DUBAI: From “mother’s apple pie”-style homes in the deserts of the Eastern Province to gigantic refineries in Texas, Saudi Aramco has been at the heart of the 75-year-old partnership between the US and the Kingdom.

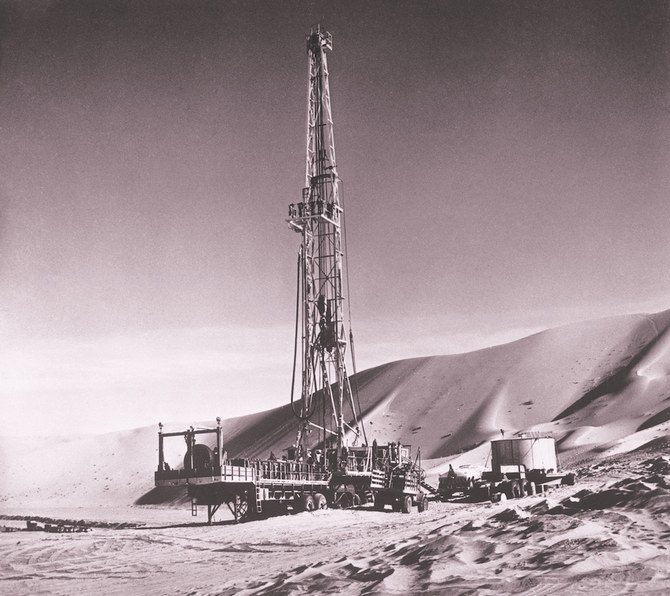

In fact, it preceded it. Ever since Oregon-born geologist Max Steineke teamed up with Bedouin guide Khamis bin Rimthan to find oil at Dammam Well No. 7 near Dhahran in 1938, the oil industry has played a major role in advancing the Saudi-US relationship.

Global oil supplies, and the vast amounts of crude that had been discovered in the Kingdom, were top of the agenda when President Franklin D. Roosevelt met with King Abdul Aziz on board the USS Quincy in 1945. “Oil was very much on Roosevelt’s mind,” wrote American analyst Bruce Riedel in his study of top-level US-Saudi relations, “Kings and Presidents.” He added: “It was also on the King’s mind.”

The relationship has inevitably changed over the decades, as the Kingdom learned from its American mentor and ultimately decided to take full control of its most precious resource, notably in the buy-out of the original American owners of Aramco in the 1970s, and the “oil ice shocks” of that and subsequent decades.

The relationship is changing again, with the emergence of the American shale industry as arguably the single most important development in international energy markets over the past 10 years. But the ties between Aramco and the US go deep, and are likely to outlast any short-term considerations of crude prices or supply agreements.

Aramco employs thousands of staff in the US, at research and technology centers in Houston, Detroit and Boston, as well as at the New York corporate headquarters. It owns and operates the Motiva refinery and petrochemicals facility on the coast of the Gulf of Mexico, the biggest such plant in North America. Despite US energy self-sufficiency, Aramco still exports significant quantities of its high-quality crude oil to America.

Many Aramco executives were educated at American colleges and universities. The management systems at the Saudi headquarters in Dhahran — among the most modern and sophisticated in the Kingdom — owe much to US standards developed during Aramco’s formative years.

After Steineke and Bin Rimthan found crude in commercial quantities, and World War II highlighted the need for secure and dependable oil sources, the meeting on the USS Quincy set the seal on the US-Saudi partnership for the next two decades

American oil engineers and their families arrived in the Eastern Province to work on the fields there, and were allowed a degree of home comforts virtually unheard of in the Kingdom at that time. The US community in Dhahran grew into an expatriate oasis, with freer dress codes and Western forms of entertainment such as Hollywood cinema and American baseball.

The “Camp” in Dhahran still exists, though it is no longer an American enclave. Now it is regarded as desirable accommodation by the “Aramcons,” the company’s Saudi workers. But it still has a feeling of “Smallville USA” about it, with porches and barbecues very much in evidence as well as US medical and other facilities.

Another clue to Aramco’s US lineage lies in the name. The Arabian-American Oil Co. was the successor to the Standard Oil Co. of California, the firm that had hired Steineke and Bin Rimthan in the first place, and which by the 1950s was a member of a consortium of the biggest US oil firms that owned Aramco, producing and exporting its crude via a concession agreement with the Saudi government.

When in 1957 the Ghawar Field was discovered, it set the seal on Aramco’s dominance of regional and global oil supply. The Americans called Ghawar “the field of dreams.” As US energy expert Ellen Wald wrote in her recent book “Saudi, Inc.”, “Aramco began as an American corporation established simply to drill for crude oil in Saudi Arabia, but within a single generation the Americans and the Saudis transformed it into a global energy conglomerate.”

By the 1970s the world had changed, and the Saudis felt they had learned enough about the energy business to go it alone. This was also the age of rising Arab nationalism, when many oil-exporting countries in the region began to nationalize their oil industries, often abruptly and without compensation, leading to a series of geopolitical confrontations with Western corporations and their governments.

In Saudi Arabia, the process was different. Instead of nationalization, the Kingdom discussed “participation” with the American owners of Aramco. In the course of the decade, the company was purchased by the Saudi government from its American owners, who were happy to get some financial return for their years of investment, though the price of the full purchase has never been disclosed.

Daniel Yergin, a prize-winning historian of the global oil industry, wrote in his book “The Prize” that the president of Exxon — one of Aramco’s owners — expected “more stable future relationships” from the “participation” agreements.

As “participation” in Aramco grew in the 1970s, so did Saudi self-confidence, especially on the price at which they could sell their product. In a series of oil “shocks” over the next few years, the Organization of the Petroleum Exporting Countries (OPEC) — in which the Kingdom played a leading role as the biggest producer — raised the price of a barrel of oil substantially.

“Oil was now clearly too important to be left to the oil men,” wrote Yergin. Most observers thought that some balance had been reasserted in global energy markets between producers and consumers, who had been benefiting from cheap oil for decades.

Over the past three decades, oil, and Aramco’s leading position in the global industry, have continued to set a pattern for US-Saudi relations. The two Gulf wars against Iraq were to a large degree motivated by the US desire to maintain security of output from its biggest crude supplier.

How it plays out in the new dynamic of the shale era — when America is much less dependent on oil from Saudi Arabia — remains to be seen. But Aramco’s role in the US-Saudi partnership has left a lasting legacy, and will continue to influence the relationship between kings and presidents.