Nokia, together with Saudi Arabia’s Communications, Space and Technology Commission, local neutral host specialist ACES NH and service providers Mobily and Zain Saudi, has completed industry-first pilot deployment of 5G standalone indoor coverage using sharable indoor spectrum on the 4.0-4.1 GHz band and active sharing techniques. For the first time, every mobile operator in the Kingdom can deliver gigabit-class 5G inside low- to medium-traffic buildings through a single, cost-optimized system, eliminating the need for duplicate equipment and 4G anchors while cutting deployment costs by more than 60 percent. The proof-of-concept underscores how Nokia’s Shikra radio portfolio and multi‑operator core network software uniquely unlock spectrum-efficient, multi-operator 5G for private wireless and public networks alike.

FASTFACT

For the first time, every mobile operator in the Kingdom can deliver gigabit-class 5G inside low- to medium-traffic buildings through a single, cost-optimized system, eliminating the need for duplicate equipment and 4G anchors.

This innovative solution was recently recognized by the Small Cell Forum, receiving the Small Cells World Summit 2025 Award for “Outstanding Progress in Enabling Neutral Host and Multi-Operator Business Models.”

Sharable indoor spectrum gives stakeholders a powerful tool to boost indoor 5G adoption without complex auctions or spectrum refarming, says Mikko Lavanti, Senior VP for Mobile Networks, MEA at Nokia

Mobile data traffic per smartphone is projected to escalate from 29 GB per month in 2024 to 54 GB per month by 2030. Although 80 percent of mobile traffic is generated indoors, conventional distributed antenna systems often dedicate separate hardware and spectrum to each operator, driving up CAPEX and energy use. By using sharable indoor spectrum on the 4.0-4.1 GHz band in combination with 5G SA active sharing, the pilot demonstrates fair access for all operators while accelerating coverage in business districts, giga-projects, and public venues. Early cost modeling by Nokia and ACES shows a further 47 percent saving when 4G anchoring is removed, making 5G SA “greenfield indoor” sites commercially viable from Day 1.

Mufarreh J. Al-Nahari, deputy governor of studies and innovation at the Communications, Space and Technology Commission, said: “This collaboration demonstrates how innovative regulatory practices, vendor expertise and local partners can together deliver reliable, high-quality 5G for enterprises and consumers. We look forward to scaling the model across the Kingdom.”

Mikko Lavanti, senior vice president for mobile networks, MEA at Nokia, said: “Sharable indoor spectrum gives stakeholders a powerful new tool to boost indoor 5G adoption without complex auctions or spectrum refarming.

Our Shikra pico radios and true 5G SA active sharing software prove that one neutral host system can serve every operator with carrier-grade performance, cutting both cost and carbon emissions per gigabyte.”

Dr. Khalid Al-Mashouq, CEO of ACES NH, said: “With Nokia’s ready and innovative indoor portfolio we can give building owners a single, future-proof solution while operators gain rapid, capital-light expansion. It’s a win for everyone in the 5G ecosystem.”

Alaa Malki, chief technology officer at Mobily, said: “Enhancing customer experience and optimizing network performance in indoor environments are core to Mobily’s strategic priorities. Our active participation in this pioneering initiative reflects our commitment to driving innovation, operational efficiency, and scalable 5G solutions. By advancing shared infrastructure models, we are reinforcing Mobily’s leadership in shaping the future of telecommunications in the Kingdom and accelerating the realization of Saudi Arabia’s digital transformation goals.”

Mohammed Al-Nujaidi, chief technology officer at Zain KSA, said: “Pioneering future-ready shareable network models that unlock scalable, high-performance connectivity is part of Zain KSA’s commitment to driving the evolution of Saudi Arabia’s digital infrastructure. By enabling seamless digital access and significantly enhancing the customer experience, this initiative plays a pivotal role in advancing and accelerating the Kingdom’s digital transformation journey and smart infrastructure development for a knowledge-based society and digital economy.”

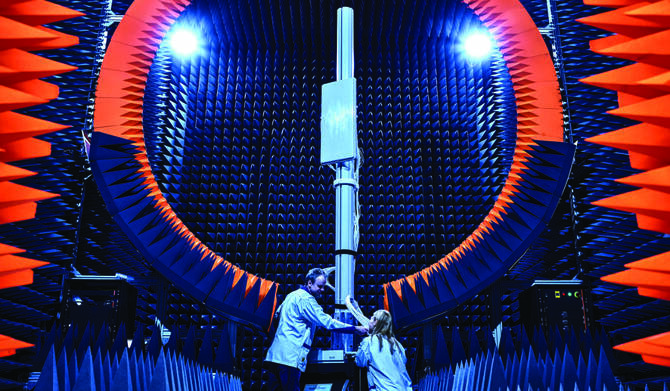

Nokia’s Shikra pico solutions for the 4.0 GHz band are compact, low-power remote radios that blanket multistory buildings with uniform mid-band 5G coverage. Leveraging 5G standalone MOCN active sharing, a single RAN and core slice can serve multiple operators at once, boosting spectral efficiency and streamlining operations. The platform is also private wireless ready: the very same infrastructure can host dedicated enterprise 5G cores, delivering secure Industry 4.0 and campus network services alongside public connectivity.