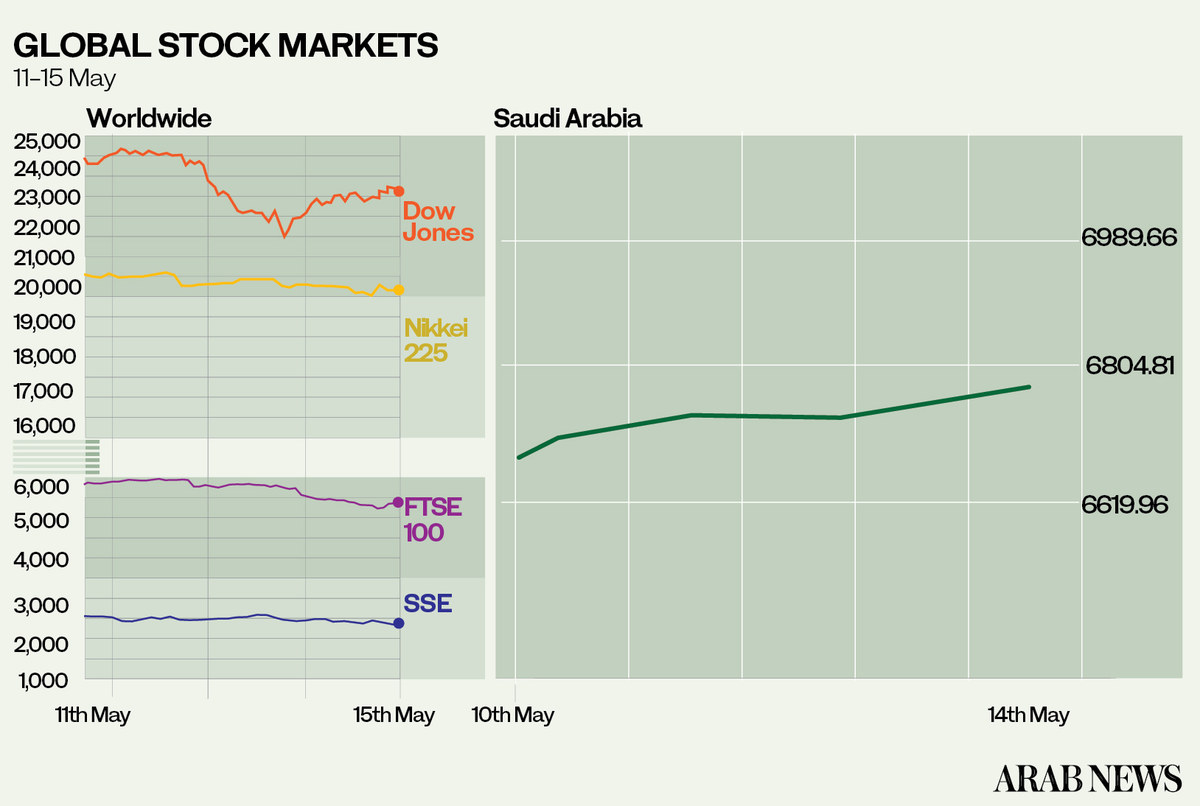

Global stock markets lost ground last week. Several big investors, like Stanley Druckenmiller, said stock markets were overvalued. Fed Chairman Jerome Powell presented a gloomy assessment of the US economy when he spoke at the Peterson Institute.

Investor legend Warren Buffet sold out of all of the four major US airlines a few weeks ago. He also sold most of his Goldman Sachs stake at the end of last week, which demonstrates a lack of confidence in markets.

Japan’s economy slid into recession with a 3.4 percent contraction during the first quarter.

The US requires any chipmaker using US technology to get a license if they want to sell to Huawei. This move will have a big impact on the global semiconductor supply chain and might force China to develop its own technology.

Jack Ma will be leaving the board of Masayoshi Son’s SoftBank. SoftBank’s Vision Fund lost $17.7 billion for the year. It had bet heavily on the sharing economy with investments in the likes of WeWorks and Uber, which were badly hit by the pandemic. SoftBank is also looking to buy back shares worth $5.7 billion and selling a significant part of its stake in T-Mobile US to Deutsche Telekom.

Ryanair reported full year revenues at 10.4 billion euros ($11.25 billion), up by 10 percent. Profit came in at 1 billion euros, up by 13 percent.The company said it would book a loss exceeding 200 million euros for the quarter ending March 31. The company shored up liquidity by taking out a loan worth £600 million ($728.84 million) backed by the UK government. Ryanair burned through 60 million euros in cash in April compared to 200 million in March despite 99 percent of its fleet remaining grounded. The company achieved cost cuts thanks to staff taking a 20 percent salary cut. Ryanair is envisaging cutting its headcount by 300, if cost savings cannot be achieved. Ryanair will resume operations at 50 percent in its second quarter (July-September) and CEO Michael O’Leary feels air travel will be markedly down for the remainder of the year. He has criticized the quarantine measures of governments as counterproductive and has also criticized direct subsidies to flag carriers in France, Italy and Germany as going contrary to European competition law. He feels that direct government subsidies, or equity stakes such as they are seen in several European countries and the US, will distort market forces and work against profitable players such as Ryanair. He is not against payroll support schemes or loan schemes, but calls the aforementioned subsidy schemes illegal. He has warned of the impact on ticket prices if Europe returns to the old “flag carrier” system.

Emirates announced that it may cut 30,000 jobs or 30 percent of its workforce, another indication of just how troubled the outlook is for air travel in the short to medium term.

First Abu Dhabi Bank is stepping away from the $700 million acquisition of Bank Audi’s Egyptian business.

Background:

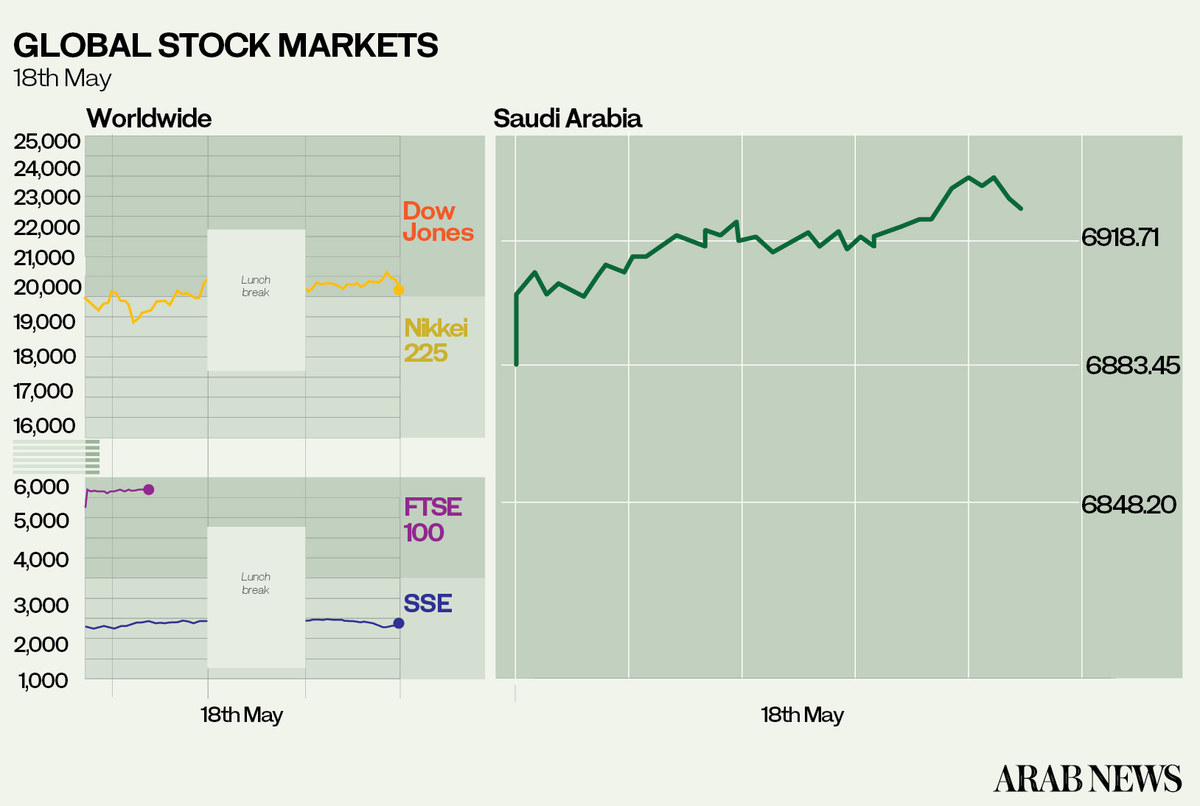

What a difference a weekend makes. While the outlook was negative through last week, the bulls were out in force on Monday.

The mood change came on the back of a CBS “60 Minutes” interview with Powell. He admitted that the US would not make a full recovery until the end of 2021 and that a recovery was conditional on a vaccine. He still emphasized that there would be a full recovery, even if it took some time.

Powell foresees a couple more months of job losses and unemployment peaking at 20-25 percent, but expects the majority of unemployed workers to go back to work once the economy picks up. Powell emphasized that one should never bet against America and that the Fed would do whatever it took to support the economy. He again opposed negative interest rates in the US.

Powell has a point, because most governments and central banks acted swiftly with the right policy measures. We have a downturn but a depression is not a foregone conclusion. Depressions happen when policymakers take the wrong decisions during economic downturns, which was not the case here.

Markets in Asia were up on the day. European stocks rallied and S&P futures were markedly up.

Oil continued its three week rally which was mainly based on a markedly improved supply and demand picture owing to economies coming out of lockdown and the OPEC+ 9.7 million barrels per day (bdp) production cuts being supplemented by an additional 1.2 million bpd cut from Saudi Arabia, the UAE and Kuwait, as well as production having dropped markedly in the US, Canada and other non-OPEC+ producers.

The rise of the gold price to $1,763 an ounce by midday in Europe shows that investors want to have a buffer against negative interest rates, inflation and stock market downturns by allocating a part of their portfolios to the safe haven. The Swiss franc, another safe haven, is also markedly up.

Where we go from here:

This week’s top events:

Tuesday — Congress testimony by US Treasury Secretary Steven Mnuchin and Fed Chair Jerome Powell.

Wednesday — publication of Fed statement.

Thursday — review of coronavirus measures by Japanese Prime Minister Shinzo Abe.

Friday — opening of China’s National People’s Congress.

— Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources.

Twitter: @MeyerResources