DAKAR: Gervais Djondo is a man with a dream.

The former industry minister of the west African state of Togo has set himself a mission to create a pan-African airline serving the continent, an elusive goal since a previous venture, Air Afrique, collapsed under a pile of debt in 2002.

Africa’s aviation market is set to soar in the coming years, powered by the resource-rich continent’s robust economic growth and burgeoning consumer market, which are multiplying business and leisure travel. Big airline manufacturers are eyeing potentially buoyant orders, as Africans increasingly turn to air travel.

Inspired by the memory of Air Afrique — a once proud name in post-independence Africa that combined the resources of a dozen or so former French colonies — Djondo has set up a privately financed Togo-based airline, ASKY, which made its first flight in 2010 and now flies to 17 countries in Africa.

“The plan in the short to medium term is to develop a strong airline for ... Africa in general, in an environment characterised by a multiplicity of small companies that appear and disappear within a few years,” Djondo said.

But the challenge facing him and other African aviation entrepreneurs is how to make headway in a tough and unforgiving market, where a jostling herd of small national flag carriers and private companies struggle to compete with global airline giants that control 70 percent of air traffic to the continent.

“It is a savagely competitive business, especially on the supply side, so small is generally not good,” said Mark Tierney, CEO of Dublin-based Crabtree Capital, which specializes in aviation and corporate finance services.

This means most African airlines lack economies of scale, face high unit costs and do not have adequate access to funding to finance fleet operations, Tierney added. Djondo and others believe the way forward is for African carriers, instead of trying to compete with each other and jealously guard their national markets, to combine their resources and create a consolidated service or network.

This is the only way they can hope to take on the airline majors from Europe and North America, and increasingly Asia and the Middle East, which are using their reach and muscle to dominate African skies at the expense of local carriers.

“African airlines companies would benefit if they pool their fleets to create a large group with substantial resources and a significant market share to compete with the European giants,” said Abidjan-based regional aviation analyst Moussa Diabate.

“The future is in consolidation,” he said.

Djondo pointed to the examples of South African Airways, Ethiopian Airlines and Kenyan Airways, which have successfully expanded their presence on the continent and further afield, especially Kenyan Airways, through its partnership with Air France-KLM.

“Why would we not do the same in west and central Africa, with maybe two strong companies which cover Africa and international routes?” Djondo said.

But this is a difficult message to preach on an immensely diverse continent of more than 50 nations, where, since the demise of Air Afrique, most countries still prefer to have their own flag carrier out of national pride.

An agreement reached some two decades ago to liberalize African skies, known as the Yamoussoukro Decision, has not prospered because most nations guard their airspace to protect their national carriers. Even if they do not have one, they do so in the hope that one day they will.

This means that Djondo’s Togo-based ASKY, whose fleet of five aircraft operates about 154 weekly flights in Africa carrying 8,000 passengers a week, finds it tough to make headway in a very fragmented market where it is mostly seen as a direct competitor rather than a partner.

In west and central Africa, it is already competing with Cameroon’s newly relaunched national carrier Camair Co, Senegal Airlines, the Celestair group comprising Air Mali, Air Uganda and Air Burkina Faso, Nigeria’s Arik and Air Nigeria.

Ivory Coast’s relaunched Air Cote D’Ivoire intends to join the fray in July, partnering with Celestair group. But some feel this may be a quixotic exercise that will struggle to succeed.

“The fact that each country is trying to create its own airline is not the right approach because African states do not have the means to maintain a functioning airline,” said a technical adviser at the Ivorian transport ministry, who spoke on condition that his name not be published.

He said most African airline initiatives had average lifespans of only three to five years.

“Most of the time, they are blacklisted and cannot fly to Europe, thus doomed to fail because they cannot make money on domestic or regional routes only,” the official said.

Safety concerns remain a challenge for Africa, highlighted most recently by the crash of a Nigerian Dana Air passenger jet in Lagos on Sunday, with the loss of all 153 people on board. It was Nigeria’s worst air disaster in 20 years.

African air companies top the list by far of air carriers banned within the European Union.

Although the International Air Transport Association (IATA) says Africa saw an improvement from 2010 to 2011, the continent’s accident rate is still the worst in the world.

“The problems of Africa are complex and include both insufficient government oversight and lack of infrastructure investment,” IATA’s Director General and CEO Tony Tyler said in March, when he announced the industry’s global accident rate in 2011 for Western-built jets was the lowest in aviation history.

But the potential of the African market is not in doubt. IATA has forecast Africa’s total air traffic to grow by 7.3 percent in 2012 and stay over the 6 percent yearly growth range through to 2015, slightly above world average.

Africa is a treasure trove of the world’s most prized resources, including gold, platinum, iron, oil, cocoa and timber, and this is attracting investments which in turn are galvanizing business and boosting air travel.

The world’s plane-makers have the continent on their radar.

In its long-term market outlook for 2011-2030, Boeing forecast the total African airlines fleet will nearly double to 1,210 from 680 in the period, with about 64 percent of those new purchases being new planes worth about $100 billion.

“Africans are turning increasingly to air travel, as road and rail infrastructure remains underdeveloped,” Boeing said in its forecast. “The resulting boost in demand for airplanes has generated firm orders ... and created a favorable climate for aircraft leasing companies.”

European rival Airbus agrees, saying Africa will see 1,101 new passenger aircraft deliveries in the 2011-2030 period, representing a 4 percent share of world deliveries.

With an eye on Africa’s healthy growth, some international airlines are also ramping up their service to the continent.

Air France-KLM, the leading European carrier flying to Africa, said in March it planned to increase its available seat kilometers (ASK) — which airlines use to measure passenger carrying capacity — to the continent by 5.4 percent this summer, servicing over 40 destinations.

Brussels Airlines, part of Germany’s Lufthansa group, has increased the number of flights to African destinations this year from 14 to 21.

In addition, several Middle Eastern and Asian carriers such as Emirates, Etihad, Cathay Pacific and Turkish Airlines now fly to the continent, as do China Southern, China Eastern, and Hainan Airlines, which all have plans to expand there, the African Airlines Association said in a report.

In contrast, Cameroon’s newly relaunched national carrier, Camair Co, posted a 9 billion CFA franc ($ 17.15 million) loss in its first year of operation, which its CEO Alex van Elk attributed to difficulties in regaining passenger confidence amid the fierce competition from international carriers.

Djondo is determined to grab a piece of this African market and believes keeping his ASKY airline in private hands and mostly financed by the private sector is one of the ways to avoid the government interference and lack of financing that eventually knocked Air Afrique out of the skies in 2002.

Air Afrique was a partnership between Air France and about a dozen former French colonies in west and central Africa.

Djondo’s group has raised an initial $120 million capital mostly through the private sector, with the participation of pan-African bank Ecobank, the West African Development Bank, investment arm of the regional central bank, and Ethiopian Airlines, which holds a 40 percent stake in ASKY.

“Our ambition remains unchanged,” he said. “To establish a strong African airline company owned by Africans.”

Pan-African airline dream faces tough take-off

Pan-African airline dream faces tough take-off

PIF’s AviLease signs deal with Turkish Airlines for eight Airbus A320neo aircraft

RIYADH: AviLease, an aircraft leasing firm owned by Saudi Arabia’s Public Investment Fund, has signed a memorandum of understanding with Turkish Airlines for long-term contracts for eight Airbus A320neo aircraft.

According to a press statement, two aircraft have already been provided, with the remaining six scheduled for delivery throughout 2025.

PIF launched AviLease in 2022 to harness the potential of promising sectors within the Kingdom, aiming to drive economic diversification and contribute to the growth of the non-oil gross domestic product.

The launch of the company also aligns with Saudi Arabia’s Vision 2030 goal to establish the Kingdom as a leading player in the aviation sector.

“We thank the Turkish Airlines team for their partnership, and we are delighted to further strengthen our relationship,” said AviLease CEO Edward O’Byrne.

He added: “These aircraft will support Turkish Airlines’ growth plans while contributing to their fleet modernization strategy and sustainability goals.”

The press statement further said that AviLease’s portfolio currently consists of 200 owned and managed aircraft, including purchase commitments, on lease to 48 airlines.

In March, AviLease delivered three Airbus A320neo aircraft to SDH Wings. SDH Wings is a joint venture between the Saudi firm and the Chinese sovereign fund, where the Kingdom holds a 10 percent stake.

In February this year, the company gave a specialized Aviation Financing Course to over 150 professionals in partnership with Prince Sultan University and Riyad Bank.

At that time, AviLease, in a press statement, said that it aimed to support the Kingdom’s Vision 2030 program by preparing Saudi talent to lead the aviation finance sector on both a national and global scale.

The company added that it will continue to drive local economic opportunities and create direct and indirect jobs for Saudi nationals in the aviation and financial sectors.

Saudi Arabia vows to strengthen voice of emerging markets on influential IMF committee

JEDDAH: Saudi Arabia is eager to elevate the voices of emerging economies on a key International Monetary Fund committee, the Kingdom’s finance minister has announced.

Speaking at the opening session of the deputies meeting of the International Monetary and Financial Committee in Diriyah, Mohammed Al-Jadaan praised the IMF and IMFC members for guiding the organization through challenging periods, the Saudi Press Agency reported.

Al-Jadaan, who was appointed IMFC chair in December 2023 for a three-year term, underscored “the importance of collaboration to ensure global financial stability and strong, inclusive economic growth,” according to SPA.

The meeting marked a milestone as the first official IMFC gathering hosted in the Kingdom.

The SPA report added that “Al-Jadaan welcomed the new '25th' IMFC member from the African continent, who is participating for the first time in the history of the committee, and stated that the Kingdom, as chair of the committee, is keen to strengthen the voice of emerging markets and developing economies in this important committee.”

Under its IMFC chairmanship, Saudi Arabia is positioning itself as a central player in shaping global economic policy.

The committee serves as the policy advisory body to the IMF’s Board of Governors, addressing global economic issues and recommending measures to sustain financial stability and growth.

Speaking at the event, IMF Managing Director Kristalina Georgieva thanked Saudi Arabia for its continued support and leadership.

She noted that amid significant global policy shifts, “the IMF’s mission to foster macroeconomic and financial stability remains as essential today as it was 80 years ago. Our 191 member countries can continue to rely on the IMF as a trusted adviser.”

During a panel titled “Breaking from the Low-Growth, High-Debt Path,” participants highlighted that the global economy is at a pivotal juncture, with heightened uncertainty disrupting capital flows across advanced and emerging markets, according to SPA.

Panelists noted that growth prospects remain below historical norms, with high debt levels constraining investments in infrastructure, social protections, and job creation — limiting nations’ ability to respond to new economic shocks.

They also discussed the dual nature of transformative forces such as artificial intelligence, digitalization, and demographic shifts, which present both risks and opportunities.

A second panel, “Strengthening the Global Financial Safety Net,” examined the IMF’s central role in supporting countries with balance-of-payments challenges.

Participants explored ways to deepen coordination between the IMF and regional financial institutions.

Goldman Sachs revises down 2026 oil price forecast amid recession risks

RIYADH: Recession risks and the possibility of higher-than-expected OPEC+ supply led Goldman Sachs to revise its annual average price forecasts again for Brent and West Texas Intermediate crude in 2026.

The Wall Street brokerage lowered its 2026 average price forecast for Brent by $4 to $58 per barrel, and for WTI to $55, Reuters reported, citing a note dated April 6.

This revision follows a previous adjustment, where the bank had decreased its 2026 forecast for Brent to $62 and WTI to $59. Goldman Sachs also cautioned that these new projections could be further modified downward.

This correlates with the firm’s decision to raise the likelihood of a US recession to 45 percent within the next 12 months, up from a previous estimate of 35 percent.

The adjustment reflects growing concerns over a trade war fueled by extensive tariffs imposed by US President Donald Trump.

In the newly released note, Goldman Sachs said: “Oil prices would likely exceed our forecast if the Administration were to reverse tariffs sharply and deliver a reassuring message to markets, consumers, and businesses.”

Other investment banks have also revised their forecasts in response to intensifying trade tensions.

Goldman Sachs cited a significant tightening of financial conditions and heightened policy uncertainty, which are expected to further reduce capital spending beyond their earlier projections.

This also aligns with last week’s adjustments by several investment banks to their recession risk forecasts, including J.P. Morgan, which estimated a 60 percent chance of both a US and global recession.

Goldman Sachs now expects oil demand to grow by 300,000 barrels per day in 2025, down from its previous forecast of 600,000 bpd, and to surge by 400,000 bpd in 2026.

The brokerage firm credited the reduction in demand growth to the adverse impact of a declining gross domestic product, which more than offsets the support provided by a weaker dollar and lower oil prices.

Oil prices dropped on April 7, extending last week’s losses, as rising trade tensions between the US and China fueled concerns of a recession that could weaken demand for crude.

On April 4, China retaliated against the US tariffs imposed by Trump, implementing a series of countermeasures, including a 34 percent surcharge on all US goods and restrictions on certain rare-earth exports. Brent crude was priced at approximately $63.87 per barrel, while WTI stood at $60.38.

“While the uncertainty around compliance and OPEC8+ production is very large, we still assume that the four months of OPEC8+ crude increases will total around 0.7-0.8 mb/d,” the bank added in its note.

Saudi non-oil growth holds firm in March with PMI at 58: S&P Global

RIYADH: Saudi Arabia’s non-oil private sector maintained its resilience in March, with the Kingdom’s Purchasing Managers’ Index reaching 58.1, the highest among its Middle Eastern peers.

According to the latest Riyad Bank Saudi Arabia PMI report compiled by S&P Global, non-oil private firms in the Kingdom witnessed a marked increase in new order volumes, although the growth rate softened further from the near 14-year record seen in January.

The March figure represented a slight decline from the 58.4 seen in February, but it was still higher than UAE’s PMI rating of 54, Kuwait’s at 52.3 and Qatar’s at 52.

Any PMI reading above 50 signifies an expansion, while a reading below 50 indicates a contraction.

The sustained momentum reflects the Kingdom’s Vision 2030 strategy to reduce reliance on oil by accelerating growth in tourism, manufacturing, logistics, and financial services.

Naif Al-Ghaith, chief economist at Riyad Bank, described the Saudi non-oil private sector as demonstrating “significant resilience and growth,” adding: “This reading reflects sustained positive momentum in business conditions, highlighting the sector’s robust economic health and its vital role in the ongoing diversification efforts of the Kingdom as envisaged by Vision 2030.”

Saudi Arabia’s non-oil businesses continued to increase their employment at an elevated pace in March, driven by an upturn in demand.

The report further said that staffing growth was little changed from February’s 16-month high, as firms widely commented on efforts to build their sales teams and overall capacity.

Survey data also indicated that job growth in Saudi Arabia’s non-oil private sector during the first three months of this year was the fastest since the third quarter of 2012.

“Rising employment rates are a direct benefit of businesses scaling up operations to meet demand. By providing more job opportunities, Saudi Arabia aims to nurture a skilled and ambitious workforce, reducing the unemployment rate to 7 percent for Saudi nationals,” said Al-Ghaith.

Speaking at the World Investment Conference in Riyadh last November, Saudi Arabia’s Minister of Economy and Planning Faisal Al-Ibrahim said non-oil activities now account for 52 percent of the Kingdom’s gross domestic product. He added that the non-oil economy has grown by 20 percent since the launch of Vision 2030.

The latest PMI report added that greater marketing efforts, lower selling prices, and a broader improvement in economic conditions played a crucial role in driving sales growth among non-oil firms in Saudi Arabia in March.

New orders from foreign markets also rose in March, although the rate of expansion slowed.

Highlighting the affinity of Saudi Arabia’s non-oil products in international markets, a report by the General Authority for Statistics revealed that the Kingdom’s non-energy exports surged by 10.7 percent in January to reach SR26.48 billion ($7.06 billion).

According to the latest S&P Global report, increased workforces and stronger new businesses supported a robust upturn in non-oil private sector activity during March.

Non-oil firms in the Kingdom also engaged in additional stockpiling as they anticipate a sustained uplift in sales.

Companies that took part in the survey revealed that purchasing activity rose sharply in March, leading to another steep increase in total inventories.

“The improvement in business conditions supports efforts to attract investment, increase the competitiveness of the Saudi economy, and enhance local business growth,” said Al-Ghaith.

He added: “This initiative is further supported by governmental enhancements in regulatory frameworks and infrastructure investments which pave the way for greater private and foreign investments.”

Attracting international investments is one of the crucial goals outlined in Saudi Arabia’s Vision 2030, with the Kingdom aiming to attract $100 billion a year in foreign direct investment by the end of this decade.

The latest S&P Global report further said that suppliers’ delivery times improved in March, with several panellists noting that strong vendor relationships had facilitated efficiency gains.

However, some reports of supply disruption and administrative delays led to a much softer overall upturn in performance compared to February. This softening also hindered efforts to clear outstanding work, contributing to a renewed and sharp rise in total backlogs.

In terms of pricing, the latest survey revealed that input cost pressures witnessed a marked easing in March.

The report added that the rate of inflation dropped to its lowest level in just over four years, as firms saw a much weaker increase in purchase prices. Consequently, non-oil companies reduced their selling prices for the first time in six months.

“Sustaining and nurturing these positive trends, Saudi Arabia is laying the groundwork for a multifaceted and thriving economy that meets the aspirations of its people and the strategic goals of the nation,” said Al-Ghaith.

“With each uptick in the PMI and every incremental GDP growth, the Kingdom moves closer to realizing its ambitions of a diversified, sustainable economic future,” he concluded.

Global markets fall as Trump’s tariffs roil world trade

- Pakistan Stock Exchange falls rapidly, suspending trading for an hour after a 5% drop in KSE-100 index

- Middle East stock markets tumble as they struggled with dual hit of new US tariffs, oil prices decline

Global markets plunged Monday following last week’s two-day meltdown on Wall Street, and President Donald Trump said he won’t back down on his sweeping new tariffs, which have roiled global trade.

Countries are scrambling to figure out how to respond to the tariffs, with China and others retaliating quickly.

Trump’s tariff blitz fulfilled a key campaign promise as he acted without Congress to redraw the rules of the international trading system. It was a move decades in the making for Trump, who has long denounced foreign trade deals as unfair to the US

The higher rates are set to be collected beginning Wednesday, ushering in a new era of economic uncertainty with no clear end in sight.

Here’s the latest:

Chinese officials meet business representatives from Tesla and other US companies.

Chinese government officials met business representatives from Tesla, GE Healthcare and other US companies on Sunday. It called on them to issue “reasonable” statements and take “concrete actions” on addressing the issue of tariffs.

“The United States in recent days has used all sorts of excuses to announce indiscriminate tariffs on all trading partners, including China, severely harming the rules-based multilateral trade system,” said Ling Ji, a vice minister of commerce, at the meeting with 20 US companies.

“China’s countermeasures are not only a way to protect the rights and interests of companies, including American ones, but are also to urge the US to return to the right path of the multilateral trading system,” Ling added.

Ling also promised that China would remain open to foreign investment, according to a readout of the meeting from the Ministry of Commerce.

Malaysia wants Southeast Asia to present a united response to tariffs

Malaysia’s Trade Minister Zafrul Abdul Aziz said his country wants to forge a united response from Southeast Asia to the sweeping US tariffs.

Malaysia, which is the chair of the Association of Southeast Asian Nations this year, will lead the regional bloc’s special Economic Ministers’ Meeting on April 10 in Kuala Lumpur to discuss the broader implication of the tariff measures on regional trade and investment, Zafrul told a news conference on Monday.

“We are looking at the investment flow, macroeconomic stability and ASEAN’s coordinated response to this tariff issue,” Zafrul said.

ASEAN leaders will also meet to discuss member states’ strategies and to mitigate potential disruptions to regional supply chain networks.

Pakistan plans to send a government delegation to Washington this month to discuss how to avoid the 29% tariffs imposed by the US on imports from Pakistan, officials said Monday.

The development came two days after Pakistan’s prime minister asked its finance minister to send him recommendations for resolving the issue. The US imports around $5 billion worth of textiles and other products from Pakistan, which heavily relies on loans from the International Monetary Fund and others.

The Pakistan Stock Exchange fell rapidly on Monday. The exchange suspended trading for an hour after a 5% drop in its main KSE-30 index.

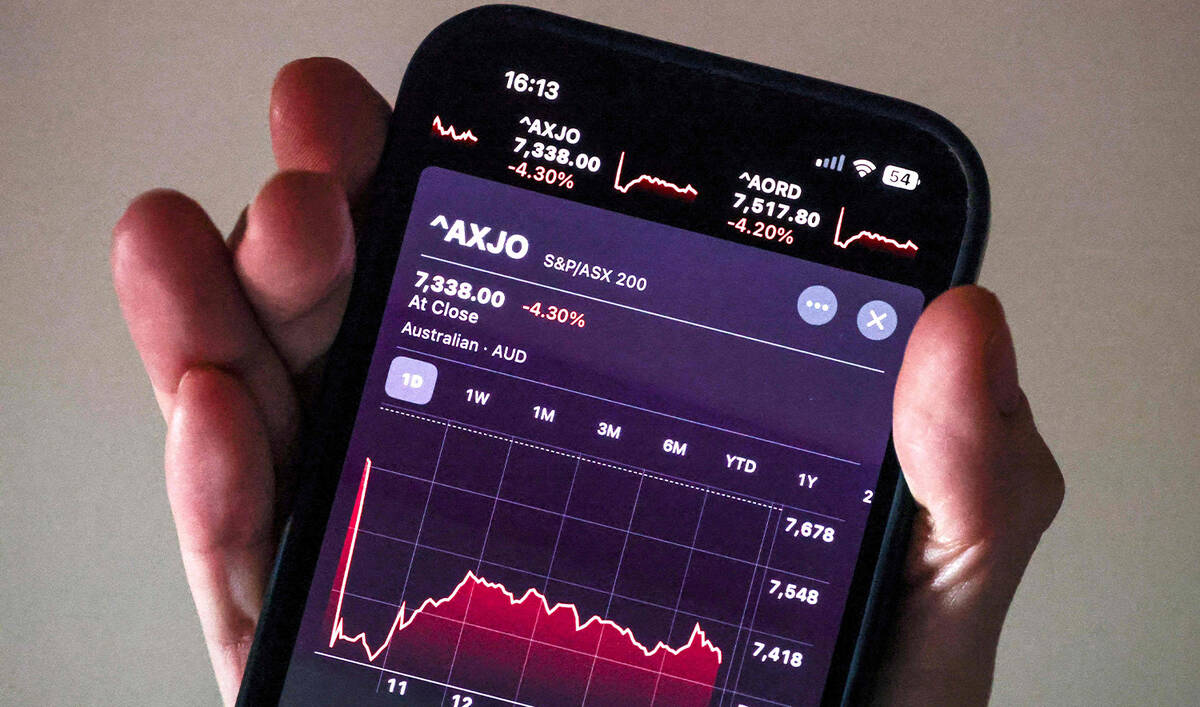

Mideast markets follow oil prices lower

Middle East stock markets tumbled as they struggled with the dual hit of the new US tariffs and a sharp decline in oil prices, squeezing energy-producing nations that rely on those sales to power their economies and government spending.

Benchmark Brent crude is down by nearly 15% over the last five days of trading, with a barrel of oil costing just over $63. That’s down nearly 30% from a year ago, when a barrel cost over $90.

That cost per barrel is far lower than the estimated break-even price for producers. That’s coupled with the new tariffs, which saw the Gulf Cooperation Council states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates hit with 10% tariffs. Other Mideast nations face higher tariffs, like Iraq at 39% and Syria at 41%.

The Dubai Financial Market exchange fell 5% as it opened for the week. The Abu Dhabi Securities Exchange fell 4%.

Markets that opened Sunday saw losses as well. Saudi Arabia’s Tadawul stock exchange fell over 6% in trading. The giant of the exchange, Saudi Arabia’s state-owned oil company Aramco, fell over 5% on its own, wiping away billions in market capitalization for the world’s sixth-most-valuable company.

Beijing struck a note of confidence on Monday even as markets in Hong Kong and Shanghai tumbled.

“The sky won’t fall. Faced with the indiscriminate punches of US taxes, we know what we are doing and we have tools at our disposal,” wrote The People’s Daily, the Communist Party’s official mouthpiece.

China announced a slew of countermeasures on Friday evening aimed at Trump’s tariffs, including its own 34% tariffs on all goods from the US set to go in effect on Wednesday.

Australian dollar drops to levels last seen early in pandemic

The Australian dollar fell below 60 US cents on Monday for the first time since the early months of the COVID-19 pandemic.

The drop reflected concerns over the Chinese economy and market expectations for four interest rate cuts in Australia this calendar year, Australian Treasurer Jim Chalmers said.

“What our modeling shows is that we expect there to be big hits to American growth and Chinese growth and a spike in American inflation as well,” Chalmers said.

“We expect more manageable impacts on the Australian economy, but we still do expect Australian GDP to take a hit and we expect there to be an impact on prices here as well,” he added.

The Trump administration assigned Australia the minimum baseline 10% tariff on imports in the United States. The US has enjoyed a trade surplus with Australia for decades.

Indian stocks fell sharply on Monday, seeing their biggest single-day drop in percentage terms since March 2020 amid the pandemic.

The benchmark BSE Sensex and the Nifty 50 index both dropped about 5% after trading opened but then recovered slightly. Both were later trading down about 4 percent.

President Donald Trump said Sunday that he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US, digging in on his plans to implement the taxes that have sent financial markets reeling, raised fears of a recession and upended the global trading system.

Speaking to reporters aboard Air Force One, Trump said he didn’t want global markets to fall, but also that he wasn’t concerned about the massive sell-off either, adding, “sometimes you have to take medicine to fix something.”

His comments came as global financial markets appeared on track to continue sharp declines once trading resumes Monday, and after Trump’s aides sought to soothe market concerns by saying more than 50 nations had reached out about launching negotiations to lift the tariffs.

“I spoke to a lot of leaders, European, Asian, from all over the world,” Trump said. “They’re dying to make a deal. And I said, we’re not going to have deficits with your country. We’re not going to do that, because to me a deficit is a loss. We’re going to have surpluses or at worst, going to be breaking even.”

Asian markets plunged on Monday following last week’s two-day meltdown on Wall Street, and US President Donald Trump said he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US

Tokyo’s Nikkei 225 index lost nearly 8% shortly after the market opened on Monday. By midday, it was down 6%. Hong Kong’s Hang Seng dropped 9.4%, while the Shanghai Composite index was down 6.2%, and South Korea’s Kospi lost 4.1%

US futures also signaled further weakness.

Market observers expect investors will face more wild swings in the days and weeks to come, with a short-term resolution to the trade war appearing unlikely.