NEW YORK: There are few certainties for year-end tax planning this year, but if you're a wealthy investor there is one sure thing — the new Medicare tax, slated to begin in 2013.

Part of the 2010 health care reform law, it is a 3.8 percent tax on investment income for individuals with adjusted gross income above $ 200,000, or $250,000 for married couples filing jointly. The same high-income taxpayers will also face an additional Medicare tax of 0.9 percent on wages and self-employment income, on top of the Medicare tax they currently pay.

"This is very real," says Robert Keebler, a partner at Keebler & Associates, a tax and estate planning firm in Green Bay, Wisconsin, who recently wrote a book on the Medicare tax for tax research firm CCH. "People are still in denial, but this is starting to change."

Workers already pay 1.45 percent of their pay in Medicare taxes. Employers also pay 1.45 percent, but won't be required to pay half of the new 0.9 percent additional tax.

The new Medicare tax is structured as a surcharge on net investment income including capital gains, dividends, interest, royalties, partnerships and trusts. The tax does not apply to tax-exempt income, such as interest from municipal bonds, or distributions from retirement plans. The rules are complex; on Monday the Internal Revenue Service issued a 159-page proposed rule designed to clarify the tax.

Depending on how much you make from wages and investments, the surcharge could apply to all of your investment income or only to part of it.

To understand how the tax works consider two examples, included in a Wells Fargo Advisors explainer on the issue. Couple A has wages of $ 230,000 and capital gains of $ 30,000, for a total of $ 260,000; they're $10,000 over the threshold, so would owe 3.8 percent of that excess, or $ 380, for the Medicare tax. Couple B has wages of $ 350,000 and investment income of $ 35,000; they would owe 0.9 percent on the $ 100,000 in wages over the threshold (or $ 900), plus 3.8 percent on their investment income (or $ 1,330), for a total of $ 2,230.

These new Medicare taxes, coupled with the slated expiration of the George W. Bush-era tax cuts at the end of this year, have accountants and tax advisers preparing for a flurry of activity from their wealthy clientele.

For high earners, the combination of the Medicare tax and an expected higher capital gains rate could result in an effective long-term capital gains rate of 23.8 percent, versus today's low rate of 15 percent.

If you're lucky enough to be above the threshold, here's how to think about your planning over the next few weeks.

If you expect to be above the Medicare tax threshold and think your capital-gains rate will be higher in 2013, that turns traditional tax-loss harvesting on its head. Instead of the typical strategy of taking capital losses at year-end, you'll want to take gains and defer losses — you can lock in the gains at 15 percent this year, versus potentially paying 23.8 percent next year.

If you have stocks with substantial gains in your taxable portfolio, you could even choose to lock in the 15 percent tax on those gains, then buy back the same stock over the coming months in order to reset your cost basis for tax purposes before rates go up. (The so-called wash sale rule, which prohibits immediately buying the same shares back when you take a loss, doesn't apply to gains.) Ideally, you'll want to pay for the tax outside of the investment you sold so as to keep the amount invested the same.

Medicare surcharge strategies get more complex for those who have trusts. Trusts are subject to the Medicare tax on the lesser of their undistributed net investment income for the year or the excess of their adjusted gross income over a threshold, currently $11,650. The result is that most trusts — with the exception of charitable trusts, which are exempt — will be affected by the new Medicare tax.

"The threshold is very low on trusts," says Ron Finkelstein, a tax partner at Marcum LLP in Melville, N.Y. "The threshold for trusts is much lower than for individuals."

One possible strategy for trusts: They may be able to reduce or eliminate the Medicare tax by distributing income to beneficiaries — especially if those recipients have income levels that put them below the cut-off for the Medicare tax.

Interest payments on intra-family loans, which have been quite popular among affluent families at a time of low rates, could also be subject to the Medicare tax for those receiving the loan repayment. That means that those parents who have used intra-family loans to help their kids without paying gift taxes may want to revisit those arrangements.

"Things that people have done in the past that were revenue-neutral, like intra-family loans, no longer are," says Paul Gevertzman, a tax partner at accounting firm Anchin, Block & Anchin, in New York. "What was a good plan two years ago isn't a good plan now. So either you want to undo it or lower the interest rate to the lowest allowable amount."

Increasing taxes on investments could prove a boon to insurance sales. That's because investment income that accrues within insurance products isn't subject to the same taxes - and death benefits are never taxed, Keebler says. While he's advising his clients to wait until the final regulations on the Medicare tax come out, he figures that insurance will be a good option for at least some of them.

Then again, when making investments, tax should always be a secondary reason for deciding what to do. As Anchin, Block & Anchin partner Laurence Feibel puts it: "Warren Buffett is right. No one chooses not to invest because the tax rate is 50 percent. That's the reality."

— The writer is a Reuters columnist.

The opinions expressed are her own.

Getting ready for the Medicare tax on investment income

Getting ready for the Medicare tax on investment income

Saudi Arabia vows to strengthen voice of emerging markets on influential IMF committee

JEDDAH: Saudi Arabia is eager to elevate the voices of emerging economies on a key International Monetary Fund committee, the Kingdom’s finance minister has announced.

Speaking at the opening session of the deputies meeting of the International Monetary and Financial Committee in Diriyah, Mohammed Al-Jadaan praised the IMF and IMFC members for guiding the organization through challenging periods, the Saudi Press Agency reported.

Al-Jadaan, who was appointed IMFC chair in December 2023 for a three-year term, underscored “the importance of collaboration to ensure global financial stability and strong, inclusive economic growth,” according to SPA.

The meeting marked a milestone as the first official IMFC gathering hosted in the Kingdom.

The SPA report added that “Al-Jadaan welcomed the new '25th' IMFC member from the African continent, who is participating for the first time in the history of the committee, and stated that the Kingdom, as chair of the committee, is keen to strengthen the voice of emerging markets and developing economies in this important committee.”

Under its IMFC chairmanship, Saudi Arabia is positioning itself as a central player in shaping global economic policy.

The committee serves as the policy advisory body to the IMF’s Board of Governors, addressing global economic issues and recommending measures to sustain financial stability and growth.

Speaking at the event, IMF Managing Director Kristalina Georgieva thanked Saudi Arabia for its continued support and leadership.

She noted that amid significant global policy shifts, “the IMF’s mission to foster macroeconomic and financial stability remains as essential today as it was 80 years ago. Our 191 member countries can continue to rely on the IMF as a trusted adviser.”

During a panel titled “Breaking from the Low-Growth, High-Debt Path,” participants highlighted that the global economy is at a pivotal juncture, with heightened uncertainty disrupting capital flows across advanced and emerging markets, according to SPA.

Panelists noted that growth prospects remain below historical norms, with high debt levels constraining investments in infrastructure, social protections, and job creation — limiting nations’ ability to respond to new economic shocks.

They also discussed the dual nature of transformative forces such as artificial intelligence, digitalization, and demographic shifts, which present both risks and opportunities.

A second panel, “Strengthening the Global Financial Safety Net,” examined the IMF’s central role in supporting countries with balance-of-payments challenges.

Participants explored ways to deepen coordination between the IMF and regional financial institutions.

Goldman Sachs revises down 2026 oil price forecast amid recession risks

RIYADH: Recession risks and the possibility of higher-than-expected OPEC+ supply led Goldman Sachs to revise its annual average price forecasts again for Brent and West Texas Intermediate crude in 2026.

The Wall Street brokerage lowered its 2026 average price forecast for Brent by $4 to $58 per barrel, and for WTI to $55, Reuters reported, citing a note dated April 6.

This revision follows a previous adjustment, where the bank had decreased its 2026 forecast for Brent to $62 and WTI to $59. Goldman Sachs also cautioned that these new projections could be further modified downward.

This correlates with the firm’s decision to raise the likelihood of a US recession to 45 percent within the next 12 months, up from a previous estimate of 35 percent.

The adjustment reflects growing concerns over a trade war fueled by extensive tariffs imposed by US President Donald Trump.

In the newly released note, Goldman Sachs said: “Oil prices would likely exceed our forecast if the Administration were to reverse tariffs sharply and deliver a reassuring message to markets, consumers, and businesses.”

Other investment banks have also revised their forecasts in response to intensifying trade tensions.

Goldman Sachs cited a significant tightening of financial conditions and heightened policy uncertainty, which are expected to further reduce capital spending beyond their earlier projections.

This also aligns with last week’s adjustments by several investment banks to their recession risk forecasts, including J.P. Morgan, which estimated a 60 percent chance of both a US and global recession.

Goldman Sachs now expects oil demand to grow by 300,000 barrels per day in 2025, down from its previous forecast of 600,000 bpd, and to surge by 400,000 bpd in 2026.

The brokerage firm credited the reduction in demand growth to the adverse impact of a declining gross domestic product, which more than offsets the support provided by a weaker dollar and lower oil prices.

Oil prices dropped on April 7, extending last week’s losses, as rising trade tensions between the US and China fueled concerns of a recession that could weaken demand for crude.

On April 4, China retaliated against the US tariffs imposed by Trump, implementing a series of countermeasures, including a 34 percent surcharge on all US goods and restrictions on certain rare-earth exports. Brent crude was priced at approximately $63.87 per barrel, while WTI stood at $60.38.

“While the uncertainty around compliance and OPEC8+ production is very large, we still assume that the four months of OPEC8+ crude increases will total around 0.7-0.8 mb/d,” the bank added in its note.

Saudi non-oil growth holds firm in March with PMI at 58: S&P Global

RIYADH: Saudi Arabia’s non-oil private sector maintained its resilience in March, with the Kingdom’s Purchasing Managers’ Index reaching 58.1, the highest among its Middle Eastern peers.

According to the latest Riyad Bank Saudi Arabia PMI report compiled by S&P Global, non-oil private firms in the Kingdom witnessed a marked increase in new order volumes, although the growth rate softened further from the near 14-year record seen in January.

The March figure represented a slight decline from the 58.4 seen in February, but it was still higher than UAE’s PMI rating of 54, Kuwait’s at 52.3 and Qatar’s at 52.

Any PMI reading above 50 signifies an expansion, while a reading below 50 indicates a contraction.

The sustained momentum reflects the Kingdom’s Vision 2030 strategy to reduce reliance on oil by accelerating growth in tourism, manufacturing, logistics, and financial services.

Naif Al-Ghaith, chief economist at Riyad Bank, described the Saudi non-oil private sector as demonstrating “significant resilience and growth,” adding: “This reading reflects sustained positive momentum in business conditions, highlighting the sector’s robust economic health and its vital role in the ongoing diversification efforts of the Kingdom as envisaged by Vision 2030.”

Saudi Arabia’s non-oil businesses continued to increase their employment at an elevated pace in March, driven by an upturn in demand.

The report further said that staffing growth was little changed from February’s 16-month high, as firms widely commented on efforts to build their sales teams and overall capacity.

Survey data also indicated that job growth in Saudi Arabia’s non-oil private sector during the first three months of this year was the fastest since the third quarter of 2012.

“Rising employment rates are a direct benefit of businesses scaling up operations to meet demand. By providing more job opportunities, Saudi Arabia aims to nurture a skilled and ambitious workforce, reducing the unemployment rate to 7 percent for Saudi nationals,” said Al-Ghaith.

Speaking at the World Investment Conference in Riyadh last November, Saudi Arabia’s Minister of Economy and Planning Faisal Al-Ibrahim said non-oil activities now account for 52 percent of the Kingdom’s gross domestic product. He added that the non-oil economy has grown by 20 percent since the launch of Vision 2030.

The latest PMI report added that greater marketing efforts, lower selling prices, and a broader improvement in economic conditions played a crucial role in driving sales growth among non-oil firms in Saudi Arabia in March.

New orders from foreign markets also rose in March, although the rate of expansion slowed.

Highlighting the affinity of Saudi Arabia’s non-oil products in international markets, a report by the General Authority for Statistics revealed that the Kingdom’s non-energy exports surged by 10.7 percent in January to reach SR26.48 billion ($7.06 billion).

According to the latest S&P Global report, increased workforces and stronger new businesses supported a robust upturn in non-oil private sector activity during March.

Non-oil firms in the Kingdom also engaged in additional stockpiling as they anticipate a sustained uplift in sales.

Companies that took part in the survey revealed that purchasing activity rose sharply in March, leading to another steep increase in total inventories.

“The improvement in business conditions supports efforts to attract investment, increase the competitiveness of the Saudi economy, and enhance local business growth,” said Al-Ghaith.

He added: “This initiative is further supported by governmental enhancements in regulatory frameworks and infrastructure investments which pave the way for greater private and foreign investments.”

Attracting international investments is one of the crucial goals outlined in Saudi Arabia’s Vision 2030, with the Kingdom aiming to attract $100 billion a year in foreign direct investment by the end of this decade.

The latest S&P Global report further said that suppliers’ delivery times improved in March, with several panellists noting that strong vendor relationships had facilitated efficiency gains.

However, some reports of supply disruption and administrative delays led to a much softer overall upturn in performance compared to February. This softening also hindered efforts to clear outstanding work, contributing to a renewed and sharp rise in total backlogs.

In terms of pricing, the latest survey revealed that input cost pressures witnessed a marked easing in March.

The report added that the rate of inflation dropped to its lowest level in just over four years, as firms saw a much weaker increase in purchase prices. Consequently, non-oil companies reduced their selling prices for the first time in six months.

“Sustaining and nurturing these positive trends, Saudi Arabia is laying the groundwork for a multifaceted and thriving economy that meets the aspirations of its people and the strategic goals of the nation,” said Al-Ghaith.

“With each uptick in the PMI and every incremental GDP growth, the Kingdom moves closer to realizing its ambitions of a diversified, sustainable economic future,” he concluded.

Global markets fall as Trump’s tariffs roil world trade

- Pakistan Stock Exchange falls rapidly, suspending trading for an hour after a 5% drop in KSE-100 index

- Middle East stock markets tumble as they struggled with dual hit of new US tariffs, oil prices decline

Global markets plunged Monday following last week’s two-day meltdown on Wall Street, and President Donald Trump said he won’t back down on his sweeping new tariffs, which have roiled global trade.

Countries are scrambling to figure out how to respond to the tariffs, with China and others retaliating quickly.

Trump’s tariff blitz fulfilled a key campaign promise as he acted without Congress to redraw the rules of the international trading system. It was a move decades in the making for Trump, who has long denounced foreign trade deals as unfair to the US

The higher rates are set to be collected beginning Wednesday, ushering in a new era of economic uncertainty with no clear end in sight.

Here’s the latest:

Chinese officials meet business representatives from Tesla and other US companies.

Chinese government officials met business representatives from Tesla, GE Healthcare and other US companies on Sunday. It called on them to issue “reasonable” statements and take “concrete actions” on addressing the issue of tariffs.

“The United States in recent days has used all sorts of excuses to announce indiscriminate tariffs on all trading partners, including China, severely harming the rules-based multilateral trade system,” said Ling Ji, a vice minister of commerce, at the meeting with 20 US companies.

“China’s countermeasures are not only a way to protect the rights and interests of companies, including American ones, but are also to urge the US to return to the right path of the multilateral trading system,” Ling added.

Ling also promised that China would remain open to foreign investment, according to a readout of the meeting from the Ministry of Commerce.

Malaysia wants Southeast Asia to present a united response to tariffs

Malaysia’s Trade Minister Zafrul Abdul Aziz said his country wants to forge a united response from Southeast Asia to the sweeping US tariffs.

Malaysia, which is the chair of the Association of Southeast Asian Nations this year, will lead the regional bloc’s special Economic Ministers’ Meeting on April 10 in Kuala Lumpur to discuss the broader implication of the tariff measures on regional trade and investment, Zafrul told a news conference on Monday.

“We are looking at the investment flow, macroeconomic stability and ASEAN’s coordinated response to this tariff issue,” Zafrul said.

ASEAN leaders will also meet to discuss member states’ strategies and to mitigate potential disruptions to regional supply chain networks.

Pakistan plans to send a government delegation to Washington this month to discuss how to avoid the 29% tariffs imposed by the US on imports from Pakistan, officials said Monday.

The development came two days after Pakistan’s prime minister asked its finance minister to send him recommendations for resolving the issue. The US imports around $5 billion worth of textiles and other products from Pakistan, which heavily relies on loans from the International Monetary Fund and others.

The Pakistan Stock Exchange fell rapidly on Monday. The exchange suspended trading for an hour after a 5% drop in its main KSE-30 index.

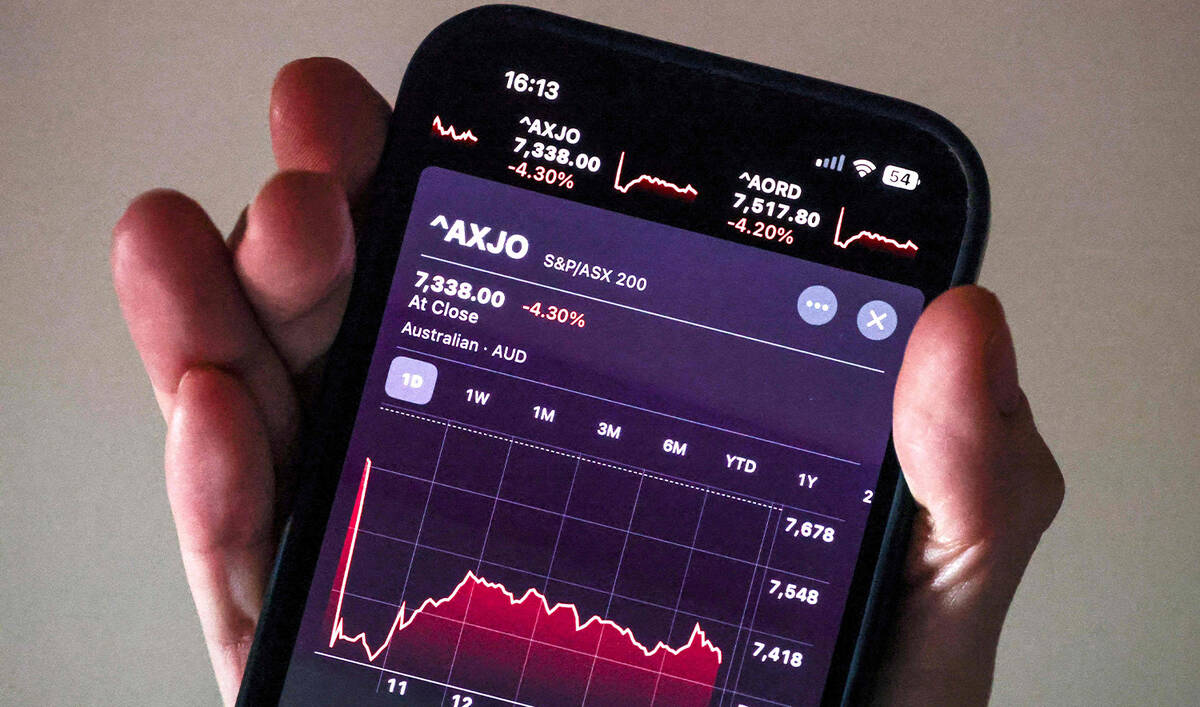

Mideast markets follow oil prices lower

Middle East stock markets tumbled as they struggled with the dual hit of the new US tariffs and a sharp decline in oil prices, squeezing energy-producing nations that rely on those sales to power their economies and government spending.

Benchmark Brent crude is down by nearly 15% over the last five days of trading, with a barrel of oil costing just over $63. That’s down nearly 30% from a year ago, when a barrel cost over $90.

That cost per barrel is far lower than the estimated break-even price for producers. That’s coupled with the new tariffs, which saw the Gulf Cooperation Council states of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates hit with 10% tariffs. Other Mideast nations face higher tariffs, like Iraq at 39% and Syria at 41%.

The Dubai Financial Market exchange fell 5% as it opened for the week. The Abu Dhabi Securities Exchange fell 4%.

Markets that opened Sunday saw losses as well. Saudi Arabia’s Tadawul stock exchange fell over 6% in trading. The giant of the exchange, Saudi Arabia’s state-owned oil company Aramco, fell over 5% on its own, wiping away billions in market capitalization for the world’s sixth-most-valuable company.

Beijing struck a note of confidence on Monday even as markets in Hong Kong and Shanghai tumbled.

“The sky won’t fall. Faced with the indiscriminate punches of US taxes, we know what we are doing and we have tools at our disposal,” wrote The People’s Daily, the Communist Party’s official mouthpiece.

China announced a slew of countermeasures on Friday evening aimed at Trump’s tariffs, including its own 34% tariffs on all goods from the US set to go in effect on Wednesday.

Australian dollar drops to levels last seen early in pandemic

The Australian dollar fell below 60 US cents on Monday for the first time since the early months of the COVID-19 pandemic.

The drop reflected concerns over the Chinese economy and market expectations for four interest rate cuts in Australia this calendar year, Australian Treasurer Jim Chalmers said.

“What our modeling shows is that we expect there to be big hits to American growth and Chinese growth and a spike in American inflation as well,” Chalmers said.

“We expect more manageable impacts on the Australian economy, but we still do expect Australian GDP to take a hit and we expect there to be an impact on prices here as well,” he added.

The Trump administration assigned Australia the minimum baseline 10% tariff on imports in the United States. The US has enjoyed a trade surplus with Australia for decades.

Indian stocks fell sharply on Monday, seeing their biggest single-day drop in percentage terms since March 2020 amid the pandemic.

The benchmark BSE Sensex and the Nifty 50 index both dropped about 5% after trading opened but then recovered slightly. Both were later trading down about 4 percent.

President Donald Trump said Sunday that he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US, digging in on his plans to implement the taxes that have sent financial markets reeling, raised fears of a recession and upended the global trading system.

Speaking to reporters aboard Air Force One, Trump said he didn’t want global markets to fall, but also that he wasn’t concerned about the massive sell-off either, adding, “sometimes you have to take medicine to fix something.”

His comments came as global financial markets appeared on track to continue sharp declines once trading resumes Monday, and after Trump’s aides sought to soothe market concerns by saying more than 50 nations had reached out about launching negotiations to lift the tariffs.

“I spoke to a lot of leaders, European, Asian, from all over the world,” Trump said. “They’re dying to make a deal. And I said, we’re not going to have deficits with your country. We’re not going to do that, because to me a deficit is a loss. We’re going to have surpluses or at worst, going to be breaking even.”

Asian markets plunged on Monday following last week’s two-day meltdown on Wall Street, and US President Donald Trump said he won’t back down on his sweeping tariffs on imports from most of the world unless countries even out their trade with the US

Tokyo’s Nikkei 225 index lost nearly 8% shortly after the market opened on Monday. By midday, it was down 6%. Hong Kong’s Hang Seng dropped 9.4%, while the Shanghai Composite index was down 6.2%, and South Korea’s Kospi lost 4.1%

US futures also signaled further weakness.

Market observers expect investors will face more wild swings in the days and weeks to come, with a short-term resolution to the trade war appearing unlikely.

Oil Updates — crude tumbles further as US-China trade tensions fuel recession fears

LONDON : Oil prices extended last week’s losses on Monday, with West Texas Intermediate falling more than 4 percent, as escalating trade tensions between the US and China stoked fears of a recession that would reduce demand for crude.

Brent futures declined $2.54, or 3.9 percent, to $63.04 a barrel at 10:45 a.m. Saudi time, while US WTI crude futures lost $2.5, or 4.03 percent, to $59.49. Both benchmarks dropped their lowest since April 2021.

Oil plunged 7 percent on Friday as China ramped up tariffs on US goods, escalating a trade war that has led investors to price in a higher probability of recession. Last week, Brent lost 10.9 percent, while WTI dropped 10.6 percent.

“It’s hard to see a floor for crude unless the panic in the markets subsides and it’s hard to see that happening unless Trump says something to arrest snowballing fears over a global trade war and recession,” said Vandana Hari, founder of oil market analysis provider Vanda Insights.

Responding to US President Donald Trump’s tariffs, China said on Friday it would impose additional levies of 34 percent on American goods, confirming investor fears that a full-blown global trade war is underway.

Imports of oil, gas and refined products were given exemptions from Trump’s sweeping new tariffs, but the policies could stoke inflation, slow economic growth and intensify trade disputes, weighing on oil prices.

Federal Reserve Chair Jerome Powell said on Friday that Trump’s new tariffs are “larger than expected,” and the economic fallout, including higher inflation and slower growth, likely will be as well.

Adding to the price changes, the Organization of the Petroleum Exporting Countries and allies decided to advance plans for output increases. The group now aims to return 411,000 barrels per day to the market in May, up from the previously planned 135,000 bpd.

“This potential influx of supply, reversing cuts maintained over the past two years, represents a major shift in market dynamics and acts as a significant headwind for prices,” said Sugandha Sachdeva, founder of SS WealthStreet, a New Delhi-based research firm.

Over the weekend, top OPEC+ ministers stressed the need for full compliance with oil output targets and called for overproducers to submit plans by April 15 to compensate for pumping too much.

On the geopolitical front, Iran on Sunday rejected US demands that it hold direct nuclear talks or face strikes. Russia claimed to have captured Basivka in Ukraine’s Sumy region and said its forces were attacking multiple nearby settlements.