BERNE, Switzerland: International waterways matter, few more than the Suez Canal. More than 1 billion tons of cargo passed through the Egyptian waterway in 2019, according to the canal authority, which equates to roughly four times the tonnage passing through the Panama Canal.

Europe, in particular, depends on the canal for its supply of energy, commodities, consumer goods and components from Asia and the Middle East. So, when the giant cargo ship Ever Given ran aground on Tuesday, clogging this vital artery of world trade, anxiety quickly set in.

When it became evident that the vessel could be wedged in place until Wednesday of next week, the ripple effect was felt far and wide — well beyond the offices of the ship’s owners and operators and their insurance companies.

The Ever Given is owned by Japan’s Shoei Kisen Kaisha and operated by Taiwanese firm Evergreen. Goods valuing around $10 billion pass through the canal every day, but the Ever Given alone is estimated to carry a load worth $1 billion, according to IHS Markit.

The canal has been in continuous operation since it was first inaugurated in 1869, with only the briefest interruptions between 1957 and 1958 when Egypt’s then-President Gamal Abdel Nasser nationalized the waterway and later between 1967 and 1973 due to the two Arab-Israeli wars.

For the most part, the canal has operated without a hitch for the past 50 years or more. And if anything, its importance has grown in tandem with globalization, cementing the links between the Orient and the Occident.

Therefore it comes as no surprise that this impasse poses far greater issues than simply dislodging a stricken ship. The temporary closure of the Suez Canal highlights several problems pertaining to ship size, as well as the vulnerability of international waterways, global supply chains and imports.

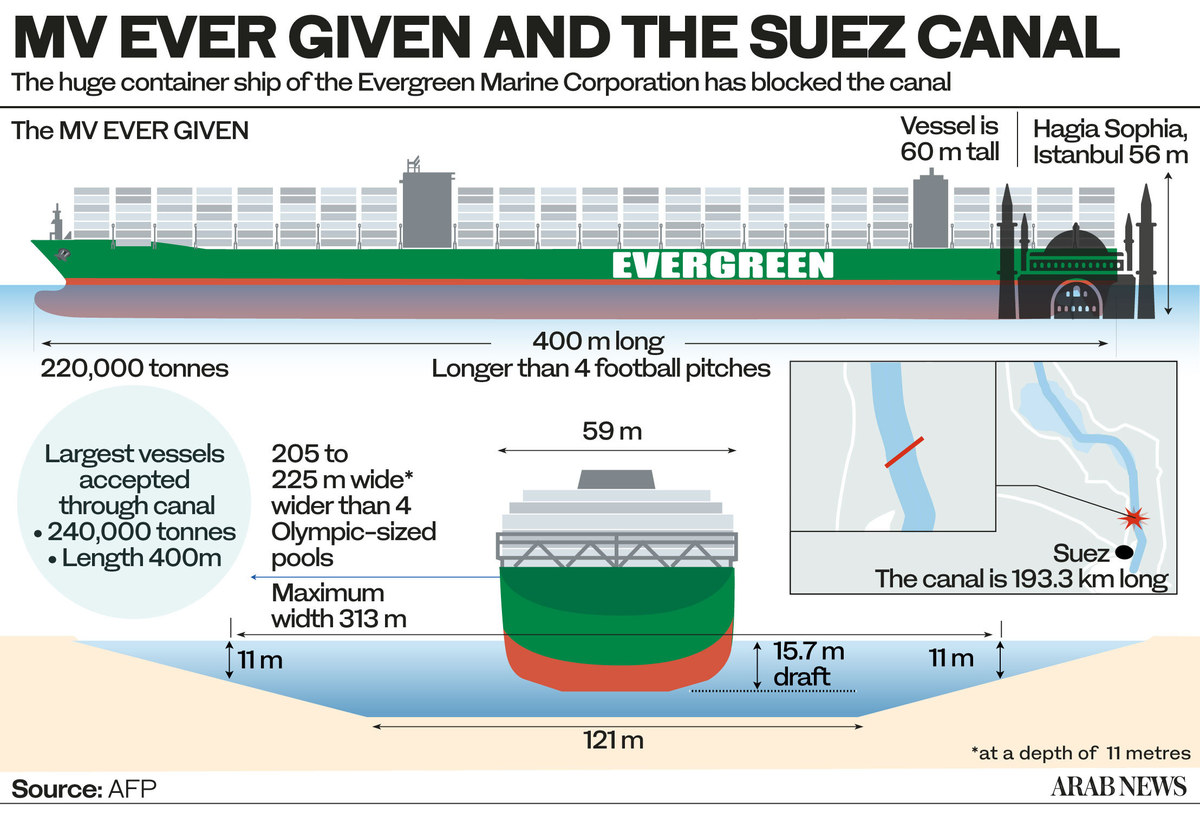

Between 1980 and 2019, global trade volume grew 10-fold to $19.5 trillion. This growth came hand-in-hand with the ever-growing size of maritime vessels to meet mounting demand. Indeed, the dimensions of the Ever Given are truly enormous, at 1,444 feet in length (roughly the height of the Empire State Building), 194 feet in width and weighing in at more than 400 million pounds.

While waterways like Suez and Panama have undergone several major expansions and are dredged on a regular basis — the last Suez expansion was completed in 2015 — accommodating these giant vessels bears inherent dangers. Tuesday’s incident is a case in point.

The question “How big is too big?” has vexed authorities, shipyards, vessel owners and operators alike. The question is also relevant for the insurance industry, which will have to pick up the bill for the Ever Given and any incidents in the future.

Another issue is how reliable “just-in-time” supply chains actually are. This question goes well beyond marine security. In just the past four years, trade wars between the US and China have left severe cracks in global supply chains.

Reshoring, when companies return goods to their country of origin, has become increasingly common, as manufacturers look to protect their investments in the face of geopolitical tensions and unreliable supply chains.

If anything, the coronavirus (COVID-19) pandemic has exacerbated that trend. Last year, countries were scrambling over a limited supply of personal protection equipment (PPE). Now they are locked in a battle over access to vaccines.

These heightened political tensions demonstrate a need for more critical goods to be produced domestically, or at least on the same continent. By way of example, Pat Gelsinger, the CEO of Intel, recently announced the tech giant will soon establish more factories in the US and Europe to reduce its reliance on external microchip supply chains from Asia.

INNUMBERS

12% Proportion of global trade which passes through Suez.

$9.6bn Value of goods that pass through canal every day.

19,000 Ships that passed through the canal in 2020.

Just-in-time supply chains are like high-precision acrobatics, where the entire performance fails if even one component arrives with the slightest delay. As such, they are incredibly vulnerable, like the Ever Given incident shows. Delayed components can put a company’s entire manufacturing process in danger.

Even with experts on hand, dislodging the Ever Given and clearing the waterway could take up to a week. This is bad news for companies waiting for their cargo. At roughly $10 billion a day in foregone or delayed business, time is money.

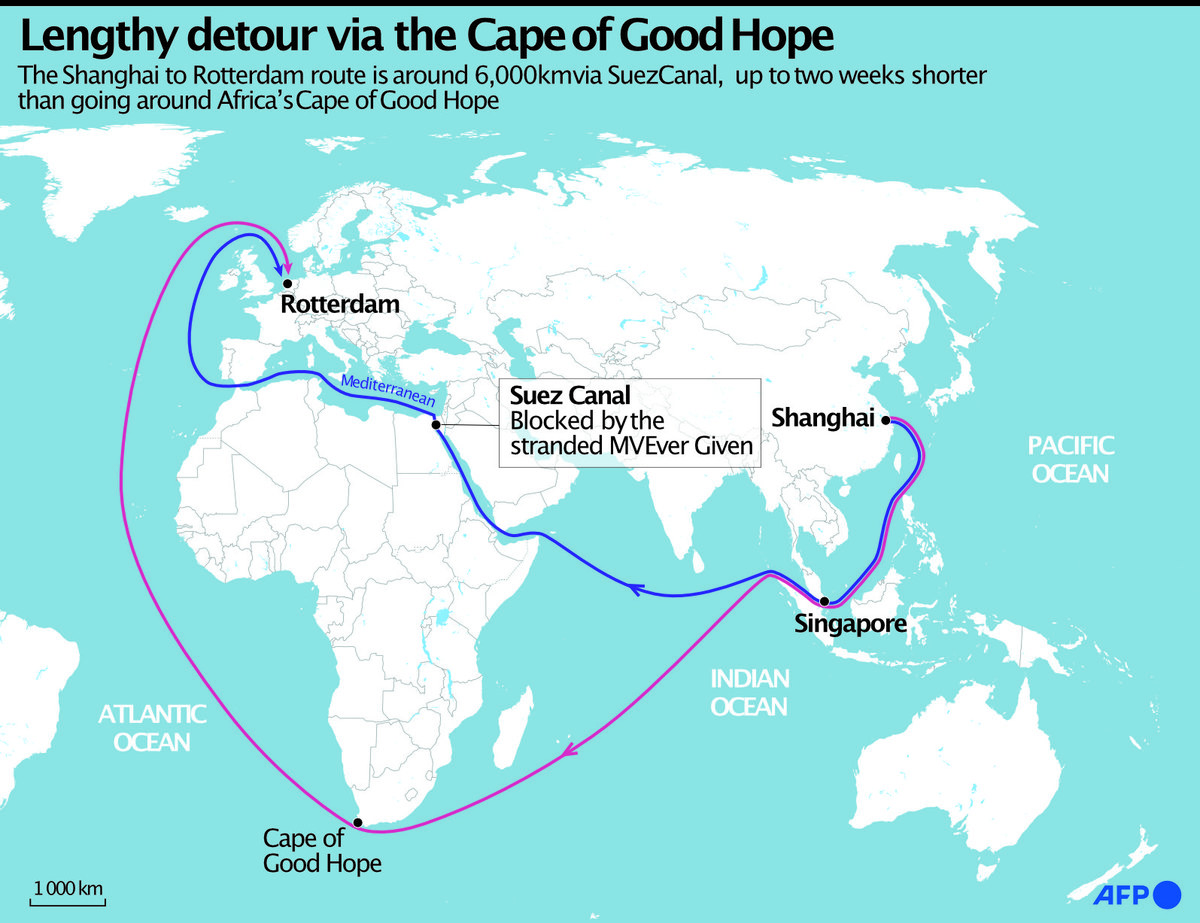

Some ships have been rerouted around the Cape of Good Hope, adding another 6,000 miles around Africa to their journey and up to $400,000 in fuel costs depending on the size of the ship. No wonder shipowners and operators have been biding their time at either end of the Suez to see how things pan out.

And the problems do not stop there. The pandemic has already upended the logistics of shipping containers, leading to a scarcity of metal boxes. The cost of a 40-foot container has quadrupled within the past 12 months.

Inflationary pressures do not just pertain to the cost of shipping. The closure of the Suez Canal, if it persists too long, may have ramifications for oil markets as well.

Fortunately, the Suez Canal has lost its importance as a shipping lane for oil from the Gulf. For one, Asia has become the most important customer for Gulf oil producers. While some 3.8 million barrels per day (bpd) passed through Suez in the early 2000s, that volume has since fallen to 2.1 million bpd.

Oil markets nevertheless rose on Tuesday and have oscillated since, ending at $64.66/barrel by early evening CET Friday. Although an extended blockage will likely affect crude supplies to Europe, demand is currently depressed owing to COVID-19 restrictions and lockdowns on the continent.

There is also the fallback option of the Sumed pipeline from the Red Sea to the Mediterranean, which has a capacity of 2.5 million bpd and is largely unused at present due to OPEC+ production cuts.

All in all, the blockage of the Suez Canal has laid bare the vulnerabilities of international shipping lanes and the fragility of supply chains. While the blockage will likely be resolved soon, it raises pertinent questions about the size of vessels and how these giant ships can be accommodated by what are essentially 19th and 20th century, man-made waterways.

The incident will have a short-term inflationary impact, particularly for Europe and the already overheated sea container market. The longer it takes to hoist the Ever Given from the sandbanks in the Suez, the bigger the impact it will have on supply chains and sea container markets.

And as freight has become a truly global business, the inflationary impact of container delays will be felt worldwide.

Although this is a major incident for maritime shipping, matters could have been far worse. As the Ever Given is Japanese-owned and Taiwanese-operated, events are unfolding in the Suez without the region’s usual geopolitical undercurrents that linger under the surface.

_________________

• Cornelia Meyer is a Ph.D.-level economist with 30 years of experience in investment banking and industry. She is chairperson and CEO of business consultancy Meyer Resources. Twitter: @MeyerResources